Axon Enterprise AXON 0.00%↑ is a leading provider of law enforcement technology solutions dedicated to protecting life and promoting peace, justice, and strong institutions. The company aims to build the public safety operating system of the future by integrating a comprehensive suite of hardware devices and cloud software solutions that revolutionize modern policing. Axon's offerings include cloud-hosted digital evidence management, productivity and real-time operations software, body-worn cameras, in-car cameras, TASER energy devices, robotic security, and training solutions. In 2022, Axon set an ambitious goal to cut gun-related deaths between police and the public in the United States by half by 2033.

Axon's strategic vision focuses on obsoleting the bullet, reducing social conflict, enabling a fair and effective justice system, and promoting racial equity, diversity, and inclusion. The company's continuous innovation, driven by significant research and development investments, addresses some of society's most challenging problems. Axon's financial strategy centers on building highly recurring, profitable businesses through purposeful product innovation. The company operates through two segments: TASER, which leads the market in conducted electrical devices, and Software and Sensors, which offers integrated hardware and cloud-based solutions for managing digital evidence and enhancing law enforcement productivity.

The investment rationale for Axon is that the company has a strong history of innovation that has led to market dominance for supplying hardware and software to police departments. Even after growing sales by 28% annually over the decade, there continues to be a significant runway for continued growth through international expansions and additional software that could leverage AI. However, my valuation calculation indicates this stock is currently at fair value leaving no room for upside after a big beat-and-raise Q2’24 earnings report on August 6.

Business Description: Axon's TASER segment, which accounted for 39.2% of company-wide sales in 2023, focuses on developing smart devices, tools, and services that aid public safety officers in de-escalating situations, minimizing the use of force, and supporting consumer personal protection. This segment includes TASER devices, virtual reality (VR) training services, and consumer devices. In order to understand the progress and quality of Axon’s products, it’s helpful to move back in time to 1993, when Axon was founded.

Starting with the AIR TASER 34000, Axon initially targeted the civilian market. However, this product was ultimately deemed a failure because it relied on producing pain by stimulating sensory nerves. By overstimulating sensory nerves of the peripheral nervous system, the result is the body sends a signal of pain to the central nervous system, but the product didn’t directly impact the central nervous system. In order to really cause muscle contractions necessary for incapacitating an individual, you need to attack the central nervous system. Therefore, people with high pain tolerances could fight off the shock from the AIR TASER 34000. The issue comes down to the fact that it was engineered based on assumptions about how much electricity it would take to temporarily paralyze an individual. Founder and CEO Rick Smith said in the Moonshots and Mindset podcast:

“So what happened when we first launched our consumer Taser, we started having failures in demos where people could fight through it. And I had one catastrophe in Prague in the Czech Republic where I went to demo to their national police force and we had seven volunteers in a row. Nobody even fell down, they all fought through it. And so when we designed that first pig experiment…

We built a test rig where we could add one, two, three or four capacitors, one, two, three or four sets of batteries. And then we could ramp up or down the intensity using some pretty gross system adjustments. And just doing that experiment and then observing the muscle contractions of that pig, we were able to very quickly identify what we needed to change. And then from that came the first of now over 100 patents that have given us a huge IP portfolio.”

The TASER M26, introduced in 1999, represented a significant technological leap. The M26 introduced neuromuscular incapacitation (NMI) by stimulating both sensory and motor nerves. This innovation meant that the M26 not only caused pain but also disrupted voluntary muscle control by sending electrical pulses that interfered with the central nervous system. These pulses caused involuntary muscle contractions, effectively incapacitating the target regardless of their pain tolerance or motivation. The development was borne out of detailed experiments, which allowed Axon to correctly design a device for reliability. In addition, the M26 offered a maximum range of 25’, compared to the 15’ range of the initial TASER model 34000.

This was followed by the TASER X26 in 2003, which offered a more compact design with enhanced NMI effectiveness. The reduced size allowed officers to more easily carry them on a duty belt.

It wasn’t until 2009 that Axon launched the first taser with multiple shots, the TASER X3. Two years later the X2 further improved functionality with multi-cartridge capabilities and reduced size from the bulky X3 version. However, there were still concerns about reliability. This is largely because the TASER guns need to hit a target and land two barbed darts at least 12 inches apart on a body. If the two land too close, the electricity doesn’t flow reliability enough to incapacitate an attacker. Analysis by American Public Media (“APM”) found in 2019 that Tasers were unreliable up to 40% of the time.

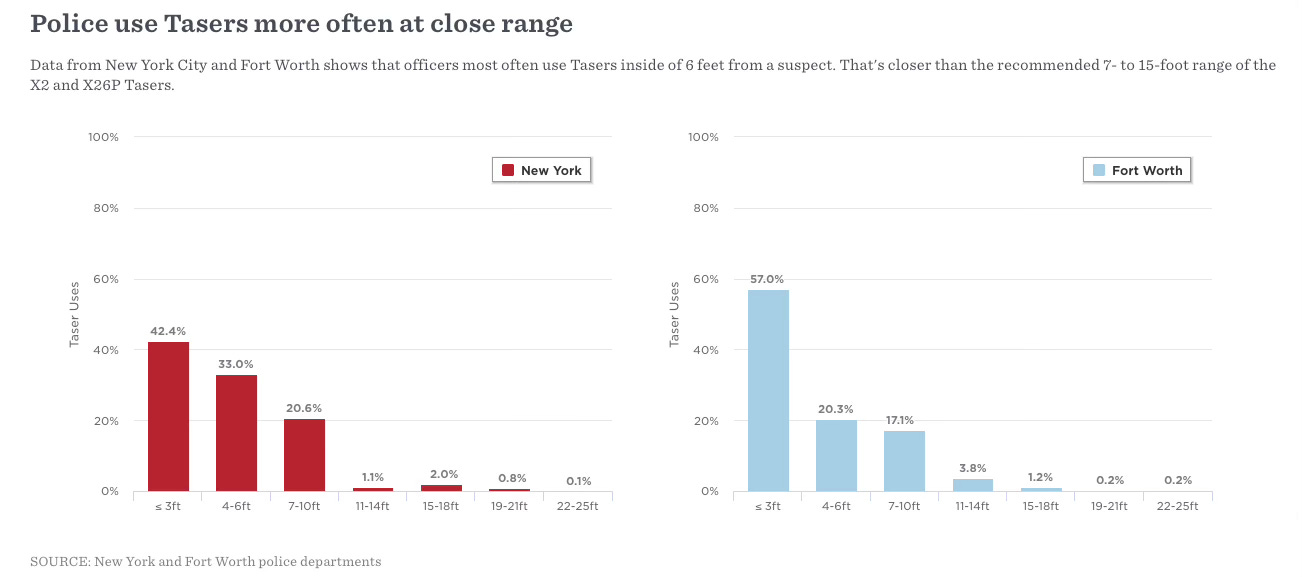

The TASER 7, introduced in 2018, enhanced reliability through its two cartridge system with one optimized for close-quarter shots and the other for stand-off range. This is important because according to APM, most officers are shooting their taser from within six feet. However, the predecessor model, X2/X3, didn’t reach optimal spread until the target was at least nine feet away.

Axon launched its latest model, the TASER 10, in 2023. This model boasts an increased maximum range of 45 feet, which compares to all prior models that maxed out at 25 feet. It also holds 10 shots and further improved probe spread for reliability. This has been hailed as a game-changing device for Axon. And it’s also been the fastest to ramp up sales, according to Axon, with shipped units total 50K in its first year of 2023. The TASER 7 sold and shipped 49K units in 2019 after its launch in December 2018. Axon said in February it shipped 50K units of the Taser 10. However, the order rate for the first year of the Taser 10 was 4X higher than the first year of the Taser 7. This indicates that bookings far outpaced what Axon thought and while they can book the sales of Taser 10, they can’t ship the units and turn them into accounting revenue. Regardless, we can see sales of devices were up a solid 16.4% in 2023 to $333.9M. The following table strings together TASER segment sales dating back to 2013. Devices revenue increased at a compounded annual growth rate (“CAGR”) of 14.8% in the 10-year period of 2014 to 2023. What’s also astonishing is the sales of cartridges to refill TASERS brought in another $193.2M, which is nearly as much as the device itself. Cartridge sales increased at a CAGR rate of 19.6% in the past decade.

The other material line item you’ll notice from the table of decomposed sales is that Axon generated another $34.8M from Axon evidence and cloud services for TASER products. This is made up of cloud-connected devices to help track firing logs, and also virtual reality (“VR”) training for using TASER pistols.

President Joshua Isner said of VR in the May 2024 JPM TMT conference:

Police training is really, really hard on agencies logistically. You think of an agency, the size of New York Police, 40,000 officers; having to get all those offices through in-service training and not only get them through training, but make sure the training was worthwhile and that they retained all of the information and so forth. It's really hard to do that. And after a couple of hours or 6 hours of in-service training once a year to expect the police officers to fire TASER at an expert level with maximum accuracy and maximum comfort with the device, it's just -- it's a stretch to think that's enough training.

And so when you have VR and you can literally put a headset on and be practicing firing a TASER in VR every day and the controller is an actual TASER 10 or it's the same weight and feel of a TASER 10 and the aiming is the exact same as you would see in the field, all of a sudden, you can get way more proficient in using the weapon, and we think that is a very interesting way to further monetize the device when you're talking about maybe disrupting the training business as a whole in public safety. And we're building this platform to -- you'd be able to engage with all use of force tools, not only TASERs. So we think the TAM here is actually bigger than our TASER market in terms of when this thing hits scale.

In the competitive landscape for conducted energy devices (CEDs) like Axon's TASER, the company faces direct competition from a variety of less-lethal alternatives, including pepper spray, rubber bullets, stun guns, and other non-lethal tools used by law enforcement. Companies such as Byrna Technologies, SABRE Corporation, and Wrap Technologies Inc. produce products that serve as alternatives to TASERs. However, Axon has maintained a strong position by offering advanced technology, versatility, and low injury rates, which are critical for law enforcement agencies. Beyond competing products, one of the biggest challenges for Axon is the growing emphasis on de-escalation techniques, where police officers are increasingly trained to resolve confrontations through verbal communication and other non-physical means before resorting to any form of force, including TASERs. This shift, driven by new laws and public pressure, suggests that the use of TASERs may be less frequent as agencies focus on minimizing the need for force in interactions with the public.

The next frontier for Axon is the development and sale of drones. Axon already sells drones within the software and sensors segment, however, Axon is concurrently exploring taser-armed drones. This has been met with pushback, including by its own ethics board. Nine of the 12 members quit over their concerns of weaponized drones in 2022. In June 2023, Axon wound up acquiring Sky-Hero, one of the leading tactical drone makers for an undisclosed amount. Axon acquired another drone company, Dedrone, in May 2024. I’ve gotten ahead of myself here because these products will actually sit in the other business segment. But for ease of reading I’ll make sense of the drones here with a quote by Isner discussing Dedrone in the May 2024 conference call:

“Dedrone, which is a two-pronged business. Number one, they do all the drone mitigation in defense. So they take drones out of the sky that are harmful enemy drones. They track all drone traffic in the air. You can think about targets like stadiums or government facilities, correctional facilities. Those are the places that are deploying Dedrone to protect their infrastructure.

And then Dedrone also offers what we think will be hugely valuable in the future, which is a product called Beyond Visual Line of Sight for drones. So right now, there's an emerging part of public safety called DFR, which is Drone as a First Responder. So 911 call comes in, you dispatch a drone first. and get all the live video of what's going on at the scene. So as the officer arrives at the same, they have more situational awareness.

Well, the problem with doing that today is this person has to literally be watching the drone from start to finish. So they're passing it off on rooftops. You've got humans set up on rooftops, watching a drone fly until they can't see it anymore. And then the next person takes over watching the drone. It's kind of humorous that, that is the workflow right now for this use case. Well, Dedrone because they monitor all of these drones in the sky, you can actually apply and get a waiver to do DFR using Dedrone instead of using a human's line of sight. And so we think offerings like that will accelerate the pace at which drones are adopted and widen the use cases for which they're used in policing.”

With multiple drones assets being developed by Axon, you could say the sky is the limit for the TASER segment.

The other segment for Axon encompasses Software and Sensors, and combined to make up the remaining 60.8% of company-wide revenue in 2023. This segment is known for making body cameras worn by police officers, in addition to in-car dash cameras. The flow of data from these devices prompted Axon to build out the software business to house all of the video and other insights into Evidence.com, its cloud-hosted software platform.

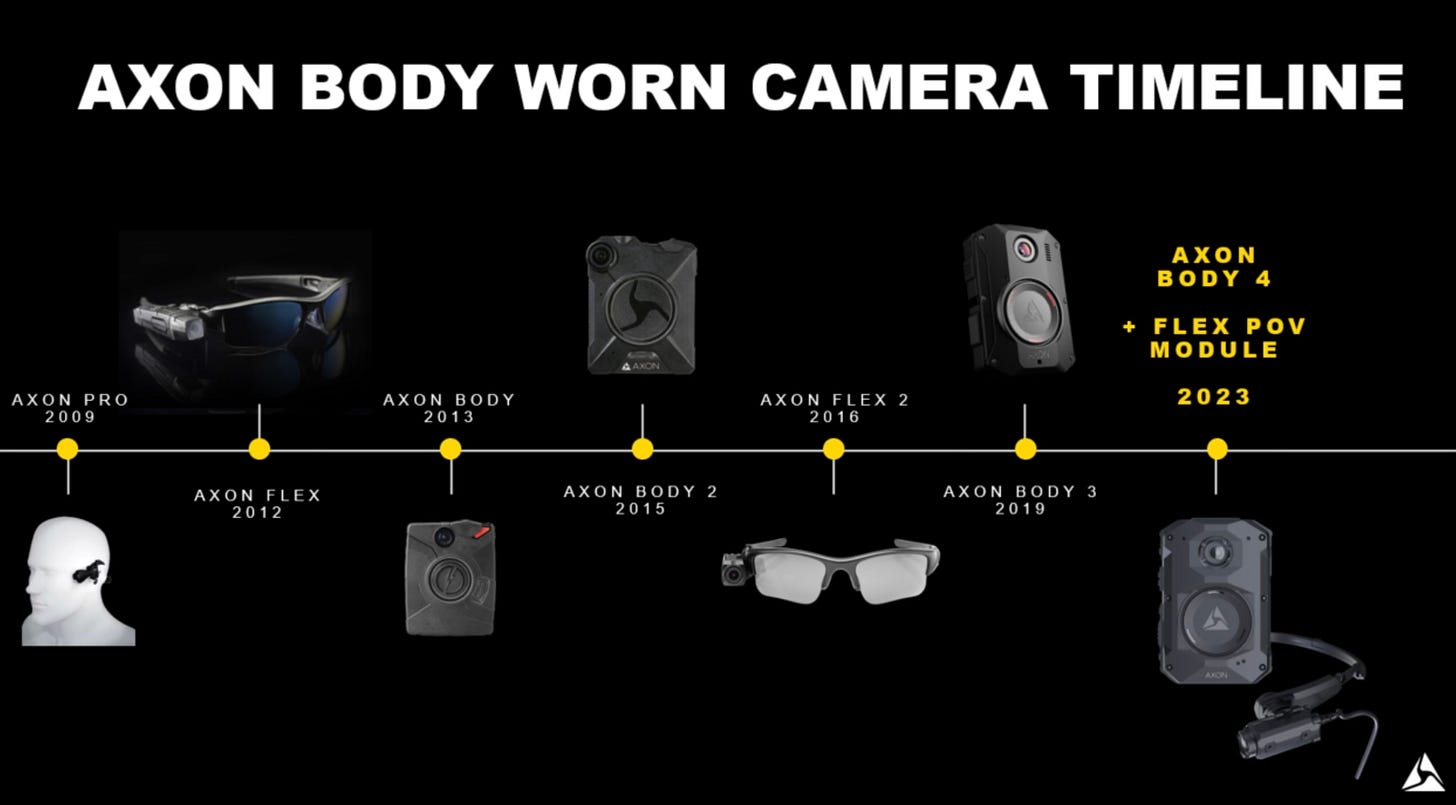

Let’s step back into time and look at how this segment came to be. Unlike the evolution timeline in the graphic below, which came from the Axon webpage title “Evolution of the Axon Body Camera”, Axon launched their first camera as an attachment to the TASER X26 in 2006. It was attached right under the handle of the TASER. The intention at the time was to specifically improve accountability in the use of their TASER product. However, starting the recording only when the TASER is unholstered captures just the intense moments of the police encounter, often missing crucial preceding interactions.

In 2009, Axon made a significant leap forward with the launch of its first body-worn camera, the AXON tactical computer, and its complementary cloud-based storage solution, Evidence.com. This marked a pivotal moment for the company, as it expanded its vision to enhance accountability and transparency in law enforcement. The AXON system consisted of three main components: the HeadCam, a lightweight headset camera designed to capture video from the officer's perspective; the Com Hub, a communication device linking the camera to the officer's radio; and the AXON tactical computer, a body-worn processor that stored the data and featured a 4.3-inch touchscreen for playback and audio reporting.

Initially, the system required agencies to download and manage the video data themselves, posing logistical challenges. However, with the introduction of Evidence.com, Axon provided a robust, offsite data storage solution that revolutionized how agencies handled digital evidence. Evidence.com allowed for secure, 128-bit encrypted storage, scalable to virtually limitless capacity, and offered features like incident marking and the Chief's Dashboard for supervisors to review footage efficiently. This integrated approach not only streamlined evidence management but also significantly improved officer accountability and safety, laying the groundwork for Axon's dominant position in the law enforcement technology market. As Rick Smith, Axon's CEO, explained, "We are expanding our vision to protect officers on the streets and in the courtroom until the last gavel drops."

In 2012, Axon introduced the AXON Flex, a video recording system designed to capture evidence from an officer’s perspective. The AXON Flex offered multiple mounting options, including integration with Oakley’s Flak Jacket eyewear, and featured Bluetooth streaming technology for real-time review on smartphones. While it provided flexibility and ease of use, its impact was limited compared to later models. The Flex camera’s durability and advanced imaging capabilities made it a step forward in wearable technology, but it primarily served as a transitional product leading to more significant innovations.

The next year, in 2013, Axon launched the AXON Body camera, which became a cornerstone of their product lineup. The AXON Body camera was designed for simplicity and affordability, priced at just $299, making high-quality video capture accessible to more agencies. Key features included a 130-degree wide-angle lens, 12-hour battery life, and low-light recording capabilities, providing a comprehensive view of officers' interactions throughout their shift. The camera's pre-event buffer captured 30 seconds of video before activation, ensuring critical moments were not missed. Videos were automatically uploaded to Evidence.com, Axon’s cloud-based storage platform, enhancing evidence management with secure, tamper-proof handling.

The widespread adoption of body cameras in law enforcement gained significant momentum following the 2014 killing of Michael Brown in Ferguson, Missouri. This incident, along with other high-profile police killings, sparked a national debate over policing practices and transparency. In response, many police departments across the United States began implementing body camera programs to increase accountability and rebuild trust with their communities. By 2016, nearly half of the country’s local police departments were using body cameras, driven by federal funding and a push for greater transparency. This surge in adoption was part of a broader movement towards reforming policing practices and addressing public concerns about excessive use of force and racial disparities. By 2020, the number increased to nearly 80%, according to Police Executive Research Forum.

In 2015, amid this increased focus on body camera adoption, Axon launched the Axon Body 2, a next-generation body camera designed to address the growing needs of law enforcement agencies. The Axon Body 2 featured advancements, including Retina HD video for superior low-light recording, a full-shift 12-hour battery life, and a pre-event buffer that captured up to 2 minutes before an event. Additionally, it introduced wireless activation through Axon Signal, which automatically turned the camera on with sensor activation, such as the use of light bars. This model further enhanced evidence management with features like in-field tagging and automatic evidence upload while recharging. Built to withstand extreme conditions, the Axon Body 2 ensured data security with encryption and provided versatile mounting options with RapidLock mounts.

Axon introduced the Axon Flex 2 in 2016, an upgrade to their original Flex body-worn camera. The Flex 2 featured enhanced mounting options, improved durability with a solid polymer casing, and a wider 120-degree field of view. It also offered HD video resolution and dual-channel audio, along with Axon Signal for automatic activation. Despite these advancements, the Flex 2 remained a smaller product for Axon, generating $10.1 million in revenue at its peak in 2017. The Flex line, while innovative, did not achieve the same widespread adoption as Axon's body camera series.

In 2018, Axon launched the Axon Body 3, marking a significant step forward in body camera technology. The Body 3 featured real-time situational awareness with live streaming capabilities and gunshot detection, significantly enhancing officer safety. It provided improved low-light capture, image clarity, and audio technology. The camera's LTE connectivity allowed for instant wireless evidence offload, reducing the need for docking and enabling immediate access to critical evidence. By 2022, the body camera line had generated $124.2 million in hardware sales, underscoring its importance to Axon's growth and paving the way for Axon Evidence.com. This platform provided a comprehensive digital evidence management solution, solidifying Axon's leadership in law enforcement technology.

In 2021, Axon held approximately 70% of the market share for body cameras, according to industry reports. This dominant position has drawn scrutiny from federal regulators, leading to complaints to the Federal Trade Commission (FTC) about Axon’s growing monopoly. The FTC alleged that Axon's acquisition of its largest competitor, VieVu, constituted anti-competitive behavior, resulting in higher prices and diminished services for police departments. The FTC's actions highlight a concern about Axon's market dominance on competition and law enforcement transparency. However, Axon continued to secure significant contracts with law enforcement agencies, due to its superior features and integrated bundling.

To catch us up to today, Axon continues to lead in body camera technology with the introduction of the Axon Body 4 in 2023. This latest model includes several advancements such as two-way communication, allowing officers to receive real-time support from their command centers, in addition to live streaming. It also offers the option to connect additional point-of-view cameras, providing multiple perspectives during critical incidents. There have also been other general improvements such as sharper image quality and a wider field of view.

In 2024, Axon expanded its market reach with the launch of Axon Body Workforce, a body camera tailored for frontline workers in retail and healthcare settings. This lightweight and customizable camera is designed to help de-escalate incidents and provide real-time support, similar to its law enforcement counterparts. Early trials have shown promising results, according to Axon, with significant reductions in incident escalations and improved safety for employees. Here’s a quote from CFO Brittany Bagley discussing the product and strategy from the March 2024 Morgan Stanley TMT conference:

“We also think there's an opportunity for nurses down the road. And the reason we think there's a big opportunity for retail associates and nurses is those are two environments where both sets of those employees feel quite unsafe in their work environment. And so the theory behind adding a potential body camera in is to de-escalate the situation, to have a single point of truth in any kind of interaction that is happening. And so Body Workforce is really meant to provide a camera that is easier for someone who isn't kitted out in full gear and wearing a vest and having a really comfortable place to put that camera to have an option to wear a camera.

So we just launched it. I'm sure we have a lot to learn about going into that space. But that is the idea is that they'll have something that is a little bit more comfortable, a little bit more sort of retail consumer-friendly to wear, and they will be able to decide that they can capture that interaction in our early trials, just having the camera results in de-escalation, like just somebody knowing that they are being filmed can sort of put a little pause on things. And so that's a big angle that we're going after.”

In 2014, Axon generated $13.8M from camera hardware, which is the first full year selling the body camera. 10 years later, in 2023, body camera and accessory sales totaled $183.0M for a CAGR of 33.3%.

The real story for Axon, financially, is actually evidence and the cloud services. Over the same 10-year period, Evidence.com grew revenue to $566.2M in 2023 from $4.0M in 2014. That’s an annual growth rate of 73.2%. Truly amazing considering it jumped by another +50% in 2023. As noted earlier, a little more than 80% of police officers wear body cameras so there isn’t much more growth available from the hardware. However, I do believe there’s still significant opportunity for Axon’s software services. This platform has already gone from a simple repository of visual data to a multi-pronged software offering that includes dispatch, records management, and soon insights and productivity via an AI layer.

For context, the additional offerings of the computer-aided dispatch, known commonly as “CAD”, and the records management system (“RMS”) are relatively new offerings. Axon launched the RMS solution in 2019 which natively integrated digital evidence, such as body cam footage, directly into incident records, allowing for a streamlined and efficient process. In 2022, the company launched Axon Dispatch, a robust CAD system built on modern cloud technologies. Axon Dispatch enhances 911 call centers by providing real-time notifications, modern mapping, and a seamless connection to critical data sources, thus improving response times and situational awareness. According to the August 2024 earnings call, management will instead pivot away from the holistic CAD system in favor of more niche solutions such as mapping and real-time video to plug into existing department processes. It seems the ROI is poor so trying to capture the CAD bundle as a whole isn’t worth it.

Axon's innovation in software solutions took another leap forward in 2024 with the introduction of Draft One, an AI-powered tool designed to draft high-quality police report narratives in seconds based on auto-transcribed body-worn camera audio. Draft One aims to significantly reduce the time officers spend on paperwork, allowing them to focus more on community engagement and personal well-being. As Axon CEO Patrick Smith stated in the May earnings call:

"Draft One leverages AI to produce police reports from body camera, audio and video. Our studies have found that officers in the U.S. spend about 40% of their time or 15 hours per week on what is essentially data entry, writing reports. This is valuable time they could be spending in their communities, with their families, in training or on their own well-being. With Draft One, we're giving them a new lifeline that we expect will save them critical hours each and every day...

This is the entire reason that we invested in a record management system 6, 7 years ago was entirely because we saw this coming, but the ability to not only have your video evidence and your written records in one system, but to be able to extract one from the other would be critical."

You piece it all together and Axon is now at the point where they can work within dispatch software for a department, capture and house immense data and efficiently port that into a records management system, with the next step being police officer productivity. Thinking about it this way, it’s easy to understand why evidence and cloud services continues to have a long runway.

In the competitive landscape of the body-worn camera and digital evidence management market, Axon has maintained a strong position. The latest freely available market share data pegged Axon at approximately 70% as of 2021. Axon's closest competitor, Motorola Solutions MSI 0.00%↑ has been aggressively expanding its footprint in this sector. Motorola acquired WatchGuard in 2019, which at the time was the second largest body camera provider.

It’s unclear just how much revenue Motorola makes from body cameras. The product sits within video, a sub-segment of their software and services business. According to the latest Motorola 10-K, video has a whole generated about $515M in sales in 2023. That would include other types of cameras, though. Regardless, Motorola is clearly the number two player and there’s a wide margin to player number three. Similar to Axon, Motorola's strategy also includes bundling its body cameras with other security solutions like two-way radios and in-car systems to create a more integrated offering. Unlike body cameras, the market for records management and CAD is competitive and fragmented.

Axon identified more than 50 competitors in the RMS and CAD verticals, according to their 10-K, including well-established firms like Hexagon AB, Tyler Technologies TYL 0.00%↑ , and Motorola, NICE Ltd. NICE 0.00%↑ as well as numerous smaller players. Despite this fragmentation, Axon believes its network of camera sensors and digital evidence management platform provides a strategic advantage. For real-time operations, Axon competes with platforms that ingest body camera video feeds, such as Genetec's Citigraf and Motorola's CommandCentral Aware. Additionally, Axon Respond competes with platforms that exclusively handle surveillance camera feeds, such as Hexagon's Connect and Live Earth's Spatialitics GeoShield.

Financial Performance: Net sales in 2023 totaled $1.56B, up from $164.5M 10 years earlier, representing a compounded annual growth rate (“CAGR”) of 28.4%. Over the last decade, the weakest year for revenue grwth was 2014 when revenue increased 19.4% YoY. The last year in which revenue decreased was 2010 and there’s only been three years total since the 2001 IPO that revenue decreased. Overall, revenue growth has been consistently strong. In addition to the consistent revenue growth, company-wide gross margins have consistently been near 62% over the last decade.

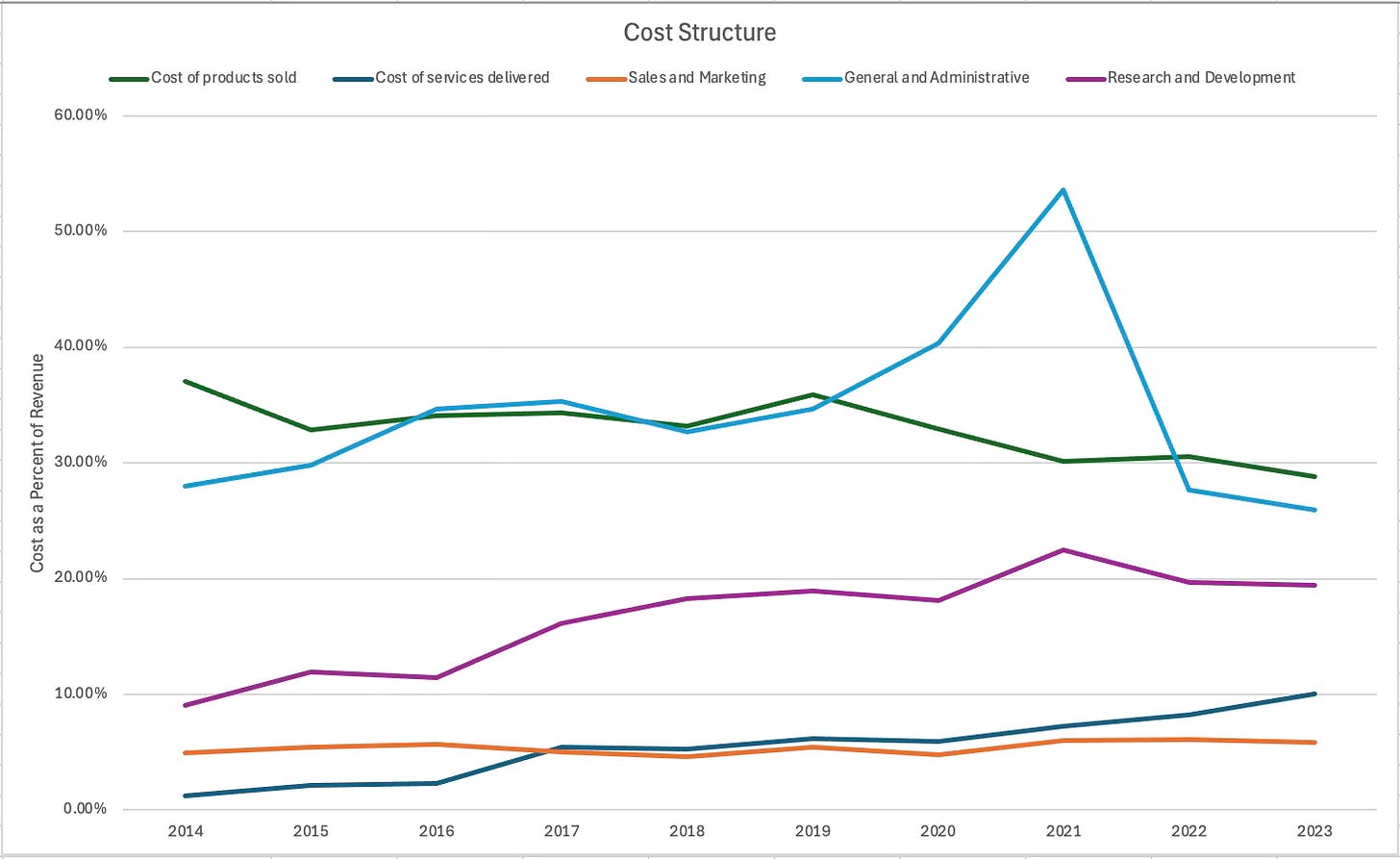

Despite the relatively flat gross margin percentage over the past decade, the segment margins have evolved quite a bit. TASER’s gross margin has moved lower from 67.3% in 2014 to 60.5% in 2023. Conversely, the Software and Sensors segment has increased from 19.1% in 2014 to a record high 61.5% in 2023.

Digging deeper, the cost structure shows the cost of products sold (TASER and camera hardware) has been moving lower over the last decade. Cost of services delivered (largely cloud hosting costs), Sales and Marketing and Research and Development have each been inching higher. The most volatile component has been the General and Administrative cost due to stock-based compensation programs at Axon (more on that later). The 2023 R&D as a percent of revenue was 19.4% and Sales, General and Administrative (“SG&A”) as a percent of revenue was 31.8%. Most of the stock-based compensation, which represented 8.4% of revenue in 2023, sits within SG&A. As a comparison, Russell 1000 growth companies averaged 26.2% SG&A margin and 5.3% SBC margin. Axon is solidly higher than that broader group and closer to software companies. It’s borderline excessive.

Capital Allocation: Shifting to Axon’s capital allocation history. In a practical sense, companies can use their capital to reinvest back into the business, acquire other companies, pay dividends and buyback stock. Over the last decade, Axon generated $839M in cash from operations. Axon has never paid a dividend. Instead, it spent $289M on capital expenditures to invest back into the business, representing 35.5% of cash from operations. Spending on acquisitions has been modest at $76M, or 9.0% of cash from operations. According to Axon’s statement of cash flows, the largest component in the capital allocation framework has been stock buybacks which totaled $542M since 2014, equal to 64.6% of cash from operations.

Nearly all of the buybacks reported on the cash flow statement were actually in the form of stock withholdings associated with vestings for stock-based compensation. The volume of these buybacks isn’t selected by management but instead is based on the timing of vestings of performance stock. Of the total $542M in reported repurchases, only $64M were executed via open market plans since 2014 according to VerityData. The last time Axon was in the market for its shares was in Q2’16 as shares were recovering from a drawdown.

Another notable data point in Axon’s capital allocation history is their use of at-the-marketing (“ATM”) offerings, which are the opposite of open-market stock buybacks. In an ATM sale, the company coordinates with a broker and sells shares at their leisure based on the market price at that time. Axon entered into an ATM program in August 2021 and quickly began selling shares in Q3’21 (July to September 2021) at about $186, according to VerityData. Management picked a near-term high to sell the shares as the stock lost half its value within a year. Axon didn’t sell shares again until Q1’23 and Q2’23 which wasn’t as timely, but did precede some weakness in the months after. This shows me that management is aware of their stock’s valuation and attuned to when to sell equity.

The total sale of 1.0M shares through Axon’s ATM program added to high dilution from stock-based compensation. Axon’s shares outstanding increased to 75.3M at the close of 2023 from 52.5M in 2014 (up 43.4%). The dilution offset Axon’s growth in free cash flow (“FCF”) per share, which increased at a CAGR of 11.9% in the past decade. Without dilution of shares, FCF grew at a CAGR of 16.4% in the same period. However, valuation is done on a per-share basis so the metric that matters is the more tepid growth in FCF per share. This is another knock on the high stock-based compensation at Axon.

Management and Incentives: Axon was founded and has been led by Patrick “Rick” Smith as CEO since 1993. Smith was 22 years old at the time and Axon makes up all of his professional work experience. He’s the founder/CEO who sunk his entire life into Axon and its moonshot mission to reduce killings, largely through the TASER product. In fact, Axon was bootstrapped with funds from the outset from Smith’s father. Ever since then he’s been laser-focused on Axon and hasn’t even served on another company’s board.

The second in command at Axon is Josh Isner whose current title is president. Isner joined Axon in 2009 and made a name for himself in 2014 by leading body camera and software sales. By demonstrating a “track record of delivering results”, Isner was elevated to chief revenue officer in 2018 and then COO in 2022. Isner now broadly leads operations, marketing, policies and employees at Axon.

Brittany Bagley joined Axon as CFO in September 2022 and subsequently added the COO title. Before Axon, she was CFO of Sonos (SONO) from April 2019 until joining Axon 2.5 years later. Bagley spent the early portion of her career at Kohlberg Kravis Roberts (KKR) in private equity with a focus on technology.

The top five executives also includes Jeff Kunins, chief product and technology officer. Kunins joined Axon in 2019 and leads product and technology spanning both body cameras and taser weapons. Before Axon, Kunins held prominent roles at two Seattle-based technology companies - Amazon (AMZN) and Microsoft (MSFT). While at Amazon Kunins was VP of Alexa Entertainment and was VP of Amazon’s Kindle. Lastly, I’ll note that Axon recently hired Cameron Brooks as chief revenue officer in April 2024. Brooks is also an Amazon alumnus whose previous role was general manager of AWS sales for Europe, Middle East and Africa. This one caught my eye because international sales have lagged behind domestic sales. Axon is based in Scottsdale and nabbing a prominent CRO who can drive sales internationally is important. According to Isner, Brooks is based in Europe too. Isner in a May industry conference:

“I'm starting to get more and more excited about (international sales) and part of that is the arrival of our new CRO, who's based in Europe, and we'll be driving a lot of the future success of deploying the cloud into some of those major European police forces.”

The components of Axon’s compensation program are made up of an annual salary, annual bonus and stock-based compensation paid in the form of restricted stock units (“RSUs”) and performance-based XSUs. XSU is a term unique to Axon and stands for eXponential Stock Units. They’re akin to performance-based stock units (“PSUs”) elsewhere, though not given every year. I extracted the compensation data for the past six years for CEO Smith, President Isner, CFO Bagley and her predecessor, and CPO/CTO Kunins. Smith has unique compensation structure that essentially follows the Elon Musk playbook at Tesla TSLA 0.00%↑. Smith may also be similar to Musk in stretching the truth, as discussed in this Reuters article that’s worth a read if you want to dig into corporate governance. Back to compensation. In 2018, Smith lowered his salary and bonus to the minimum amount and instead took an outsized stock award that was intended to cover his compensation for “up to 10 years”. I’ll cover the actual incentives in a bit, but first, I’ll touch on the ratio of pay.

In the six year period from 2018 to 2023, just 0.1% of CEO Smith’s compensation was paid in the form of a salary. He never received a bonus and his “other” compensation, made up of 401K contribution and life insurance premiums, were immaterial. 99.9% of his pay came from stock-based compensation. This ratio has a uniquely high weighting on stock-based compensation. Other named executive officers (“NEOs”) had 3.1% of total compensation paid in the form of salary, 7.7% from bonus and 88.9% in the form of stock. I like seeing the high ratio of pay paid in the form of stock because it’s the best way for management to have alignment with shareholders, however, the absolute dollar value of pay is relatively high at Axon. For instance, President Isner has averaged $11.5M in total pay in the past six years, which is solidly higher than the CEO of peer company Tyler Technologies (TYL). Having said that, management at Axon has beyond delivered in the past decade so you could still say shareholders are getting a lot of bang for their buck.

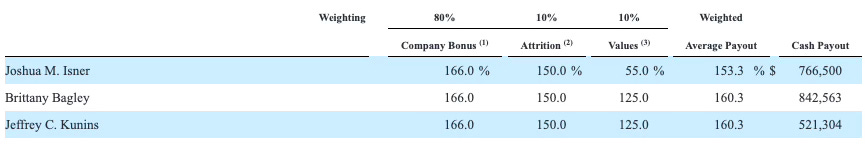

Now to the actual incentives. The annual cash bonus is weighted 80% toward company financial goals and 20% toward operational goals. The following table shows the weights for financial goals which is 30% revenue, 30% adjusted EBITDA, 20% new marketing bookings and 20% new product adoption. In February 2023, Axon gave initial full year 2023 guidance of revenue of $1.43B and 20% adjusted EBITDA. These match exactly what Axon used for the target goals for compensation which is a nice and clean way of setting the goals. Management gets 100% of their bonus for meeting the guidance laid out to shareholders at the time.

The operational goals are related to “regrettable attrition” and “Company values”. Isner has an additional KPI related to company engagement.

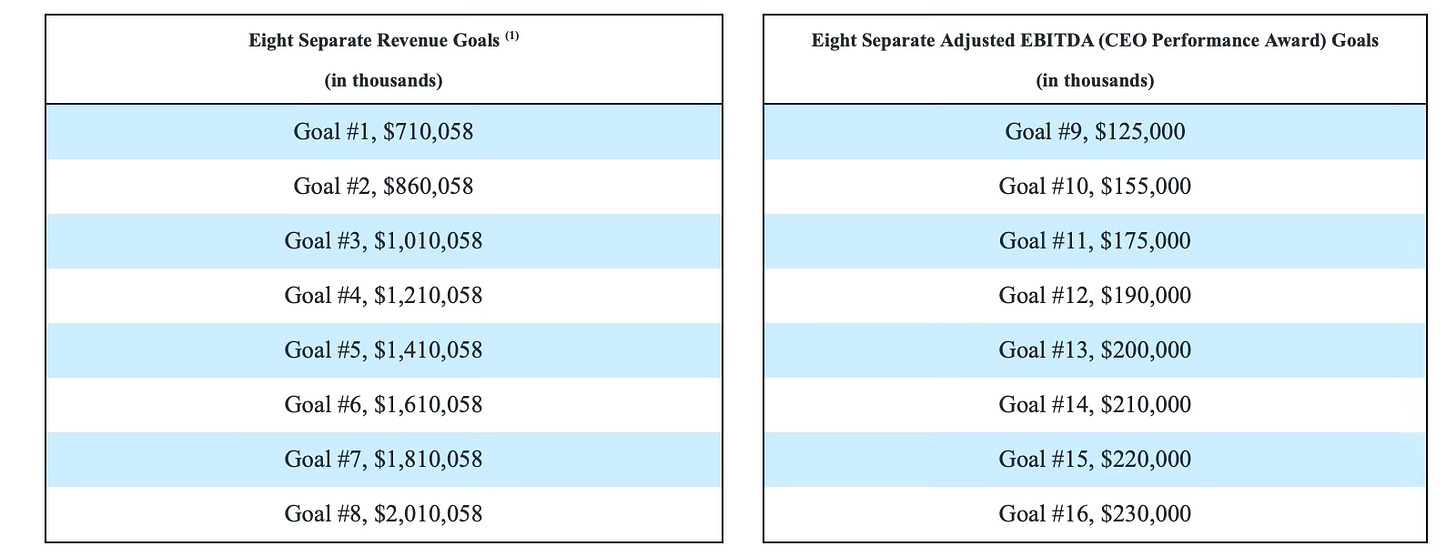

Next I’ll discuss incentives for stock-based compensation though it’s quite complicated with multiple plans running so I’ll leave out some details. As noted earlier, Axon doled out a massive stock award in 2018 valued at $246.0M to CEO Smith. This was a Tesla style vesting as it had 12 market-cap tranches with additional revenue and adjusted EBITDA goals. The table below shows the eight revenue and eight adjusted EBITDA goals. Axon needed to clear the market-cap goals that ranged from $2.5B to $13.5B ($1.0B increments for each tranche) and financial goals (either revenue or adjusted EBITDA). For context, Axon did $1.56B in revenue and $329M in adjusted EBITDA so they clear nearly all the revenue goals, all the adjusted EBITDA and easily cleared all the market-cap goals.

A year after giving CEO Smith the special award, Axon approved the 2019 eXponential Stock Performance Plan (“XSPP”) for other executives with identical performance criteria to the CEO plan. One significant difference between the NEOs and CEO is that the NEOs still received annual RSUs payments so that means the NEOs were guaranteed some value regardless of financial and stock performance.

Fast forward to May 2024, shareholders approved a new 2024 CEO Performance Award and 2024 eXponential Stock Plan (XSP 2.0). The financial and stock price hurdles are the same for the CEO award and XSP award for other executives, except the minimum service date is slightly later. Anyway, the notable data points to key in on are that the highest revenue hurdle is $6.999B, the highest adjusted EBITDA goal is $1.75B, and the highest stock price hurdle is $943.75. Axon has until 2032 to reach these hurdles so it’s not necessarily one per year. The initial stock price hurdle is $247.40 and each additional hurdle requires 25% additional appreciation so this is harder than the previous award that required $1.0B in additional market cap gain (meaning each hurdle gets smaller on a percentage basis). The difficulty of the financial goals for the 2024 plan is similar to the 2018 plan.

I like the aspirational stock and financial targets laid by Axon for their managers. This has been working as an incentive for management in the past decade. However, I don’t like seeing the level of compensation this high for a ~$20B company with the CEO receiving ~$200M in stock every six years.

Outlook: Axon last reported earnings on August 6 and gave full year 2024 guidance of $2.025B (midpoint), up 29.5% year-over-year (“YoY”). Management also generally gives a three-year longer-term financial guidance, and right now is targeting at least 20% annual revenue growth. The goal for adjusted EBITDA (excluding stock-based compensation) is 25%, which compares to the current adjusted EBITDA margin of ~23%.

When painting a picture of the longer-term outlook for Axon over the next five to 10-years, there’s a lot to be excited about. There’s three areas for Axon to expand into that could help the company 5X revenue in the next decade. 1) leveraging AI to enhance police officer productivity, 2) penetrating into non-core customers which is international and U.S. federal, and 3) drones.

As discussed in the business description section, Axon rolled out Draft One, an AI writing tool that uses body camera transcriptions to write reports. This is the perfect starter use of AI within Axon. According to the last earnings call, CEO Smith said customers’ response to Draft One is “better than anything I’ve seen”. Isner added:

“In the three months since launch, Draft One has generated over $100 million of pipeline, the fastest of any Axon software product to do so.”

The second order effect of Draft One is that it can bring more customers into cloud use. According to CEO Smith, reactions in Europe were compelling enough to interest customers into cloud use.

“when you think about the complexity of deploying AI at scale and the massive GPU clusters you're going to need and the connectivity into the cloud just eases all that. So, we've been almost religious about our cloud forever.

In the US, our customers told us early on the cloud was illegal, and they couldn't do it. Of course, we pressed through that, and now it's become ubiquitous. Europe has been harder. They've been very resistant to the cloud, and we've stuck to our guns, but it's taken a lot longer than we thought.

I think this is still theory. We haven't seen it paradigm, but the early reactions are AI services like Draft One and some of the new stuff you'll see in a few months could be enough to tip it over and start to make the cloud sweep through the rest of the world that's been very resistant to it. That will be a real game changer if that pans out.”

Concurrently, international bookings increased 100% during Q2’24. This is important to see because international sales have lagged domestic sales by only making up 14% of total sales. In 2023, $1.38B in revenue came from the United States while just $225M came from other countries. This has been exacerbated in the past two years due to relatively modest revenue increases internationally of about 13% while the United States had ~40% growth in each 2022 and 2023. That could begin to reverse, however, given the outperformance of international growth in Q2’24. Axon said international sales increased 49% YoY, solidly higher than the company-wide growth of 35%.

According to Axon, the total addressable market (“TAM”) for international business $26B so it will be important to see Axon grow globally beyond the core U.S. state and local departments that hold a TAM of $17B. I don’t necessarily trust the TAM and penetration numbers themselves but I do believe there’s a big untapped opportunity for international customers and Axon so far hasn’t penetrated well, often citing difficulty in selling the idea of cloud storage compared to domestic customers.

After AI integrations and international expansion, the next leg of the stool for long-term growth could be drones. There’s a big Federal Aviation Administration (“FAA”) hurdle for deploying drones out-of-sight and so Axon likely won’t sell a material amount of drones for real-time operations until another 10-years. But there could be a one-to-one ratio of police cars if departments are allowed to deploy drones as first responders. Recall, this is about providing the officer additional eyes and awareness before arriving to a scene.

A bonus long-term growth drive could also be personal protection. When CEO smith was on the Moonshot podcast he mentioned the Mars idea being cutting deaths in the general public through consumers opting for tasers instead of guns. If the technology gets good enough, there could be significant growth. A fun way to think about it is the futuristic sense like Phaser guns in Star Trek. Perhaps that becomes a reality when humans stun each through sophisticated taser-like guns. Smith’s remarks:

“Our belief was once we proved that [tasers] worked in policing, then consumers would follow suit. And there's actually some great case studies. The Glock handgun, the Maglite flashlight did similar things where consumers would then buy what the pros are using. Now since then, we've found a great market in policing, and our current moonshot is to cut gun deaths in policing.

But our Mars shot that comes after this is to cut gun deaths in the general public. But first, we've got to win in policing….

So once we get there, and that's what we'll do by the end of this decade, then watch us. We're going to pivot and then go into the consumer space. And I think for most consumers as well, hey, if you don't have to take a decision to take somebody's life in that moment when you want to stop a threat, that is just a huge advantage. You know, morally and legally and from a liability perspective.”

Now for the risk to this outlook. There’s legal and regulatory risks of the use of force for taser weapons. Despite the taser being a smaller and smaller piece of the pie, the taser is a good entry point for the sales team and the beginning of the flywheel to get more products into a department. Local governments will need to be lenient in allowing officers to use tasers for the business to grow. Another risk is the failure of international growth to materialize. Lastly, there are broader political risk and uncertainty due to trends such as Defund the Police, and it’s unclear what the next president of the United States will bring to the table. I think the pendulum is swinging away from the Defund the Police. Axon will need to see departments continue to grow their budgets in order to continue to upsell more products such as AI and operations software.

Valuation: To value Axon's shares, I built a five-year discounted cash flow model. I prefer five years because it’s difficult to forecast anything longer than that (even five years can be quite unpredictable). But five years is generally long enough to capture some change in growth trends. However, Axon could very well be a high growth company for the whole five years.

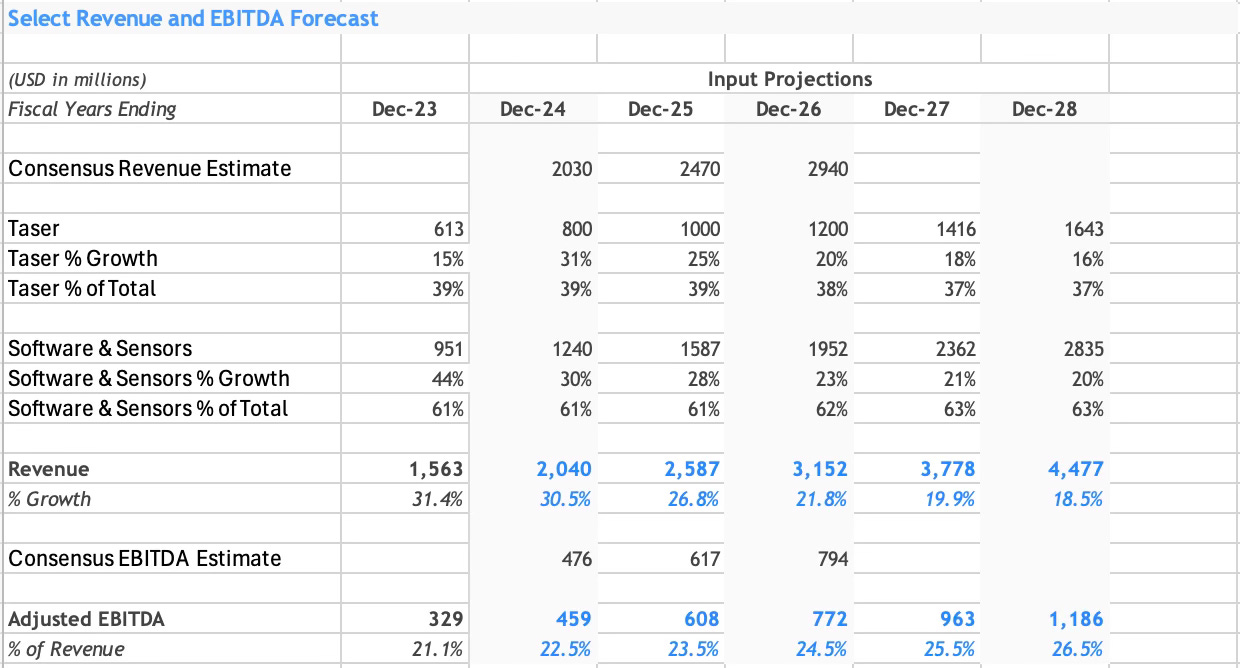

The DCF model starts out with forecasted revenue growth of 30.5%, which is just above the street consensus estimate. There’s a gradual slow-down in company-wide revenue growth through year five when 2028 revenue is expected to be $4,477M. This model reflects my base case, and there’s admittedly a lot of potential variation here to gain ~$3.0B in additional revenue in five years from the base of $1.6B in 2023. We’ll likely need to see a few years where international revenue is growing +50% annually.

I opted to use adjusted EBITDA rather than reported EBITDA. I’m projecting an adjusted EBITDA margin of 22.5% in 2024, and a linear path of 100 basis points in margin leverage added each year. My thinking here is that there’s a path to higher margins for the TASER segment, which was relatively poor in 2023, and the Software and Sensors segment has consistently improved profit margins over the last decade as more of the revenue comes from the high margin software business. By year five, Axon could generate an adjusted EBITDA of $1,186M. Recall the 2024 performance stock package had seven hurdles, and this financial forecast would see Axon complete five of the seven hurdles. Again, those seven hurdles don’t necessarily line up in annual fashion since the company has 10-years to meet the thresholds.

Because this DCF used adjusted EBITDA (excludes stock-based compensation), I had to add back in the stock-based compensation impact by including dilution. I’m taking a simple path with average annual dilution of 3.0%, so the equity waterfall assumes an outstanding share count of roughly 88M shares.

Other pertinent inputs include a weighted average cost of capital (“WACC”) of 8.0% (see below screenshot for build-up). The terminal exit multiple of 50X EV/EBITDA is against EBITDA of $828M, or adjusted EBITDA less 8% margin for stock-based compensation. For market fairness, the multiple does not use adjusted EBITDA. 50X is fairly elevated, though my comparison was Tyler Technologies which has an average EV/EBITDA of 59X in the last five years and Axon has significantly outperformed Tyler. The summary output calculates fair value of $362.00, about 3% below the current market price.

Conclusion: Axon has been the most fun and compelling company I’ve researched so far. They have a history of excellent execution and their CEO and other managers have made Axon a captivating story. And stories help sell a high valuation. Even though I’m pricing in ~23% top-line revenue growth over the next five years, the valuation still seems too high for me and I don’t think I could comfortably underwrite a higher multiple here to call this undervalued. Therefore, it seems the market is correctly pricing in material international, AI integrations and new potential lines. Despite the rich valuation, it’s certainly not a company I would bet against because the sky is the limit for Axon.

Disclaimer: The content of this report is for informational and research purposes only and should not be construed as financial advice. The views expressed are my own and do not reflect those of my employer. While care has been taken in preparing this report, I make no representations or warranties of any kind regarding its accuracy or completeness. I currently hold no position in any stock mentioned. However, like any financial analyst, my perspectives may carry inherent biases. Readers are encouraged to conduct their own due diligence.