AZEK AZEK 0.00%↑ is a maker of composite decking, siding, trim and other outdoor living products that largely serves the residential market. AZEK is benefiting from consumers converting to engineered materials that can replace the need for wood. AZEK reported better-than-expected earnings and revenue on February 6 for fiscal Q1’24 (ended December 31, 2023).

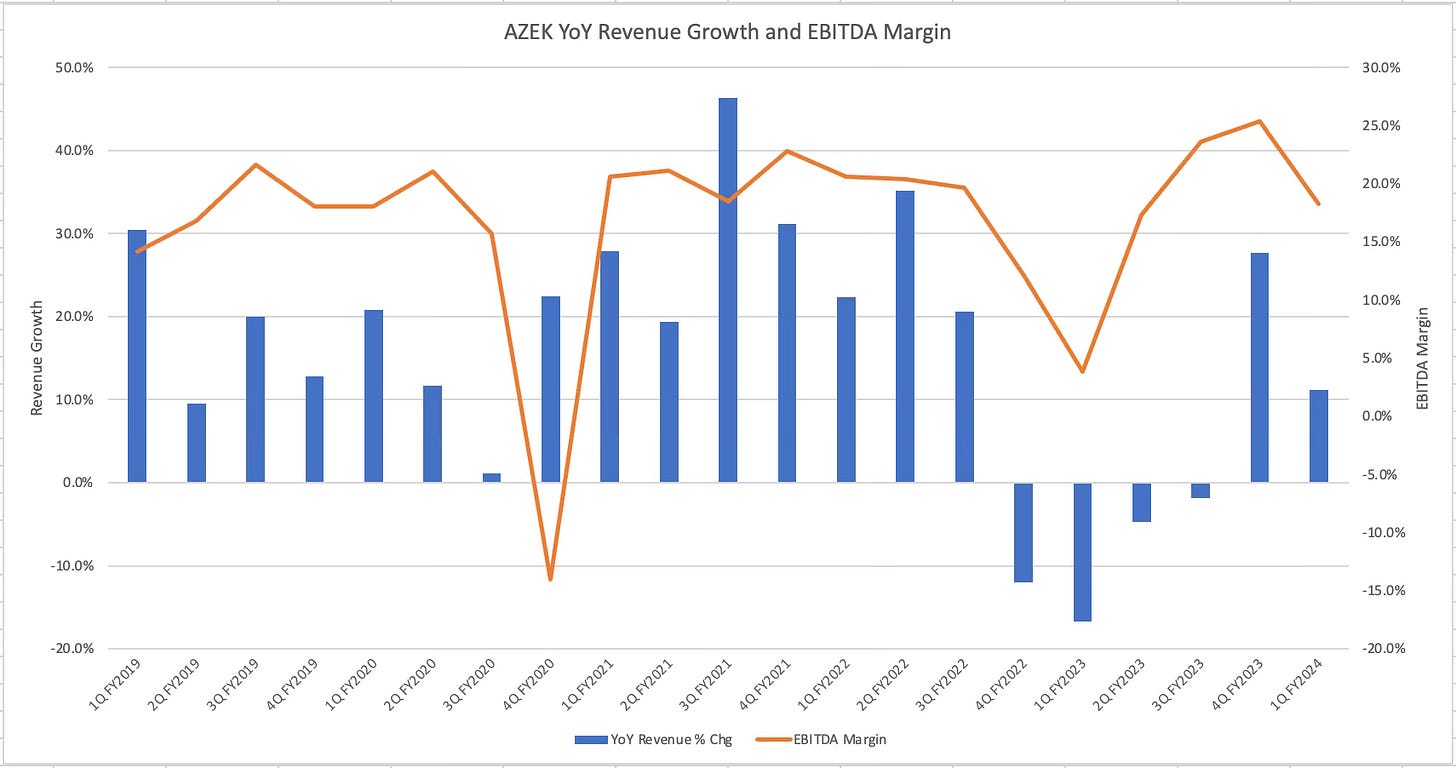

Here are the high-level numbers, starting with revenue that came in at $240.4M, up 11.2% from FQ1’23 on a reported basis, which beat the Wall Street consensus of $233.4M (3.0% surprise). When you exclude lost revenue from the business AZEK sold in November, Vycom, revenue was up 22% YoY. Adjusted EPS of 10 cents for FQ1’24 was up from a loss of 9 cents a year earlier and beat the consensus estimate of 5 cents per share. AZEK has been on a mission to increase its profit margins and that was seen in FQ1’24 through its adjusted EBITDA margin of 23.2%, up 1620 basis points compared to the same quarter a year earlier. The reported (unadjusted) EBITDA margin of 18.3% was also up 1440 basis points (FQ1’23 EBITDA was just 3.9%). The dip in the EBITDA margin on the chart below (orange line) is due to seasonality. Q1 has the lowest amount of sales so there’s margin de-leveraging on a sequential basis.

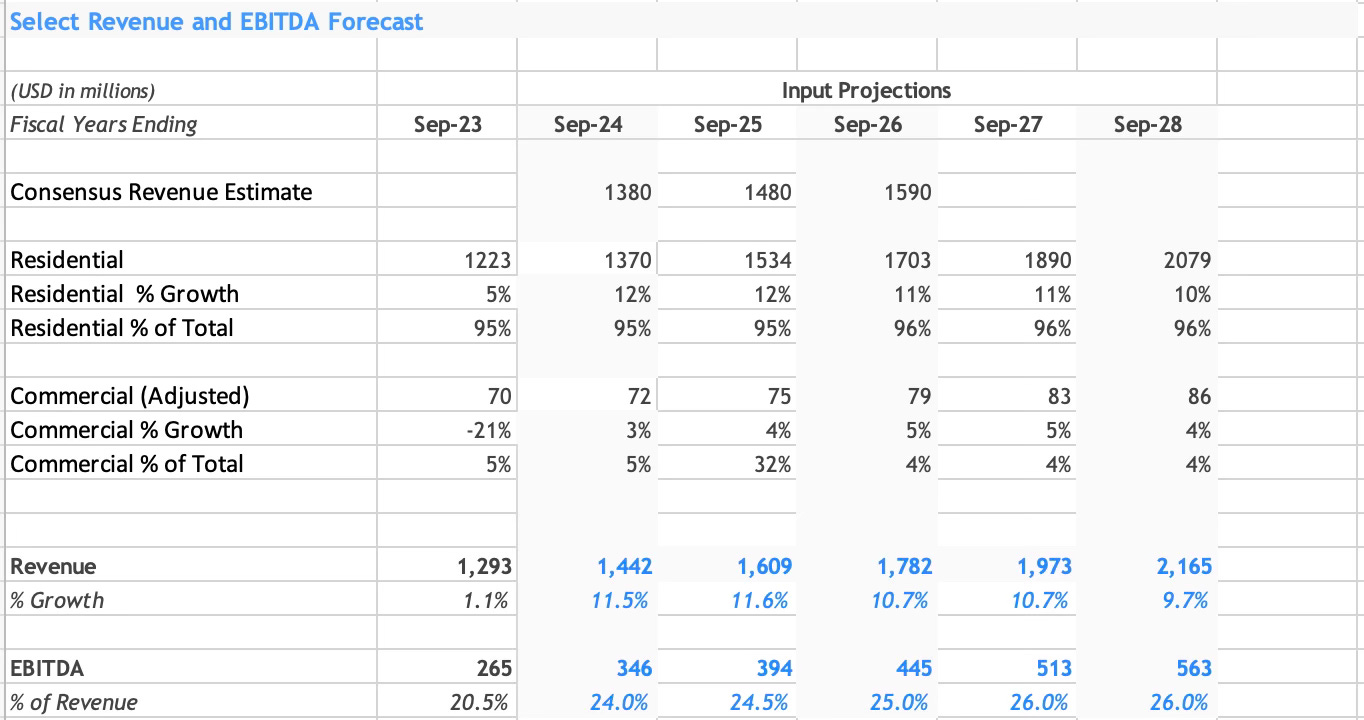

AZEK also revised its guidance for 2024 upwards with revenue now expected to be $1.405B (mid-point), which is $40M above the previous estimate. FQ2’24 guidance was also hotter than expected at $410M (up 14% YoY excluding Vycom). When you subtract the actual revenue for FQ1’24 and FQ2’24 guidance, it implies mid-single-digit growth in the back half of the year. I think that’s a bit low and there’s room for AZEK to revise higher again given the current trends. The adjusted EBITDA guidance was also revised solidly higher to 25.8% from the previous guidance of 24.0%. That would compare to 21.3% in 2023 and gets the company closer to their long term goal of 27.5% by 2027.

Some takeaways from the earnings call commentary include management talking up the shelf-space gains, another quarter of strong sell-through (rate of sales growth to end consumers) and normalized operations after a year of channel de-stocking in 2023. CEO Jesse Singh said in his prepared remarks on the earnings call:

"We are seeing the cumulative and structural benefits of the actions we have taken over the last few years during significant market and supply chain volatility. We have systematically gained shelf position in the pro and retail channels, launched innovative new products, invested in our brand, and added strategic acquisitions that have led to a stronger position in the market and increased our capability to drive above-market growth. We have also increased the use of recycled materials, aggressively used our AZEK integrated management system to improve our efficiency, priced to offset supply chain issues, and improved our product design, all leading to our expanded margins.”

CFO Peter Clifford noted that channel inventories are down about 20% versus the historical norm. Clifford added in the call:

“Consistent with our contractor and dealer surveys, we are cautiously optimistic on demand in the selling season but need to see more data in the season to update our expectations around the market and associated sell-through. On the margin side, the second fiscal quarter will be positively impacted by higher production levels, increased utilization and cost absorption. We continue to see benefits from our focus on sourcing as well as recycling initiatives, which will continue to drive lower input costs to the benefit of our gross margins in the quarter.

AZEK is also experiencing a tailwind in margins due to input cost deflation. And higher than anticipated sales are helping clearing out older, high-cost inventory. Clifford said:

“we're in an environment right now where extra sales means extra production, which means leverage in the plants. It means extra recycling activity, which means extra recycling impact. If we're buying more, we're getting more deflation. So we're in a pretty enviable position right now whenever we get additional revenue.”

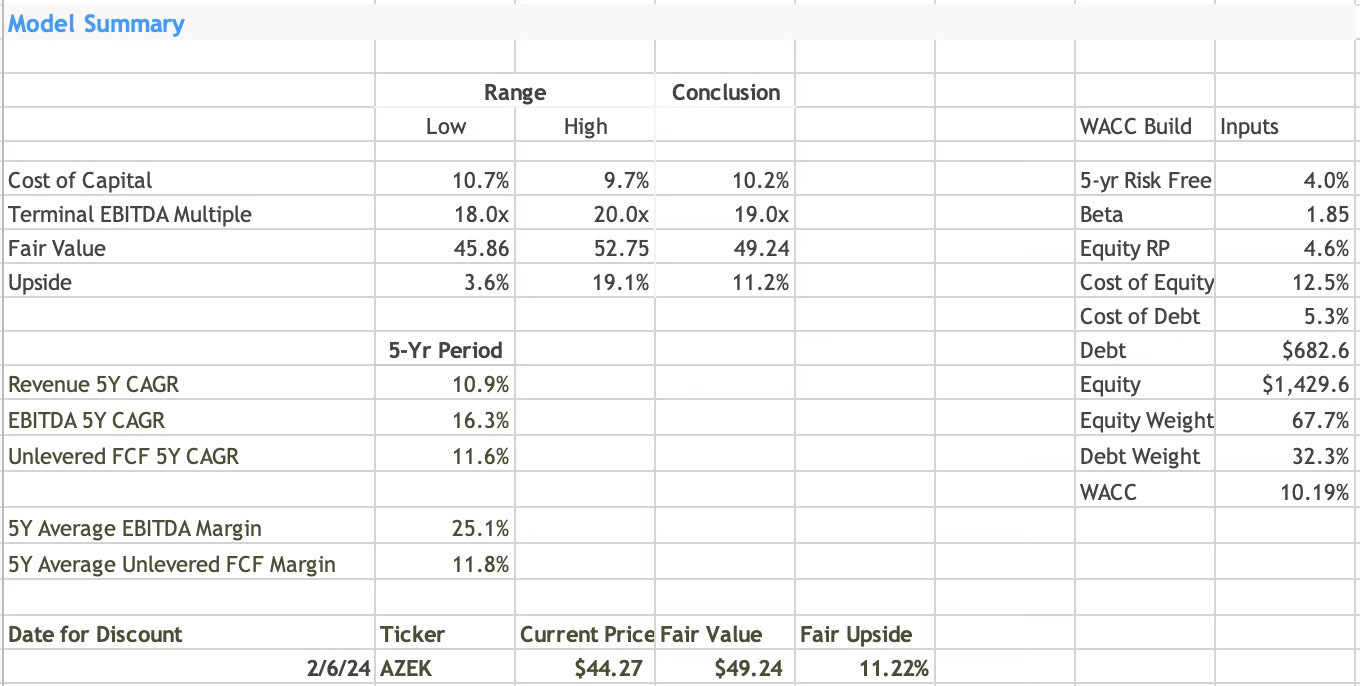

Shares of AZEK were up nearly 12% in after-hours trading to $44.27. This follows a significant rally over the last three months of 42% so there’s been quite a revaluation over the last six months. I did an update to my DCF model for AZEK which features double-digit growth in the residential segment and steadily increasing margins. The EBITDA margin is a non-adjusted figure, which is why 2027 ends up below AZEK’s goal.

The summary calculation implies a fair value estimate of ~$49, which means there’s now 11% upside. The increased estimate value is through a combination of higher FCF estimates and a slightly higher exit multiple. When I last published a valuation on AZEK, I used 18X LTM EV/EBITDA as the exit multiple within the DCF. That’s now bumped to 19X and my thinking is that AZEK deserves a higher multiple after shedding half its commercial business. The valuation gap to TREX TREX 0.00%↑ should narrow some. TREX has an average trailing EV/EBITDA multiple of 24X.

Bottom line: AZEK is executing well so far in 2024 and it’s nice to see shelf-space wins helping driving higher revenue this year. There’s little upside left in the stock after the significant rally but I continue to find the story and theme an interesting one to track.

Disclaimer: The content of this report is for informational and research purposes only and should not be construed as financial advice. The views expressed are my own and do not reflect those of my employer. While care has been taken in preparing this report, I make no representations or warranties of any kind regarding its accuracy or completeness. I currently hold no position in any stock mentioned. However, like any financial analyst, my perspectives may carry inherent biases. Readers are encouraged to conduct their own due diligence.