Azek (AZEK)

Turning plastic and recycled wood into quality decking and exterior products

This post will cover The AZEK Company AZEK 0.00%↑ by providing an overview of the business and the industry dynamics followed by an examination of the capital allocation history, management and their incentives, capped with an outlook and valuation.

Overview: AZEK is a top-tier designer and producer of low-maintenance, eco-friendly products aimed at the fast-growing Outdoor Living market. AZEK's product portfolio features engineered decking and accessories (56% of total revenue), exterior trim/siding (25% of revenue) and pergolas (5% of revenue). With the rise in homeowners enhancing their outdoor spaces, the demand is drifting from conventional materials, especially wood, towards engineered, durable materials. They also cater to the commercial market with engineered products like partitions, lockers, and storage solutions. AZEK's significant scale, vertically-integrated manufacturing, advanced material science know-how, and execution-focused management team all contribute to their leadership in the product categories.

AZEK’s is known for its decking line called TimberTech which is second in market share behind the more well-known Trex TREX 0.00%↑ decking product. Trex is synonymous with engineered decking. When you see composite decking you think of Trex. While there’s significant overlap in the products for AZEK and Trex, AZEK has diversified its revenue through different product types compared to Trex, a subject I’ll dive into more in the competition analysis section.

AZEK has been a market innovator for over three decades, driving growth by leveraging its distinctive manufacturing capabilities, advanced material science, and R&D expertise. They have excelled in creating new, top-quality products, and their consistent investments in sales, marketing, R&D, and manufacturing solidify their standing as a market leader. AZEK has an impressive track record of introducing disruptive products and effectively expanding its portfolio, meeting consumer needs across a wide range of price segments. They have earned a reputation as a premium brand through their commitment to customers and developing innovative products that blend the latest style and design trends with their unique material science expertise and proprietary production technologies.

Sustainability is a cornerstone of AZEK's operating platform. From product design to raw material sourcing and manufacturing, they prioritize the use of recycled materials like plastic waste, recycled wood, and scrap in their products. AZEK's investments in recycling capabilities have not only heightened the sustainability of their operations but also reduced their costs. Their TimberTech PRO and EDGE decking lines are primarily composed of recycled materials. AZEK's recycling programs diverted around 500 million pounds of waste and scrap from landfills in fiscal year 2022. Most of their TimberTech, AZEK Exteriors, and Versatex products are recyclable at the end of their useful lives.

AZEK's growth strategy is multi-dimensional, focusing on conversion of wood products to AZEK’s engineered materials, brand building, product innovation, multi-channel expansion, margin expansion through enhanced recycling and productivity, and strategic acquisitions to expand their addressable market. The intent is to drive profitable growth exceeding market rates in their serviced markets.

There’s two reportable segments: 1) residential segment that makes up 86% of total sales; 2) commercial segment that makes up the remaining 14%.

The residential segment is made up of engineered outdoor living products made up of decking, railing, trim and moulding, siding and cladding, pergolas and cabanas that are intended to drive consumers away from wood. AZEK says of its engineered products:

These products are primarily manufactured using capped wood composites and PVC technology that are aesthetically similar, yet functionally superior, to finished wood, as they require less maintenance, do not rot or warp, are resistant to water, insects, stains, moisture, mold, mildew, scuffs and scratching, and do not require painting or staining for protection.

I didn’t realize how much engineered decking boards have evolved over the past 30 years, but there’s been some good strides to make a quality product that doesn’t warp, scratch and crack as easily. Part of that is through ‘capping’ which is surrounding the board with a protective polymer layer. This is a link to AZEK’s webpage for PVC vs. Composite decking. Here’s another link showing how increasing the capping helps extend the life of the boards.

My quick summary of some history to engineered decking materials. The first generation of composite decking emerged in the late 1980s when the scarcity of trees became more apparent. The initial version was a combination of wood fibers and recycled plastic, often polyethylene. It aimed to provide the appearance of wood with increased durability and less maintenance. However, the first generation was susceptible to color fading, warping and mold. In response, manufacturers introduced second generation known as capped composite decking around the early 2000s. These products have a core made of wood and plastic, but they're coated with a protective polymer shell or cap. The third and more recent generation improved performance further by offering fully capped designs and utilizing advanced materials.

Decking and railing: AZEK is one of the only decking manufacturers to offer both capped composite and PVC decking products. Emulating natural wood, AZEK's products resist fading, cracking, and rotting, coming across as a more cost-effective solution in the long run. The wood used in the core is 100% recycled and the decking material overall is made up of 85% recycled material, which increased in the past year. The decking offerings—TimberTech AZEK, TimberTech PRO, and TimberTech EDGE—provide a variety of colors, textures, and styles, ranging from entry-level to premium options with industry-leading warranties. Features such as slip resistance, heat dissipation, fire resistance, and mold protection set AZEK's products apart. Alongside decking, AZEK provides attractive, high-quality, low-maintenance railing solutions through its TimberTech, ULTRALOX, and INTEX brands, effectively challenging traditional materials by averting problems like warping and rust. The aluminum railing products afford unobstructed views, and AZEK's proprietary technology facilitates quick on-site customization. These products are versatile, complementing the company's decking lines or serving the broader, stand-alone market. AZEK also offers functional and decorative accessories such as drink rails, lighting packages, and gate kits.

Trim and Moulding: AZEK leads in designing and manufacturing PVC trim and moulding products through the AZEK Exteriors and VERSATEX brands. Similar to other product lines, AZEK’s trim and moulding products emulate the aesthetics of wood but are more durable and require less maintenance. With features like moisture and insect resistance, they are increasingly used for both exterior and interior applications, including home accents like pergolas, arbors, and unique interior spaces. The full line includes trim boards, sheets, skirt boards, moulding, specialty siding, and various innovative solutions like PaintPro trim and TimberTech AZEK Cladding. Additionally, AZEK offers custom milled solutions and accessories such as adhesives and bonding solutions. The benefits are highlighted with these photos from the investor deck that show the durability and ease of maintenance when using engineered materials.

This product line piqued my interest because just last week some wasps squeezed through where my siding and window trim was supposed to be touching and made a hive. Perhaps if I had more durable composite trim and siding that wouldn’t have been an issue. Back to AZEK.

Pergolas and Cabanas: AZEK is new to the pergola market through its acquisition of StruXure in December 2021. The pergola (and railing) offering was built out further through the acquisition of INTEX in August 2022. The acquisitions of StruXure is a natural fit for the TimberTech portfolio as StruXure is also focused on recycled, engineered materials that will help drive wood conversion. Pergolas and cabanas, which provide shade and rain protection, are a fast-growing niche that represents a $1.0B market opportunity. The announcement of the acquisition of StruXure said “StruXure delivered net sales of approximately $50 million and mid-teens Adjusted EBITDA margins in calendar year 2021, and was named to the Inc. 5000 Fastest-Growing Private Companies list for the seventh consecutive year.”

Roughly 80% of fiscal 2022 sales of the residential segment came from residential repair and remodel while the remaining 20% went to residential new construction. The illustrations below are for fiscal 2021.

AZEK leverages its manufacturing platform and material technology from the Residential segment to its other segment, Commercial. The Commercial segment is made up of two product lines - Vycom and Scranton Products. Commercial generated revenue of $187M in fiscal 2022 (14% of total sales), which was up 38.7% from the prior year. Similar to the Residential products, Vycom and Scranton Products produce sustainable, low-maintenance materials that are intended to replace traditional materials such as wood and metal. Vycom’s end markets are outdoor living, graphic displays, recreation and playground equipment, marine and other various applications. Scranton Products makes storage solutions mostly for schools, stadiums, recreational and commercial facilities. Demand for Commercial segment products is driven commercial construction activity, material conversion and a secular trend of increased privacy.

Distribution and Sales: AZEK's distribution strategy involves a comprehensive network that caters to both the Residential and Commercial segments. In the Residential segment, the company sells products through over 5,000 professional dealers and various home improvement retail outlets, served by around 40 distributors with over 150 branch locations across the United States and Canada. Exclusive relationships, digital tools, and marketing initiatives help drive sales and brand loyalty. The Commercial segment's distribution involves around 125 engineered product distributors for Vycom products, primarily selling to OEMs, and approximately 850 dealers for Scranton Products that cater to industrial and commercial customers. Throughout fiscal year 2022, roughly 99% of gross sales came from the U.S. and Canada, but the company also maintains distributors outside these regions as well.

AZEK's Residential segment leverages geographically based sales teams to target contractors, architects, and builders, supported by comprehensive marketing campaigns and digital tools. Education initiatives such as AZEK University and the AZEK Pro Rewards program drive brand preference and loyalty. Attracting more contractors and architects is important to AZEK as the brand leans toward the pro channel rather than retail DIYers.

Only one distributor accounted for more than 10% of company-wide sales, Parksite, a prominent distributor of building products that typically serves lumber yards and other building product dealers. Parksite accounted for 20.3%, 23.3% and 19.3% of revenue in 2020, 2021 and 2022, respectively. As a comparison, Trex relies more heavily on Home Depot and Lowe’s which is discussed prominently in their 10-K. Three customers combined to account for 56%, 61% and 64% of company-wide sales for Trex in 2020, 2021 and 2022. It’s nice to see AZEK is much more diversified on the distributor front than Trex.

In the Commercial segment, Vycom focuses on engineered polymer solutions for various industries, using direct territory managers and manufacturing representatives to increase market penetration. Scranton Products employs a direct sales approach, targeting architects and facility managers to create demand across institutional and commercial markets. Overall, the strategy emphasizes customer engagement, education, and market-specific targeting to foster growth.

Operations: AZEK operates as a vertically-integrated U.S.-based manufacturer, with a focus on quality products at competitive costs, largely facilitated by domestic production. The company's manufacturing operations, spread across 14 facilities in 13 locations, utilize a blend of virgin polymers and recycled materials in 85% of gross sales. Recent expansions include manufacturing facilities in Boise, Idaho, and acquisitions like PVC recycling Return Polymers.

Raw materials used by AZEK include petrochemical resins, reclaimed polyethylene, PVC material, waste wood fiber, and aluminum. Supply contracts are generally short-term, with fluctuating prices influenced by market conditions and crude oil prices. AZEK actively manages the effects of these fluctuations by diversifying its supplier base, increasing recycling use, and investing over $75 million to enhance recycling capabilities from 2017 to 2022. Dependence on single suppliers for specific raw materials creates potential risks, but the company’s strategies aim to mitigate interruptions and maintain quality.

Competition: The Residential segment competes against Trex (TREX), Fiberon, which is owned by Fortune Brands FBIN 0.00%↑, Deckorators of UFP Industries UFPI 0.00%↑, Oldcastle APG, Westlake WLK 0.00%↑, Kleer Lumber and CertainTeed. The Commercial segment competes against a relatively fragmented market. The named competitors of Vycom are Mitsubishi Chemical Advanced Materials, Rochling Plastics, 3A Composites USA, Simona AG and Kommerling Plastics. Scranton Products’ named competitors are Global Partitions Corp., Hadrian Manufacturing and Bradley Corp.

I searched online for top rankings of composite decking to get an idea of where AZEK stacks up against the competition. The first Google hit is House Beautiful which ranks TimberTech number one due to its aesthetics. The second Google hit is Consumer Reports (paywall). Consumer Reports tested all of AZEK’s named competitors and more to produce a top four for 2023. Envision EverGrain was number one with TimberTech’s Harvest Collection at number two, Fiberon Horizon at three and TimberTech’s PRO Legacy collection at four. The next Google hit that provided rankings was Deck Bros who also had TimberTech at number one due to wood-replication, shipping and superior capping method.

Historical Financials: AZEK debuted in a June 2020 IPO and provided segment financial data back to 2018. For the following analysis, I took segment results and backed into rough figures (for instance product results aren’t detailed in financial statement but AZEK lists the percentages of sales generated by product type). I was also able to get 2016 and 2017 financials by backing into them based on the growth figures AZEK gave in the IPO prospectus, therefore, deconsolidated numbers may not perfectly sum to company-wide net sales. Note that AZEK’s fiscal year ends on September 30.

I also want to bring up a little more history on AZEK. PE firms Whitney & Co. and Clearview Capital sold Compression Polymers Holdings, AZEK’s predecessor company, to private equity firm AEA Investors in 2005 and through a merger turned into CPG International. CPG was reporting financial results through 10-Qs and 10-Ks from 2006 through 2010. AEA had filed IPO documents to float the company in 2011 but changed their mind and ended up selling to Ares Management and Ontario Teachers Pension Plan (“OTPP”) in 2013 for around $1.5B, according to a Reuters article. Naturally, management would turnover and CPG re-branded as AZEK in 2018. When AZEK ended up hitting the public markets in 2020, Ares and OTPP each held 48% pre-IPO stakes that were diluted to 37% through the IPO. The rest of the shares were held by management/employees. I bring all this all to point out that there is some old data on AZEK’s predecessor entity, though the following financial analysis will focus on AZEK’s current operating company.

The first segment is Residential which made up 86.2% of company-wide sales in fiscal 2022. Residential has grown at a compound annual growth rate (“CAGR” from here on) of 16.5% during the seven-year period from 2016 - 2022 and 12.0% during the 15-year dating back to 2007 (using CPG financials). AZEK has historically split the residential segment further into decking and railing sales and exterior product sales, then more recently broke out pergolas sales. Decking and railing made up 65% of segment sales in 2022, and as the largest base of business, has driven growth in recent years. Decking and railing sales did regress toward the end of 2022 and overall the year was flat. However, sales of exterior product continued to be strong and was up 20% YoY in 2022.

As far as margins go, AZEK only provides adjusted EBITDA on a segment basis.

We define Segment Adjusted EBITDA as a segment's net income (loss) before income tax (benefit) expense and by adding to or subtracting therefrom interest expense, net, depreciation and amortization, stock-based compensation costs, asset impairment and inventory revaluation costs, business transformation costs, capital structure transaction costs, acquisition costs, initial public offering costs and certain other costs.

I try not to use adjusted EBITDA when analyzing companies and I never think stock-based compensation should be removed to adjust EBITDA. But sometimes you’ve got to work with what you’ve got, and adjusted EBITDA is the only margin provided on a segment basis. As the table shows, adjusted EBITDA margins have held pretty steady since 2018 at around 30%, dipping to the lowest level in 2022. There’s been more asset efficiency with sales increasing as a percent of assets for the segment.

The next segment is commercial which made up the remaining 13.8% of company-wide sales in 2022 (much lower than what it was before 2011). Commercial had a strong 2022 with growth of 39%, significantly better than any other year. Both brands — Vycom and Scranton Products — experienced growth and it was “exceptional” for Vycom helped by the end markets of outdoor living, marine, semiconductor and industrial. Moreover, margins for commercial greatly improved in 2022 driven by operational optimization and cost savings initiatives. Management had also called commercial margins depressed in 2020 so there was a lot of effort to improve that business in the last two years.

Performance of the commercial segment has regressed significantly so far in fiscal 2023, a topic I’ll cover more in the outlook section. For now I’ll note that revenue for commercial was down nearly -21% in the first nine months of fiscal 2023. Maybe this shouldn’t be a surprise as AZEK had an interesting change in the latest 10-K which deleted the following sentence from the prior year. “We expect to continue experiencing significant growth in Scranton Products' sales in the commercial markets, which we believe is driven primarily by an increased focus on bathroom privacy considerations, design and aesthetics.” Deleting a sentence that says we expect to continue to experience significant growth is foreshadowing that growth will moderate or even turn negative.

The next illustration stacks sales by product category to show the change over time. The performance of the Exterior residential products has been impressive and therefore has more recently made up a larger piece of the pie in terms of sales.

When it comes to publicly traded companies, there’s not a closer peer than Trex. Unfortunately, Trex hasn’t been granular with segment analysis by only reporting residential and commercial results. And for Trex, commercial only represented slightly less than 5% of sales in 2022 and 2021 and was therefore an immaterial part of the business. In fact, commercial had negative EBITDA margins and Trex sold the business in December 2022 for a paltry $7.3M.

The following chart plots out AZEK’s revenue for just the residential segment against Trex’s company-wide sales. It’s nice to look at the quarterly data, rather than annual fiscal data, because Trex’s fiscal year ends on December 31, unlike AZEK’s September 30 fiscal year-end. Trex sports a market-cap of ~$8B and AZEK has a market-cap of about $5B, which is quite the difference considering AZEK has done more sales in just its residential segment. However, Trex does have solidly better margins. AZEK’s (unadjusted) EBITDA has averaged 17% since 2017 and Trex’s EBITDA margin has been 28% over that period. AZEK’s margins are dragged lower by the commercial segment while the residential segment has had similar EBITDA margins to Trex.

According to investor presentations and commentary on earnings call, Trex and AZEK combined for about 70% of the composite decking market. AZEK doesn’t break out decking and railing revenue on a quarterly basis so it’s hard to compare apples-to-apples performance. The above chart, instead, shows AZEK’s residential revenue which includes exterior products. Trex’s exterior products are immaterial as exterior product revenue is generated through licensing agreements. When you combine the annual product revenue mix AZEK reports (65% of residential came from decking and railing in 2022) to the quarterly data it appears AZEK and Trex have trended on similar paths and neither is making headway in capturing market share from each. Management teams of both companies have been vocal about goals of taking market share from wood, rather than other composite decking manufacturers.

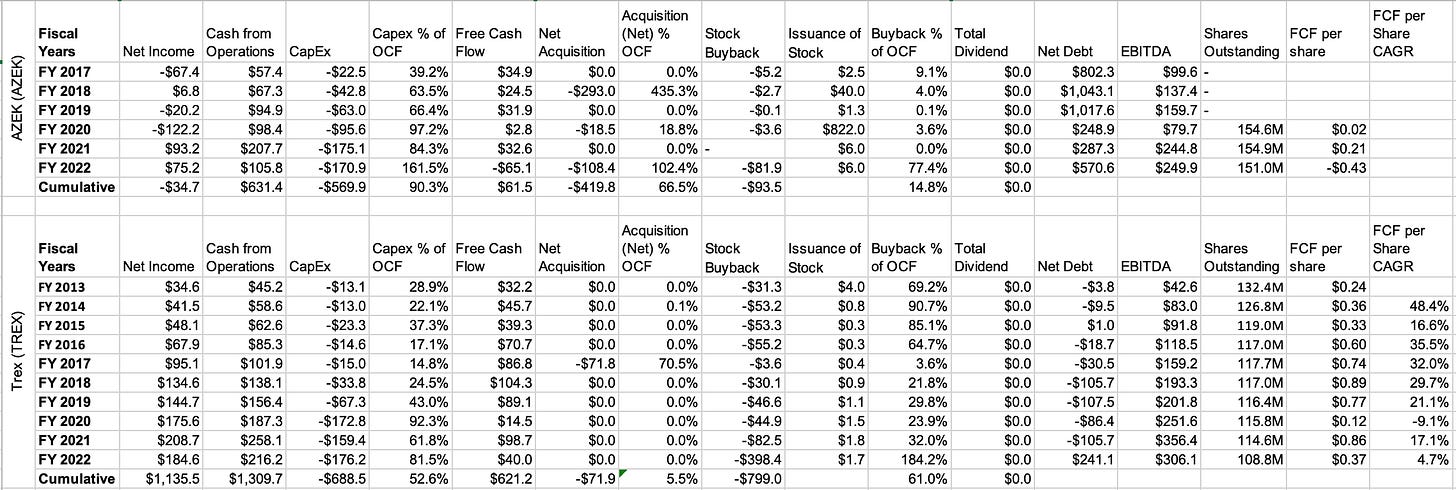

Capital Allocation: To analyze AZEK’s capital allocation history, I’m going go to compare Trex. I generally look back 10-years to understand capital allocation and for AZEK there’s six years available.

Since 2007, AZEK has generated $631M in cash flow from operations. 90.3% of that amount went back into the business through capital expenditure to grow or maintain the existing business. AZEK was also aggressive in M&A by spending the equivalent of 67% of its cash from operations on acquisitions. The largest was in 2018 by acquiring Versatex Building Products for $271.2M in total consideration which contributed significantly to AZEK’s exterior portfolio. That year AZEK also bought Ultralox for $23.4M to bolster the decking railing products. The other significant acquisition to make a dent on the use of cash flow was StruXure in 2022 to bring on pergolas for total consideration of $82.7M.

AZEK has never issued a dividend, but the company has returned capital via buybacks and was active in 2022 at what now looks like depressed prices. In aggregate, 15% of cash from operations since 2017 went toward buybacks. Opposite of the buybacks, AZEK garnered $817M in proceeds from the 2020 IPO. The money was used to pay down debt and in the table below it shows net debt dropping from roughly $1.0B in 2019 before the IPO to $250M by the end of fiscal 2020. Private equity investors like to operate companies with high leverage so it was an appropriate move to dilute via an IPO and rebalance the capital ratio by paying down debt.

As a comparison, Trex has produced $1.3B in cash from operations since 2013, and 53% of that went back into the business via capital expenditures, which is more modest than AZEK. Trex has also differed on M&A with just 5.5% of cash from operations going toward acquisitions (compared to AZEK 67%). Instead, Trex was much more active in buybacks by spending 61% of its cumulative cash flow from operations to buyback stock. Both AZEK and Trex have opportunistic histories of buybacks and I suspect the ratio of cash going towards buybacks over the last 10-years for AZEK would’ve been higher had they not been privately held. The last bucket of capital allocation to note is dividends and similar to AZEK, Trex hasn’t returned capital via dividends.

As noted, Trex’s M&A spend has been limited, and since 2013, it’s only included one acquisition which was for Stadium Concepts for total consideration of $71.8M. Stadium Concepts made up Trex’s commercial segment, which was later written down via an impairment charge and sold for $7.3M last year. That means their one-off try at M&A was a failure (point AZEK).

Management: AZEK has been led by Jesse Singh since June 2016, when he joined the company in his current role as CEO. Before that Singh, 57, was with 3M (MMM) where he held titles such as chief commercial officer, president of 3M’s health information systems business and VP of stationery and office supplies business that featured Post-it and Scotch tape brands. Those subsidiaries have different dynamics than building products but he’s nonetheless executed well in his role as CEO at AZEK.

CFO Peter Clifford similarly joined AZEK from outside and has been with the company since August 2021. He also similarly comes without direct building products experience, in fact Clifford was most recently COO and president of healthcare company Cantel Medical (former CMD). Clifford was also CFO of CMD, and before that, unit CFO for reporting segments of IDEX Corp. (IEX). Before Clifford was CFO of AZEK, Ralph Nicoletti held the position for just two years. He retired in his mid-60s and appeared to serve as a stop-gap CFO while the company was brought public.

The next highest-ranking executive is President, Residential Segment Jonathan Skelly who was promoted to that role in July 2022 after working as SVP, customer experience for a year. Skelly joined AZEK as SVP of strategy and execution in 2018 and held that title until 2021. He was previously with W.W. Grainger as VP of corporate development and was also director of strategic business development for Home Depot (HD), giving him good industry experience.

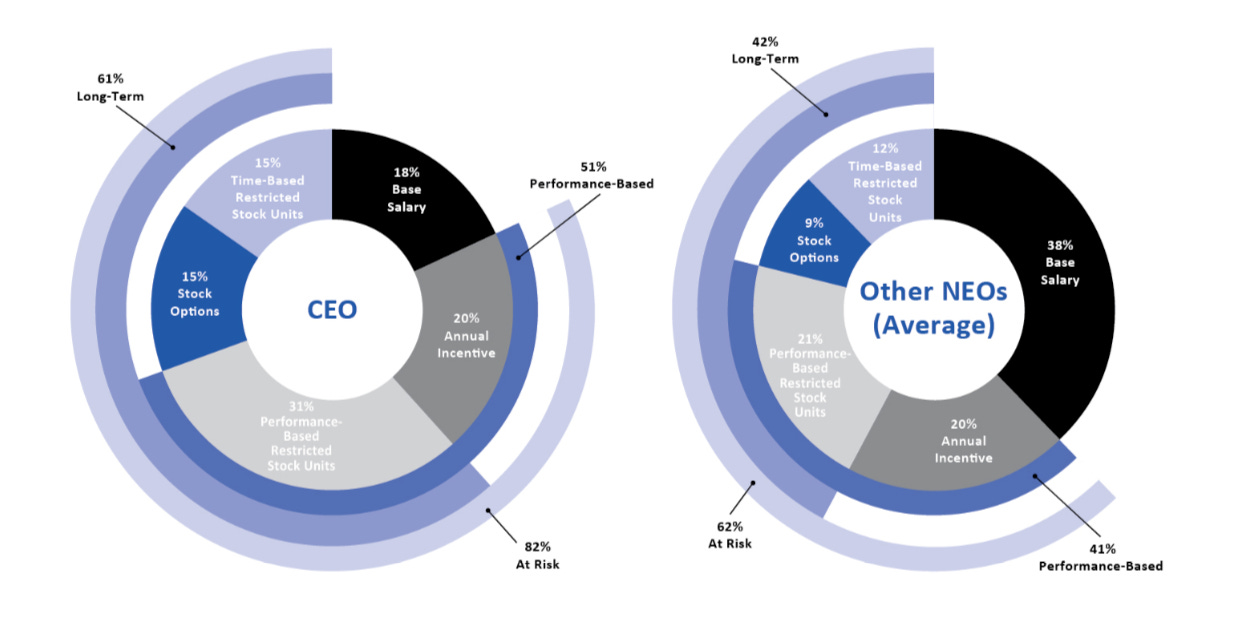

Compensation and Incentives: AZEK pays out compensation in the form of a base salary, annual bonuses paid in cash and long-term compensation that 50% in performance-stock units (“PSUs”), 25% in restricted stock units (“RSUs”) and 25% in stock options. There’s also sporadically been bonuses that are separate of the annual bonus for special purposes, such as guiding AZEK through the IPO. The typical pie chart provided by the company is below. It shows the CEO’s pay is 61% from long-term pay (PSUs, RSUs and options or total SBC). That percent has been on target for Singh. It also shows other executives had 42% of their pay in stock and my table below shows it’s generally been higher with an average of 61% for the select top executives.

A glance at the table shows some particularly high values for stock awards for executives in 2020, such as $25.0M for Singh and $5.3M for former CFO Nicoletti. That was due to the conversion of pre-IPO profit interest units (“PIUs”). PIUs are common in private equity and for AZEK were converted into common shares if already vested and RSUs if unvested. That means exchanging profits interests for Class A stock didn't quicken vestings. Alongside, recipients of the new shares got options to buy more Class A stock, ensuring they retained their original "leverage" from the profits interests. There was also a vesting of performance shares based on the realization of an exit multiple by the PE companies. The change in terms triggered a compensation expense and the conversion carried a cost of $103.4M (11.5% of revenue).

Next I’ll discuss the performance incentives to the different compensation buckets, starting with the annual bonus. Annual bonuses at AZEK have a target amount tied to the executive’s salary. For CEO Singh, CFO Clifford and Unit President Skelly, the amounts are 110%, 75% and 50%. The payouts are based on performance weighted 50% to adjusted EBITDA, 25% to net sales targets, 15% is weighted toward individual pre-established performance goals and 10% is based on individual contribution to achievement of ESG goals. The individual performance is fairly qualitative while 75% is quantitative by attaching it to adjusted EBITDA and revenue.

In order to get a 100% payout for the annual bonus for fiscal 2022 financial performance, AZEK needed to achieve $1,373.5M, which was 97.4% of the sales guidance given for 2022 in November 2021 (when AZEK reported fiscal Q4’22 results). Achieving the threshold amount yields a 50% payout of the target, the target means the executive gets 100% of the bonus pay and the maximum is capped at 200% of the bonus pay. The table below looks at the targets set out versus the guidance at the start of the year. I’m good with management getting their bonuses paid in full if they simply meet the guidance sheet. I listed actual performance as well, given in the proxy, which takes out performance from acquisitions. Also note that President, Residential Segment Skelly had performance goals strictly tied to the residential segment.

As a comparison, Trex’s annual cash bonus was weighted 75% based on the achievement of a pre-tax income target and 25% weighted toward a target of operating cash flow. Both of these figures are adjusted for “extraordinary” items. For instance, in 2021, the pre-tax income target excluded the write-off of goodwill of Trex’s Commercial Products because it was “not anticipated in the financial plan”. Sounds like some poor governance if you ask me. In any case, it’s notable that Trex has all of the annual bonus tied to profit-like performance whereas AZEK has 50% tied to a profit-like metric, 25% growth and 25% qualitative individual goals.

Next in the compensation program is long-term incentives (stock-based compensation). AZEK sets a total dollar value then pays out that amount with 25% in time-based RSUs, 25% in options that are also vest over time, and 50% paid in the form of PSUs. The PSUs have a three-performance period and are weighted 45% toward a cumulative net sales goal and 45% toward an adjusted EBITDA goal. The remaining 10% is based on the average return on net tangible assets. Target amounts are set and payouts can range from 50% to 200%.

Trex’s long-term incentive program is 35% RSUs, 50% PSUs and 15% stock appreciation rights (“SARs”). SARs are like options though less dilutive. The PSUs similarly have a three-year performance period and the incentive is 100% based on EBITDA targets. Another situation where Trex is more focused on profits rather than outright growth.

Outlook: AZEK is three-quarters the way through its fiscal year of 2023 as of this writing. AZEK reported fiscal Q3’23 results on August 8 and revenue so far for the first nine months came in at $981.5M, down 6.6% from the first nine months of 2022. The gross profit margin so far this year was 29.3%, down from 32.1% in the first three quarters of 2022. Looking more granularly, growth appears to be coming out of a trough and is rebounding after Q1’23 when revenue was -16.7% lower YoY. Revenue began to decline in fiscal Q4’22 when growth moderated and channel de-stocking quickly occurred. It was evident distributors built out too much inventory post-pandemic when deck building was popular and it needed to be recalibrated. Note that margins have followed this same trajectory of hitting a trough early in the year before rebounding solidly in the latest quarter.

Exterior products remained strong and the over-built inventory was focused in decking and railing products. However, commercial products reverted to negative growth in the first nine months of 2023. The story for commercial products was similar to decking in which channel partners met demand through inventory drawdowns causing AZEK commercial segment revenue to decline.

Residential segment sales was down -4.5% in the first nine months, but up 2.5% in Q3’23 showing meaningful improvement. Commercial segment sales were down -20.6% in the first nine months and -30.8% in Q3’23. Management expects the recalibration of the commercial segment to take two more quarters. Even with continued softness in the commercial segment, AZEK management expects Q4’23 revenue to grow at 20.3%, which should take the company back to an elevated level.

The following chart shows quarterly YoY revenue changes on a percentage basis. As you can see, the past two quarters approached revenue growth that was flat YoY.

With growth returning at AZEK there’s a lot to be excited about and it appears AZEK will be on track to again grow organically at a low double-digit pace. Last year, AZEK laid out a 2027 sales target of $2.3B which will be achieved by growing at 10% organically.

In order to achieve 10% organic company-wide sales growth, the residential segment will need to grow at 11% annually. Management expects 4% to come from remodel and repair, 2% - 3% to come from growth initiatives like new product and 3-4% to come from wood conversion.

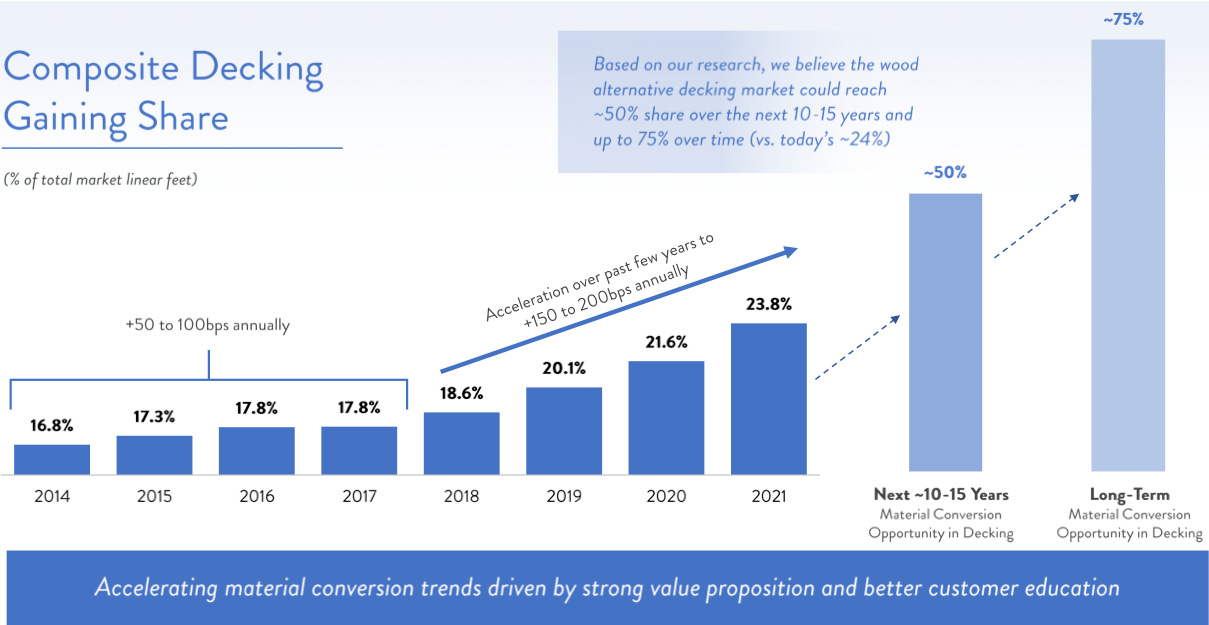

The wood conversion component has been a boon to composite deck makers in the past five years. According to Principia and company estimates, the composite decking made up just 3% of total decking sales in 1998. By 2015, that number was above 17%, then accelerated higher beginning in 2018 as the following graphic from AZEK shows. Each 1% increase in market-share of composite decking of the total decking adds 4% in annual growth to the composite decking market. That indicates AZEK is forecasting composite decking adds another 1% annually each year over the next five years.

In fact, AZEK is ultra-bullish on the long-term market-share of composite decking by saying the 10 - 15 year opportunity is 50% market-share, up from the ~25% currently. The long-term opportunity is 75%. Both are possible, though the gap in cost of composite decking to wood would have to narrow.

The last topic within outlook I’ll discuss is the opportunity for margin expansion. Adjusted EBITDA margins have been about 22% since 2020. AZEK management plans on getting to 27.5% by 2027. A large portion of that is better recycling to help out the costs of PVC decking and trip, in addition to product design, operating leverage and other optimizations.

Quarterly adjusted EBITDA jumped to 25.0% in Q3’23 after briefly sinking to 7.0% in fiscal Q1’23. CEO Singh said of margins on the August 8 earnings call:

We meaningfully expanded our margins within the quarter as we realize the benefits of cost and sourcing actions and more normalized production levels versus the first half of the fiscal year when we aggressively reduced our production to draw down inventory in our channel and within our own walls.

In addition, we were challenged with having to work through higher cost inventory on the balance sheet that mask the cost reductions that we had already implemented. We expanded our adjusted EBITDA margin sequentially by 570 basis points and year-over-year by 310 basis points. Results within the quarter reflect strong execution by our operations team and our current cost structure.

CFO Clifford noted the drivers to improved adjusted EBITDA margins were material deflation, a more normalized production environment and execution against cost savings initiatives. In Q&A Clifford added “the results here in the third quarter and what we expect in the fourth quarter gives us a tremendous amount of confidence that we're not only on track, but exactly where we'd like to be in pacing to hit the 27.5% in 2027.”

Valuation: I put together a DCF model to value AZEK. Management guided a mid-point 2023 revenue target of $1,348 and with just one quarter left I don’t have a reason to deviate from that figure. That incudes fiscal Q4’23 revenue growing at 20.3%. The DCF forecasts residential and commercial separately to get a better feel for the business. Residential should end up with about 2.0% growth in 2023 whereas commercial will be about -15.0%. From then on residential picks to 12% in 2024 and 2025 and settles at 10% at the end of this forecast period. Commercial increases through 2025 and settles at 4.0%.

I forecasted these growth figures based on the historical performance and it appears there’s still upside with continued wood conversion. This still puts AZEK well below their 2027 goal of $2.3B in revenue, though after a rough 2023, it’s too much ground to make up in my opinion. The five-year CAGR through 2027 would be 8.2% when including fiscal 2023. That follows a five-year company-wide CAGR of 18.8% in the prior five years. Breaking that down further, residential has been at a CAGR of 16.5% since 2016 (including some M&A) and commercial has been at 6.0% since 2016. Investors can even look back on AZEK’s predecessor company for long-term performance of commercial business which clocks in at revenue CAGR of 4.3% since 2007. The residential segment has transformed so much that long-term growth in revenue isn’t a relevant figure.

I’m projecting EBITDA margins of 23.5% in 2024 and then continue to move higher to 26% in 2027, which aligns with management’s adjusted EBITDA target of 27.5% (about 1.5% is SBC).

Capital expenditures are expected to be $85M in fiscal 2023. This follows an average of 10.5%, which I’d consider elevated for AZEK. The DCF model plans for 8.0% of revenue going toward capital expenditures. Cash flow projections are as follows.

The other critical inputs of the DCF model are the discount rate which is 10.9% based on a beta of 1.8 and the current 5-year risk-free rate of 4.4%. AZEK’s average trailing EV/EBITDA multiple in its short trading history is 35.4 and the median is 26.5. That includes a fairly high multiple in 2020 and 2021. This DCF will exit at 18X. The summary is as follows, which calculates a fair value of ~$42.50, roughly 31% higher than the current price.

Another way to look at AZEK’s current valuation is a relative multiple to Trex. Here I’m showing the forward EV/EBITDA multiple via Koyfin. As you can see, Trex has almost always traded at a premium. Trex is a good company but I gap in valuation multiples seems too big given Trex is at 23X next twelve months EBITDA while AZEK sits at 15X. Part of the lower multiple for AZEK may have to do with having a slower growth commercial business that makes up 12% of company-wide sales. By my estimates, commercial will make up less than 10% of sales in 2026 as the business is increasingly made up of the faster growing residential products.

Higher valuation multiples generally come with higher growth. In the revenue forecast screenshot I noted that the sell side estimate for 2024 is $1.47B (8.9% YoY growth) and is $1.58B (7.5% YoY growth) for 2025. By comparison, sell-side analysts are more bullish on Trex by estimating 11.1% growth in 2024 and 12.7% in 2025. This is a bit surprising to me. If I was to place a bet on better growth prospects it’d be on AZEK.

Conclusion: AZEK is a well-managed maker of composite decking and exteriors that continues to have a tailwind as more buyers shift to composite materials from wood products Conversion from wood was strong in the past five years and there’s solid runway left that could make for strong cash flow in the next five years. I like that AZEK has some diversity to its business with exterior trim and siding balancing out the decking business. AZEK’s commercial business further broadens the revenue streams. In addition, there’s likely some extra demand for shares based on the ESG considerations. Shares have experienced a strong rally in the past three months with shares up 37% to ~$32.00. There’s some upside in shares left for those with a long-term horizon though I’d prefer to wait for a pullback if possible given the DCF’s fair value estimate of ~$42.50.

Disclaimer: This is not advice to buy, sell or hold any stock referenced. Do your own due diligence. I have no position in any stock mentioned in this report. Like any financial analyst, doesn’t mean I’m not biased.

Do you think its reasonable they can expand margins that much over the next few years, given you mentioned the margin for their residential business is already ~similar to Trex? Trex hasnt expanded its own margin much in the last 5yrs. The building blocks they mention look more like they fall under the category of "continue to try run your business more efficiently where possible", rather than some transformative lever they can pull.

Also exiting at 18x EBITDA is roughly equivalent to 33x PE no? (c28% EBITDA margin less 8% of capex, less 24% of tax)