Encore Wire (WIRE)

Electric wire maker getting a boost from Electrification of Everything movement

This post will cover Encore Wire by providing an overview of the business and the industry dynamics followed by an examination of the capital allocation history, management and their incentives, capped with an outlook and valuation.

Overview: Encore Wire WIRE 0.00%↑ manufacturers electrical wires and cables that are used to distribute power from transmission grids to the end-use at a wall outlet. The products are driving an economical transition to a more sustainable infrastructure through electrification — the act of converting infrastructure that was previously fueled by non-electric power into electric. This includes cars that were internal combustion or grids powered by fossil fuels such as coal. The conversion and Electrification of Everything is acting as a meaningful tailwind for Encore.

Electrical wires are mostly copper, and so the business of Encore is heavily tied to the commodity price. Some investors don’t like investing in commodity-tied companies. The price of copper is unpredictable and there’s less control of management on the profit compared to a lot of other industries. Encore Wire is a unique company with lots of peculiar attributes so even if you don’t like commodity-tied company, Encore still makes for an interesting company to read and learn about.

Their strategy is focused on utilizing its unique delivery model in which products are produced from a single, vertically integrated campus in Texas that is matched with exceptional customer service. The single-campus model is considered a competitive advantage to Encore by enabling low-cost manufacturing and administrative efficiencies. Generally single-campus models are prone to risks such as scalability, vulnerability to supply chain disruptions and geographical limitations. However, Encore says its single campus approach has combatted most of that by optimizing raw material usage and provides agility. Many companies experienced supply chain disruption from 2020 to 2022 and those in the building materials and infrasture industries were not immune. Encore emphasized its single-campus model in the 2023 10-K by breaking out a new section and saying it has been resilient to supply chain issues experienced by others.

Customer service has also been a key driver to success which has been earned through industry-leading order fill rates. This has been helped by holding broad and deep inventory on hand. My view on the exceptional customer service that Encore touts really means faster order fill rates. When it comes to electric wire, customers want cheap and fast, rather than focusing on brand recognition. Encore strives for just-in-time delivery with orders shipping in 48 hours or less.

Encore Wire’s product line consists of various types of electrical building wire, used in different scenarios from residential to commercial applications. This assortment includes NM-B cable, UF-B cable, THHN/THWN-2, XHHW-2, USE-2, and other types such as SEU, SER, Photovoltaic, URD, tray cable, and metal-clad and armored cable. If you’re unfamiliar with electric wiring, those products types will seem foreign. Explaining each type is unnecessary, but for general knowledge the names explain the type of cable, whether made with either copper or aluminum, insulation material, conductor type, and intended use. This diverse offering positions Encore to effectively cater to the varied needs of customers across different sectors and circumstances. Encore provided its primary product line and I compiled the graphic giving an explanation of each.

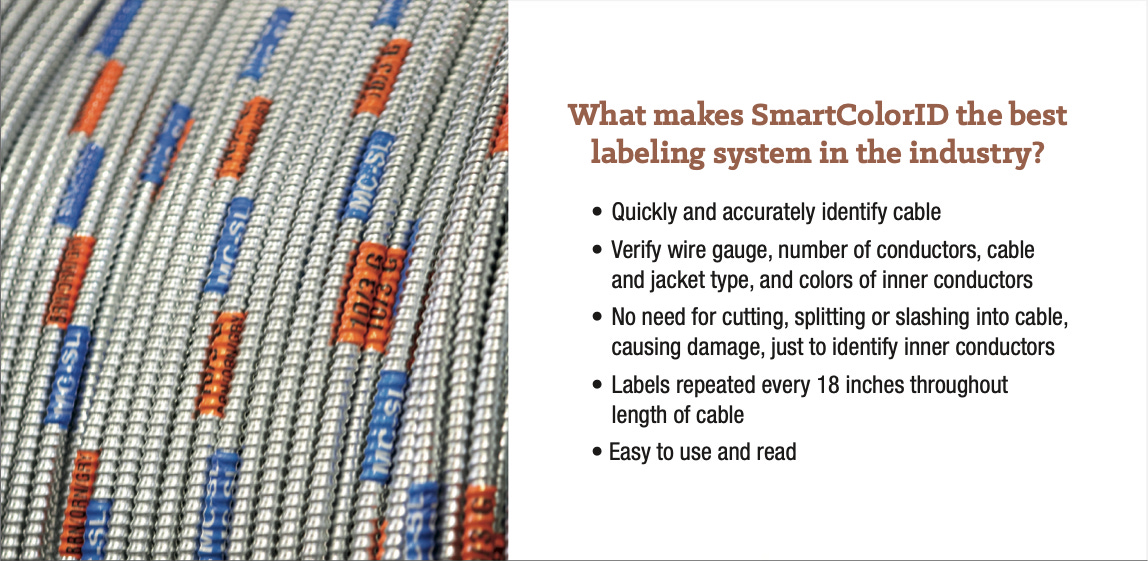

Overall, these products are commodities that are hard to differentiate. Encore has put his foot forward with innovation by pioneering the widespread application of colored insulation for commercial and residential cables, enhancing safety and installation efficiency. Encore touts its unique and patented SmartColor ID® in which metal-clad wiring has printed information on the cable that says the size, quantity of cables, ground, color of cables and armor type. Without this sort of ID system, users would need a reference chart or booklet. This makes the wiring easy to identify for inspectors.

In addition, Encore has other creative solutions such as the spool-free PullPro® which is a portable case that makes wires tangle-free and avoids cracks in spools to improve job-site scrap rates. Similarly, the self-spinning Reel Payoff® helps by efficiently pulling cable that saves 74% in labor time, according to Encore. Continuous innovation, evidenced by multiple patents and patent-pending improvements, reflects Encore's commitment to refining processes and enhancing packaging solutions. Note that neither of these innovations is truly groundbreaking and other peers also have colored cable that can be identified and have their own different pull systems and reels.

Encore Wire primarily uses raw materials like copper, PVC thermoplastic compounds, and aluminum in its manufacturing process, with copper being the primary material, constituting 78.6% of raw materials' dollar value in 2022. Prices for these materials are determined by COMEX closing prices for the given month, alongside a negotiated premium. The company also internally manufactures copper rods from copper cathodes and scrap, meeting most of its copper rod requirements. It purchases aluminum rods from various suppliers for aluminum wire production. Additionally, Encore compounds its own wire jacket and insulation materials, producing a significant portion of its PVC needs.

Encore sells its products to numerous wholesale electrical distributers in the United States. Two distributors each made up a little more than 10% of total sales. Distributors then sell to contractors who are the end customer. Distributors in particular strive for lean inventories and therefore Encore looks to carry sufficient inventory itself to satisfy needs.

An effective way to gauge whether too much inventory is building up is the inventory turnover ratio or Days Inventory Outstanding (“DIO”). The metrics are inverse of one another and DIO is expressed in a more digestible form, days, so we’ll look at that here. Last quarter, Encore held its inventory for 32.3 days before selling it. Encore had relatively poor inventory management in 2016 and 2017 when DIO peaked at 45.1 in Q2’16. 2020 supply chain disruptions caused the figure to bottom at 17.4 in Q2’21. Inventories have been normalized since and the Q1’23 Days Inventory Outstanding was in-line with the 10-year average at 32.3.

Encore Wire effectively markets its products nationwide via independent manufacturers' representatives. The company stores the bulk of its finished product inventory at its service center in McKinney, Texas, but also keeps additional inventories at warehouses across the U.S. to accommodate immediate delivery requests. Goods are usually delivered by truck, with the carrier selection based on cost and availability. Encore directly handles customer invoicing and credit limit determinations, with minimal historical credit losses. Despite reserving a modest $1.5 million for credit losses in 2021 and $0.7 million in 2020, these figures remain significantly low as a percentage of sales, affirming a robust credit management process. Importantly, the manufacturers' representatives do not have authority to set product prices or modify customer credit limits, ensuring the company maintains full control over these key aspects.

Competitors to Encore feature Southwire, Cerrowire, General Cable and AFC Cable Systems. Let’s dig into these companies to analyze where Encore fits in the industry. For context, Encore had 1,672 employees as of December 31, 2022 and generated $3.0B in sales in 2022. Southwire was founded in 1950 and has always been family-owned, so details on them, and most peers, are limited. Their website says they employ more than 7,000 employees while Forbes pegged their 2022 estimated revenue at $8B (up from $5.5B in 2021), making it Americas 66th largest privately owned company. General Cable previously traded under the ticker BGC but was acquired by Italy’s Prysmian Group in 2018 for $3.0B. General Cable had generated $3.8B in sales in 2017 (more than 3X Encore at the time) and employed 8,500 employees. Now General Cable is consolidated in Prysmian financials so it’s unclear exactly how much that business is generating. Cerrowire is a smaller player though again not much is known from a financial perspective as the company is owned by the Marmon Group, a subsidiary of Berkshire Hathaway. Some online sources estimate their revenue at nearly $300M.

Encore names AFC Cable as a competitor, and it’s owned by Atkore International (AKTR). Atkore is also a key player in the manufacturing of electrical products but is more diversified, servicing non-residential, residential, and industrial markets. Their Electrical segment, which generated $3.0B (77%) of $3.9B in total sales in 2022, focuses on constructing electrical power systems using conduit, cable, and installation accessories. Atkore’s product lineup extends to safety and infrastructure items, including metal framing, mechanical pipe, perimeter security, and cable management solutions, thereby serving contractors, OEMs, and end-users. They aim to adapt their offerings to meet changing customer needs and industry trends, including digital design tools and labor-saving solutions.

Compared to Encore, Atkore's product portfolio is more extensive, with products not only related to electrical systems but also infrastructure and safety. Both companies focus on innovation, but while Encore's innovations are mostly related to the physical properties of the cables (e.g., color coding and packaging), Atkore's innovation extends to the installation process, making it faster and smoother with products like the MC Glide Tuff armored cable and Eagle Basket.

When you aggregate the named competitors there’s about $20B in revenue between them, including Encore, meaning the company has a small amount of market share currently. Unfortunately, it’s tough to get a sense of the cost advantage since the two largest players in the U.S. don’t disclose financials. It is likely that the single campus model has helped Encore in recent years to speed up production, an attribute Southwire and General Cable do not have. Peers are either too small to have meaningful supply chain resources such as railway into the manufacturing facility, like Encore does, or they’re very large and spread out. Encore seems to blend both.

Now let’s shift to Encore’s historical results and seeing as the company debuted on the public markets in 1992, there’s a lot to look back on. In the most recent calendar year, 2022, Encore generated $3.0B in sales, up 16.4% YoY from 2021 when revenue was $2.6B. The increase in sales was driven by a 7.9% increase in pounds of copper wire shipped, which was offset slightly by a 0.5% decrease in the average selling price. As mentioned earlier, Encore’s sales are tied heavily to the underlying price of copper. In 2022, the average COMEX closing copper price was $4.00, down 5.8% from the 2021 average of 2021. What’s more closely tied to the underlying commodity price is the average purchase price of copper, which decreased 2.7% in 2022, increasing the spread at which Encore buys copper and sells wire.

While the cost of purchasing copper is close to the commodity price, the average selling price of copper wire can vary, and that’s largely due to market dynamics (basic economics here of supply, demand and competition). That gets clearer looking at 2021 results. In 2021, sales skyrocketed 103% to $2.6B from $1.3B, representing the largest annual jump since the first year as a public company in 1992. 2021 sales were driven by an increase in the average selling price of 84.7% which was coupled with a 10.8% increase in volume according to the copper wire pounds shipped. However, the cost of copper purchased only increased 49.5% that year (much less than the increase in the average selling price), leading to a jump in margins. 2021 was a year in which builders needed copper wire and Encore’s relatively solid supply chain was able to fill orders and mark up the price. The result was the gross profit margin jumped to 33.5% in 2021 after a decade of gross profit margins near ~13%. Gross profit margin inched even higher in 2022 to 36.9%, which is the highest ever for Encore as a public company. In the outlook and valuation section I’ll put some thoughts down discussing where that will go in the future.

When I analyze commodity-sensitive companies, I focus on volume of product more than price as the latter isn’t as controllable. I went through the past 20 10-Ks and extracted both the annual change in pounds of copper sold and average selling price of copper. Encore doesn’t disclose the figures outright (instead giving an annual percent change) so I indexed the change back to 2002 and created the following table and chart. Through 2005, Encore maintained a streak of year-over-year increases in unit volume according to pounds sold. Four years later, in 2010, volume reached its trough then steadily recovered before accelerating higher in 2021. Overall the growth in pounds shipped grew at an average annual compound rate of 2.0% since 2002 and 3.5% in the past 10 years. Copper prices were very strong in the 2000s then flatlined from 2011 to 2018. Overall Encore’s average selling price has grown at a CAGR of 9.7% since 2002 and 7.5% over the last decade since 2013.

Cash flow has historically been volatile due to the varying prices of copper and management has responded by conservatively operating Encore with no debt. In fact, Encore hasn’t carried debt since 2010. In the next section I’ll review how Encore spends it money.

Capital Allocation: The broad ways a company can spend their cash is capital expenditure to maintain and grow the existing business, growth via acquisitions, dividends or buybacks. Encore has exhibited a unique strategy of not spending on M&A, instead cash flows have mostly been spent on building the business organically. It’s common for companies to try to grow through acquisition. CEOs often have an itch for empire-building and a lot of resources are spent pitching acquisition targets to management from investment bankers looking to make money themselves.

As a comparison of the capital allocation at Encore, the graphic below includes Atkore. Starting with Encore. The business has generated $1.6B in cumulative cash flow from operations over the last 10 years (2013 - 2022). Of that, 38.5% was spent on capital expenditures. 19.2% was spent on buybacks, with most of that in the past three years. Dividends were negligible at 1.0% of operating cash flow. As mentioned, no cash was spent on acquisitions and there weren’t any divestitures either. Combined, that means about 40% of the cash generated wasn’t actually spent, and since Encore has no debt, the cash has simply accumulated.

During the same 10-year period, Atkore generated $2.5B in cash from operations. The capital allocation priorities were more balanced and typical with the company spending 18.3% of its cash generated on acquisitions, net of divestitures. 16.6% went toward CapEx and 55.1% went to buybacks. Atkore never paid a dividend. Buybacks were driven higher in 2018 when it bought back nearly 30% of its outstanding shares from its private equity sponsor, Clayton Dublier & Rice (“CD&R”).

Back to Encore, which ended 2022 with $730.6M in total cash and cash equivalents, a figure that decreased slightly as of Q1’23 via continued elevated buybacks. That means at the last reporting period (March 31) Encore had about $39 per share in cash, or about ~20% of the stock price. When discussing capital allocation priorities in August 2022, CFO Bret Ekert said:

Given today's volume and raw material requirements, just to kind of baseline, I believe we need to keep roughly $200 million of cash on the balance sheet for working capital needs. It's on the fringes where you're going to need cash, $2 copper, $8 copper, right, is where you're going to really draw in your cash balances.

As I said before, we continue to have 3 primary uses of cash. We've got capital expenditures, we've got share buybacks, and we've got a dividend. We've grown organically from day 1. We've never done an acquisition. We've got 460 acres, and we sit on 220, 225 of them. So we've got a lot of room for growth right here on this vertically integrated campus.

We just discussed CapEx levels -- CapEx level. And I'd tell you we're likely tapped out for the next 3 years with the current initiatives that we have. We did repurchase 1.1 million shares year-to-date in 2022 for approximately $132 million. Since February of 2020 through the second quarter of '22, we purchased just over 2 million shares for a total cash outlay of $196 million.

So I would tell you some new news or current news, the Board, as you know, had previously authorized the repurchase of 2 million shares in March 31, 2023. We have repurchased, as I said, $1.1 million year-to-date on that authorization. The Board has reloaded that authorization back up 2 million shares through March 31, 2023. We continue to see this as a good use of cash. We do discuss the highest and best use of company resources with the Board every time we meet, and we're going to continue to evaluate those options on a go-forward basis.

More recently, on the April earnings call, Eckert added this comment in regards to capital expenditure spending.

Capital spending in 2023 through 2025 will further expand vertical integration in our manufacturing processes to reduce costs as well as modernize select wire manufacturing facilities to increase capacity and efficiency and improve our position as a sustainable and environmentally responsible company. Total capital expenditures were $148.4 million in 2022 and $31.8 million in the first quarter of 2023.

We expect total capital expenditures to range from $160 million to $180 million in 2023, $150 million to $170 million in 2024 and $80 million to $100 million in 2025. We expect to continue to fund these investments with existing cash reserves and operating cash flows.

Connecting the two statements that management would like to have about $200M (maybe $250M now) in cash and plans to spend $420M on capital expenditures in the next three years, combines to nearly $700M in cash usage. For what it’s worth, maintenance CapEx is about $60M annually. Given the current cash pile, and ongoing cash flow, there’s still a lot of room for buybacks, which could be equal to all of the cash flow from operations in the next three years.

Management and Incentives: CEO Daniel Jones joined Encore in 1989 as director of sales. He was promoted to COO in 1997 and added the president title in 1998. Jones initially took on the CEO role on an interim basis in 2005 then was named permanent CEO in 2006, a position he’s held since. Despite having served as CEO for 17 years, Jones is currently 59 years old, so there’s a little runway left.

Bret Eckert joined Encore in his current role as CFO at the start of 2020. Eckert spent the first 22 years of his career at Ernst & Young where he worked with Encore by auditing the company for five years. He then shifted his career with his first CFO role at Atmos Energy (ATO) from 2012 - 2017. In between Atmos and Encore, Eckert worked in consulting.

Generally for industrial companies the third-ranking executive is the head/chief of operations. For Encore, that’s William (W.T.) Bigbee whose title is VP of operations. Bigbee started his career as a process engineer at peer company General Cable from 1989 - 1998 then shifted to Encore and worked as VP product and research development before promotion to VP of operations in 2016. Given the hierarchy, Bigbee seems to be a suitable candidate to succeed as CEO. Eckert is also a CFO who is highly involved and is another candidate to become CEO. What I found unusual is that Bigbee isn’t a named executive in the proxy; only CEO Jones and CFO Eckert are named executives and therefore have compensation detailed in the proxy. It’s unusual for an industrial company with a ~$3.0B market cap to have only two named executives. When looking at the count of insiders, which is a different threshold than being a named executive for proxy compensation rules, Encore has three insiders with the inclusion of Controller Matthew Ford. To put that into context, Russell 3000 companies have a median of six executive officers. Industrial Goods companies (the sector Encore is in) have a median of seven. This is yet another example of how Encore is an outlier company.

Now shifting to compensation. In 2022, 6.3% of Jones’ total compensation came from salary, 35.8% came from his annual cash bonus and 57.6% was paid in the form of stock awards. Eckert’s compensation split was similar. For each executive the amount total compensation paid in the form of a base salary was unusually low compared to the prior five years and the amount paid in the form of equity was unusually high. The table details compensation.

Encore’s at-risk compensation is split between annual cash incentive (cash bonus) and stock awards paid out as RSUs. Both are highly qualitative in nature compared to the norm which is to tie compensation to defined targets (such as revenue growth or profit margins). Encore says “Our bonus payouts are highly variable based on Company and individual performance.” The amounts are determined based on each executive officer's contribution to the company's performance of key objectives and profitability. The company believes that profitability is one of the most effective measures of management's efficiency in creating value for the company's stockholders. Therefore, Jones and Eckert saw significant rises in bonus pay in 2021 and 2022. Jones’ bonus was $6.0M, or about 6X his salary, and Eckert had a similar multiple of salary. Given that high multiple, there’s apparently no cap to the bonus payout (common example 200% of salary).

The stock award component, which is purely RSUs (time-based vesting), are given in connection with each executive officer's efforts and performance in the preceding fiscal year. The amount of equity granted to officers is determined by considering the individual's position, scope of responsibility, ability to influence profitability, the individual's performance, and the value of stock awards in relation to other elements of total compensation. The company's profitability, compared to historical results and recent peer group results, is also taken into account when determining the number of equity awards to be granted to officers. “The equity awards granted in January 2022 were made in connection with each named executive officer's efforts and performance in fiscal year 2021.” Compensation programs don’t get simpler than that. A qualitative judgment of the amount of equity to dole out with a time-based vesting scheme rather than more complex performance stock units that vest according to financial and/or stock performance. I personally prefer specific metrics tied to the compensation plan and would advocate Encore provide a more clearly defined and quantitatively-driven compensation plan. Generally, as a shareholder, I like to clearly know if management is incentivized with compensation tied to increasing revenue, profit or perhaps boost the stock via total shareholder return targets.

Outlook: Most of the overview section focused on Encore’s history from 2003 - 2022. Stocks are valued on what they can do in the future, not what they’ve done in the past. And most recently, in Q1’23, Encore reported its first quarterly revenue decrease on a year-over-year (“YoY”) basis after 10 straight quarters of growth (Q3’20 - Q4’22). For Q1’23, revenue dropped 8.7% driven by a flat quarter of volume change and an 11.8% decrease in the average selling price of copper (nearly matching the 10.3% drop in the COMEX average daily close in Q1’23 against Q1’22).

Encore doesn’t give guidance but I’ll note the Wall Street consensus expectation calls for a -6.0% YoY change in revenue in 2023. Moreover, EPS is expected to decrease -37% in 2023 as analysts forecast a drop in profit margins.

I can’t predict where copper will go in the near-future, and I’m not a short-term investor looking to game out earnings beats and misses (Encore does report earnings after the bell on July 25 by the way). However, I can lay out the narrative for the long-term, which is a meaningful secular tailwind of “Electrification of Everything”.

The Wall Street Journal posted a May 2021 articled title The Electrification of Everything: What You Need to Know that’s worth reading. The article links back to a Princeton University study examining that electrifying nearly all transport and buildings would double the amount of electricity used in the U.S. by 2050. The study also “estimates the country will need between double and triple today’s electricity transmission capacity to accommodate the Biden administration’s goal of achieving net zero greenhouse-gas emissions by 2050.” The Journal also had these quotes:

In California, electric heat pumps are gaining traction as more than 26 of the state’s counties and cities have enacted bans on natural-gas hookups in new construction. Other places have done the same, and there’s no doubt many others across the country will follow…

If we’re going to rely much more on electricity, we need to know the grid isn’t going to break down. Right now, we don’t know that, even for today’s level of demand. Sections of today’s grid were built in the 1950s and 1960s and are approaching end-of-life conditions. The 2019 wildfire crisis in California, for instance, highlighted how much of PG&E’s thousands of steel electricity towers needed to be repaired or replaced.

The Inflation Reduction Act that was signed into law in August 2022 includes funding of $7.5B to make electric chargers more accessible to Americans, in addition to extending tax credits for buying electric vehicles. When asked about the impact of the Inflation Reduction Act on the April 2023 earnings call, CFO Eckert responded:

It really gets back to what you all think about the continued expansion of data centers and what AI might do to that and what you think about renewables in this country, look at EVs, right? 1% of the vehicles in the U.S. are electric, right? But to get to that, you've first got to build battery plants.

You've got to build the facilities to build the cars. You need more semiconductors. And so you've got to build semiconductor plants, all that takes wire and cable. And then once you get the electric vehicle, the electric vehicle charging capacity in the U.S. is not great. right?

The majority of a charging station is copper. You power it with aluminum. And so a lot of the things with regard to the infrastructure, the hardening of the grid and the electrification is all going to take wire and cable with a looming supply gap in copper -- headed out there in the next 3 to 4 years. And so those are the constructs that we look to when we look for capacity additions and where we want to build in the market.

Encore covered The Increasing Call on Copper with the following slide in its March 2023 presentation titled Electrifying the Future. There’s a lot of information here. A few points to make note of is the amount of copper used for electricity generation of renewable energy versus non-renewable (3X the amount and higher); copper used for electric vehicles versus ICE cars; global copper demand’s continued trajectory higher and lastly the copper deficit.

Encore Wire referenced S&P Global’s July 2022 on the Looming Copper Supply Shortfall. Banning natural gas to heat homes and stove tops, the shift to electric cars and the charging stations that come with them, and shifting to more renewable energy via wind and solar all are causing a deficit in copper. Here’s a snippet via S&P Global:

Under current trends—whereby both capacity utilization and recycling rates remain at their current 10-year global average—the study's Rocky Road Scenario projects annual supply shortfalls that reach nearly 10 million metric tons in 2035. That is equivalent to 20% of the demand projected to be required for a 2050 net-zero world.

Even under the study's optimistic High Ambition Scenario—which assumes aggressive growth in capacity utilization rates and all-time high recycling levels—the copper market will endure persistent supply deficits through most of the 2030s, including a deficit of nearly 1.6 million metric tons in 2035—much higher than any previous shortfall…

Such a supply gap would have broader consequences across the global economy, disrupting supply chains for both energy transition and non-energy transition industries, the study says. Given copper's use in a wide range of end markets, it would also exert tremendous upward pressure on the cost of goods for global manufacturers as well as energy costs for consumers.

Taken together, the Electrification of Everything movement and projected copper deficits indicate over the next +10 years the price of copper has an upward trajectory. The chart below shows the price of copper in tons dating back to 1992.

The next chart shows the performance of Encore shares plotted against the price of copper. Encore shares have decoupled from the price of copper in the last two years. Looking back further and it’s clear Encore shares haven’t been strongly correlated with the commodity price as profit is driven by the margin in buying copper and selling the wire.

The Electrification of Everything secular tailwind is meaningful for Encore and secular stories like that provide compelling investment theses. At any point in this type of secular cycle, you’ve got ask why is now a good time to invest and how much runway is left. Let’s examine that question in the next section.

Valuation: In order to value Encore shares, I created the following DCF model. Starting with revenue growth of -6% in 2023 which essentially matches the sell side analysts’ consensus estimate. However, each year after the model forecasts more aggressive growth than the street. A rebound in 2024 seems achievable given the jump in housing starts late in Q2’23 and it’s reasonable Encore can grow at 3% - 4% annually after with the Electrification of Everything movement. Overall the five-year period is a CAGR of just 1.5% for sales. That compares to a CAGR of 11.4% from 2003 - 2022 and 11.2% from 2013 - 2022. On a more bearish note, revenue growth was flat from 2006 - 2020 so the 20-year CAGR figures are helped by the early 2000s and 2021/2022.

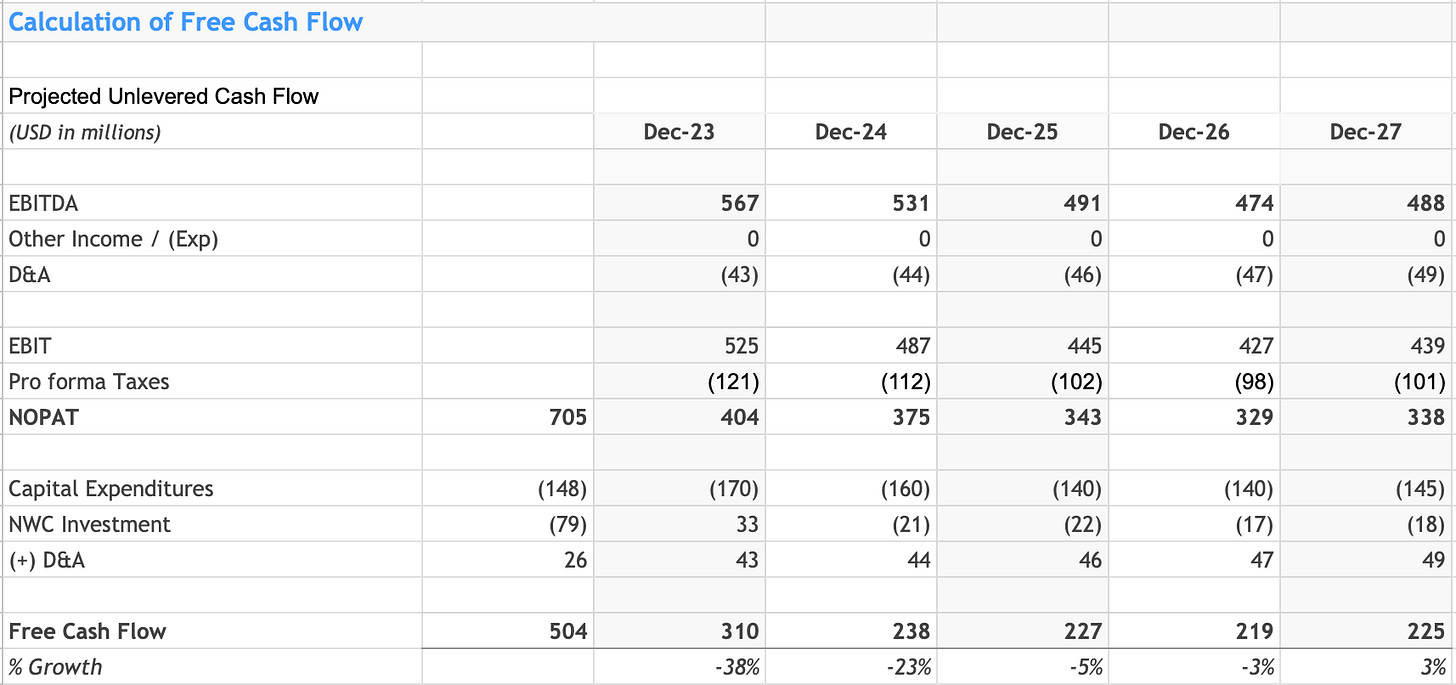

I’m forecasting margins contract back toward the historical norm which had been around 10% for EBITDA for the last 20-years. Year five of the DCF has EBITDA margins at 15%. It’s hard to believe Encore can maintain the unusually high profit margins. Encore and other electrical wire manufacturers have been building out capacity. For Encore in particular, they added 15-20% in capacity late in 2022 through the addition of a repurposed manufacturing facility (plant 7). When manufacturers add capacity it’s easy for margins to compress after.

Recall that CFO Eckert providing CapEx forecasts for the next three years of $170M, $160M and $90M in 2023, 2024 and 2025 (mid-point). The prior five years had CapEx equal to 4.5% of revenue so for 2025 and beyond I picked percentages close to that figure. The following shows the calculations of free cash flow.

The exit multiple for the DCF is 8.5X EV/EBITDA (TTM), which matches the average of the last 10-years and close to the last 20-years. Encore has no debt so the capital structure is currently 100% equity. The 10.5% discount rate is therefore driven by a beta of 1.3, and equity risk premium of 5.0%.

The following calculates a fair value $239 based on the above-mentioned inputs, indicating upside of ~38% presently. However, I’ll note that if EBITDA margins instead gradually fall down to 10% by year five, the DCF implies 0% upside. At that point, it appears the market is pricing in that margins revert back to the norm. It becomes a reverse-DCF. I view that more closer to the bear case (with the addition of lower growth). The bull case would be copper prices charge higher in the next five to 10 years and Encore grows meaningfully more than the base case I’ve presented.

Summary: Encore has a simple and easy-to-understand business model that has edge through its cost-effective single-campus model and efficient just-in-time delivery. With a 10-K that’s just 42 pages, Encore is digestible and has many attributes that Warren Buffett would like. The business has compelling secular tailwinds as the U.S. ramps up the Electrification of Everything. Given the upside of nearly 40% implied through the DCF, I will stamp Encore shares with a Buy. Investors would need to have a long-term investment horizon in order to initiate a position in a commodity-type stock while growth slows.

Disclaimer: This is not advice to buy, sell or hold any stock referenced. Do your own due diligence. I have no position in any stock mentioned in this report. Like any financial analyst, doesn’t mean I’m not biased.

Appreciate the write up.

I think this one is a sell at the moment though. I believe margins are rapidly headed back to 10% and the stock is likely to overreact to the downside. Below $100 per share, I agree this is a buy due to secular trends, but not at current prices.

Margins are inflated because copper price volatility and shortages made price comparisons difficult. As copper prices stabilize, regardless of the level, buyers of commodity cabling will drive margins down to 10% within a year. I don’t buy management’s story that customer service will enable them to maintain higher margins.

Great write up, thank you CI.

$WIRE is not unionized but I found their Glassdoor employee reviews concerning.