Qualys (QLYS) Q2'23 Earnings Update

Operating leverage increases margins, helping earnings beat

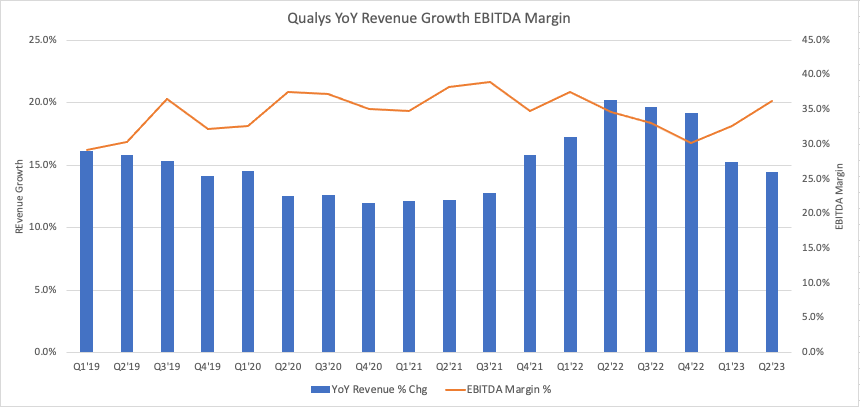

Qualys is an IT, security and compliance solutions company that helps companies protect their systems and asset from cyber attacks. Their offerings are focused on monitoring, compliance and risk management. I published a deep dive on Qualys on April 2 (link here). The qualities I like about Qualys is that they have historically been a steady grower with margins that are quite strong compared to others in the software and cybersecurity space.

Qualys reported earnings after the bell on August 3. Revenue for the quarter came in at $137.2M, up 14.4% from the prior year, and also better than the midpoint guidance of $135.7. Non-GAAP EPS of $1.27 compares to their guidance issued in May for Q2’23 of $1.02. Note that revenue and EPS also beat the consensus estimate by 1% and 39.7%, respectively. The takeaway for Q2’23 performance is that profit margins were strong, leading to a boost in EPS and strong guidance for Q3’23 and the rest of the year. Qualys now expects FY2023 non-GAAP EPS of $4.58, up 38 cents from the prior guidance. GAAP EPS is expected to be $3.15, up 50 cents from the prior guidance. The non-GAAP EPS guidance, if achieved, will be 23% higher than 2022 EPS. Guidance for revenue of $554M generally remained intact and would mark a 13.1% increase over the prior year.

I’ll dig into financials a bit further starting with a quote from CFO Joo Kim:

Revenues from channel partners grew 17%, continuing to outpace direct, which grew 12%. Channel revenue contribution remained the same as last quarter at 43%.

By geo, growth in the U.S. of 16% was ahead of our international business, which grew 12%. U.S. and international revenue remained the same as last quarter at 60% and 40%, respectively.

Although customer dollar retention was largely unchanged in Q2, the selling environment was challenging, with new business down and our net dollar expansion rate on a constant currency basis at 108%, down from 109% last quarter and 110% last year. While there continues to remain room for improvement from smaller customers spending less than $25,000 with us, we remain pleased with the continued strong revenue growth of 17% from larger spend customers.

Net retention, which shows how much you can upsell existing clients, is a closely tracked figure for SaaS companies. For Qualys, it’s mostly been around 109% for the past eight quarters and while it ticked lower in Q2’23, it wasn’t a material drop. The slight drop was due to companies giving “additional scrutiny on the upsells this quarter”.

The other KPI that’s popular in the technology world is new bookings/billings. Qualys doesn’t manage its current calculated billings figure, according to management, and it’s derived as total revenues recognized in a period plus the sequential change in current deferred revenue in the corresponding period (technology companies are inconsistent in calculating equivalent figures). Current billings had steadily decreased in every quarter from Q2’21 to Q1’22, but finally reversed in Q2’23. Management said the depressed Q1’23 growth in current billings was an “anomaly”.

The recovery in billings was nice to see, but the focus should be on the operating leverage Qualys exhibited that led to improved margins. Kim said in her prepared remarks on the earnings call:

Reflecting our scalable and sustainable business model, adjusted EBITDA for the second quarter of 2023 was $65.8 million, representing a 48% margin compared to a 45% margin a year ago. Operating expenses in Q2 increased by 6% to $53.4 million, primarily driven by investments in sales and marketing, including headcount. Although we remain focused on driving growth, with our disciplined approach to investing, we are being mindful of where to further increase investments while optimizing returns and others, which resulted in EBITDA margin exceeding our expectations in Q2. This demonstrates our ability to maintain high operating leverage and remain capital efficient while continuing to innovate and invest to support our long-term growth initiatives.

Then when asked about what’s driving improved operating leverage, Kim said:

the way we look at investment opportunities, we take a look at initiatives that we have to set plan for the full year, and then we tend to prioritize based on the returns that we see from each of the investments that we've already made.

And right now, we just didn't see that there was a reason for us to accelerate and increase investments in multiple different areas. And especially because we knew that we were looking for a new CRO, we had planned on finding the right person this year. And we're very fortunate to have Dino on board. So with Dino onboard with us right now, we'll be assessing all the initiatives to understand maybe it makes sense for us to increase investments in Q3 or in Q4. But based on what we see right now, we think that the most likely scenario is ending the full year at EBITDA margin in the 45% range.

Adjusted EBITDA in the first half of 2023, for context, was 46% so the impression is spending will ramp up in the second half of the year. The comment about prioritizing investments based on returns is exactly how executives should manage a company.

To expand on the chief revenue officer higher, Qualys announced on July 10 that it hired Dino DiMarino to lead global sales. DiMarino was most recently CRO of cybersecurity unicorn Snyk for about two years. Before that, he was CRO of Mimecast (former ticker MIME), giving him good experience with a similar size publicly traded company.

Overall this quarter was a win for Qualys and its investor. Shares traded about 7% higher in after-hours trading to $148.00. I’ll be interested to track Qualys and see potential improvements in sales with DiMarino on board.

Disclosure: This is not advice to buy, sell or hold any stock referenced. Do your own due diligence. I have no position in any stock mentioned in this report. Like any financial analyst, doesn’t mean I’m not biased.

Nice update, thanks.