Qualys (QLYS) Q4'23 Earnings Update

Management plans increased staff investment; fallout of partnership with Microsoft spun in positive way

Qualys QLYS 0.00%↑ is an IT, security and compliance solutions company that helps companies protect their systems and asset from cyber attacks. Their offerings are focused on monitoring, compliance and risk management. Qualys reported better-than-expected earnings for Q4’23 on February 7. Guidance was mixed and incrementally lower due to a partnership in which Qualys’ vulnerability scanning tools will be removed from Microsoft Defender. It’s a well-publicized fallout with pros and cons to the separation.

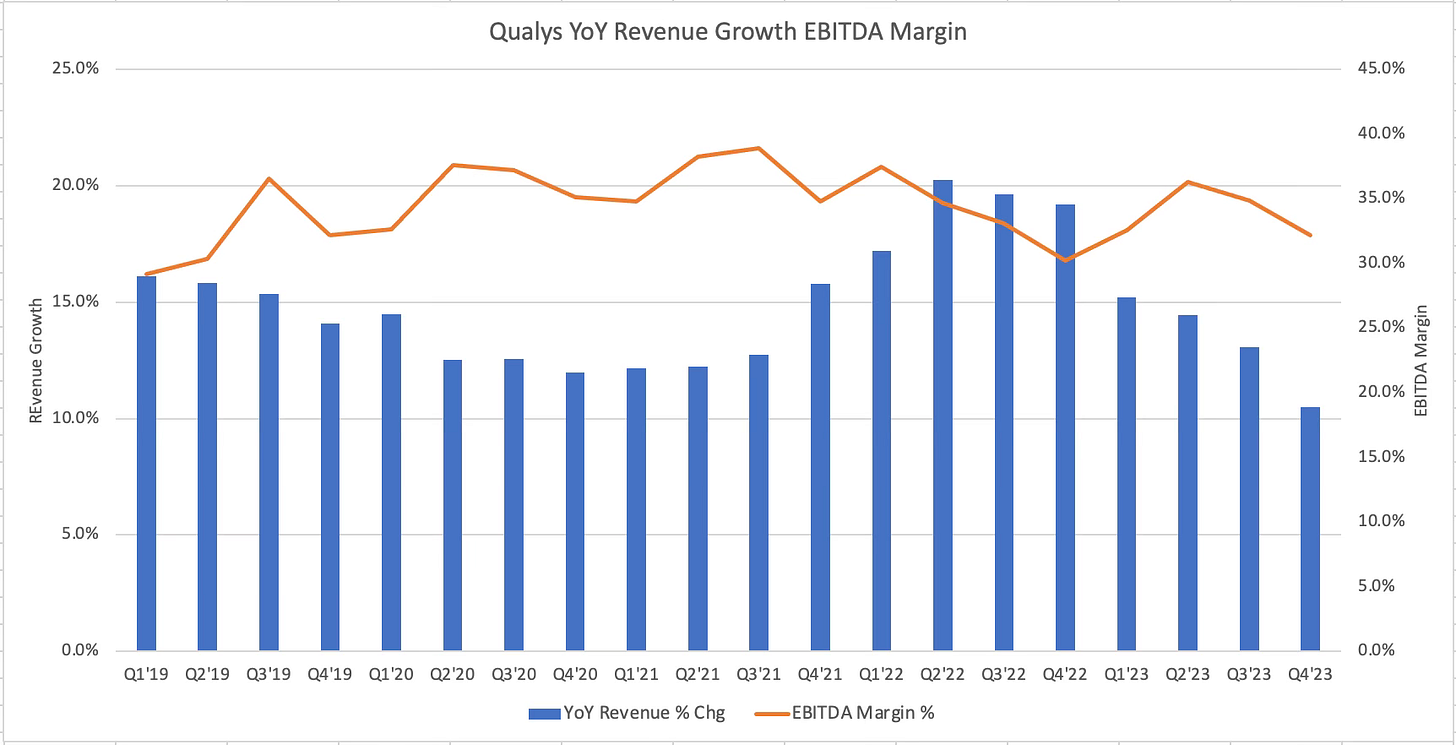

The high-level numbers feature revenue of $144.6M (up 10.5% from the prior year), which matches the Wall Street consensus estimate of $141M. Non-GAAP EPS of $1.40 was up from $1.01 per share in Q4’22 and beat the consensus estimate of $1.24. The adjusted EBITDA margin of 45.5% was up 345 basis points from the prior year. Reported (unadjusted) EBITDA margins were up a more modest 200 basis points to 32.2% compared to 30.2% last year but down slightly sequentially.

Guidance for Q1’24 came in at $145.5M (midpoint), which implies 11.3% YoY growth. The full-year 2024 revenue guidance is $605M, representing growth of 9.1%. The GAAP EPS guidance of $3.27 for 2024 is modestly lower than the 2023 GAAP EPS of $4.03. Non-GAAP EPS guidance for 2024 is also lower than 2024. The read on the lower EPS is due to higher investment into the sales staff in 2024. That began to set-in during Q4’23, evidenced by the higher SG&A expense as a percent of sales. This caused the EBITDA margin to drop sequentially. During the Q3’23 earnings management talked about the under-investment in the sales staff. This quarter CFO Joo Kim said:

“The way we're looking at the investment in 2024 is relatively in line with what we had in 2022. So back in 2022, we said that it was going to be an investment year. We had increased Sales & Marketing investment by approximately 25% back then, and we have increased our Sales & Marketing head count by 22%. This is kind of what we're looking to repeat in 2024, especially given that we've only grown sales and marketing by 14% in 2023. Primarily it will be driven by increasing the Sales & Marketing, the employee count that hiring for quota- carrying sales reps as well as other support functions associated with that, especially with a particular focus on the channel managers with our focus on partner first. Additional investment that we plan to make is related to anything that's like pipeline generating activities, including marketing, trade shows, events and partner enablement as well as sales enablement.”

Kim also added notable color on the partnership with Microsoft that will sunset on May 1 and caused a 1.0% decrease in revenue growth for 2024 (guidance would’ve called for 10% instead of 9% YoY growth). Kim said:

“Earlier this year, Microsoft Defender for Cloud users, using Qualys solutions were notified that we will be retiring our integration on Microsoft Defender and transitioning to BYOL model. With this change, these customers will be able to leverage Qualys TotalCloud CNAPP to effectively manage their security risk for cloud and container workloads. Although this strategic shift is estimated to result in a short-term negative impact to revenues, we believe it will be key to delivering long-term value to consumers. Normalized for this change, our revenue guidance for the full year 2024 would have been 9% to 11%.”

The immaterial drop in revenue is encouraging. To back up a bit, a sell-side analyst published a report on February 5 suggesting that the partnership made up 5-10% of Qualys revenue. That amount seemed too high given this partnership doesn’t get mentioned in SEC filings.

For more context on this, Microsoft Defender is a comprehensive security solution that provides threat protection for networks, endpoints, and cloud environments. Qualys' product integration within Microsoft Defender meant that Qualys' vulnerability scanning tools were directly available and operable within the Microsoft Defender ecosystem. This enabled Microsoft Defender users to seamlessly access and utilize Qualys' vulnerability assessment capabilities as part of their existing security workflow, without the need for separate installation or management of Qualys' tools. Essentially, this integration offered a built-in option for users to conduct vulnerability scans using Qualys technology directly through the Defender interface, simplifying the process of identifying and mitigating security risks. CEO Sumedh Thakar had a positive spin on it by saying in his prepared remarks:

“We also evolved our partnership with Microsoft Azure by sunsetting our vulnerability assessment only integration to provide Azure customers with the full capabilities of VMDR in its marketplace, and we'll start ingesting Defender data into VMDR TruRisk platform. Further continuing our partnership with Microsoft, we are also selected to participate in its Security Copilot leveraging an AI- powered security solutions.”

Thakar added additional color within Q&A:

“If you look at what VM has evolved quite a bit over the last few years and VMDR that we came out with, which took the scan-only VM and evolved it into multiple other additional capabilities, including inventory and threat detection as well as certificate management, giving an ability to patch systems. And so that VMDR really, in my mind set the standard for what end-to-end modern VM needs to be. And so what -- with the relationship with Microsoft, the particular integration was the legacy scan-only VM that they were leveraging. And so moving to the full -- to the BYOL allows us to have the ability to work with the customers to bring the full VMDR license into Azure environment.”

While the cessation of Qualys' direct integration with Microsoft Defender presents challenges, such as immediate revenue impacts and increased competition, Qualys views this transition as a strategic shift that aligns with the modern evolution of vulnerability management. Qualys can deepen its engagement with Azure customers and potentially offset initial concerns about the partnership's cessation with Microsoft by expanding and upselling customers beyond vulnerability to the broader VMDR (Vulnerability Management, Detection & Response) suite. Thakar pointed out in the earnings call that Qualys had another partnership win with Ingram Micro that highlighted that Qualys is “much more than just a Vulnerability Management vendor”.

Couple other KPIs from the Q4’23 earnings release to note was the continuing decrease in net dollar expansion to 105%, down from 106% last quarter and 109% last year. This shows Qualys is struggling to expand revenue at existing partnerships and Kim chalked it up to the new normal of budget scrutiny. Another popular KPI is the billings figure, which jumped in Q4’23 due to unusual timing and early renewals. Absent that, billings growth would’ve been 12%. Collectively, investors weren’t satisfied with the results and Qualys shares sank nearly 10% in after-hours trading on February 7.

Bottom line: when you consider the increased investment into the sales staff and regular product enhancements, Qualys has a path to rejuvenate growth in the medium-term while sacrificing profit margins slightly. Having heard Quals’ take on the Microsoft partnership, I’m not any more or less worried about the threat that Microsoft poses on Qualys and other cybersecurity vendors.

Disclaimer: The content of this report is for informational and research purposes only and should not be construed as financial advice. The views expressed are my own and do not reflect those of my employer. While care has been taken in preparing this report, I make no representations or warranties of any kind regarding its accuracy or completeness. I currently hold no position in any stock mentioned. However, like any financial analyst, my perspectives may carry inherent biases. Readers are encouraged to conduct their own due diligence.