Silgan Holdings (SLGN)

Deep Dive: Evolving packaging maker with path to strong earnings growth

Silgan SLGN 0.00%↑ is a prominent rigid packaging company that’s become an essential contributor to the world's consumer goods sector over the past three decades. The company's product range is diverse, catering to various end markets with items such as dispensing and specialty closures, steel and aluminum containers, and custom-designed plastic containers. These products find their way into everyday essentials—ranging from food and beverage to personal care, healthcare, garden care and industrial chemicals.

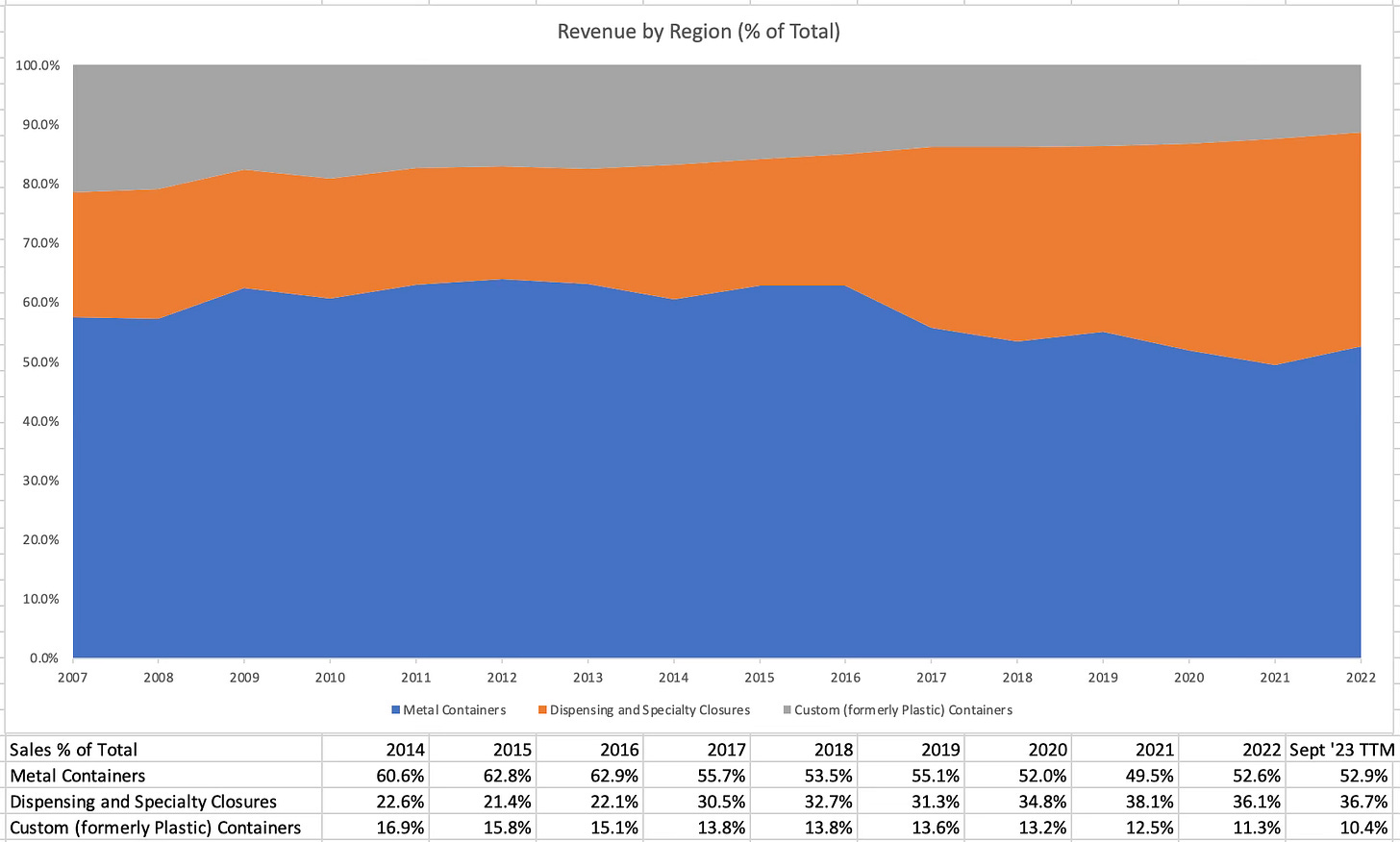

Silgan divides its business into three segments.

Dispensing and specialty closures segment: This segment specializes in providing innovative dispensing systems and specialty closures for a multitude of products, including food, beverages, and personal care items. By generating revenue of $2.32 billion in 2022, dispensing and specialty closures made up 36.1% of company-wide sales.

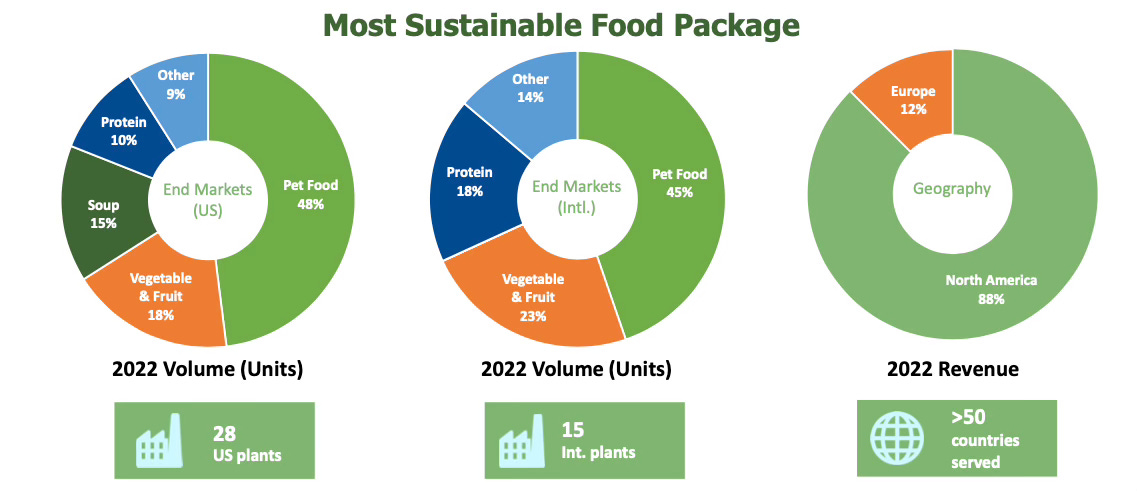

Metal containers business: Silgan dominates the metal container market in North America and Europe, particularly in the metal food container sector. Metal container, is the largest segment by accounting for $3.37 billion in sales in 2022, equal to 52.6% of company-wide revenue. Their leadership in this area, backed by strategic geographical presence, commands more than half the market share for metal food containers.

Custom containers segment: This segment produces a variety of containers for personal care, food, healthcare, and more by leveraging its capabilities through the other two segments. Custom containers generated $723.0 million in net sales in 2022, equal to 11.3% of net sales.

The company was founded in 1987 by R. Philip Silver and D. Greg Horrigan. When you merge the first three letters of Silver’s name and the last three letters of Horrigan’s last name, and divest the rest, it combines to make the company name Silgan. Silgan was largely built in the 1990s by buying assets from major canned food companies and producing cans for them under long-term agreements. For instance, Silgan bought assets from Campbell Soup CPB 0.00%↑ in 1998 and as part of that purchase also entered into a 10-year agreement with them to produce cans for Campbell. Partnerships and relationships like the one with Campbell have been instrumental in Silgan’s growth.

Since those early days, Silgan has smartly taken the cash it earned from that initial canned business and expanded into adjacent markets. That includes cans for pet food, which has been growing at a rate higher than GDP, and in the past decade, Silgan has been focusing on the dispensing portion of packaging. Silgan focused its M&A targets in the dispensing space that includes pumps and sprayers for various end markets which has diversified the business and helped increase profit from the low-margin canned goods business.

The investment rationale for Silgan is focused on the company’s steady metal container business and also the path to high earnings growth from the dispensing business, which has become Silgan’s most important segment. The product lines are also durable and relatively sustainable, with low risk of substitutes. The valuation calculations imply 26% upside to the current stock price and there’s a case to be made for higher upside.

The rest of this analysis will cover Silgan by providing an overview of the business and the competitive environment followed by an examination of the capital allocation history, management and their incentives, capped with an outlook and valuation.

Business Overview: The cornerstone of Silgan's business strategy is the delivery of "best value" packaging products, characterized by exceptional quality, service, and technological support. Silgan's approach to maintaining its position as a low-cost producer executed through a lean organizational structure, economies of scale, investment in new technologies for manufacturing efficiency, and rationalizing plant structures.

Financially, Silgan employs a strategy of utilizing reasonable leverage to support growth and enhance shareholder returns. Right now leverage (net debt/EBITDA) stands at 4.0X, which is in line with its peers and 10-year average. This approach is underpinned by stable and predictable cash flows, primarily due to long-term customer relationships and the recession-resistant nature of its business. The company's financial tactics include leveraging its steady cash flows for value-enhancing acquisitions, repaying debt, and shareholder-oriented activities such as stock repurchases or dividend increases (I’ll dive deeper into capital allocation philosophy later in this report).

Lastly, Silgan's strategy includes enhancing profitability through productivity improvements and cost reductions. Investments in capital for productivity enhancements and manufacturing efficiencies have enabled the company to rationalize plant operations and reduce overhead costs. This approach has led to the closure of several manufacturing facilities, optimizing the company's operations. Future acquisitions are expected to contribute further to manufacturing efficiencies, economies of scale, and the elimination of redundant functions.

Shifting to segment analysis, Silgan's Metal Containers segment is the largest contributing 52.6% of consolidated net sales in 2022. This segment, particularly dominant in the metal food container market in the United States, has a market share north of 50% making it the largest maker of metal cans. Silgan's range includes steel and aluminum containers used for various food products, including pet food, soups, proteins, and fruits, as well as general metal containers for chemicals.

The company's 43 metal container manufacturing facilities, strategically located across the United States, Europe, and Asia, cater to over 50 countries worldwide. A key factor in the steady performance of the business is Silgan’s focus on multi-year customer supply arrangements, with 90% of metal container sales coming from multi-year deals.

Silgan's metal containers are favored over alternatives like plastic, paper, glass, and composite containers for products requiring high-temperature preparation, larger quantities, or long-term storage while maintaining product quality. The company’s containers, particularly preferred over glass due to their durability and lower transportation costs, also stand out for being infinitely recyclable, making them an environmentally sustainable option. Innovations such as the Quick Top easy-open ends, shaped containers, and diverse color options enhance Silgan's offerings, along with significant capital investments that boost the competitive edge of these containers in the food sector.

Silgan's marketing strategy emphasizes long-term customer relationships, with a direct sales force and a network of distributors for the custom containers business. The company's sales approach is efficient, focusing on customers within a 300-mile radius of its manufacturing plants to minimize transportation costs. Major clients for these products include well-known brands like Campbell, Nestlé and Conagra Brands CAG 0.00%↑. Nestlé in particular has been Silgan’s largest customer representing 13% of company-wide sales in 2022, up from 12% in 2021 and 11% the year before that. No other customer accounted for more than 10% of company-wide revenue.

The Metal Containers segment's performance is influenced by factors like regional vegetable and fruit harvests, especially in the United States and Europe. This seasonality affects the segment's sales and operations, often leading to higher sales volumes and a significant portion of annual income in the third fiscal quarter. Compared to the two other segments, Metal Containers are relatively recession-proof as they lean toward consumer durables products.

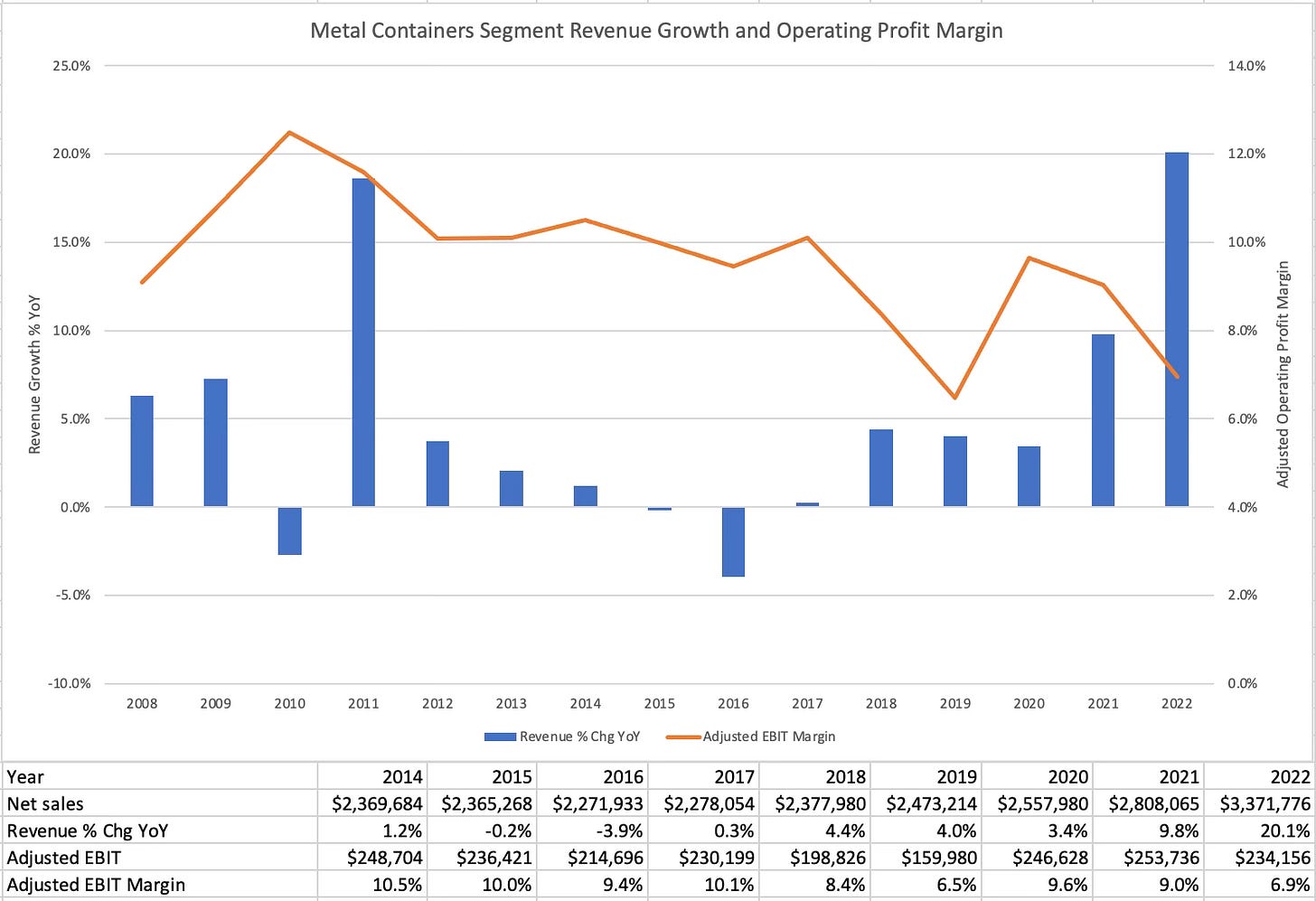

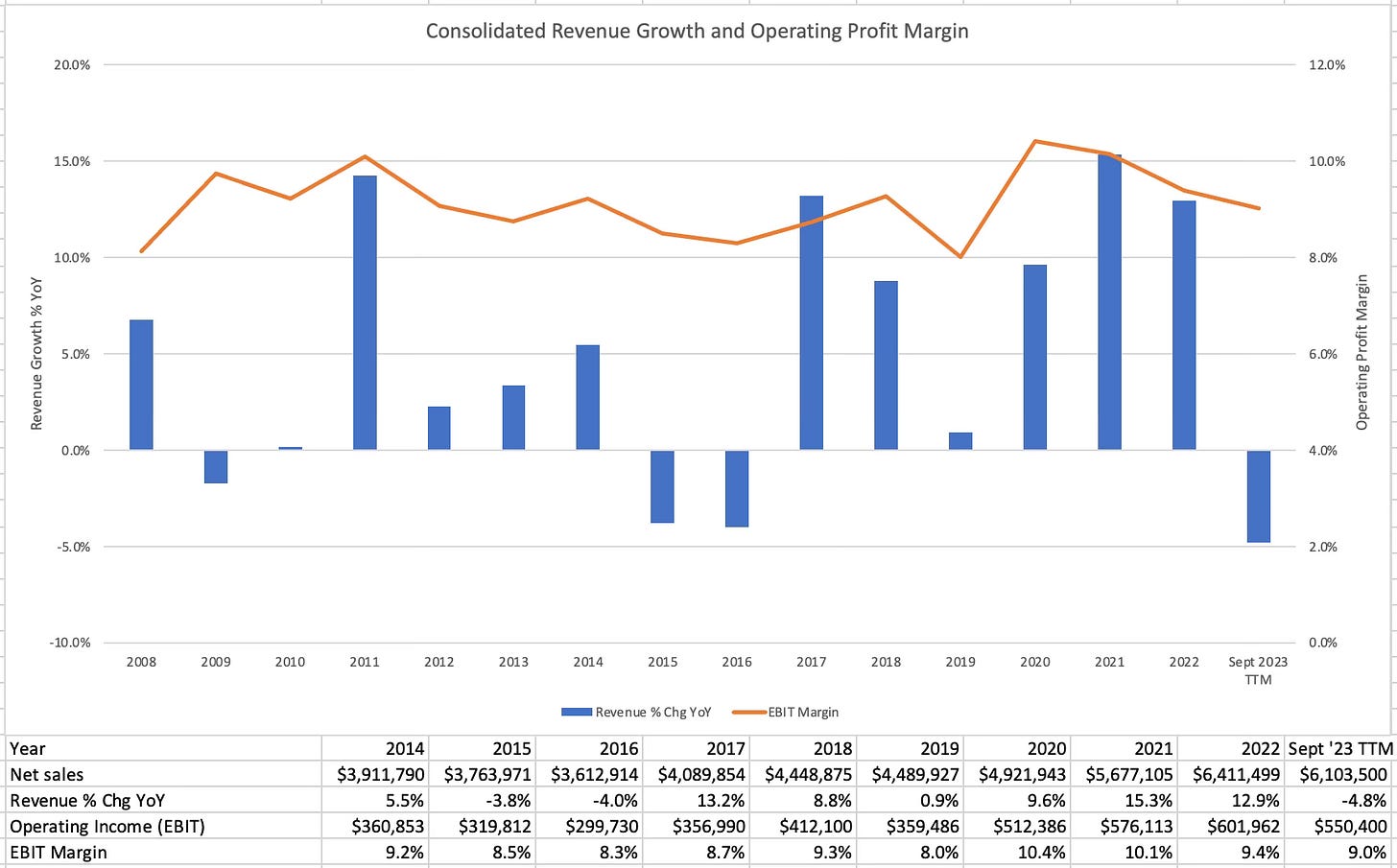

According to the latest 10-K filed in February 2023, the metal container segment has grown at a CAGR rate of approximately 7.6% since its inception in 1987. For this analysis, I extracted segment financials through 2007. Silgan doesn’t clearly disclose organic growth, which is unfortunate because it’s difficult to decipher how much M&A is contributing to top-line growth. The following financial data is taken from 10-Ks that list segment performance. Metal containers have grown its revenue at a CAGR rate of 4.8% since 2007 and only three years had materially negative performance. That includes 2016 when deflation dragged sales lower and 2023 due to customer destocking. This follows strong top-line growth in 2022 when Silgan passed through high material cost increases.

Silgan historically reported 'segment income' for each of its business segments, reflecting the operating profit (EBIT) generated by each segment independently. The total segment income represents the company-wide operating profit, adjusted for corporate-level charges that are not assigned to specific segments. However, in 2023 Silgan began reporting adjusted EBIT by excluding: acquired intangible asset amortization expense, pension expense (income) and rationalization charges and costs attributed to acquisitions. I much preferred the GAAP EBIT disclosure because acquiring companies is part of Silgan’s DNA and costs to do so shouldn’t be excluded. They often have rationalization charges because they optimize footprint for the current customer base as well. If they’re repeated/consistent costs they should be left in. But that’s modern investment accounting for you. The segment analysis will cover data from 2007 - 2022 and then I’ll give an update on 2023 performance in the company-wide

Metal containers, in particular, has had an average operating margin of 9.5% in the past 15 years. It’s generally seen a decrease and was low in 2022 due to exiting Russia operations that increased rationalization charges (one-time expenses generally used for cost-cutting initiatives). Excluding rationalization charges in 2022, the operating margin would’ve been about 9.1%, in-line with its historical average.

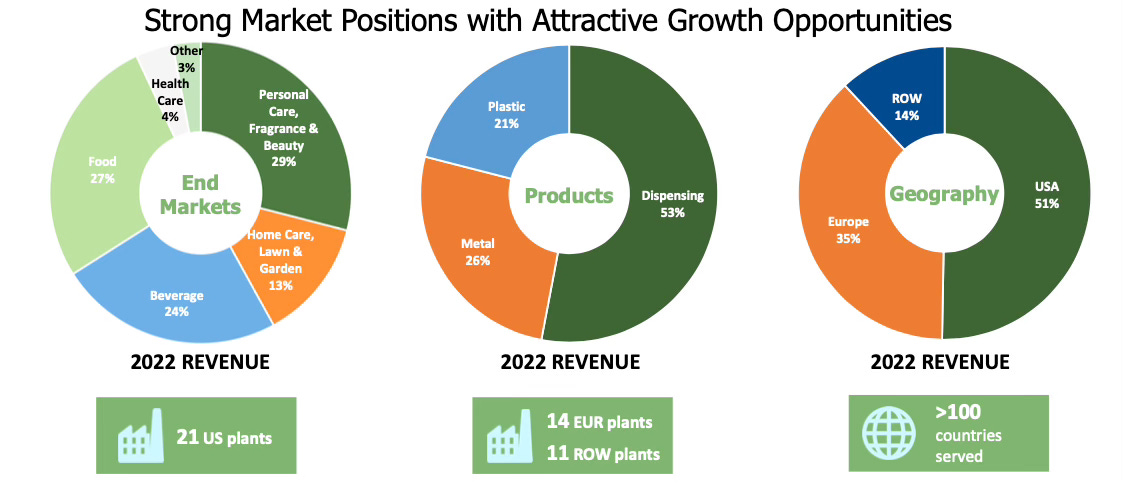

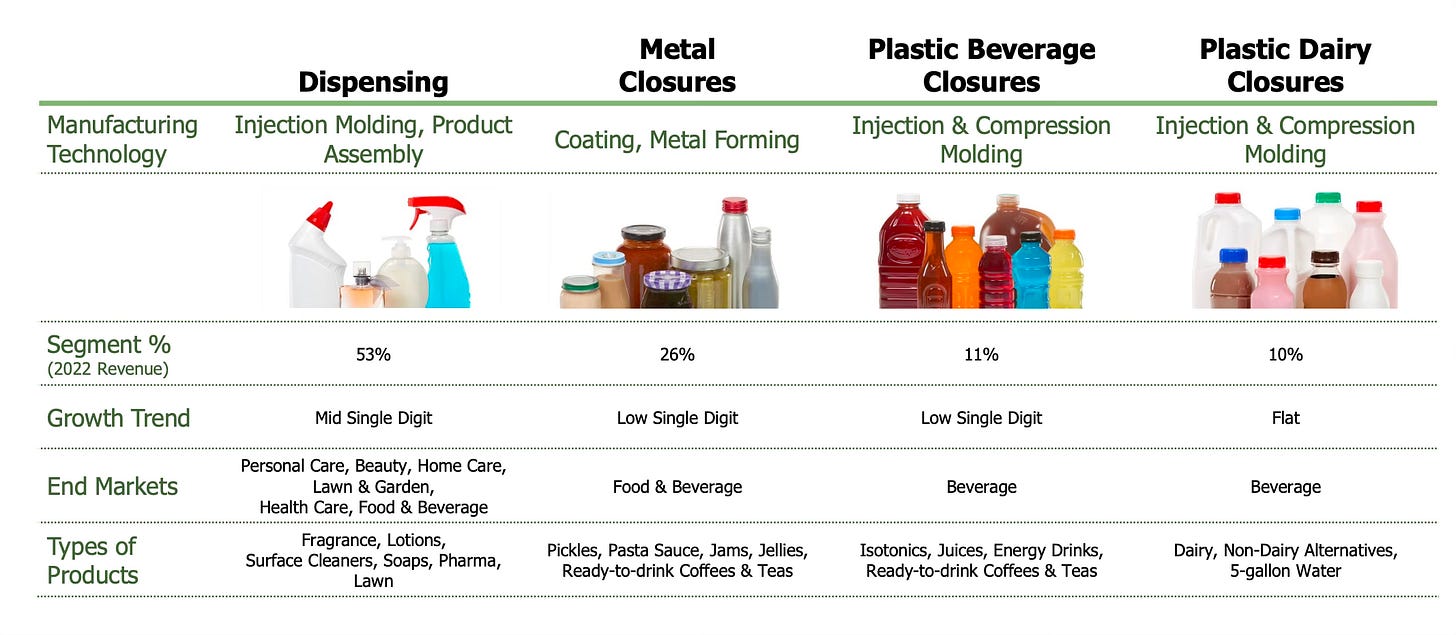

Transitioning from the Metal Containers segment, Silgan's Dispensing and Specialty Closures business is the second largest segment accounting for 36.1% of the company's consolidated net sales in 2022. Silgan offers an expansive array of dispensing systems and specialty closures, catering to a diverse range of industries including food, beverage, healthcare, personal care, and beauty products. This segment, with 46 manufacturing facilities across North America, Europe, Asia, and South America, effectively serves over 100 countries, highlighting Silgan's extensive global reach.

In terms of product range, the dispensing and specialty closures business covers a broad spectrum. These include dispensing systems for various applications, from healthcare sprays to beauty and food products, and specialty closures for a multitude of food and beverage items. Recent acquisitions like the Albéa Dispensing Business and Gateway Packaging have further enriched Silgan's portfolio, expanding its capabilities in pumps, sprayers, foam dispensing solutions, and precision dosing. These additions have also broadened the company’s reach into new markets, including Point-of-Care diagnostics. It also prompted Silgan to slightly change the name of the segment to dispensing and specialty closures from just “closures”. The new, longer name gets abbreviated to “DSC”.

The manufacturing processes for these products are sophisticated, utilizing compression and injection molding techniques for plastic closures and advanced multi-die presses for metal closures. This manufacturing expertise enables Silgan to offer an array of customization options, including various decorating choices, to meet unique customer needs and regulatory requirements.

Silgan's customer base in this segment is both extensive and prestigious, featuring names like Campbell, Coca-Cola KO 0.00%↑ , and L'Oréal. Additionally, Silgan's strategy of licensing its technology to other manufacturers further extends its global footprint, ensuring its presence in markets not directly served by the company. This comprehensive approach in the Dispensing and Specialty Closures segment underscores Silgan's commitment to quality, innovation, and customer satisfaction.

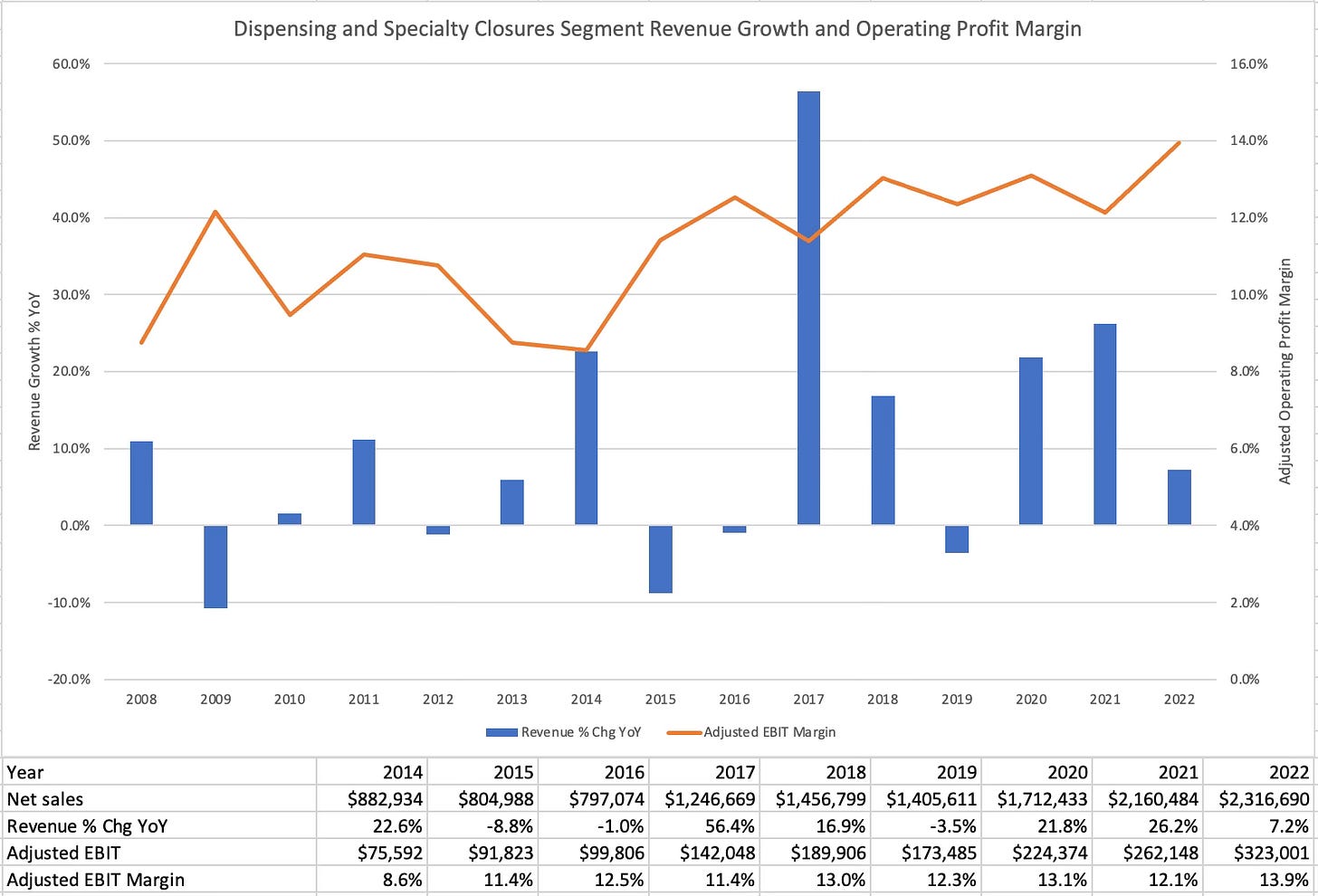

Since 2007, reported revenue for the dispensing segment increased at a CAGR rate of 9.2%, which is by far the strongest of each of the segments. In 2007 this sector made up 21% of company-wide sales, which is up to 36.1% in 2022. The relative outperformance largely reflects acquisitions and some organic investments. The biggest jump in revenue was in 2017 when Silgan acquired WestRock (WRK)’s specialty closures and dispensing business. The worst year was 2015 when the closures business was weak due to foreign currency translation and lower material cost pass-throughs. Management over the years has smartly built this business and it should be noted that operating profit margins have been gradually increasing. In 2008 the profit margin stood at 8.8% and that’s increased to 13.9% in 2022, which compares to an average of about 11.5% over the 15-year period.

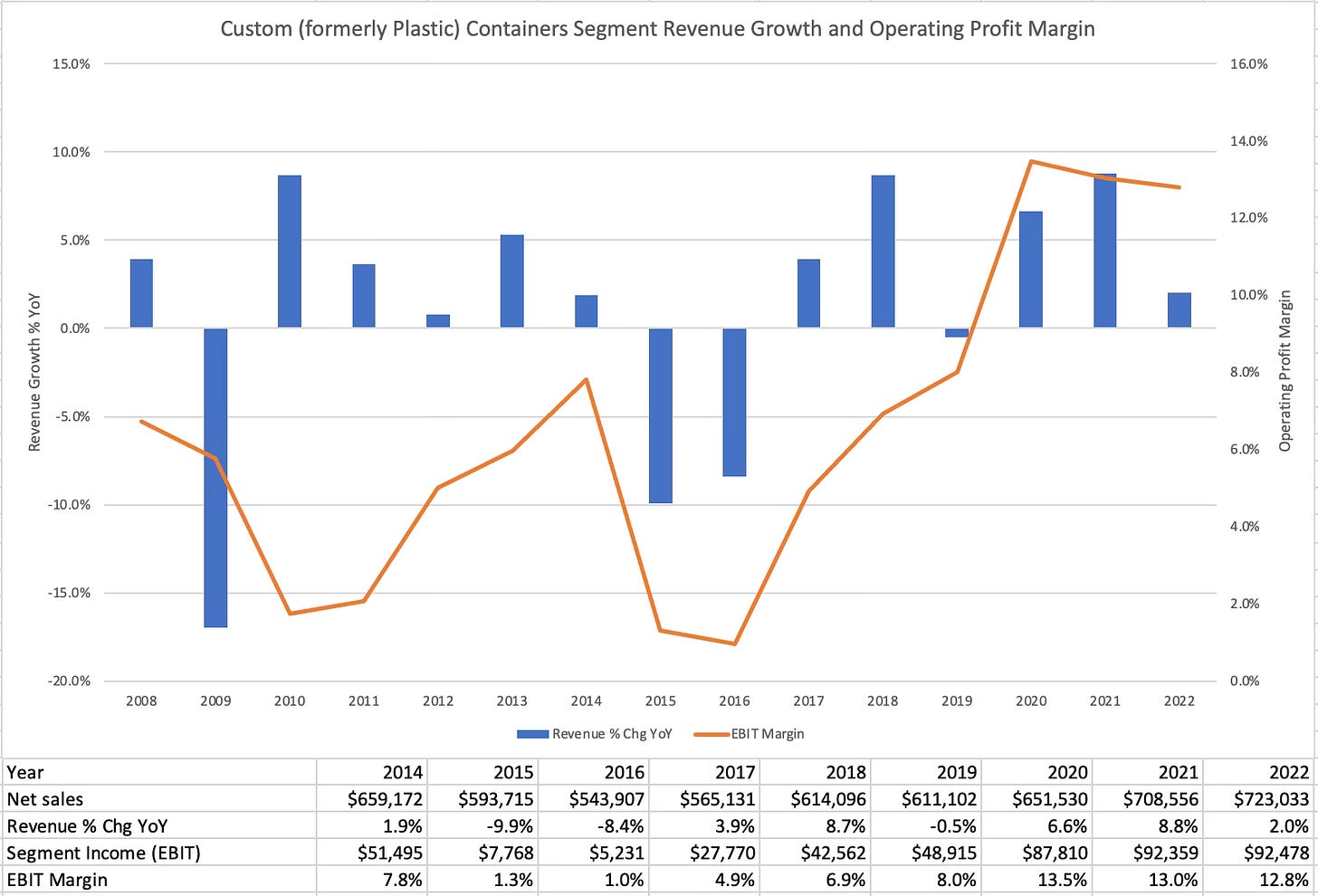

The last segment in Silgan's arsenal is the Custom Containers business, formerly known as Plastic Containers, accounting for 11.3 percent of the company's consolidated net sales in 2022. This renaming coincided with Silgan changing the name of the closures segment amid the acquisition of Albea in 2020. The change from plastics to custom containers implies a broader array of solutions offered by Silgan.

As a leading manufacturer in North America, the Custom Containers segment specializes in high-density polyethylene (HDPE) and polyethylene terephthalate (PET) containers. HPDE is a strong opaque plastic used for things such as laundry detergent whereas PET is a clear plastic for products like water or mouthwash. These custom-designed containers cater to various markets, including personal care, healthcare, food and beverage, and household chemicals.

The segment's prowess lies in its ability to rapidly respond to customer needs for design, development, and technological support. Its diverse product line results from its capacity to produce containers from a full range of resin materials, using various manufacturing, molding, and decorating techniques. State-of-the-art decorating equipment and methods like in-mold labeling and post-mold decoration further enhance the appeal of these containers. This versatility positions Silgan to meet the evolving and innovative packaging needs of its customers.

Resins like virgin HDPE and PET, along with recycled materials, form the backbone of Silgan's raw materials in this segment. The company has secured multi-year arrangements with several major resin suppliers, ensuring a steady supply despite market fluctuations. Most customer agreements in this segment include clauses for the pass-through of changes in resin costs, providing financial stability and predictability.

Marketing for Custom Containers is done through a direct sales force and a vast network of distributors, reaching a variety of markets across North America. Major clients include McCormick, General Mills, and Johnson & Johnson, among others.

Financially, custom containers had a forgettable decade for most of the 2010s. Since 2007, the segment has grown revenue at a CAGR rate of just 1.0%. The lag meant the segment went from making up 21.5% of company-wide sales in 2007 to just 11.3% in 2022. However, the business has improved, particularly segment income which has grown at a CAGR rate of 3.3%. Note that profit margins have grown to 12.8% in 2022 from ~1.0% in both 2015 and 2016 when plastics was at its worst.

After running through the segments, it’s no surprise the (dispensing and specialty) closures segment has steadily been making up more and more of the company-wide revenue, while custom containers has been the shrinking piece of the pie. What’s most fascinating is that profit from the closures and dispensing now makes up half of company-wide EBIT. This is largely due to the increase in margins for that segment, which has now become the most important business for Silgan.

On an aggregate level, the financial figures feature Silgan’s revenue CAGR of 5.4% since 2007 where revenue rose from $2.9B in 2007 to $6.4B in 2022. The growth in operating profit has been similar during that 15-year period by growing at CAGR of 5.6%, which also shows that margins have been steady (profit and sales have grown at similar rates).

With the dispensing acquisitions — Albea and a portion of WestRock — Silgan has evolved from a consumer staples-focused containers company to a more diversified consumer packaging company. There’s a potential for the consumer discretionary end markets to drive more growth while also having the metal containers segment offset poor performance of the rest of the business in an economic downturn. That theme can be seen within segments because Silgan offers closures for premium glass packaging products food and also plastic. Think about the types of products that come in glass and plastic, such as ranch or syrup. Glass is the pricier, discretionary option whereas plastic represents the inexpensive option that consumers may trade down to.

Competition: In the competitive world of packaging, Silgan stands out with its well-established customer relationships and a business model that thrives on multi-year contracts. This approach has allowed Silgan to carve out a steady position in an industry where strong customer ties are as important as innovation.

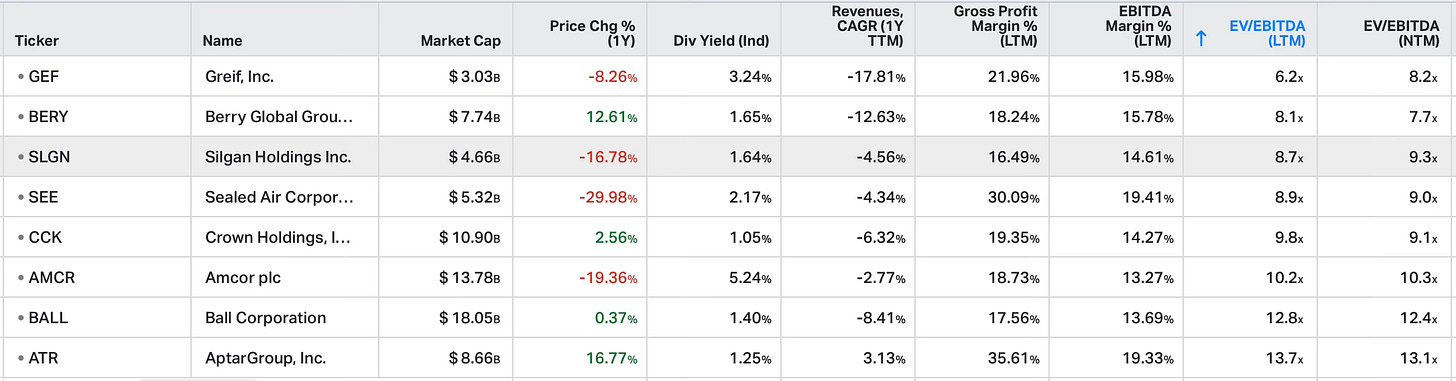

In the Dispensing and Specialty Closures space, Silgan faces competition from notable players like AptarGroup and Berry Global Group. Silgan's strength lies not just in the range of its products but also in its capacity to meet diverse customer needs across various industries. From food and beverage to personal care, Silgan offers solutions that go beyond just packaging – they deliver reliability and quality, crucial in retaining customer loyalty in a sector where choices abound.

In the Metal Containers segment, Silgan stands out in an industry where choices abound for customers, ranging from self-manufacturing to opting for various material alternatives like plastic, paper, glass, and composites. Despite this array of options, Silgan holds a significant advantage, thanks to its strategic approach and the inherent strengths of metal containers. The key to Silgan’s success in this space lies in understanding the specific needs of the products that metal containers hold. Metal is often the preferred choice in situations where products are subjected to high temperatures during preparation or require long-term storage. This is because metal containers are excellent at preserving the quality of their contents under such conditions. Furthermore, when it comes to larger consumer or institutional quantities, metal containers offer durability and cost-effectiveness that other materials struggle to match. Their robust nature makes them more desirable than glass containers, especially when considering the lower transportation costs and reduced risk of damage.

Additionally, Silgan recognizes the growing environmental consciousness among consumers and businesses. Metal containers are not only one of the most recycled packages globally but are also infinitely recyclable, aligning well with the increasing demand for sustainable packaging solutions. Comparatively, some packaging peers produce plastic products that are criticized for their toll on the environment.

Silgan's strategic positioning of its manufacturing plants within a 300-mile radius of its customers is another crucial aspect of its competitive strategy. This proximity offers logistical advantages and cost efficiencies, both of which are vital in maintaining strong customer relationships. However, this also brings a level of dependency on the geographical stability of key customers, as major relocations could impact the business.

In the realm of custom containers, Silgan competes with the likes of Amcor and Berry. Despite this, Silgan holds its own, thanks to its quick response to customer design and development needs and a diverse product line. Being adaptable and customer-focused is key in this segment, where innovation in resin composition and changing manufacturing technologies are pivotal.

Financially, Silgan's relative performance has been steady, though not spectacular. With a 10-year CAGR stock performance of 7.6% and an EBIT profit margin of around 10%, Silgan's numbers are solidly average in the industry. This steadiness is reflective of a business underpinned by long-term contracts and a consistent approach to customer relationships. This profile might not make headlines for flashy growth numbers, but it provides a foundation of reliability and predictability – valuable commodities in a competitive landscape.

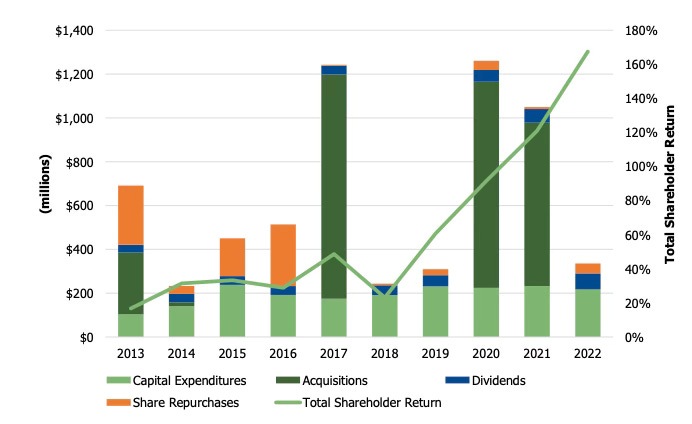

Capital Allocation: To frame how management of Silgan has spent its capital, and how much it relied on M&A, I’ll review capital allocation over the last decade. Silgan generated $4.7B in cash from operations in the 10-year period from 2013 to 2022. A hefty 41.0% of that cash from operations was reinvested back into the company via capital expenditure, the modest dividend made up 10.1% of the cash from operations, and 18.9% of the cash from operations was spent on buybacks during the period. It’s no surprise the largest component of capital allocation has been acquisitions, with $3.0B spent on acquisitions, according to cash flow statements, equal to 63.6% of the cash from operations. Before extracting these numbers, I expected the percentage spent on CapEx to be less and the percentage on acquisitions to be higher. But there’s not been a significant transformative merger and so Silgan’s spending on M&A hasn’t been equivalent to serial acquirer status.

The first material acquisition in the past decade was for Portola Packaging for $262M (net of cash acquired) in 2013. Portola specializes in plastic caps for closing various food and beverages. “We believe that the acquisition of Portola broadens our global closure franchise," former CFO Bob Lewis said at the time. There were no material transactions in the three years after until 2017 when Silgan acquired WestRock’s Specialty Closures and Dispensing Systems Business for $1,024M in April 2017. This was a cash deal that was largely funded by debt. When it was brought under Silgan, it was renamed Silgan Dispensing Systems and made triggers, pumps, sprayers and dispensing closures for health and beauty, and garden as well food products. Former CEO Tony Allott said of the acquisition:

“We are particularly pleased with this acquisition as it's a business that we've literally had our eye on for over a decade. The reason for that is we think it's such a great fit in terms of the markets served, the approach to markets and customers, the technology that is deployed by the business, and the strong cash return nature of the business”

After a two-year break, Silgan was busy again with acquisitions in 2020 and 2021. Silgan’s acquisition of Albea in June 2020 was for $901M and effectively made the dispensing offerings more complete by manufacturing foam pumps for personal care (soaps) and bolstered sprayers for beauty such as misting and lotion pumps. In September 2021 Silgan acquired both Gateway Plastics and Unicep Packaging for $484M and $237M, respectively, and combined for another solid year of acquisitions.

Silgan’s appetite for acquisitions in 2022 and 2023 has been limited. For some companies, it can be easy to balance growth via internal investments and M&A. Silgan’s existing businesses are mostly mature and exhibit low growth so any growth above GDP is more likely to come from M&A. It’s worth being aware the returns from M&A can shrink when the philosophy entails issuing debt if the price of debt is elevated (such as 2023). Instead, Silgan shifted to stock buybacks with about $150M spent in Q3’23 alone after the stock pulled back, which reflects their opportunistic return-based capital allocation philosophy.

Silgan generated free cash flow (“FCF”) of $1.95 per share in 2013, which grew to $4.84 per share in 2022, representing a CAGR of 10.6%. That period includes poor performance in 2014 and 2015 when Silgan went through a rough patch of slowing growth and decreasing margins. As noted, Silgan is experiencing a downturn in 2023 and is expected to generate $3.19 in FCF per share. That decrease would still represent an annual growth rate of 7.7% against 2014 (10-year difference).

As a comparison, Berry Global generated $11.5B in cash from operations in the 10-year period of fiscal 2014 to fiscal 2023 (ended September 2023). $4.3B (37.6% of cash from operations) went toward CapEx, $1.4B (12.3%) was used for buybacks and $9.4B (81.7%) was spent on acquisitions, net of divestitures. Berry only began paying a dividend in fiscal 2023 which was equal to 7.9% of the cash flow for the year but the 10-year dividend allocation is therefore quite limited. Overall the difference in capital allocation shows Berry spent relatively more on M&A and less on dividends in the past decade compared to Silgan.

Berry had two notable outsized acquisitions in the past decade. The first was for Avinitiv in fiscal 2016 for $2.26B in cash (net of cash acquired). Avinitiv was a materials maker for hygiene and personal care products to companies such as Proctor & Gamble (PG) and Kimberly-Clark. (Berry put its health and hygiene business up for sales in September 2023 but there haven’t been takers yet.) Berry then spent $6.1b on RPC Group PLC, a European-based maker of plastic packaging and some select non-packaging plastic products. The deal was also paid for in cash and financed through debt, indicating their playbook matches Silgan where the packaging companies eschew issuing shares in favor of debt. These transactions helped bring Berry’s FCF per share to $7.84 in fiscal 2023, up $2.68 in fiscal 2014 (12.7% CAGR in the 10 years). You can see their FCF per share was increasing at a faster clip before those two transactions, which have coincided with decreasing profit margins in recent years.

Management and their incentives: Silgan has been led by Adam Greenlee as CEO since September 2021. Greenlee, 50, already has a long tenure with Silgan having joined the company in 2005 as EVP of North American operations of Silgan White Cap. He worked in increasing responsibilities in operations roles until he was named COO in August 2009 and president in 2019.

Silgan also replaced its CFO from within by promoting Kimberly Ulmer to the top financial role in March 2023. Ulmer initially joined Silgan from General Electric (GE) in 2004 as controller. From 2018 to 2023, Ulmer worked as VP and then SVP of finance. Note that Ulmer took over as CFO in 2023 from Robert Lewis, who was CFO for nearly 19 years. As part of the succession plan, Lewis down-shifted his responsibilities and remains with the company as EVP, corporate development and administration. I was drawn to Silgan because of their savvy returns-based capital allocation practice and while it can be discouraging to see a recent CFO turnover, it’s comforting that Silgan has slowly onboarded Ulmer while keeping Lewis close by.

The last notable member of the executive management team is Thomas Snyder, who is the second highest-paid officer. Snyder has been President, Silgan Containers since 2007, leading the metal container business. Snyder is also a long-tenured executive whose initial role in 1993 was as a national account manager for the containers business.

The compensation philosophy consists mainly of a base salary, annual stock awards and stock-based compensation paid in the form of restricted-stock units (“RSUs”) and performance awards of restricted stock units (“PSUs”). Adam Greenlee, while CEO, and his predecessor Anthony Allott were paid 13% of their total compensation in salary and 13% paid in the form of the annual cash bonus. Roughly 64% of total compensation was paid in the form of stock awards while the remaining 3% was paid through other means (401K and dividend equivalents associated with RSUs). Other executives besides the CEO (“NEOs”) had a higher proportion of total compensation paid in the form of salary (28%) and a lower proportion from stock awards (50%).

The more important insight to get from the compensation plan is the actual incentive metrics used. Starting with the annual bonus, Silgan focuses on adjusted EBITDA to determine the size of bonus payouts. CEO Greenlee has a target bonus of 100% of his salary, but can earn a maximum of 200% of his salary. Other named executives have a target and maximum bonus equal to 60% of their salaries.

Note for this section I’m going to write and discuss CFO compensation as attributed to former CFO Robert Lewis, but the characteristics will generally match what newly promoted Kimberly Ulmer will receive. Silgan splits the cash bonus plan in a few categories with CEO Greenlee in one camp, unit heads Jay Martin (plastics) and Thomas Snyder (metal containers) in another camp with bonuses tied to their units. The third camp is CFO Lewis/Ulmer and General Counsel Frank Hogan (“Holdings Executive Officer Program”) who have incentives tied to company-wide performance but are separated from the Senior Executive Performance Plan that Silgan places the CEO in. There’s some ambiguous language for goals and I think Silgan could’ve done a better job at clarifying goals.

As noted, Silgan uses adjusted EBITDA for the annual cash bonus. There is a lot of adjustments. Anything that’s remotely non-recurring is removed, “subject to further adjustment as determined by the Compensation Committee for acquisitions and/or divestitures”. The target amount of adjusted EBITDA to earn the maximum bonus is simply the prior year’s adjusted EBITDA implying management does not need to grow the business to earn its bonus. And while the CEO’s plan allows for a bonus equal to 200% of their salary, it always gets paid out at 100%, which is a bit strange.

Recall about 64% of the CEO pay is paid in stock and about 50% of total compensation for other executives is paid through stock awards. Of that, Silgan pays most of it in performance awards with the remaining minority in RSUs that vests without performance goals attached. The specific incentive for the performance awards is again adjusted EBITDA. The minimum amount is 75% of the prior year’s adjusted EBITDA, which is an admittedly low bar. Most companies have multiple goals for different payout levels. Silgan’s writing is ambiguous but does imply management gets the full payout for earning 75% of the prior year’s amount. Exact text is as follows:

“For grants made in 2022, the Compensation Committee established in 2021 the Company's Adjusted EBITDA, subject to adjustment as determined by the Compensation Committee for acquisitions and divestitures, as the performance criteria and the minimum level of performance by the Company for 2021 as 75% of the Company's Adjusted EBITDA level in 2020. At the time the performance criteria is set for a particular year, the Compensation Committee approves a maximum number of restricted stock units that may be granted to each individual in the following year if the Company attains the minimum level of performance.”

Also note that the financial metric is a one-year goal then the performance stock is certified and vests over five years. There’s an interesting line of text from the proxy that speaks to the philosophy of the compensation plan:

“The minimum level of performance required to be attained for grants to be made in the following year is set by the Compensation Committee at a level that, although not certain, should be attainable because the primary purpose of these grants is retention.”

It’s strange the board of Silgan views the compensation plan as simply a tool to promote retention rather than using it to incentivize management to increase shareholder value. In order to benefit shareholders, this compensation plan should be overhauled with some incentives tied to growth/revenue. Or at least increase the target amounts of adjusted EBITDA Silgan needs to earn in order for management to get bonus and performance stock payouts.

As a comparison, Berry’s annual cash bonus is paid out based on a mix of adjusted EBITDA, free cash flow, and a reduction of greenhouse gas emissions. The larger, equity-based component consists of 40% stock options and 60% performance-based stock. The PSUs are tied to total shareholder return (“TSR”) and return on capital employed (“ROCE”). Generating TSR that’s equal to the median of its peer group and a ROCE of 14% earn the target amount. I find the inclusion of free cash flow targets and a clear ROCE target of 14% beneficial.

Outlook: Silgan is a durable company that features the metal container business. Given that 53% of revenue is from making cans, and most of that is for human food, Silgan’s fortunes will likely be tied to the broader economy for the near and long-term. Silgan has the ability to organically grow faster than GDP due to its current portfolio that’s beginning to tilt into higher growth businesses.

Within the metal container segment, close to half is from the pet industry, with most of that coming from cat food in particular. Volume growth of pet food has been strongly outperforming human food growth over the last decade and it’s a tailwind that’s likely to continue for many more years. It’s also worth acknowledging that cat food from a can, while a premium compared to dry food, is generally recession-proof because cat owners don’t swap back and forth. The remaining portion of the metal containers is also largely made up of recession-proof food staples which has supported the company in previous recessions. It’s easy to get a meal out of a can for $2 or less, which is quite difficult for many other food items. My personal favorite in that category is Cattle Drive chili from Costco; such a great deal under that $2.00 mark.

Silgan is also nicely positioned for sustainability. There’s two angles to this: 1) a willingness to buy products that are recyclable and 2) lack of more sustainable substitutes. Silgan’s head of investor relations, Alexander Hutter, participated in the Gabelli Waste & Sustainability conference in May 2023, providing insights that were pertinent to the outlook. Among the topics discussed were that 95% of the products Silgan makes company-wide are recyclable. Cans in particular are “infinitely recyclable” and are the “most highly recycled food or beverage package”, according to Hutter. Hutter also touted the reduction in greenhouse gases through canned food, because you don’t need to refrigerate the food. That difference seems incremental at best, however, canned foods do help reduce food waste so there is some clear sustainability impact in the end-product. In terms of substitutes, cans won’t be easily phased out through technology unless food consumption drastically changes in a Wall-E like world. Hutter had this quote:

“in terms of substrate substitution, I think this is one of those kind of franchise hallmarks within Silgan that was built into the business from the beginning. So if we just go across the segments, within the Metal Container business it's important to understand that the food that's in the food can is cooked in the can. So switching to another substrate like a plastic pouch, right, is extremely costly for our customers…there's a fully depreciated filling and cooking asset base that many of these customers that we have really all of them have within their own operations. It's highly efficient for them to run through their -- through their current thermal assets…

In our Dispensing and Specialty Closures business, so those products are predominantly metal and plastic, but mostly on the plastic side within dispensing, there's not really a substrate that can replicate the attributes that those products make in terms of product dispersion, if you think about something like a fragrance spray, right, you're not going to be able to do that with something that's made out of metal. Now you can bring metal components into that. But the issue there is that, that makes that product then not recyclable….The metal closures that we make within the Dispensing and Specialty Closures business, which is about 1/4 of the revenue in the segment. Those have all the same attributes that our metal cans have in terms of recyclability and recycling rate.

And then as we look to some of our some Custom Containers products, Those, again, we've stayed away from across our portfolio, doing things that are single serve. So we don't do water or carbonated soft drink, closures or bottles. What we focus on really are multi-serve applications. So if you think about like a shampoo bottle, right? It's unlikely that consumers are going to take a glass bottle back into the shower anytime soon. So those are the types of products that we focused on driving kind of our growth on. So from a substitution standpoint, don't think that there's much risk there….

But I think more recently, metal packaging, obviously, has taken off as a sustainable package. And so we've been spending more resources in terms of investing in R&D and bringing new packages for things that haven't been in metal packaging before things like K-Cups for coffee or metal yogurt cups and things like that. So bringing those solutions to customers again, there's always a cost element that goes with that for customers. But I think it's maybe reinvigorated some of the growth in the business as well.

The last theme to note in regards to outlook is the relatively higher growth to be expected from the dispensing and specialty closures segment. Overall this business can expect mid-single-digit organic growth in the coming years, propelled by potential double-digit growth in most dispensing products (fragrance sprayers etc.) that will be offset by the legacy closures (bottles caps). Dispensing is now the majority of that segment, making it a niche to watch, especially since it can carry Silgan to a higher-margin territory.

Valuation: Silgan reports Q4’23 earnings on January 31 and it’ll be meaningful to see quarterly revenue reverse the trend of deeper negative growth. YoY revenue for the quarter turned slightly negative in Q1’23 due to customer destocking and tough strong comparable figures in 2022. Growth contracted further to -7.6% in Q2’23 and more recently -8.5% in Q3’23. The current sell-side estimate for Q4’23 is $1.39B, which would imply -4.5% YoY revenue growth, suggesting a move back toward positive territory. I don’t focus on quarterly forecasts. Instead, I have a longer-term mindset and favor a five-year forecast (just enough to feel like I’ve got a grasp of the financials but not too long where you need a crystal ball).

The DCF forecast to value Silgan has segment forecast of revenue. All three segments will be negative in 2023 and I forecasted a recovery in 2024 with consolidated revenue of $6.37B, which is slightly lower than the high-water mark set in 2022. The dispensing segment is expected to carry mid-single digit growth during the forecast period while metal containers and custom containers will exhibit relatively lower growth. Note this forecast doesn’t assume any M&A, which would push reported revenue higher.

EBITDA margins are expected to be poor in 2023 due to further rationalization charges that coincide with the latest “cost reduction program” that will yield $50M in cost savings, according to Silgan management. The forecast then includes a gradual rise in EBITDA margins to 15.0% by 2027. Silgan’s highest EBITDA margin (including non-recurring costs) was 14.9% in 2020. In my opinion this is easily achievable if the Dispensing segment continues to make up a higher proportion of sales. Dispensing in particular had an average EBITDA margin of 17.7% in the last decade, compared to 13.4% company-wide. Moreover, dispensing achieved a 20.2% EBITDA margin in 2022, compared to the company-wide figure of 13.5%. The point is that this is a higher-margin segment that continues to make up a larger piece of the pie..

Some simple assumptions to calculate free cash flow are as follows: CapEx at about 4.1% of revenue per year, depreciation and amortization at 4.3% of revenue and a pro-forma tax rate of 22%. The other critical assumptions are the cost of capital of 5.8%, which is based on Silgan’s two-year beta of 0.82, and current five year risk free rate of 4.0%. Lastly, I picked an exit multiple of 9.5 EV/EBITDA (LTM). Together, this calculates a fair value of about $55, which implies 27% upside in the stock price.

One of the most powerful inputs in a DCF like the above is the exit multiple. 9.5X EV/EBITDA is the 10-year average. However, it’s worth noting that if Silgan can shift toward a higher-margin business it would lead to stronger earnings growth and shares could command a higher multiple than the historic average. With that consideration, there’s room for further upside in the bull case. The bear case is continued low margins which would imply shares are closer to fair value.

Final thoughts: Silgan is a well-managed packaging company that has executed compelling acquisitions in recent years to take this metal can maker to a new stage. The durability and sustainability in the business products are admirable during a time when many around the globe are criticizing non-sustainable packaging. The stock and the underlying financials have historically had very average performance. With the business coming out of a trough, it makes for an intriguing investment for those looking for a steady business tied to consumer demand. Given the fair value estimate of $55.00, it’s solid upside for a mid-cap packaging company. Overall it’s hard for me to have confidence that Silgan is a material outperformer. The company has historically had aggressively medium performance. The probability they outperform, via earnings growth, outweighs the probability of underperformance.

Disclaimer: The content of this report is for informational and research purposes only and should not be construed as financial advice. The views expressed are my own and do not reflect those of my employer. While care has been taken in preparing this report, I make no representations or warranties of any kind regarding its accuracy or completeness. I currently hold no position in any stock mentioned. However, like any financial analyst, my perspectives may carry inherent biases. Readers are encouraged to conduct their own due diligence.