This post will cover Synaptics SYNA 0.00%↑ by providing an overview of the business and the industry dynamics followed by an examination of the capital allocation history, management and their incentives, capped with an outlook and valuation.

Overview: Synaptics is a tech company founded in 1986, specializing in creating the "brains" behind various smart devices. The company stands as a major developer and fabless supplier of mixed signal semiconductor solutions, which refers to complex chips that help devices like smartphones, laptops, and cars understand both digital and analog signals—think of these as interpreters between the device and its user. The company serves three main markets: Internet of Things (IoT) 70% of revenue, Personal Computers (PC) 16% of revenue, and Mobile devices 14% of revenue (those percentages have evolved quite a bit in its history.) Taken together, their current product is on consumer technology products. The company has had three distinct phases in which they first focused on PC products, then shifted to mobile and now IoT.

IoT Applications Market: In simpler terms, IoT refers to interconnected devices like smart speakers or smart fridges. Synaptics provides these devices with technologies that include wireless connectivity like Wi-Fi, Bluetooth, and GPS, along with display and touch integrated circuits (“ICs”) tailored for automotive use and display features. Their technology also powers smart devices at the edge of networks such as smart speakers, set-top boxes and has a strong footing in the Android-based platforms. They have been beefing up their offerings by adding artificial intelligence and more advanced capabilities for edge computer.

PC Product Applications: Synaptics develops features for PCs like touchpads and fingerprint sensors for enhanced security and ease of use. In its earliest days, Synaptics is credited with creating the world’s first touchpad for laptops and they still have a strong hold on the market for touchpads. If you’re reading this on a laptop, there’s a strong chance Synaptics built the touchpad for your computer. They’re also the leading maker of fingerprint sensors on computers.

Mobile Product Applications: On the mobile front, Synaptics supplies technologies for smartphones and tablets. Their focus here is on user-friendly designs that are efficient, durable, and reliable.

Synaptics aims to solidify its leading role in the semiconductor market, specifically targeting IoT, personal computing, and mobile applications. The company plans to innovate by leveraging its extensive intellectual property and engineering expertise to produce user-friendly, cost-effective products. Their focus is on the fast growing IoT sub-sector, where Synaptics wants to expand by adapting its technologies to meet market demands. Strategic partnerships and acquisitions are also on the agenda to diversify offerings and penetrate new markets. Additionally, the company employs a 'fabless' manufacturing model, outsourcing production to focus on R&D, thereby keeping costs flexible and tied to sales. Overall, Synaptics is gunning for market expansion through technological innovation and strategic collaborations.

Synaptics offers a diverse range of products aimed at providing interface solutions across various consumer and industrial segments. They’re often a market leader for the products they make (see graphic above) which are niche. It’s a theme CEO Michael Hurlston talked about in the recent September 6 Investor Day.

If you look at our IoT portfolio today, we have a lot of products that are in relatively narrow segments, I'd say but are #1 or #2 in those various markets. Our challenge as a company and what we've been aiming to solve is, how do we get into bigger markets? If you think about it today, we are in a series of markets. These are all great markets for us. All of them are narrow.

They're not huge in terms of the TAM or the SAM that we can go after, and we're a significant player in all of these markets. So we want to take the success that we've had here in these narrower markets and build into broader markets where there's larger opportunity for us and that again, will lead to this concept of growth.

To make sense of their other products, in high performance, they make chips for over-the-top streaming, home security, robotics and drones. Winning business for these types of products comes down to long range, low power consumption and size. Synaptics says they win in all three of those. Broad market applications feature (smart) appliances, home automation and sensors, and wearables (watches/fitness trackers). These are propelled by wireless connectivity with state-of-the-art Wi-Fi, Bluetooth, and GPS solutions. It’s important to note that Synaptics isn’t just making computer chips for technology products to communicate with each other, but also creating software for the products. In the August 2023 earnings call, CEO Hurlston discussed product developments and pointed out the use of its Active Noise Cancelling (“ANI”) and Environmental Noise Cancelling (“ENC”) software.

On the product front, we've started a journey to expand our existing processor portfolio into more deeply-embedded applications. We have a few design wins now in this area, leveraging both existing software and hardware, differentiating with our AI capabilities. With limited investment, we believe we can unlock opportunities outside our traditional operator space in applications such as video conferencing, high-end smart appliances, point-of-sale terminals, factory automation and security solutions.

We will also leverage work being done in human presence detection to introduce a chip that can serve as the basis for an M55-based processing device that has advanced AI features. While we begin some critical future product advancements, we are winning at present in both our traditional operator base with multimedia products as well as in headset customers. Panasonic's recently announced True Wireless Earbuds feature 2 of our audio processing devices that offer our most advanced ANC and ENC algorithms.

Synaptics has an extensive technology portfolio that strategically positions the company in various high-growth markets. Chips are application-specific, rather than general-purpose, in order to optimize performance. Synaptics also leverages multimedia, voice, and audio technologies, focusing on enhancing human experience and communication products. Deep learning and neural networks have been adopted for data sense-making and interpretation. Mixed-signal integrated circuits allow digital and analog interfacing, crucial for products like touchscreens.

Wireless connectivity solutions are another strength, with a focus on Wi-Fi and Bluetooth standards like 802.11AX and Bluetooth 6.0 (these will be upgraded with an acquisition of intellectual property that I’ll discuss later). Video interface and compression technologies are designed for both consumer and commercial applications, while their imaging and modem technology find applications in printers, cameras, and fax machines. Capacitive technologies for fingerprint, position, and force sensing as well as multi-touch are significant for user-interface applications. Lastly, their display systems and circuit technology focus on optimizing display and touch functionality, extending to advanced automotive-grade solutions. Overall, Synaptics’ ability to integrate these technologies gives them a competitive edge.

Customers of Synaptics consists of large mobile and PC OEMs, IoT OEMs, auto manufacturers and consumer electronics companies. The latest 10-K filed in 2023 didn’t detail leading customers, unlike previous years where Synaptics would give a long list of top customers. The following nine companies were in the customer list from 2018 - 2022 (each of the five years): Dell, Google, Hewlett-Packard, Huawei, Lenovo, Oppo Mobile, Samsung, Sony and Vivo. I’ll note Ford and emerged in 2019 and was in it each year since as Synaptics leaned more into automotive.

The list of OEMs makes up the end customers of Synaptics, however, they are generally served through their contract manufacturers, supply chain partners and distributors. The 2020 10-K noted that sales to Fuhrmeister Electronics and Sharp Corp. accounted for 18% and 12 of Synaptics revenue, respectively. Only one direct customer (unnamed) made up 10% of sales in 2023. Relative to their history, customer concentration has gotten quite low if only one customer made up 10% of sales in 2023. In 2016 and 2017, three customers made up ~55% of net sales in each year. This is driven by the shift in product offerings from PC and mobile to IoT. CFO Dean Butler talked about the difference in customer concentration in IoT versus the legacy segments.

Really in the world, there's basically 3 PC OEMs that produce something like 97% of all the world's PCs comes from 3 OEMs, super concentrated, mobile phones, very similar. There's kind of about 6 names that produce almost all of the world's mobile phones. Now as you start going right on this chart, automotive is a great business. It's going from mechanical to digital. That's why a lot of semiconductor people like it. But there's really only sort of 20 to 30 automotive OEMs. It's a big market. They sell lots of cars, a lot of content, great expansion for semiconductors.

Then you go into enterprise…Now you're talking hundreds of customers. Finally, as you get broader and broader, what we think about in IoT is really core IoT, traditional IoT businesses. Now you're talking thousands, if not tens of thousands of customers. By the way, every logo on this chart is actually a Synaptics customer. So we've already been moving in this direction for quite some time.

The following chart shows revenue by geography. Because of the nature of selling to contract manufacturers, rather than OEMs, they generate most of their revenue abroad.

Synaptics employs a fabless manufacturing model, meaning they don't own or operate their own manufacturing, assembly, testing, or packaging facilities. Instead, they rely on third-party organizations, mainly based in Asia, to handle these aspects of production. The company focuses on their core competencies like R&D, technology advancements, and design engineering.

The wafers integrating Synaptics' designs are produced by third-party wafer manufacturers. These wafers are then sent to other third-party facilities for packaging and testing. The resulting products can be standalone Application-Specific Integrated Circuits (ASICs) or part of custom modules. These are either sent directly to customers or through various contract manufacturers, which could then assemble these into final products. This setup offers Synaptics scalability and reduced capital investment but also introduces supply chain vulnerabilities and dependence on a few key suppliers. They have attempted to mitigate these risks through long-term agreements and diversification of suppliers.

Synaptics introduced three risk factors in the 2023 10-K and one indicated challenges tied to this manufacturing model. Specifically, the company highlights that not owning their own manufacturing facilities means they can't reduce costs as rapidly as competitors who do. This makes them vulnerable to factors like inflation, tariffs, supply chain constraints, and increased component prices, which could all negatively impact their gross margins. Moreover, they must rely on forecasts to place orders with these third-party manufacturers, leading to the risk of excess or obsolete inventory if they overestimate demand, or lost revenue and market share if they underestimate it.

Competition: In the IoT sector, Synaptics has a diverse range of SoC solutions targeting markets like home automation, STB/OTT platforms, and surveillance cameras. They're rubbing shoulders with heavyweights like Broadcom (AVGO), MediaTek, NXP Semiconductors (NXPI), and Ambarella (AMBA). They've also ventured into voice and next-gen audio applications, squaring off against companies like Cirrus Logic, BES Technic, Realtek, and Qualcomm (QCOM). For wireless IoT, they're in the ring with Infineon, Qualcomm, MediaTek, NXP Semiconductors, and Silicon Labs (SLAB).

On the automotive front, they provide touch and display solutions, competing against firms like Focaltech, Himax (HIMX), Novatek Microelectronics, and Microchip (MCHP). For PC and mobile applications, Synaptics' main competitors are Broadcom, Goodix, Focaltech, and STMicroelectronics (STM) in the touchscreen market, and companies like Novatek Microelectronics, Samsung LSI, LX Semicon, and Raydium in display drivers.

Now, how do they stack up against these competitors? In the IoT sector, companies like NXP and Broadcom are well-established, and Synaptics carved out some market share by leaning into niche offerings. The audio space is really crowded, and they have to face Qualcomm, a giant with deep pockets. That's no small task. The automotive sector is also competitive, but less crowded, giving them a good shot at establishing a strong position. In the PC and mobile sector, they face intense competition in a rapidly changing landscape, so agility and innovation will be key for Synaptics. Overall, they seem to be positioned well in multiple sectors but will need to bring their A-game to outmaneuver these strong competitors.

Shifting to Synaptics’ financial performance, which has varied greatly in its long history. Synaptics has ridden technology waves that have driven strong growth at times and significant decelerations. I extracted segment revenue over the since 2013 to show have sales have evolved. Recall the segments are mobile, PC and IoT products. Mobile made up the majority of sales for Synaptics in the mid 2010s.

Synaptics built out mobile products through two notable mergers. The first was for Validity Sensors for $128M in 2013, a maker of biometric sensors (fingerprint authentication), causing a jump in sales in 2014. The next was for Renesas SP Drivers (“RSP”), which specialized in chips that controlled LCD screens. Synaptics bought RSP for $463M in June 2014 and it contributed $715M to sales in 2015. Revenue that year was $1.4B, up 109% from 2014, though only up 5.3% if you strip out the contribution from RSP (organic increase).

Revenue for Synaptics hit a peak in 2017 and it began to steadily drop, largely because of Synaptics mobile products business. Synaptics ended up divesting a major product line within mobile in 2021 and now the mobile products business makes up a fraction of Synaptics revenue. Instead, Synaptics has grown via its IoT products business in recent years.

When I read about Synaptics’ product history it made me think of technology companies that have risen and fallen by riding waves they can fit within. Think about well-known stories like Blackberry or Nokia. There’s multiple products that came and went for Synaptics, such as the iPod scroll wheel, and a more recent example being mobile fingerprint sensors.

Fingerprint sensors first emerged in 2007/2008 and Synaptics jumped into the market in 2013 through their noted acquisition of Validity Sensors. Fingerprint sensors gained widespread adoption around 2014 when Apple launched touch ID on the iPhone 5s (seems like so long ago). Synaptics became a major supplier of sensors to the Android market during 2014 - 2016, helping drive sales higher. However, fingerprint sensors fell out of favor while facial recognition gained traction in 2017 and mobile product sales lagged. I bring this up because it’s an example of Synaptics riding a wave of technology.

The amazing aspect of their transition away from mobile is that it’s not the first time the company made a major pivot. Synaptics’ business was dominated by PC revenue from inception into the 2000s and they made a similar transition to mobile as the company more recently made toward IoT products.

The company has more recently ridden a wave of providing chips within the likes of smart speakers and other popular consumer electronic components. However, the market turned on Synaptics in 2023 with revenue down -22%. You can see from the chart displaying revenue by segment that sales for each segment decreased in 2023. The drop was due to excess inventory build up which can be attributed to demand softness and macroeconomic uncertainty. All segments were down in 2023 as customers preferred to deplete existing inventories and slow purchases from Synaptics. Revenue was down -16% YoY in Q2’23 (ended December 31) and each quarter since growth declined further with Q4’23 revenue down -52% compared to the prior year. Note that Synaptics’ fiscal year ends in late June and they filed their latest 10-K on August 18.

The inventory challenge experienced in 2023 was within direct customers. In addition, their own inventory levels have been bloated. The days of inventory outstanding (amount of days it takes to sell the inventory amount) was at its highest level ever at the end of Q4’23, according to data from Koyfin. This is a notable attribute given one of the risk factors added called out potential obsolete inventory. Technology moves fast so you don’t want to be a company with inventory that quickly becomes worthless.

Capital Allocation: In order to analyze capital allocation, I’m going to compare Synaptics against Broadcom (AVGO). When it comes to product overlap, Broadcom is the closest to Synaptics. Broadcom is also much larger and more diverse in covering similar products to Synaptics and more. Synaptics generated $2.4B in cash from operations in the last 10 years (fiscal 2014 - 2023). $311M (13.1% of cash of operations) was spent on capital expenditures, $1.16B (48.7% of cash of operations) was spent on stock buybacks and $1.85B (77.9%) was spent on acquisitions. Synaptics hasn’t ever paid a dividend. Note these percentages don’t sum to 100%. A company can spend more or less than it’s cash flow for the year that tapping into its cash and/or debt or spending less than its cash flow and adding to its cash reserves.

Synaptics has employed an opportunistic approach to buybacks, which have been relatively aggressive this year. The opportunistic approach is a reason I was drawn to Synaptics (and almost all of the stocks I cover in this newsletter). I was recently on Verity’s podcast Differentiated that was published on September 24, 2023. In it, I chatted about Synaptics’ efficient buyback execution this year. Specifically, I pointed out that since the CEO and CFO were brought on in 2019, they were timely by buying back shares in calendar quarter Q1’20 during the COVID-induced pullback then refrained from buying back shares for the next 2.5 years. Synaptics returned to the market for its shares in calendar Q3’22 after the stock was in the midst of a multi-quarter drawdown and fluctuated the pace in response to volatility in 2023. Since calendar Q3’22, they bought back at an average of ~$92 and during that period the stock closed at ~$106 on average. You can check out the full conversion here (episode seven). I talk about Synaptics 18 minutes into the podcast.

The biggest year for acquisitions on a dollar basis was in 2020 when Synaptics bought DisplayLink for $444M and wireless connectivity assets from Broadcom for $250M. DisplayLink brought on video compression semiconductor-based solutions used in docking stations and other applications. Management discussed the Broadcom assets acquired in 2020 in the investor day conference and pointed out that it was a $65M business in terms of revenue when acquired and has grown to $225M in 2023. Synaptics more recently added an intellectual property deal with Broadcom on July 31, 2023 for $130M that brings on WiFi 7 technology, among other IP. That will bolster Synaptics product offerings and lift average selling prices for some wireless products by 30%, according to Synaptics management. Sales via that deal should begin to materialize near the end of fiscal 2024.

The four buckets of capital allocation from the cash flow statement (CapEx, buybacks, M&A and dividends) capture most investment activity for companies where manufacturing is material. For technology companies, however, the investment in internal growth is largely in the form of R&D. The accounting difference is R&D costs are expensed and shown on the income statement whereas CapEx is capitalized and thus shows up on the cash flow statement. CapEx is tangible and easily measurable. R&D is instead spending on less tangible assets, such as investment in emerging technologies, which often involves costs like engineer salaries. At Synaptics, cumulative R&D costs since 2014 total $3.1B which is slightly more than the amount spent on buybacks and M&A combined.

By comparison, Broadcom has a more balanced capital allocation profile. Broadcom generated $75.3B in cumulative cash flow from operations in the past 10 fiscal years (2013 - 2022). Just $5.4B (7.2% of cash of operations) was spent on CapEx, while $44.8B (59.5%) was used for acquisitions (net of divestitures), and $24.3B (32.3%) was spent on buybacks. Where Broadcom differs notably is that they spent $29.3B on dividends (38.9%). Similar to Synaptics, CapEx isn’t the only figure that covers internal growth. Broadcom spent $31.3B on R&D, which is equal to 18.2% of cumulative revenue over the past 10-years. Synaptics’ R&D spend over the last 10-years equals 21.0% of its revenue. Another way to normalize for company size would be to add R&D and CapEx together the divide by cash flow operations, before R&D, as the denominator. This approach is an unconventional way to add R&D and CapEx to understand total reinvestment into the business absent tax impacts. Regardless, with this methodology, the reinvestment amount for Synaptics would be 62% and 34.5% for Broadcom. So no matter how you cut it, Synaptics has reinvested more heavily than Broadcom.

It’s not paid off, however, given Broadcom has grown its FCF per share at a compounded annual rate of 39.9%, beating out Synaptics’ FCF per share CAGR rate of 12% in the last 10-years. This indicates Broadcom is more efficient via reinvestment into the business and/or its been more efficient through inorganic growth via M&A. Broadcom has been known for its savvy history of acquisitions.

Management and Incentives: Michael Hurlston joined Synaptics as CEO in August 2019. He was CEO of Finisar (former FNSR) from January 2018 until August 2019 when the communications components company was acquired for $3.2B. Hurlston joined Broadcom in 2001 and worked in increasing roles through 2017 where he was most recently SVP and GM of Mobile Connectivity Products/Wireless and Connectivity Division, giving him good familiarity with the acquired assets in 2020.

CFO Dean Butler also joined Synaptics from outside by taking on his chief finance duties in October 2021. Before that he was VP of Finance at Marvell Technology (MRVL) for three years where he led strategic initiatives, including M&A. Butler was at Broadcom prior to Marvell and also spent team at Maxim Integrated (former MXIM), so he’s made the rounds on finance teams at semiconductor companies.

The third highest ranking executive, according to compensation, is SVP & GM of Enterprise and Mobile Saleel Awsare. He oversees leading products such as the TouchPad, fingerprint, and video interface business products through DisplayLink (docking stations, video adapters and USB monitors). Awsare joined Synaptics in July 2017 when it acquired Conexant where he similarly oversaw audio and imaging products.

Hurlston, Butler and Awsare each participated in the September 7 investor day conference. As did SVP & GM of Wireless Products Venkat Kodavati and SVP and GM of IoT Processor Vikram Gupta. Gupta is new to Synaptics having joined in January 2023 and previously held a similar title/role with Infineon Technologies (INFN). Kodavati also has an interesting background having joined Synaptics in 2020 when it acquired the wireless assets from Broadcom. Kodavati was a senior director at Broadcom in wireless connectivity and has spent most of his career in the space. He even co-founded and sold a start-up producing wireless IP. Much of the potential growth at Synaptics will come from wireless IoT products and Kodavati will be orchestrating that.

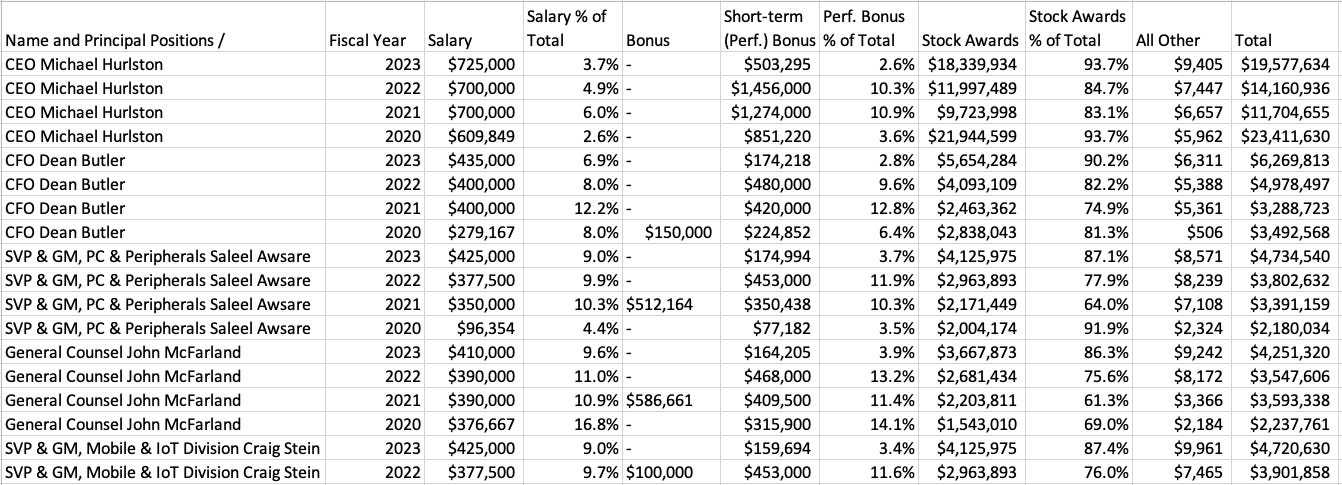

The compensation program for executives of Synaptics is made up of salary, modest annual cash bonuses and the bulk of compensation is in the long-term incentive. For CEO Hurlston, his total compensation over the past four years has averaged 4.3% from salary, 6.8% from the annual cash bonus and 88.8% in stock-based compensation (“SBC”). Those figures are similar to the target amounts for 2023. Other executives had 9.7% of their total compensation paid in the form of salary, 8.5% in annual cash bonus and 78.9% in the form of SBC. The SBC component can be further broken out with ~24% paid in the form of RSUs (stock that vests over time), ~24% in the form of performance-stock awards (“PSUs”) that vests according to EPS targets and ~53% in market stock units (“MSUs”) that vests according to relative total shareholder return (“rTSR”).

The percentages stand out compared to peers because they lean so heavily on stock-based compensation. I looked at a few other mutual peers (each company has each other listed as a peer) of similar size such as Lumentum (LITE), Diodes (DIOD) and Cirrus Logic (CRUS). Those companies have higher percentages paid in the form of salary and annual target bonus with smaller percentages in SBC. This is a combination of Synaptics paying a modest salary and bonus, and high SBC.

I’ll dive into the key incentives of management starting with the annual performance bonus. The target amount is 130% of the salary for Hurlston and 75% for other executives. The payout is based on equally weighting a revenue target, non-GAAP gross margin and non-GAAP operating profit. The non-GAAP versions of those strip out M&A-related cost and stock-based compensation. In each case there’s a minimum performance level in order to get any payout and a maximum payout of 200%. The compensation committee sets the targets in the beginning of the near, however, Synaptics doesn’t provide full-year outlook, only quarterly. Synaptics’ 2022 revenue was $1.74B and they set the target goal for 2023 at $1.84B indicating they were surprised by the decrease in revenue.

The PSU awards at Syanptics are earned based on a one-year performance period of non-GAAP EPS. It’s unusual to have such a short-term performance period for PSUs; one year performance-periods are generally used for cash bonuses. Similar to the cash bonus, there’s a minimum and maximum performance payout (0% and 200%). For 2023, the compensation committee set a non-GAAP EPS target of $12.47 but the actual result of $8.12 meant that executives received a payout of just 0.458%.

The last and most import performance incentive of management is via the MSU awards. They are dependent on how Synaptics' relative Total Shareholder Return (“rTSR”) compares with other indexes over a one, two and three-year performance period. For awards after 2021, the benchmark is the Russell 2000 Index. Before that, it was the S&P Semiconductors Select Industry Index. Depending on their rTSR achievements, the payout can range from 0% to 300% of target shares (up from a max of 200% in prior years). Notably, if Synaptics' TSR is below the 25th percentile, there's no payout, but hitting or surpassing the 80th percentile can lead to a payout of 300% of the target. Furthermore, the rewards are structured to be released gradually over three years with one-third eligible for release each year and a true up based on final achievement.

The value of stock-based compensation at Synaptics seems excessive for a $3.2B company. Though I do like the incentives by focusing on rTSR with nearly half the total compensation based Synaptics beating other small-caps. The one critique I have is using the broad index of the Russell 2000 rather than an industry-specific index.

Outlook: In order to understand the outlook I’ll reiterate that Synaptics currently has a niche product offering and aims to serve a broader market. This quote by CEO Hurlston speaks to that well:

Our product line is very much targeted to high performance. I think we've discussed it on in previous calls where, for the most part, we're moving video from one device to another. And that requires very high bandwidth. It requires quite high performance.

Where we're aiming our roadmap over the next couple of years is a more basic connectivity, simple point-to-point connections, whether that be over Bluetooth, whether that be over the ZigBee technology, whether that be over Wi-Fi. There is kind of a margin-rich and high TAM area there that we have totally not tackled. So our engineering investment right now is very much geared toward retuning our roadmap to go after that broad market. Eventually, we think that there's going to be opportunities for us to bring in our SoCs, our processors and either through integration or through a bundling type of scenario where you can pull through a lot more content in that broad market area.

To get a better idea of the difference, imagine Synaptics makes a custom semiconductor chip for a modern security camera that’s operating 24/7 or even a smart speaker that plays music but is also always alert for questions and instructions. These are high performance chips with high bandwidth. Conversely, low bandwidth chips could be in products such as smart light bulbs and door locks, industrial sensors for temperature and humidity or healthcare diagnostics products. In these cases, chips could be repurposed. By going broad, Synaptics’ serviceable addressable market (“SAM”) will greatly expand. Synaptics provided some updated SAM estimates in their September investor day meeting. On the left side is an estimate of the growth in the IoT semiconductor market that’s expected at a CAGR of 12%, which is the fastest subsegment of semiconductor markets. On the right side is the expanded SAM.

The goal of serving a broader market is enough of a shift for Synaptics that they will be changing their reporting segments to core IoT, enterprise + automotive (which will include the current PC products) and mobile. Core IoT, which will feature wireless connectivity products and edge processing, is expected to be the fastest-growing of the segments.

Despite the strong expectations for core IoT of 25-30% annual growth, the inventory channel is still working its way to normalization which should take another two quarters, or three, covering most of fiscal 2024. Thus, Synaptics isn’t expected to grow this year. In addition, the new potential product offerings via the latest IP asset acquisition from Broadcom won’t come into play until late in 2024, which will then allow Synaptics greater offerings thereafter.

Management’s revenue expectation for the next five years is quite ambitious. I expect there’s going to be greater competitive pressures as they shift to broad-end markets. For their benefit, Synaptics has good relationships with a lot of major technology companies which should help build trust in getting their chips into more products.

To understand if their 12% revenue CAGR projection is realistic, let’s compare their history. Revenue has grown at a CAGR of 4.1% over the last 10 years through fiscal 2023 and the growth rate is at -2.1% since 2019 when current top management joined Synaptics. Those figures don’t give me much confidence in the high goal management recently provided.

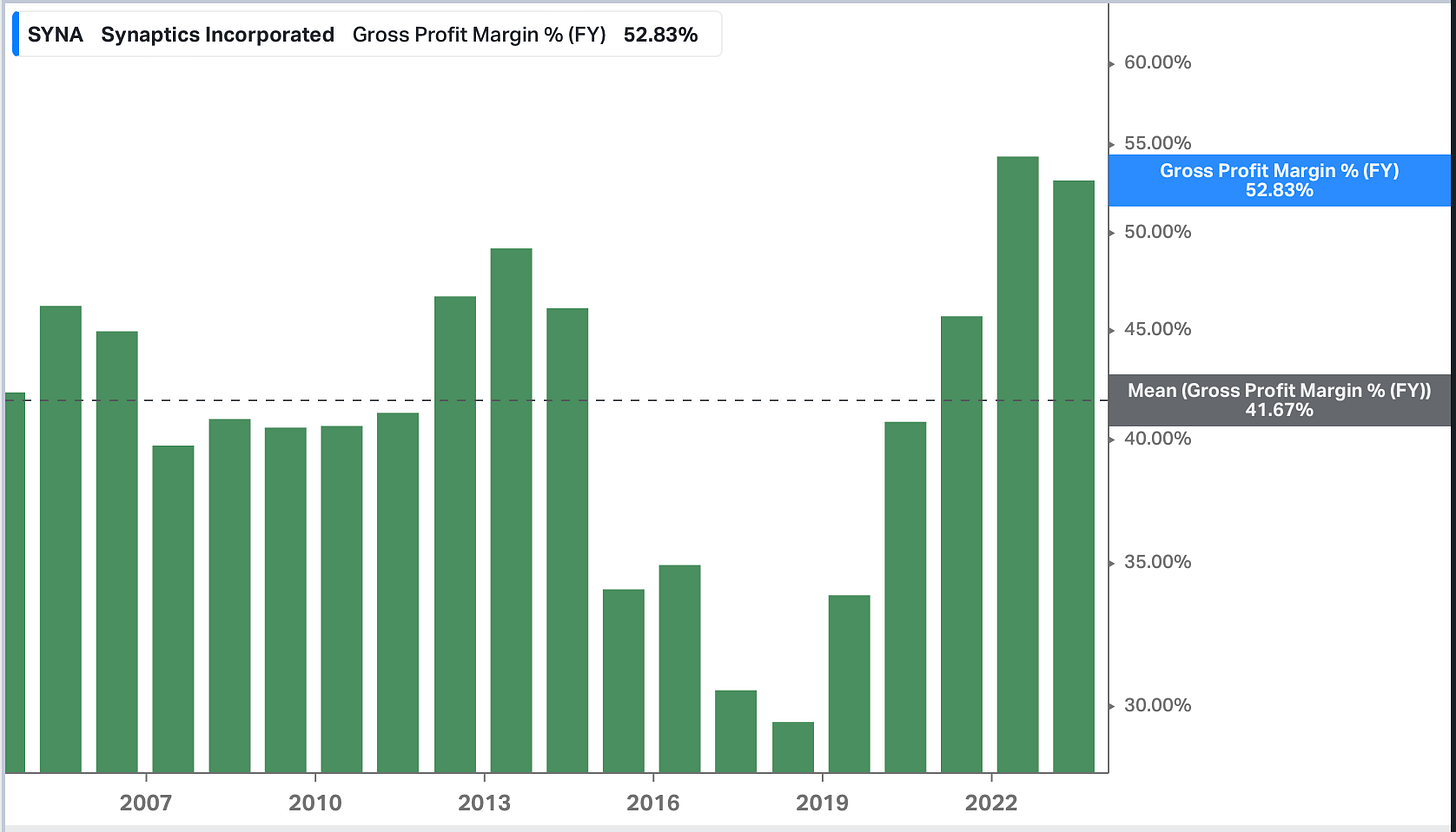

Synaptics also provided a long-term non-GAAP gross margin target of 57%, which compares to ~60% in the prior two years but an average of 48.8% in the prior six years which is also close to the 20-year average. It shows they’re expecting some margin abatement after experiencing strong margins in the last three years. To their credit, Synaptics did hold onto its elevated profit margin in fiscal 2023 despite pricing pressure amid the glut in inventories in 2023 so perhaps margins can continue to be higher than the historical norm. Separately, I should note that Synaptics has emphasized recently that margins are correlated to the product mix, specifically the weighting of IoT, which is a higher margin than PC and mobile. More IoT means higher margins so future years should pull margins higher again.

Guidance for fiscal Q1’24 included a GAAP gross profit margin of 45.5% and non-GAAP gross profit margin of 53.5% suggesting further margin compression to start the year. Note that non-GAAP gross profit margin is about 600 basis points higher than GAAP gross profit margin because Synaptics takes out acquisition-related costs and a little SBC.

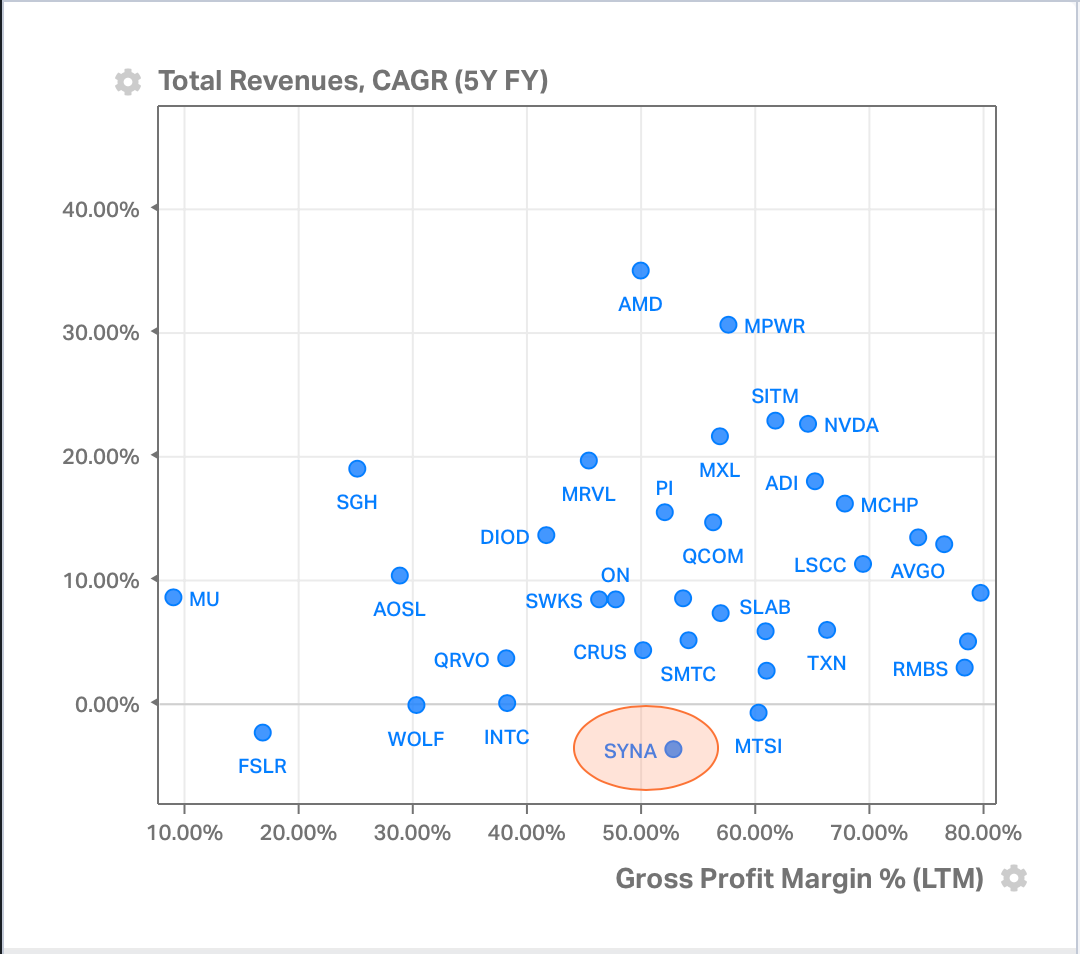

The upcoming transition in product offerings has been labeled as “margin-rich” by management. Synaptics would then compete more closely with companies such as Silicon Laboratories (SLAB) which have even better margins. The following scatterplot looks at gross profit margins and revenue growth by those in the SPDR Semiconductor ETF. Synaptics is currently in the middle of the margin territory.

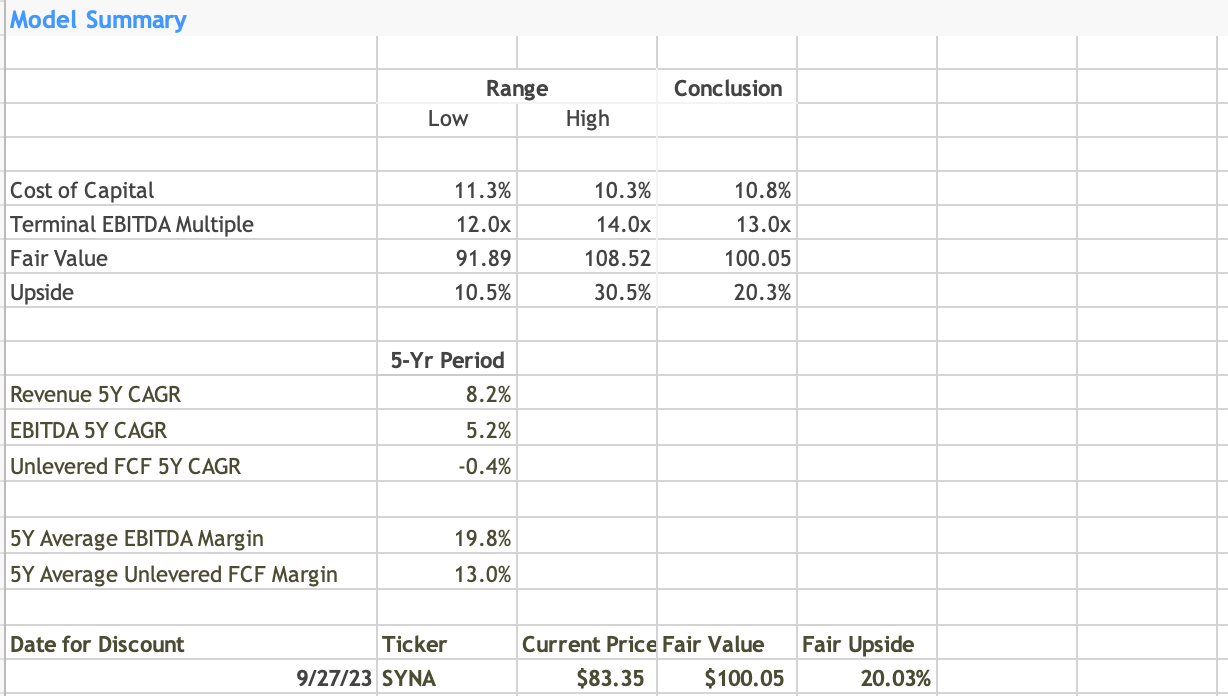

Valuation: I built a financial model forecasting financial performance over the next five years to produce a DCF valuation. Management gave revenue guidance of $230M for Q1’24, which would be -48% below Q1’23. It will also reverse the QoQ decline in sales after posting revenue of $227M in Q4’23. Taken together, revenue growth will still likely be negative in fiscal 2024 and should reverse on an annual basis in 2025. What gives me confidence in the turnaround is that Synaptics has been undershipping by about $100M a quarter. That means end-customer demand is still strong. So if the inventory channel of their direct customers were normal sales would be ~$330M in Q1’24.

Moving onto annual sales figures, I expect Enterprise & Automotive and Mobile segments to grow at a steady state over the duration of the DCF. Auto is relatively small for Synaptics but could be strong this year. Core IoT is the driver of growth for Synaptics. The wireless connectivity portion of the business had rapid growth already and that can carry Core IoT over the next five years. In addition, new product offerings could boost sales further beginning in 2025. Overall my revenue estimates are below the consensus analyst estimate for both 2024 and 2025, and the overall trajectory is lower than Synaptics’ management expectation of 12% CAGR.

The EBITDA margin should dip in 2024 before picking up in 2025 and remain steady. There’s a few gives and takes here. Margin benefits for new product offerings can pull margins higher, offset by the gravity of settling back near the historical EBITDA margin. The average EBITDA margin for Synaptics over the last 20 years is 15.4% when there was a higher weighting of lower margin mobile and PC products.

CapEx and depreciation and amortization are expected to be near the five-year average, as a percent of sales. Though you could argue Synaptics needs to invest even more heavily than they have been. Cash flow projections are as follows.

The other critical inputs of the DCF model are the discount rate which is 10.75% based on a beta of 1.8 and the current 5-year risk-free rate of 4.6%. Synaptics’ average trailing EV/EBITDA multiple in the last 10 years is 13.9 and the median is 12.0. This DCF will exit at 13X. The summary is as follows, which calculates a fair value of ~$100, roughly 20% higher than the current price.

Conclusion: Synaptics next frontier of semiconductor growth could be quite fruitful though I have my reservations the company can grow at a CAGR of 12% in the next five years. There’s going to be a new business cycle for Synaptics (they experience them frequently) and higher stock prices with that, at some point. The bear case is that Synaptics grows at a CAGR of 5% or less and EBITDA margins fall back to the historical norm near 15%. The bull case scenario would be that Synaptics realizes higher growth from its IoT portfolio and higher EBITDA margins than 20%. The 20% implied upside in the stock, according to my model, isn’t enough to entice me to stamp this with a buy right now. I’d rather wait to see some growth materialize or wait for a cheaper stock prices.

Disclaimer: This is not advice to buy, sell or hold any stock referenced. Do your own due diligence. I have no position in any stock mentioned in this report. Like any financial analyst, doesn’t mean I’m not biased.