For this company analysis, I will dig into Thor Industries (THO). This write-up starts with an overview of the company, discusses the competitive landscape, capital allocation then covers management and their incentives through compensation. Lastly, I’ll finish with a section for the outlook and valuation.

Overview: Thor Industries is the largest recreational vehicle (“RV”) maker in the world that sells in both North America and Europe. Founded 1980, Thor has well-known brands such as Jayco, Heartland and the iconic Airstream. There’s three reportable segments: 1) North American Towables, 2) North American Mortorized and 3) European RVs. THOR also has an “Other” segment made up of RV components and digital assets.

Towables consist of conventional trailers that are towed by pick-ups and SUVs and fifth-wheel style trailers that have a raised forward section and are attached to the bed of a pick-up truck. Motorhomes, as the name sounds, are RVs that are self-powered with their own engine. Class A Motorhomes are constructed on medium-duty truck chassis that are supplied by companies such as Ford (F), Freightliner and The Shyft Group. Class C and B are built on Ford, General Motors (GM) and Mercedes-Benz (MBG) small truck or van chassis. In either case, Thor designs and installs a living area on the supplied motorhome chassis. It’s a similar dynamic in Europe with Thor assembling motorhomes from chassis made by Stellantis (STLA), Mercedes-Benz, Ford and trucking company Iveco. The nomenclature is slightly different in Europe as RV trailers are generally referred to as caravans and motorhomes are called motorcaravans. Thor notes that in Europe “the focus is on light and small caravans that can even be towed by small passenger cars.”

Thor entered the European market through the acquisition of Erwin Hymer Group (“EHG”) in 2019. Note that Thor has done a lot of growth through acquisitions and EHG was one of many. The company bought Jayco in 2016, which was a big boost to the towables segment, and then acquired Tiffin in 2020 which added to the Motorhome segment. The following graphic highlights improved net profit before taxes at the acquired companies. Each saw a gain in margins, except EHG. I’ll touch on M&A again in the capital allocation segment.

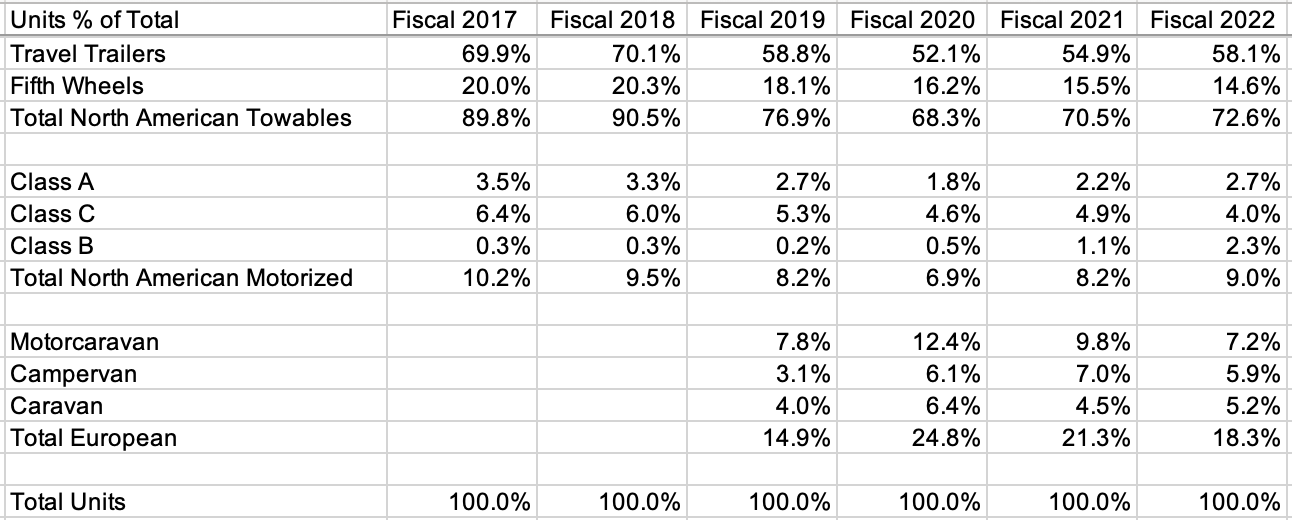

Thor generates most of its revenue through the North American Towables segment, which accounted for 53.1% of sales in fiscal 2022. Most of that is within the smaller travel trailers segment, rather than fifth wheels. North American motorhomes made up 24.4% of 2022 sales, which is the highest for Thor since 2018. 4.0% of the improvement in the past four years is driven by Class B for all those consumers in the #VanLife culture. Lastly, the European segment made up 17.7% of sales. The table shows the make-up of sales by percent since 2017.

Because motorhomes have expensive drivetrains that are built on large truck chassis, it’s no surprise they’re relatively expensive as compared to travel trailers. In addition to breaking out revenue by RV type, Thor also breaks out units sold by RV type. I strung together data from several 10-Ks and as you can see below, travel trailers made up 58.1% of the units sold compared to 33.3% of the revenue. Meanwhile, Motorhomes (all three types), made up 9.0% of units sold in 2022 and 24.4% of revenue. The table breaks out sales by unit (instead of dollar value above).

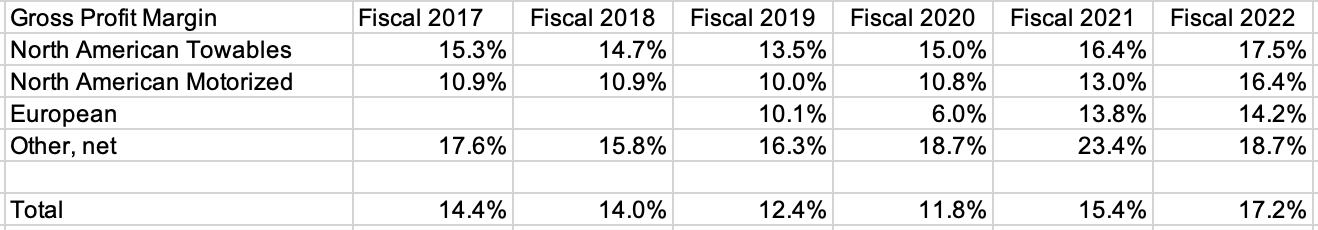

The margin profile has generally been slightly better for towables as compared motorhomes. Gross profit margins for North Amercian Towables were 17.5% and 16.4% for motorhomes. And towables have been about 3.0% higher than motorhome homes each year. Gross profit margins for the European segment has lagged North American overall at 14.2% in 2022, though that’s up from previous years.

Margins have similarly been higher for towables when stepping down to income before taxes, according to Thor 10-Ks that break out margins by segment. What is noticeable when looking at margins at Thor is how bad the European segment is. Profit margins were 3.0% in 2022 and graphic highlighting acquisitions above said EHG (European) was 4.0% when acquired. Not only does it lag other segments, but it’s also dropped over time. 2019 and 2020 figures were dragged down by integration costs. Even still, the lag is dramatic.

Thor’s main competitors in North America is Forest Rivers (owned by Berkshire Hathaway) and Winnebago Industries (WGO). According to Thor, the RV market is intensely competitive and is characterized by low barriers to entry. The competition section of the 10-K said there was approximately 65 RV manufacturers in the U.S. and Canada in 2020, which increased to 70 in 2021 and 80 in 2022. It’s a quick rise in recent years that indicates new competition from upstarts.

According to the March 2023 10-Q, Thor had 40.9% market share of North American towables (trailers) and 48.3% market share of North American motorhomes, for overall market share of 41.7% according to retail units. Thor had market share of 47.9% in 2016, upon acquiring Jayco, and it’s steadily declined due to a drop in market share of towables which makes up most of the market. The pick-up in Motorhomes in 2021 (light blue line) was driven by the acquisition of Tiffin. I’ll add that EHG has the second highest market share in Europe at 18.0%, though considering it was acquired 2019 there’s not a long trend of data. Overall it’s a poor trend to see the money-maker towables decline in market share.

Thor intends to minimize its own inventory, so RVs are generally built to dealer order. Manufacturing is quickly ramped up and down in North America, though it tends to be more sticky in Europe. This is largely due to stricter labor laws in Europe. When it comes to raw inputs, such as steel, lumber and fiberglass, Thor is supplied by numerous providers. There has been issues with chassis suppliers in recent years, specifically constraints for key components such as semiconductors with demand outpacing production and it’s negatively harmed motorhome manufacturing. Non-chassis components have also been constrained in recent years. Parts suppliers for RVs seems particularly concentrated. LCI Industries (LCII) is the main parts maker and they own 55% of the RV market-share.

The sales channel works in a way that Thor sells to dealers, who then sell to customers. The dealers are generally independent, non-franchise entities for which ~2,400 carried Thor products in 2022. Another 1,100 European dealers carry Thor products. One dealer customer, FreedomRoads, more commonly known as Camping World (CWH) is particularly large. FreedomRoads accounted for 20% of sales in 2018, 18.5% in 2019, 15% in 2020 and 13% in each 2021 and 2022. Thor notes that it generally doesn’t finance dealer purchases, which are instead financed through unrelated banks. Apparently, it’s common for RV manufacturers to put in place repurchase agreements with the banking lending to dealers. So, what's a repurchase agreement? Basically, if a dealer defaults on their loan within 18 months, Thor steps in and buys back the unsold RVs from the lender. The amount they pay is often less than the dealer's original cost. This spreads the risk of loss over many dealers and is further reduced by the resale value of the units they'd repurchase. Thor believes any future losses under these agreements won't have a significant impact on their bottom line.

As of July 31, 2022, Thor's total commitments under repurchase obligations were $4.3B, up from $1.8B the previous year. Good news though, losses from repurchases haven't been significant in recent years. When selecting dealers, Thor looks for financial stability, creditworthiness, reputation, experience, and strong customer service.

Now that the flow of sales is understood, analyzing backlog and dealer inventories is critical. As of January 31, 2023, Thor had a backlog of $6.1B in RV orders, half of which is from North American dealerships. Backlog consists of unfilled dealer orders. The total backlog is down from $17.7B at the close of January in 2022. In January 2019 and January 2020, North American backlog was about $1.5B so the 2023 backlog is still elevated at ~$3.0B. According to the 2021 10-K, backlog increased by about $767M because of their acquisition of Tiffin. Taken together, it’s normal to see a North American backlog of $2.0B and $1.2B for the European segment.

The elevated backlog, and an extreme backlog in 2021 and 2022, are due to the increased demand for RVs during and after the onset of COVID-19 in addition to constrained demand for much of that time period. Thor wrote in their 2021 10-K:

“We believe this increase is attributable to a number of causes, including the perceived safety of RV travel during the COVID-19 pandemic, a strong desire to socially distance, the reduction in commercial air travel and cruises, an underlying desire by many to get back to nature and relax with family or friends, an increase in various marketing campaigns to promote sales, and to a lesser extent, supply chain issues which delayed certain shipments beyond July 31, 2021 and which prevented us from further increasing production rates, and the lower levels of independent North American and European RV dealer inventory levels, all of which have led to increased dealer orders and backlog.”

Essentially interest in RVs spiked, a logical travel option during COVID-19 restrictions. Now the backlog and dealer inventories are normalizing. The stock has struggled through the process of getting back to normal, and that’s largely why Thor is particularly interesting right now. On the topic of dealer inventories, Thor provided the following chart in March 2023 looking at dealer inventories of Thor products. To take the data slightly further back, the inventory count in January 2018 was 155,650 units making for an average pre-covid inventory count of ~136K. Consider that Tiffin was acquired in December 2020 so the normal inventory count should be closer to 140K units. The willingness of dealers to hold 140K units will depend on the strength in sales at the time. I’ll dive deeper into the subject later in the outlook section, but I’ll note for now that the market has soured quite a bit this year and the current dealer inventory is likely fully stocked given the environment.

Capital Allocation: The source of growth at Thor has largely been through acquisitions. Over the last 10 years, Thor has generated cash from operations of $4.3B. The company spent 23.3% on capital expenditure to grow and maintain the existing business. Stockholder returns have been modest with 6.8% of free cash flow (“FCF”) going to buybacks and 21.4% going to dividends. Meanwhile, Thor spent 108.4% of its cumulative FCF on acquisitions dating back to 2013. As mentioned, the large purchases were Jayco in 2016 and EHG in 2019. Jayco was funded by cash on hand and debt. The EHG merger was larger and involved Thor issuing stock to EHG, and the share count saw a 3.6% increase that year.

For the capital allocation review, I used Winnebago (WGO) as the comparison company. The use of capital is quite similar for Winnebago who spent 20.4% of its cash from operations on capital expenditures and 96.1% of its FCF on acquisitions. Winnebago has leaned on dilution/issuing stock for mergers, especially the purchase of Grand Design which caused a large jump in the outstanding count in 2017. The second big jump in outstanding was in 2020 when it bought motorhome maker Newmar. Other notable acquisitions for Winnebago are marine companies Chris-Craft in 2018 and Barletta Pontoon Boats in 2021. Winnebago now generates 13% of its revenue from marine. Another material difference has been shareholder returns with WGO spending 31.3% of its FCF on buybacks and only 9.4% of its FCF on dividends.

Both companies have been opportunistic with stock buybacks, and Thor is rarely in the market for its shares. As you can see by the year-by-year table above each company ramped up buybacks in 2022 while the RV market softened. The difference in buybacks to dividends may have contributed to the outperformance of Winnebago. However, more of the difference is chalked up to the selection and integration of mergers. Recall the graphic shown earlier that visualized margin improvements at Thor acquisitions. The only acquisition that saw decreased efficiency was Thor’s largest acquisition EHG. That’s generally when Thor stock started underperforming against Winnebago.

To back up the above stockholder performance chart, I’ll note that FCF at Thor increased at a compound annual growth rate (“CAGR”) of 22.5% while Winnebago achieved a FCF CAGR of 55.7%. The increase in revenue has been more similar, so there’s clearly been a gain in operational efficiency.

Management and Incentives: Robert Martin has been CEO since August 2013 upon promotion from his last role of president and COO. He joined Thor in 2001 from another RV company, Coachman, and worked his way up the ladder through executive positions associated with Keystone. He began leading the Keystone in 2010, which was the largest subsidiary for Thor.

COO Todd Woelfer joined the company in 2012 as general counsel until promotion to his current role in 2021. He too worked at Coachman from 2007 - 2010. The two-year gap between Coachman and Thor was spent as a managing partner at a law firm focusing on corporate clients. It’s uncommon for general counsels to shift over to operations, such as Woelfer. Lastly, Colleen Zuhl was also promoted from within to CFO in 2013. Zuhl joined the company in 2011, initially serving as director of finance then corporate controller. Prior to Thor, Zuhl similarly worked at Coachman from 2006 to 2011, so there was overlap with Woelfer, but not Martin.

As with most companies, base salary is a small fraction of total compensation for executives. Thor points out that CEO Martin, at $750K in 2022 salary, was 20% lower than the next lowest in the peer group. The general counsel was also below the whole peer group. Instead Thor favors variable compensation. That’s generally two buckets - annual compensation paid in cash (bonuses) and long-term, stock-based compensation. Compared to the norm, the portion of total compensation paid out in the form of bonuses is relatively high. It’s common for companies to pay most of the compensation in the form of long-term incentive pay, but that was actually lower than short-term pay (bonus).

The following graphic by Thor shows the distributions of pay by base salary, short term incentive pay (bonus) and long term incentive pay (equity). As a comparison, the CEO’s pay at Winnebago (WGO) was 15% salary, 19% bonus and 66% equity. Other executives had 28% total compensation in salary, 26% in bonus and 46% in equity. The big difference is more bonus pay at Thor and less salary. However, I’d prefer to see the CEO of Thor have a large percentage of his pay in equity.

Let’s dig into the performance drivers to compensation at Thor. Variable short term incentive pay is paid in cash, on a quarterly basis. It is essentially a profit sharing plan as Thor pays executives a percent of the adjusted net before tax profit (“NBT”). For instance, CEO Martin was paid 0.511% of the NBT and Woelfer was paid 0.178% while Zuhl had a percentage of 0.153%. If you like to nerd out about legal language in filings, I found the changes to the section in the proxy covering this quite amusing as each year the wording got softer as they began to rely on adjusted earnings.

In 2020, Thor said “We generally rely on true GAAP numbers for purposes of calculating our NBT and do not otherwise manipulate earnings.”

In 2021, they remove phrase manipulate earnings and instead said “We generally rely on true GAAP numbers for purposes of calculating our NBT and do not otherwise adjust earnings for purposes of these calculations.”

Then in 2022 Thor took out true GAAP and that they do not adjust earnings, while adding which adjustments they make. “We generally rely on GAAP numbers for purposes of calculating our NBT which includes standard adjustments, to exclude gains/losses as a result of LIFO, non-controlling interests, impairments, and certain foreign currency exchange gains/losses.”

Long term incentive pay is split between restricted stock units (“RSUs”) and performance share units (“PSUs”). The RSUs, like short term pay, uses NBT as a metric to determine the value of RSUs for the year. However, vesting is then in equal installments without performance. It’s an unusual program to attach the value of RSUs to annual profit. PSUs instead vest based on performance over a three year cycle. The performance metrics of PSUs are split evenly between free cash flow (“FCF”) and return on invested capital ("ROIC") goals versus forecasted performance.

I’m a fan of attaching FCF to PSUs and while I appreciate capital allocation and the association to ROIC, it’s a metric that’s calculated inconsistently. Also note that none of the performance pay is tied specifically to revenue growth. Management instead is incentivized to drive profit and cash flow.

Outlook: The RV industry has grown well when focused on units alone. In 1990, wholesale units were 173.1K, which has grown to 493.3K in 2022 for a CAGR of 3.3% (US population grew at about 1.0% per year in that period). It’s been volatile at times with a big downturn in 2009 when units were sliced in half compared to two years earlier. As noted, volume soared in 2021 when the industry reached a high watermark of 600.2K units. The chart below splits up industry-wide towables and motorhome units. It’s a nice overall trend for the industry because companies could simply increase prices at the inflation rate and generate +5% growth in revenue when accounting for the rise in units sold. The expectation by the RV Industry Association (“RVIA”) is ~334K units in 2023 so volume is nearly getting sliced in half again against 2021.

Long-term, there are some tailwinds in the RV industry driven by good demographic trends with a heightened number of retirees and increasing interest from younger generations such as millennials. Retirees have generally been beneficial to RV purchasing and we’re two-thirds the way of baby boomers reaching retirement age. Boomers are born between 1946 and 1964. For the tail end of that, a person born in 1964 is 59 years old right now, or six years away from 65 (a common retirement age). Put another way, there’s still another six years of elevated numbers of Americans retiring each year. An economist at the Federal Reserve of St. Louis put this chart together four years ago forecasting the number of Americans turning 65 each year. I’m sure it’s changed a bit post-covid but the point is there continues to be elevated amounts of Americans retiring and potentially enjoying life on the road as an RVer.

The second positive demographic tailwind is an uptick in the interest by younger generations such as millennials. Despite the uptick in retirees in recent years, baby boomers make up about 20% of RV ownership. The bulk of ownership is now from Gen-X and millennials. As workers enjoy a work-from-anywhere lifestyle, it’s made for an increased ability and interest to spend more time RVing. RV industry companies have done plenty of surveying to tout the interest by Gen-Z and millennials, such as RVIA. The surveying seems quite biased and targets RV goers so I’m not going to rely on it. According to RVIA, “of the current millennial and Gen Z owners, 84% have said they want to purchase a new unit in the next five years”. I’m more interested in surveys that could tell how many non-RVers will become RVers, rather than current RVers planning to purchase in the next five years. I will add some commentary from Thor management to give insight into the market outlook. Matt Zimmerman, head of North American RV Group, said in the June 2022 investor day:

"Many of you in this room probably are well aware that baby boomers one time fueled our industry for many, many years as the #1 demographic in the industry. Today, they're the third largest group and only represent 22% of the overall RV space. But don't get me wrong, we love our boomers. And we will certainly continue to build products and serve them up to them that they desire.

But Gen Xers and millennials today represent nearly 70% of the RV space. And if we're not building products that are attractive to these young enthusiasts, then we're missing out on incredible opportunities.

For the first time in my career, RV-ing isn't just something what the grandparents did. It's the cool thing now, right? This is how these young enthusiasts want to get outdoors. They want to connect. They want to use an RV.”

There’s also a potential increase of consumption stemming from the ease of renting through peer-to-peer RV sites. Last year I used Outdoorsy, a P2P site, to rent and tow an RV. I enjoyed it enough that I’m taking my second trip with my family this summer. I’m a suburban living millennial and can’t say that I’d purchase an RV because I wouldn’t use it enough. But I am interested in renting an RV for a trip once a year or so. Therefore, a consumer with my buying behavior could contribute to RV demand by renting and I’m in a demographic where RVing wasn’t so popular five years ago.

While the medium to longer-term tailwinds are good, the short-term headwinds are unfortunately stronger. When Thor reported earnings for fiscal second 2023 results (Q2’23) on March 7, the company slashed its sales expectations for 2023 to $11.0B (midpoint) from $12.0B. The new guidance represents a -32.6% drop in revenue compared to the record sales in fiscal 2022. Softening demand is directly tied to the rise in interest rates and inflation. Buyers generally finance an RV and the willingness to buy an RV at relatively high interest rates has depressed demand. In addition, inflation has hurt consumers’ ability to afford RVs. They’re highly discretionary objects so when you’ve got to cutback, the purchase of an RV isn’t in the cards. Management said the in Q&A of its March earnings release:

“Entering calendar 2023, we experienced an encouraging early spring retail show season across the country with high attendance figures and solid retail activity, reinforcing the underlying strong interest for the RV lifestyle. However, activity on dealer lots has not matched the strong show season and sales conversions have been challenged. While we had anticipated softening retail activity in our fiscal second quarter, it was more pronounced in the back half of the quarter, suggesting that retail consumers are succumbing to the macroeconomic pressures most prominently triggered by the Fed's rate policy in the face of sustained inflation.”

“While near-term demand will continue to be influenced by macroeconomic conditions, we believe that the recent greater-than-expected softening in demand will be temporary, and in the longer term, we remain strongly optimistic about both the industry's and THOR's future growth…This longer-term optimism is supported by data that indicates interest in the RV lifestyle continues to exceed pre-pandemic levels, RV utilization remains high, consumer satisfaction among RV owners is very strong, and repeat buyer intentions reaffirm the “stickiness” of the RV lifestyle. The strength of the consumers' interest in the lifestyle has been demonstrated by strong show attendance across North America despite the macro pressure on consumers. Given these facts, we believe that retail demand should rebound once current macroeconomic risks subside. As we think about our stock, the short-term challenges created by the macro environment will create turbulence in reaching fair value, but for holders with a longer time horizon, the temporary depression of our performance creates opportunity. Nothing about the short-term turbulence casts any legitimate doubt on our long-term optimism.”

Another comment that caught my attention in the March update was on dealer inventories. As I mentioned earlier in this write-up, it appeared the backlog was quite robust. Management said:

“As of January 31, 2023, we believe North American dealer inventory levels for most of our towable products are slightly higher than dealers' desired levels given current retail sales levels, inflation, rising interest rates and other associated carrying costs while dealer inventory levels for our motorized product lines are generally more closely aligned to dealers' desired stocking levels as of the end of January 2023.”

My point of view is that until the cost of borrowing subsides, and the inflation rates come down further, Thor will struggle. As of May 2023, the fed funds rate is at 5% and interest rates on buying RVs is often above 7.0% (my local credit union is above that). It could take well into 2024 for interests to come down enough to spark a rebound in buying of RVs. It’s also notable that Thor management has repeated that RV show attendance has been high. Perhaps there will be pent-up demand for RV buying after a drop in interest rates.

Valuation: For my DCF model, I’m forecasting revenue of $11.0B for fiscal 2023, which matches the current management forecast and is lower than the analyst consensus estimate of $11.18B. Part of this is because I’m in the higher for longer camp (for interest rates) meaning the headwinds of costs to consumers is too great right. Regardless, $11.0B will be tough to achieve after fiscal Q2’23 sales were -39.4% YoY. By my calculations the second half of the year will have to be no worse than -22% YoY. I’m taking the ~$200M miss (against the sell side target) and pushing that and some into 2024. Then I’m forecasting Thor returns to elevated growth. Sales will still remain well below the fiscal 2022 mark.

The average EBITDA margin is 7.7% for the last 20 years (including 2008/2009 financial crisis lows) and 8.7% over the last 10 years. The DCF model includes poor margins of 7.0% in 2023, then settles at 7.7% for the last three of the model to match the historic average. I know Thor is hoping to improve margins, and outlined goals for increasing the European segment. Supply chains and labor dynamics seem tougher in the EU so it’s not clear they can achieve the goal of enhancing margins by 2.0% for Europe.

Thor forecasted capital expenditure spend of $200-$220M for 2023 (2.0% of revenue). The average over the last five years 1.4%. The DCF generally has CapEx equal to 1.5% of revenue. Other line items that flow to the free cash flow calculation similarly match the average of the last five years on percentage terms.

Now that I’ve laid out the cash flow forecast, the next two important inputs are the exit multiple and discount rate. Thor has an average trailing EV/EBITDA of 7.2 over the last five years and 8.5 over the last 10-years. I’m opting for 7.5 in the DCF while keeping in mind Thor would have topline growth of 6.0% at the time. Given the high cyclical nature of Thor, shares have experienced a high beta of 1.28 for the last two years and 1.74 for the last five years. I’m picking 1.5 to calculate the discount rate. Current debt to equity is 47.6%. Therefore the current discount rate calculates out to 10.7%, though I’ll round up and go with 11.0%. The following summarizes the DCF model and values Thor at $116.18 per share for 45% upside.

Modeling Thor is unpredictable given the potential demographic changes and potential M&A. I’m not sold that millennials will accelerate sales in the future. If it does happen, you could see further upside. As noted several times, Thor has grown significantly through M&A. However, this model assumes no M&A. Theoretically the fair value doesn’t have to change much as you take current cash flows to increase future growth and cash flow. Whether an acquisition by Thor pans versus the cost/valuation of shares is uncertain. Some work, some don’t. In order for Thor to increase its value through M&A, they have to buy below fair value and/or achieve synergies that are less than integration costs. In addition, Thor will be materially impacted by future interest rates, which are also highly unpredictable right now.

For good measure I’ll note that buying Thor based on a relative valuation approach (against Winnebago, LCI Industries and Polaris) calculates a slightly lower fair value price than the DCF. When valuing Thor (or Winnebago) on a trailing basis, such as EV/EBITDA, the price appears cheap with the industry in a trough. These two stocks have traded similarly over the last 10-years as can be seen on the chart below showing last twelve months EV/EBITDA multiple.

The current valuation according to the forward EBITDA (instead of last year’s EBITDA) is quite close to the historical average which indicates Thor is close to fair value. Note that Thor and Winnebago have been closely tied through both metrics. And Winnebago is slightly cheaper, especially when looking at EV/EBITDA for the next twelve months (NTM). Boat maker Brunswick (BC) trades at 5.9X right now too so perhaps Winnebago is dragged lower by marine.. I’m not a fan of simply attaching on valuation metric on a forward or trailing basis when the sales pattern is so inconsistent. You tend to get more insight through a DCF model which allows for fluctuations in sales.

Conclusion: There’s solid potential upside in Thor for those who can stomach the current volatility in sales and wait for the longer-term. By factoring the forward EV/EBITDA and DCF model, I’ll give Thor a $110 price target indicating about 35% upside. It’s not enough upside for the risk, in my opinion. Sales will continue to struggle through the remainder of fiscal 2023 (July 31). After learning more about Winnebago through this research, those shares also look appealing. Winnebago has operationally outperformed Thor, shares have been stronger in recent years and the valuation multiple is a touch cheaper. However, Thor is a pure play on the RV industry while Winnebago has some boating exposure to keep in mind.

Disclaimer: This is not advice to buy, sell or hold any stock referenced. Do your own due diligence. I have no position in any stock mentioned in this report. Like any financial analyst, doesn’t mean I’m not biased.