WEX WEX 0.00%↑ is a payment processor and software company that has three segments: 1) mobility with exposure to fuel prices; 2) health and benefits and 3) corporate and travel payments. WEX reported an earnings and revenue beat for Q4’23 on February 8 that included guidance for Q1’24 and full year 2024 that was largely in-line with expectations.

Revenue for Q4’23 came in at $663.3M, up 7.0% YoY and compared to the Wall Street consensus estimate of $653.1M (1.6% surprise). Adjusted net income per share (excludes non-recurring costs and stock-based compensation) was $3.82, up 11% from Q4’22. This figure also beat the consensus estimate of $3.72 (2.8% surprise). 53% of revenue came from the mobility segment, which does fuel payment processing. Excluding the impact of lower YoY fuel prices and foreign exchange impacts, revenue would’ve grown by 13% and net income per share would have increased by 21% in Q4’23.

As for segment performance, sales for the mobility segment were $350.1M, down 4.6% from the prior year. WEX processed payments for 3.358 billion gallons of fuel, which was down 0.9% against Q4’22. The volume of fuel processed is an important KPI that’s closely aligned with business performance. The average price of fuel was down 13.4% YoY, causing the drop in revenue. While management can’t control fuel prices, they can drive growth by processing more gallons of fuel, but that’s slowed over the past year. Part of the drag on gallons processed and number of transactions has been the tighter credit policies imposed by WEX on customers in the past year, which has also decreased revenue from late fees. They’ve generally made up for it with stronger operating profit margins so it’s been a net benefit. Another positive for mobility is the net interchange rate (take rate) that continued to rise in Q4’23 on a YoY basis due to escalator clauses stemming from higher interest rates. Lower fuel prices de-leveraged operating profit margins in Q4’23 to 43.0% from 45.2% a year-earlier.

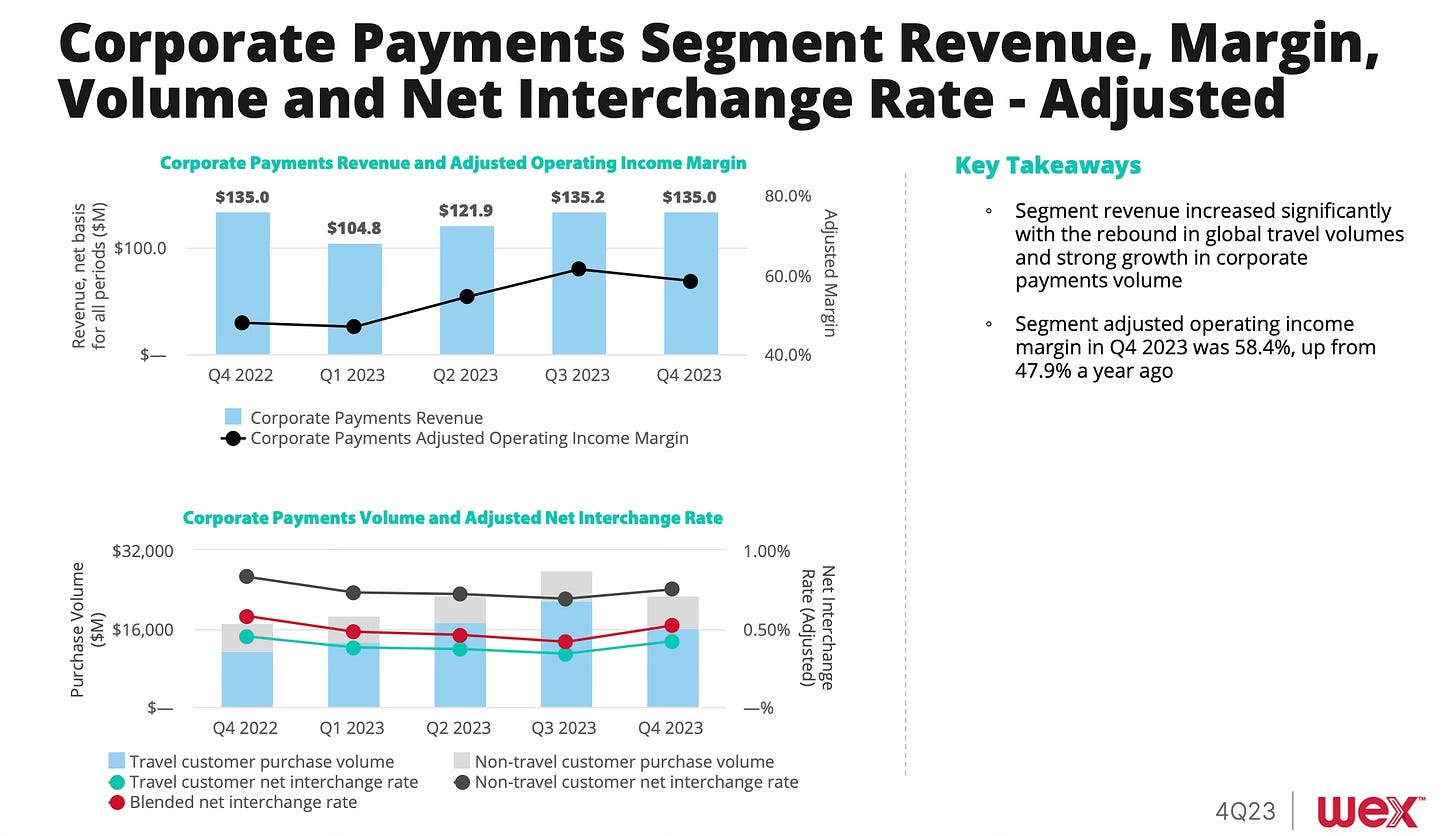

Revenue growth in the corporate payments segment continued to be hot due to higher travel spending. Revenue was $135.0M, up 22.0% compared to Q4’22. The dollar value of corporate payments increased 33.5% in Q4’23 and the take rate was up slightly year-over-year. The corporate payment segment can be broken down further to travel revenue (up 39% YoY) and other corporate payments referred to as non-travel (up 5% YoY). There’s excellent leverage in corporate payments and the increase in revenue has been a boon for operating income margins. CFO Jagtar Narula said:

“The segment adjusted operating income margin was up 10.5% over the last year to 58.4%. There has been significant improvement in these margins during the year as volume accelerated. In fact, this is the second quarter in a row where more than 100% of the year-over-year revenue increase flowed through to adjusted operating income margin.”

Lastly, (health) benefits segment revenue of $178.2M was up 27% YoY. Of the $37.5M in increased revenue, half came from increased revenue from custodial (HSA) assets that are tied to treasury yields and the other half was a mix account serving revenue, purchase volume and some M&A contribution from the Ascensus acquisition. Operating profit for the segment was up 49.5% YoY. The increase in margin for the health segment was due to high revenue from HSA deposits, which is a high-margin business.

Management of WEX gave FY2024 guidance with revenue expected to be $2.72B, representing a 6.8% increase over 2023. Adjusted Net Income per share is expected to be $16.15, up 9.1% from 2023. On a segment basis, mobility is expected to grow 8% when excluding fuel price changes, corporate payments will be “high single digits” and healthcare is expected to grow 12.5% in 2024. WEX’s planning assumptions have GDP growth at a modest 1.5% and their assumptions are factoring in five quarter-point (0.25%) decrease to the fed funds rate. This presents an interesting consideration for those who believe that the economy will have a soft landing and rates will be higher for longer. In that case financial performance will be better than expected, but net income would be offset somewhat by higher interest costs.

Also recall that last quarter WEX revealed that it would acquire field services software company Payzer which does scheduling, dispatching, and communications for businesses such as HVAC or lawn maintenance companies. WEX is planning on revenue synergies with those customers driving 2% extra growth for the mobility segment (included in the stated growth guidance). CEO Melissa Smith gave additional color on guidance during Q&A based on recent trades:

“We ended 2023, we grew revenue 13%, excluding fuel prices in FX. And if you look at the midpoint of our guidance for '24, it's 9% on the same basis…one of the most important things for us is to continue the sales momentum that we had in 2023. We'll get a benefit of the sales tail of what we sold this year, and we expect our sales professionals to continue to deliver in 2024. We also have pricing levers that we're going to continue to use, which we did in mobility in '23, and we'll continue to in '24.

We'll Get the benefit of the annualization on the changes we made from our credit policies, which will give us a lift from a comparability standpoint, both on late fees and on attrition. And then we'll get a full year benefit of the acquisitions…On the corporate payment side, we are expecting to see lift on the nontravel part of our business, and you can see that has come true sequentially. Each quarter, we've come up a little bit over the last couple of quarters, and we're expecting that momentum to continue into 2024.

And that's coming from the pipeline that we have on our embedded payments product as well as the success we've had with our direct sales force, which is becoming a more meaningful part of the business. And then we expect our travel business to become a little bit more muted in -- and from a growth perspective in 2024 compared to '23, which was bullish we're coming off a 40% spend volume growth in the fourth quarter of 2023. And so we're expecting, as you go through the course of 2024, that, that growth will moderate.”

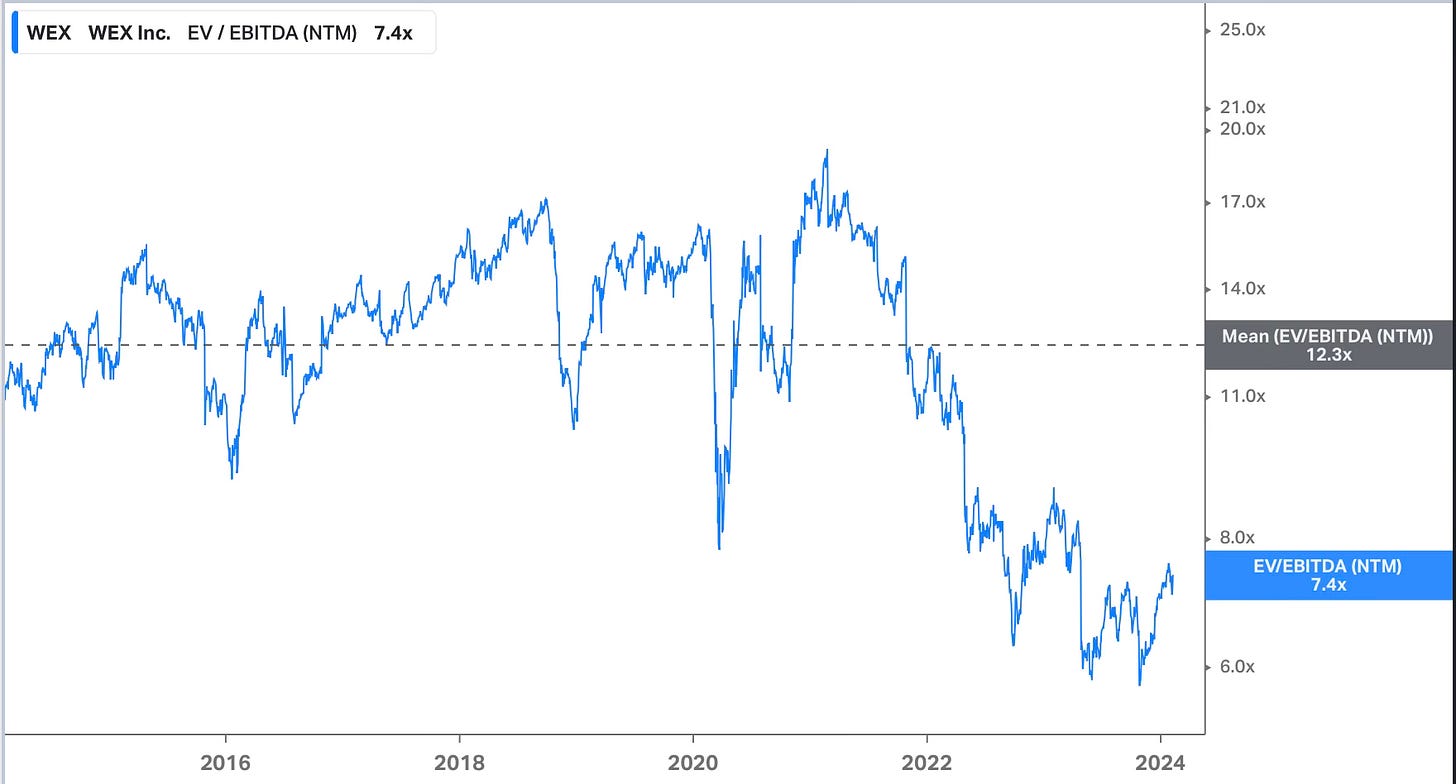

Bottom line: WEX continues to perform well, evidenced by strong operating profit growth in Q4’23. Guidance was no surprise and my sense was WEX was being a little conservative. Fuel is always unpredictable, the travel industry is coming off a hot year and treasuries (which feed into HSA revenue) are elevated. Those factors have caused relative multiple to compress. Compared to the historic norm, the valuation is cheap with a forward EV/EBITDA multiple at just 7.4X.

Disclaimer: The content of this report is for informational and research purposes only and should not be construed as financial advice. The views expressed are my own and do not reflect those of my employer. While care has been taken in preparing this report, I make no representations or warranties of any kind regarding its accuracy or completeness. I currently hold no position in any stock mentioned. However, like any financial analyst, my perspectives may carry inherent biases. Readers are encouraged to conduct their own due diligence.