Overview: Zurn Elkay specializes in manufacturing solutions that handle and manage water primarily within commercial and institutional settings. Their products ensure that every droplet of water in a building flows correctly, safely, and efficiently. Their product range is expansive, spanning from professional-grade water safety tools and systems that control water flow to offerings that guarantee clean drinking water and heighten hygiene.

There’s a growing trend to retrofit older structures to make them more energy and water-efficient. That’s likely to be further fueled by legislative mandates for filtered water. Zurn Elkay rides this wave with a broad product portfolio, securing their position as industry frontrunners by crafting innovative solutions compliant with rigorous third-party regulatory, building, and plumbing code prerequisites. Their distinctiveness in the market is rooted in a rich lineage of innovation. As a result, ~75% of their revenue comes from products Zurn Elkay is a market leader. With an increasing public awareness of quality drinking water, and a willingness for law makers to make clean water mandates more stringent, there’s a meaningful tailwind for Zurn Elkay going forward from increased demand for its products.

The investment thesis for Zurn Elkay comes down to a growing awareness and legislation for stricter water quality testing and filtering. The consensus growth estimates for Zurn Elkay are modest and I discuss later in this post that Zurn Elkay can beat those estimates by growing at the historical rate. Despite that, there’s only modest upside of ~20% in the stock according to my valuation estimate of $31.34 via a DCF model.

The rest of this post will cover Zurn Elkay Water Solutions by providing an overview of the business and the industry dynamics followed by an examination of the capital allocation history, management and their incentives, capped with an outlook and valuation.

In order to become a pure play water company, Zurn Elkay has transformed quite a bit in the past two years. Zurn Elkay’s predecessor company was previously known as Rexnord (former ticker RXN), which previously operated the water management segment and a process and motion control (“PMC”) segment making mechanical components for complex systems. Rexnord spun off the PMC segment in October 2021 and merged it with then Regal Boloit in a reverse-morris trust (“RMT”) style spinoff. RMTs are used for companies that spinoff a segment and immediately merge it with another business. Regal Boliot changed its name to Regal Rexnord (new ticker RRX) while former Rexnord changed its name to Zurn Water. But the transformation didn’t stop there. In February 2022, Zurn Water announced the acquisition of Elkay Manufacturing for approximately $1.56B bringing on leading water products serving the commercial market. Zurn Water then changed its name to Zurn Elkay Water Solutions with previous Zurn Water shareholders owning 71% of the combined company and the Elkay shareholders, which constituted the original founding family, owning the remaining 29%.

With a broadened portfolio boasting prominent names like Zurn, Elkay, and Wilkins, their products find their presence spanning across a diverse spectrum of end-use scenarios. Water safety and control products, under Zurn and Wilkins, provide solutions like backflow preventers and pressure-reducing valves, and find applications across commercial, residential, and institutional spaces to control potable water supply. On the other hand, flow system products manage storm and wastewater through diverse offerings, from point drains and hydrants to innovative wastewater pre-treatment products, marketed under brands like Zurn and Green Turtle that help the environment and safety of wastewater discharge. Navigating towards the hygienic and environmental product line, Zurn Elkay encapsulates a vast domain from sensor-operated flush valves, commercial faucets to water conserving fixtures, articulated through brands like Aquaflush and EcoVantage as solutions across institutional and commercial spaces. Next time you walk into the bathroom of a modern office or other commercial facilities like airports there’s a good chance the toilet, sink or faucet was made under the Zurn Elkay umbrella. Strategic acquisitions such as Just Manufacturing and Hadrian have further augmented the breadth of offerings in the hygienic and environmental domain. The merger with Elkay has notably broadened horizons into the drinking water product segment, which caters to diverse applications by offering a wide array of drinking water solutions, ensuring a blend of hygiene, accessibility, and sustainability. In general, Zurn Elkay avoids segments of the market that are commoditized or don’t require differentiation.

Zooming out, the markets Zurn Elkay operates in are vast and fragmented, but they've carved out their niche. Their focus areas are tethered to the growth in commercial, institutional (education, healthcare and government segments), and waterworks construction. They've anchored their business around markets with long-term growth potential, wherein they either lead or see a clear pathway to leadership. When the merger with Elkay was announced in 2022, the presentation at the time pointed out that 75% of the combined revenue comes from end-markets Zurn Elkay is the #1 leader in and 95% come from products that are either #1 or #2. What I find most iconic is Elkay’s drinking fountains and water bottle filling stations.

Moving to product development, an approximate team of 150 engineers leverages a "Voice of the Customer" philosophy. Zurn’s product development team got a boost by acquiring Elkay with a combined team of 150 engineers (up 67% from the prior year). The expansion will help expand innovation for the company. A notable area of innovation for Zurn Elkay has been in IoT where the company has been spending time adding digital features for wireless monitoring of water usage and consumption, and alerting of efficiency for maintenance purposes. As more states mandate monitoring of water quality, it’ll be an important feature. There’s a nice section in the 10-K covering the company philosophy through Zurn Elkay Business Solutions (“ZEBS”) that states:

a culture that embraces Kaizen, the Japanese philosophy of continuous improvement and the concepts around 80/20 simplification. We believe applying ZEBS can yield superior growth, quality, delivery and operating costs relative to our competition, resulting in enhanced profitability and ultimately the creation of stockholder value. As we have applied ZEBS over the past several years, we have experienced improvements in growth, productivity, cost reduction and asset efficiency and believe there are opportunities to continue to improve our performance as we continue to apply ZEBS.

Competition: When it comes to the competitive landscape, Zurn Elkay is short on words in describing its competition. Using inFilings structured filings, I ran a search of industrial companies above $100M in market-cap and found that 90% of companies have a full sub-section within business description dedicated to explaining their competition. It’s the norm for companies to dedicate a section to talk about competition, which is an insightful portion of the 10-K that satisfies regulatory expectations of transparency. In addition to a boilerplate risk factor on competition, Zurn Elkay simply has this written in the 10-K:

“The markets in which we participate are relatively fragmented with competitors across a broad range of industries, sectors, and product lines. Although competition exists across all of our businesses, we do not believe that any one competitor directly competes with us across the breadth of all of our product lines.”

To get an idea of some competitors, they would be Watts Water Technologies (WTS), Badger Meter (BMI), Circor (CIR), Kohler (privately held), American Standards Brands (owned by Japanese LIXIL Group), Sloan Valve (private), Moen owned by Fortune Brands (FBIN) and German-listed Gerberit (SIX: GEBN). Mutual peers within the proxy last year were BMI, CIR and MWA, which means those companies also listed Zurn Elkay as a peer.

While Zurn Elkay delivers an expansive portfolio that blankets both aesthetic, user-interactive products such as sinks and faucets and critical, behind-the-scenes infrastructure components like flow management systems, its competitors exhibit more specialized focuses. For instance, Kohler and Moen predominantly spotlight their consumer-facing, visually appreciable products like faucets and sinks, aligning their brands strongly with the aesthetic and functional aspects of water usage in both residential and commercial spaces. Conversely, a company like Badger Meter pivots sharply toward the unseen, foundational aspects of water management, concentrating on flow measurement and control technologies which, while crucial, do not engage the end-user in a direct, visible manner. Thus, Zurn Elkay uniquely straddles two facets of the industry: marrying the visible, interactive aspects of water use with the unseen, vital components that ensure its safe and efficient delivery and management

I’ll discuss and compare products by Watts Water and Zurn Elkay a bit more. Watts Water and Zurn Elkay share commonalities in their product offerings, especially within the domain of water safety, control, and management, establishing them as competitors in certain market segments. Both companies offer products that ensure safe and efficient water flow and management within various building and construction contexts, underscoring the crucial aspect of safeguarding potable and emergency water supplies. For instance, both firms manufacture backflow preventers and thermostatic mixing valves, which are necessary for preventing water contamination and ensuring safe water temperature, respectively. Moreover, both companies exhibit a strong focus on water quality and drainage solutions, an example being Watts Water's drainage & water re-use products and Zurn Elkay's flow systems products, which manage storm water and wastewater through various products and systems like point drains and linear drainage systems.

However, while there's noticeable overlap in certain product lines and solutions, Watts Water and Zurn Elkay also exhibit unique offerings and strategic focuses that differentiate them within the market. Zurn Elkay, particularly after the Elkay merger, has solidified its standing in drinking water products. In contrast, Watts Water delineates a substantive involvement in the HVAC & gas product domain, which includes commercial high-efficiency boilers, water heaters, and hydronic pump groups, areas which Zurn Elkay doesn’t appear to have an emphasis on.

Segment Analysis: Currently, Zurn Elkay reports revenue for “institutional” customers, “commercial” customers and “all other” (residential and waterworks) as three different buckets. “The institutional construction end users include education, healthcare, and government segments. The commercial construction end users includes office, warehouse, lodging, retail, dining, and sports arenas segments,” according to the latest 10-K. Institutional customers made up 40% of company-wide sales in 2022, with each commercial and “other” pulling in about 30% of sales apiece. Institutional was up slightly from 2021 while commercial and other made up slightly smaller pieces of the pie.

Before the spinoff of Rexnord’s Process & Motion Control segment, the combined company reported the Water Management business as a different segment and also broke out operating profit separately. At the time, the water segment was further detailed by sales of 1) Water safety, quality, flow control and conservation products and 2) Water infrastructure. The spinoff was completed at the start of Q4’21, so company-wide sales have only been the pure play water segment for the past seven quarters. That short period isn’t enough to judge a company making it important to reach further and grab financial data for the water segment of the previously combined Rexnord company.

The following chart plots out Zurn Elkay revenue by year since the start of 2016 and shows the year-over-year (“YoY”) change as reported and the percent change in core sales YoY. Core sales represent the organic change by removing mergers & acquisitions, divestitures and foreign currency impacts. Reported sales were up 40.7% in 2022 via the acquisition of Elkay while core sales were up 11% that year, according to Zurn Elkay. Sales were particularly strong in 2021 and 2022 and increased at an annual rate of 6.7% from 2015 to 2022. Meanwhile, Elkay grew revenue at an annual rate of 12% in the 10-years leading up to the merger in 2022.

To get a more detailed understanding of their growth history, here’s a look at sales and core growth on a quarterly basis. Before Q4’22, the only period there was negative organic growth was from calendar Q3’16 to Q1’17 when it ranged from -4% to -1%. Part of that decline was driven by underperforming wastewater assets. Two years later, in 2018, management decided to sell the VAG business (wastewater products) and stopped reporting it in calendar Q2’18, hence the drop in reported sales while core sales was up 9% in calendar 2018.

More recently core sales turned negative again in Q4’22. That quarter Zurn Elkay blamed lower residential market demand and “channel partners reducing inventory levels following the overall improvement of our lead times.” Core sales reversed back to positive in Q1’23, but negative again in Q2’23. Inventory has more recently normalized but the negative -5% core growth in Q2’23 was attributed to soft residential demand “as well as timing of shipments in the prior year as we began working down an elevated backlog during the second quarter of 2022.” What I also found notable is that Zurn Elkay said the core sales figure would be -1% on a pro forma basis when excluding product lines that management opted to exit. During the October 2022 earnings call CFO Mark Peterson said:

“Over the past 90 days, we've been able to thoroughly review the Elkay sales volume at a SKU level and customer level and have finalized the plan and simplify the business to focus on better growth, better margins, and better returns on invested capital.”

Peterson added during the February 2023 earnings call:

"With respect to residential sinks, we continue to execute on our 80/20 simplification actions in the quarter to exit certain residential commodity, private label and OEM sink SKUs and remain on track to our targeted SKU reduction and related profitability improvement.”

It’s nice to see Zurn Elkay management spot underperforming businesses or product lines that don’t fit the strategy and quickly opt to sell/discontinue.

Now shifting to profitability. Just like the quarterly sales data, I grabbed the quarterly operating profit and EBITDA figures for the water segment pre-spinoff and then used company-wide profit measures post-spinoff. Those are summed for annual figures and presented below. I’d like to bring up an accounting note about segment analysis. When companies report segment profit, they generally associate costs to each segment, and have costs that don’t go into a segment that instead are listed under “Corporate”. Therefore, segment margins are inflated, which is something to be aware of when looking at the water segment profit margin pre-spinoff. Here’s an example to make that clear. During fiscal 2019, Process & Motion Control had $1,380.6M in sales and operating profit of $226.1M, resulting in a margin of 16.4%. Water segment had $670.3M in revenue (32.7% of total revenue) and had $139.7M operating profit, or an operating profit margin of 25.7%. Corporate reported an operating loss of $60.2, which netted company-wide income from operations to $305.6M (14.9% company-wide operating margin).

Zurn Elkay’s water segment has routinely been profitable when looking at operating margins or EBITDA margins. From 2016 to 2020, profit margins crept higher, culminating in an EBITDA margin of 26.4%. Margins regressed in 2021 as costs outpaced sales during supply chains issues post-COVID. In all cases, margins in the graphic below are non-adjusted, which amplifies the drop in margins in 2022 because of the one-time costs brought on that year by the acquisition of Elkay. Reported EBITDA for 2022 totaled $161.6M (12.6% EBITDA margin). That amount includes $68M in costs that are one-time in nature, particularly restructuring costs, fair value adjustments for acquisitions and merger costs. Absent that amount, EBITDA would’ve been $229.6M (17.9%). Point being, low margins seen in 2022 were abnormal and the business performed better than as reported.

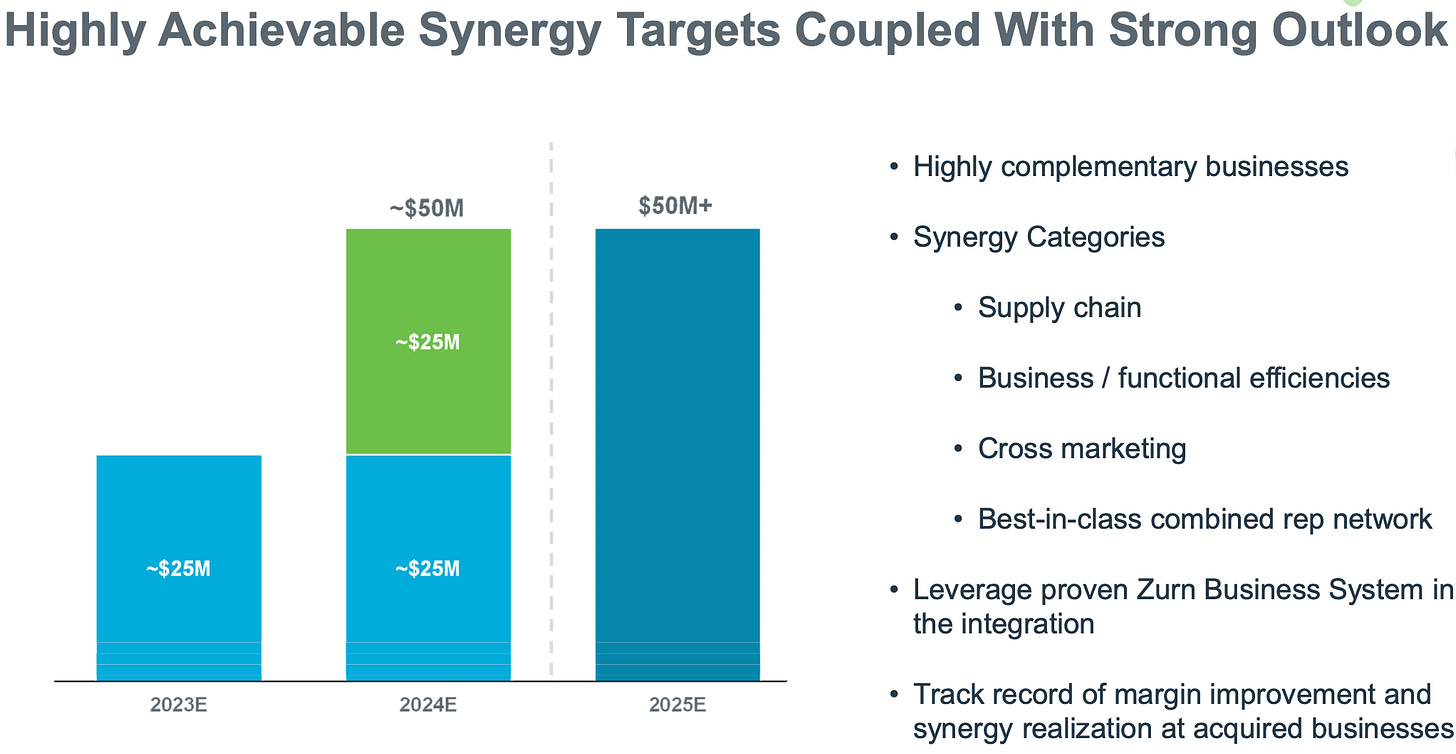

Longer-term, the merger with Elkay provides an opportunity for profit margins to rebound back toward the 2020 peak. When management announced the merger early in 2022, they said there was a target of $50M in synergies that would add to the bottom line. Zurn Elkay is on schedule for that cost-reduction plan, according to commentary on the latest earnings call. CEO Todd Adams:

“when we announced the transaction a year ago, we outlined $50 million. We obviously got a running start over the back half of last year. We got $25 million plus this year, and we're targeting another $25 million. So in aggregate, it will probably end up being a little bit more than the $50 million that we originally contemplated, but it's essentially on the same timeline.

I think the only acceleration was some of the simplification work that we did really from July through December because we just felt like getting that piece behind us quicker, sooner would aid everything else, whether that was supply chain, whether that was organization, whatever it might be, we sort of got ahead of it early but since then, we've been hitting our marks on whether it be an announcement or internal work that needed to get done to facilitate a next set of moves. So very much on track, taken as a whole probably a little bit ahead early the last 6 months of last year.”

As an example of the functional efficiency being tackled, Zurn Elkay has consolidated manufacturing of similar products. And to frame the $50M in cost savings, that’s roughly 3% of sales, or enough to place Zurn Elkay’s EBITDA margin at around 24% - 25%.

Capital Allocation: Analysis of capital allocation is a good way to figure out how management has spent capital and how efficient they’ve been. For an industrial company like Zurn Elkay, they can invest organically through capital expenditures, expand through M&A, or return capital through stock buybacks or dividends. For this section I’m going to look back at the last 10 years of financial data to understand management’s philosophy. A big portion of the capital generated was through the now spun-off Process & Motion Control segment. However, I’m more focused on management actions here so it’s more relevant to include the company as a whole. Also note that I’m relying on Koyfin financial data for this section, unlike the segment analysis that was gathered manually.

Zurn Elkay has generated a cumulative $2.1B in cash from operations since 2013. $425.6M was spent on capital expenditures (20.3% of cash from operations), $211.3M was spent on stock buybacks (10.1% of cash from operations) and $146.9M (7.0%) was spent on dividends. In addition, $824.9M (39.3% was spent on acquisitions, net of divestitures). Note that their total spend on acquisitions of $824.9M is well below the single acquisition of Elkay that was for $1,462.9M. That acquisition was paid for in stock and you can see from the table below that shares outstanding ballooned by ~40% after it closed. Prior to that, its large acquisitions consisted of $213.7M for Cambridge into the Process & Motion Control segment in fiscal 2017 and another $173.6M spent on World Dryer and Centa in fiscal 2018. World Dryer, a maker of hand dryers, sat within the water segment. All three of those acquisitions were paid for in cash. However, Zurn Elkay did issue nearly $400M in convertible stock at the time that converted to 16.0M shares in 2020, another bump in the shares outstanding count. In total, the shares outstanding is 82% higher than it was in 2013.

It’s helpful to get a comparison of capital allocation so for this section I gathered similar data for peer Watts Water. Since 2013, Watts Water generated $1.65B in cash from operations (“CFO”). The company spent $308.2M on CapEx, equal to 18.6% of CFO. $416.3M (25.2%) was spent on M&A, $361.6M on stock buybacks (21.9%) and lastly $276.6M (16.7%) was spent on dividends. It’s a more balanced approach to capital allocation than Zurn Elkay who has returned a small amount to shareholders via buybacks and dividends, and instead spent more on M&A. What’s also notable is each company spent less than they generated through cash from operations and therefore the net debt (debt after subtracting cash) went down for both companies. It was popular for companies to raise debt and spend more than they made over the past decade during an era of low interest rates but these two companies stand in contrast to that philosophy.

I also want to draw attention to the growth in FCF per share, one of the best financial performance metrics. After the acquisition of Elkay in 2022, free cash flow per share took a hit in 2022 by dropping to 51 cents per share. Recall margins were depressed due to merger costs and the shares outstanding jumped higher. Considering Zurn Elkay (its predecessor company) generated FCF of 87 cents per share in 2013, the growth turned out to be negative through 2022. Assuming Zurn generates $215M in FCF in 2023 (current estimate), that still makes for no growth in FCF over an 11 year period that’s seen quite a bit of dilution.

Watts Water, on the other hand, has steadily grown its FCF per share since 2023 with a compounded annual growth rate (“CAGR”) of 9.7%. It’s paid off for Watts Water with shares growing at an annual rate of 15.2% compared to Zurn Elkay whose shares generated a 9.5% annual return.

Management and Incentives: Zurn Elkay has been led by Todd Adams as CEO since 2009. Adams has a financial background having joined Zurn Eklay (then Rexnord) in 2004 as treasurer and controller and then served as CFO for a year then took on a brief operating role as president of the Water Management platform before taking the helm as CEO. Before Zurn Elkay, he held senior financial positions at Boeing (BA), APW Limited and Idex Corp. Also note that Adams is on the board of Badger Meter, a peer of Zurn Elkay with some product overlap.

Mark Peterson joined Zurn Elkay in 2006 as a unit CFO. He then was promoted to corporate vice president & controller and in 2011 was elevated to his current role as CFO. Peterson has overseen the financial transformation of Zurn Elkay. Initially as the company transitioned from a private equity ownership from Apollo to the public markets through a March 2012 IPO. Next through the spinoff and subsequent acquisition of Elkay.

The second highest-ranked executive, according to compensation, is chief operating officer Craig Wehr. Wehr was promoted to his current role as COO in August 2022 after serving as president of Zurn. The promotion made it so Wehr is responsible for company-wide operations that now include Elkay. Wehr joined Zurn Elkay in 1993 as a regional sales manager and worked in increasing roles by adding sales and business development responsibilities.

Zurn Elkay has a balanced compensation incentive program, starting with healthy salaries and cash bonus. The table below extracts data from the 2023 proxy listing summary compensation figures for the top four currently employed executives. The pie charts below show the breakdown by type of pay when aggregating over the previous three years. CEO Todd Adams has had 12% of his compensation paid in the form of a base salary, 21% from an annual cash bonus and 64% came from stock-based compensation. I bucketed CFO Mark Peterson and COO Craig Wehr as other Named Executive Officers (“NEOs”). Those two averaged 18% of total compensation from salary, 17% from their annual cash bonus and 62% from stock-based compensation. It’s normal for non-CEO NEOs to get a little more pay from salary as a percent compared to CEOs but executives at Zurn Elkay are fairly even. Before moving on to the actual performance drivers of the compensation program, note the variation in stock award values by year. For instance, CEO Todd Adams was paid $4.2M worth in 2020, then $11.9M in 2021 and nothing in 2022. That’s because Zurn Elkay paid the 2022 annual award in October 2021 (instead of annually in May) to get ahead of the spinoff so 2021 was doubled-up in value.

Let’s dig into the actual performance drivers of the compensation plan to understand how top executives are incentivized. Starting with the short-term cash bonus. Payout of the cash bonus at Zurn Elkay is weighted 50% adjusted EBITDA and 50% free cash flow. Both metrics are heavily doctored. Adjusted EBITDA nearly matches what the company reports in earnings for adjusted EBITDA, except they use constant currency for the compensation program. And Free cash flow also subtracts several costs, such as un-budgeted acquisition costs, tax benefits on stock option exercises and “other non-recurring items”.

The value of the cash bonus is determined based on financial success against pre-set annual goals. Targets are a percent of the salary (125% of the salary for Adams, 50% to 100% of the salary for other executives). Meeting the financial goals means 100% of the target is paid; anything less than 90% of the financial target is not paid and executives can get 250% of the target amount for exceptional financial performance.

Zurn Elkay made $140M in free cash flow in 2022, according to the calculations for the purposes of the compensation program, which was 90% of the goal. Adjusted EBITDA was below the minimum and paid out at 0%. I’ll note that Zurn Elkay didn’t actually say what the adjusted EBITDA goal was which I’d view as poor corporate governance.

The largest component of compensation for executives at Zurn Elkay, and most public companies, is through long-term equity incentive awards, known as stock-based compensation. For 2023, 40% of the value of stock was in the form of restricted stock units (“RSUs”) which means they vest out over time regardless performance. The remaining 60% is paid in the form of performance stock units (“PSUs”). That’s the same ratio as the prior year, though some executives have been paid a mix of options and RSUs instead of PSUs. PSUs can be earned at a level between 0% and 200% based on performance during a three year period. The actual incentives are free cash flow conversion and ROIC. The reasoning is below, from the 2020 proxy:

Vesting of 50% of the value of the fiscal 2020 PSUs is based on goals related to absolute free cash flow conversion (defined as free cash flow divided by net income before special items) to reward the efficient generation and use of cash, which also aligns with the Company's long-term strategic plan. Vesting of the other 50% of the value of the fiscal 2020 PSUs is based on goals related to return on invested capital ("ROIC"). The Committee uses ROIC as a performance measure for the fiscal 2020 PSUs to help ensure that our executives focus on effectively employing capital and creating stockholder value as well as to better align with the Company's current growth strategy and absolute free cash flow conversion goals.

The last published goal was simply turning 100% of the net income into free cash flow. And the ROIC goal was 11.75%. Similar to the cash bonus disclosures, Zurn Elkay hasn’t always been clear on the goals (what the actual ROIC target is for instance).

Zurn Elkay's decision to use both metrics of FCF conversion and ROIC indicates a desire to balance efficiency (free cash flow conversion) with effective capital use (ROIC). However, the combination is strange. While both metrics are geared towards efficiency, neither directly incentivizes overall growth or absolute profitability. In a scenario where the company's net income is dwindling, even a 100% free cash flow conversion might not be impressive in absolute terms.

Outlook: Before looking ahead, a reminder on past growth rates. Zurn’s water segment within Rexnord grew at an annual rate of 6.7% from 2015 to 2022 (pre-Elkay merger). Elkay, according to Zurn management, grew at an annual rate of 12% in the prior decade to the merger. The Elkay side skews more toward drinking water, even though there is non-drinking water products such as sinks and faucets.

There’s a growing awareness of a need for filtered water and more states are mandating filtered drinking water. To be clear, The Safe Drinking Water Act (“SDWA”) was passed in 1974, mandating quality drinking water for human consumption. It served as a foundation for clean water and has been amended in the decades after, but states have more recently pushed for higher standards. In the February earnings call for Q4’22 results, CEO Adams referred to the following slide and said:

In this 3-year plan, we're over-indexing our strategy deployment process around drinking water, actually safe drinking water, focused on K through 12 students and schools, which we believe is worth hundreds of millions of dollars of growth moving forward as the states and legislation are now beginning to take meaningful action to solve the issue…

The reality is in this country, over half the population drink water from lead service lines, the most vulnerable are kids with the impact felt not only in places that you've heard of like Flint, but very, very likely in the schools where you live, your kids, your neighbors, nieces, nephews or grandchildren go to school. With over 131,000 K through 12 schools in the U.S., over 13 million kids went to school last year with elevated lead levels. There is, however, a growing awareness and legislation that's beginning to take shape, and we're investing to make sure that we have the go-to solution to address this incredibly solvable problem. It starts with having a leading market share and largest installed base of point-of-use drinking water solutions in Elkay.

Continuing on this theme of growing awareness and legislative action, Michigan recently took a significant step in this direction. Governor Gretchen Whitmer signed a set of bipartisan bills collectively known as the "Filter First Bills" on October 19, 2023. These bills, encompassing House Bills 4341-4342 and Senate Bill 88, mandate childcare centers and schools in the state to install water filters to thwart lead contamination. Beyond the mere installation of filters, the Clean Drinking Water Act that these bills enact requires institutions to develop comprehensive drinking water management plans. It's not just about putting up a filter and walking away. Institutions are required to engage in routine sampling and testing to ensure the young ones are indeed sipping from a safe source.

This legislative move is emblematic of a broader trend. While the SDWA laid the groundwork for water quality standards nearly half a century ago, states like Michigan are pushing the envelope, demanding more stringent standards tailored to contemporary challenges. The crux of Michigan's bills is a response to a stark reality – the lasting and detrimental impact of lead exposure, particularly on children. With memories of the Flint water crisis still fresh, Michigan is pioneering efforts to ensure such a catastrophe doesn't befall another community.

The stricter requirements imply that schools and childcare centers will be looking for robust, reliable solutions to meet these mandates. Companies poised with the right products, expertise, and market presence such as Zurn Elkay stand to gain significantly. As CEO Adams pointed out, with over half the U.S. population drinking water from lead service lines, and many of them being children, the need is urgent, the problem solvable, and the market vast. In that same February earnings call, Zurn Elkay listed out a long-term total addressable market (“TAM”) of $2.9B, which assumes a government willingness to pay for 130K schoools to re-vamp their drinking water, and hundreds of millions in annual revenue in just a few years out. In addition, there’s a recurring revenue aspect with a replacement cycle of 3-5 years for fountains and bottle fillers. The Michigan legislation might just be the tip of the iceberg, setting a precedent for other states to follow suit. If the trend of more filtered water continues, we can anticipate a surge in demand for drinking water solutions, presenting companies like Zurn Elkay with a lucrative growth trajectory.

As bullish as that sounds, it doesn’t appear the market is forecasting high growth rates, at least judging by sell-side analyst estimates. The consensus estimate for 2024 implies a 2.1% growth rate in revenue and 4.8% growth rate in 2025. Margins are expected to improve by 250 basis points through 2025.

Valuation: I put together a DCF model by forecasting financial performance over the next five years. Zurn Elkay doesn’t have defined segments to break out revenue. The disaggregation by customer type is somewhat new therefore this DCF just includes consolidated financials.

The DCF starts with revenue of $1,538M in 2023 which essentially matches the management guidance for the year. After that, I’m estimating growth of 4.0% in 2024 then 6.5% and 7.5% in the final two years. Note that this trajectory is solidly higher than the street estimate and roughly in line with the growth rate of Zurn Elkay as a combined company. In July, Zurn Elkay management issued adjusted EBITDA guidance for 2023 of $340M, which would translate into about $290M in unadjusted EBITDA. However, there’s still some one-time costs this year that will bring EBITDA down to my estimate of $277M/18.0%. Margins should be on a good track to recover back to 24.0% by 2026, if not sooner.

Some simple assumptions to calculate free cash flow are as follows: CapEx at about 2.1% of revenue per year, depreciation and amortization at 5.8% of revenue and a pro-forma tax rate of 22%. The other critical assumptions are the cost of capital of 9.0%, which is based on Zurn Elkay’s beta of 1.1, and the exit multiple of 15 times the LTV EV/EBITDA. The two combine to produce a fair value of $31.34, which implies upside of 22.4%.

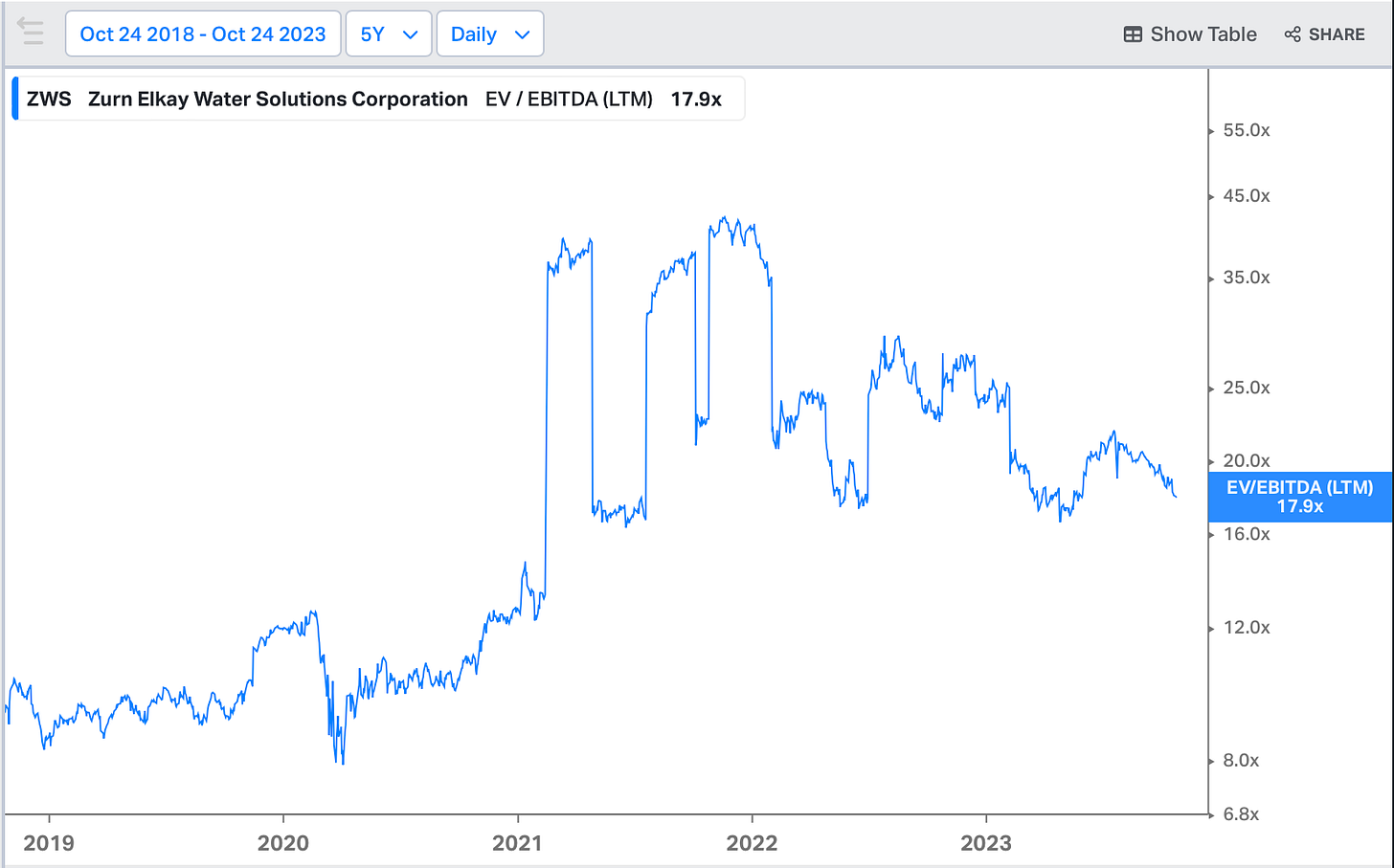

No reader has an issue seeing a 9% cost of capital. The exit multiple, on the other hand, is what brings out differing opinions. Industrial companies trade with valuation multiples that vary quite a bit, with ESG-type companies often fetching premiums. Take Zurn Elkay for example. After Rexnord announced the separation of the non-water segment in February 2021, the company has traded at a higher valuation multiple. The chart below from Koyfin bounced around as EBITDA also bounced around because of one-time costs.

In order to get a better sense of the market, I built a peer list of companies by extracting similar-sized non-utilities companies from two thematic ETFs: Global X Clean Waters (AQUA) and Ecofin Global Water ESG Fund (EBLU). These companies have a similar growth profiles of Zurn Elkay with a 5-year CAGR of ~8% and a current average EV/EBITDA multiple of 20X with the median at 13.3X. Given my forecast of growth of 7.5% in five years, an exit multiple of 15X EV/EBITDA seems quite fair.

Conclusion: The potentially strong clean-water tailwinds make Zurn Elkay a company worth tracking. The fair value estimate of ~$31.00 doesn’t provide enough margin of safety to make me want to buy shares right now. Zurn Elkay is an interesting enough company to continue to monitor. As I post this write-up while traveling to San Diego, clean water is a topic that’s been on my mind more. During my due diligence phase I found that San Diego tested poorly for drinking water, as compared to other parts of California. I’ve enjoyed seeing Zurn Elkay products begin to help that through filtration. A couple data points I’ll watch for are legislative changes and cost efficiencies that can yield better free cash flow. Zurn Elkay has room for more buybacks in order to decrease the shares outstanding. Most of their peers carry very little debt and in order to fit in there’s not much capacity for leverage. Therefore, increasing FCF per share will come down to better profitability and growth.

Disclaimer: This is not advice to buy, sell or hold any stock referenced. Do your own due diligence. I have no position in any stock mentioned in this report. Like any financial analyst, doesn’t mean I’m not biased.