Encore Wire (WIRE) to Get Acquired; Has 35-Day 'Go-Shop' Period

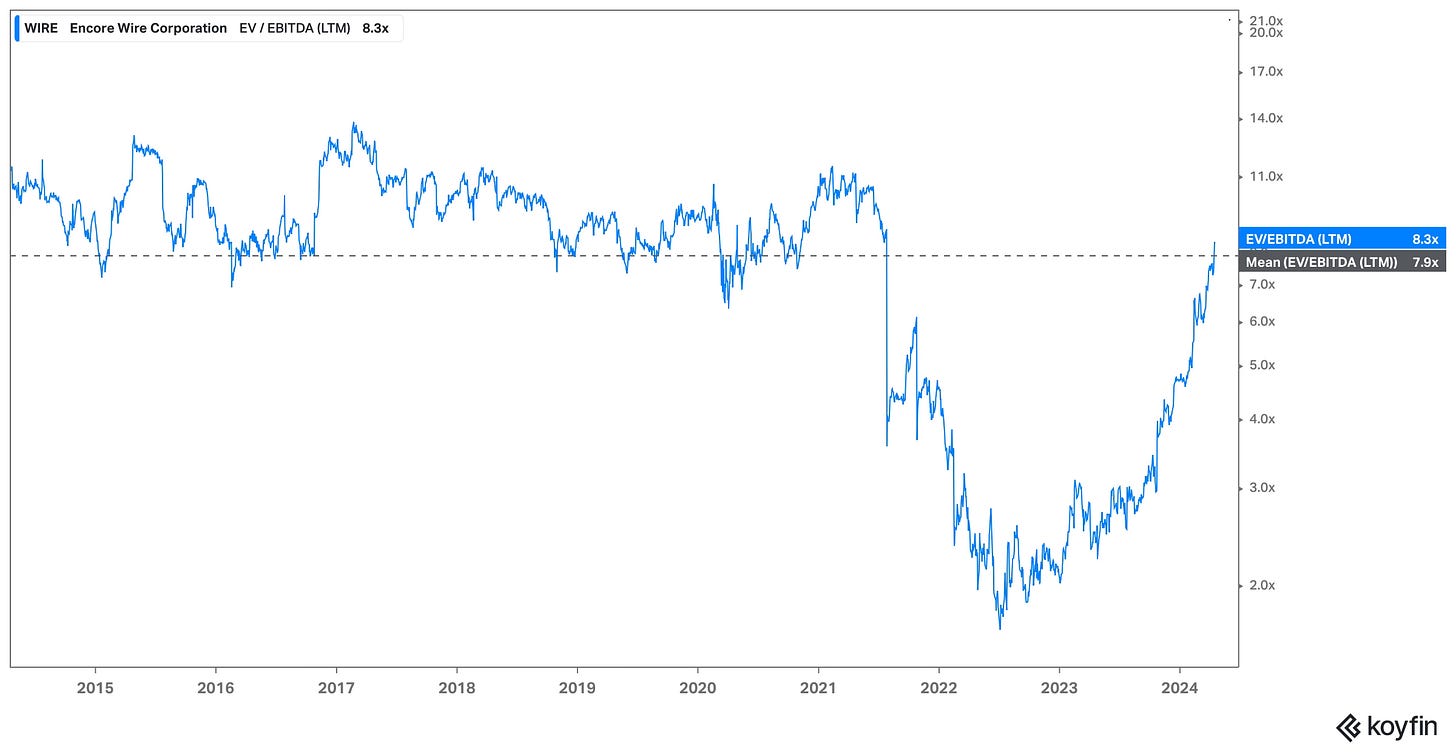

Acquisition price of 8.2X EV/EBITDA in-line with historic average

Encore Wire WIRE 0.00%↑ announced yesterday, April 15, that it agreed to get acquired by Italy-based Prysmian (BIT: PRY) for $290.00 per share in cash. The price represented an 11.1% premium to the prior day’s close from April 12. It adds to a strong three-month gain of about 34% and a one-year return of 72%. I first covered Encore Wire in a July 19, 2023 deep dive so I wanted to put down a few thoughts for those that have been following along.

The buyer is Prysmian Group, a maker of power and telecommunications cable. They previously acquired Encore’s peer General Cable in 2018 for $3.0B. The enterprise value of Encore now stands at $3.9B so this is a slightly larger deal. The valuation multiple for Encore Wire is 8.2X 2023 EV/EBITDA, which is close to the 10-year average of 7.9X. According to the press release, the run rate synergies will reduce costs so Prysmian is buying Encore for 6.3X EV/EBITDA. When you compare the takeout multiple to how Encore historically traded it’s not an impressive premium.

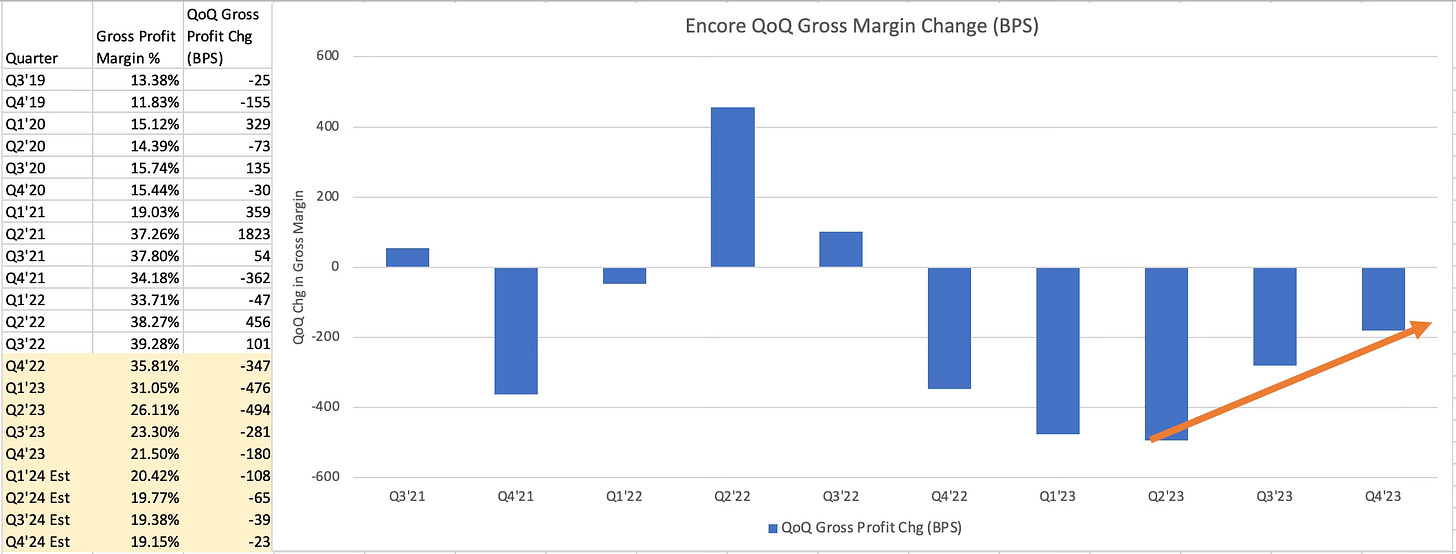

For much of 2023, the consensus was that Encore’s EBTIDA would come down significantly because the profit margins were inflated compared to pre-covid levels. The rally in shares in the past year was driven by stronger economic prospects that fueled higher copper prices and the realization that profit margins would settle at a materially higher level than pre-COVID levels. I wrote about this in my Q4’23 earnings update for Encore Wire.

“For Q4’23, the gross profit margin was 21.5%, which is down 180 basis points from Q3’23. Short sellers have closely watched Encore's profit margins, focusing their thesis on margin compression after the unusually high margins from 2021 to 2023. Gross profit margins began their consistent descent in Q4’22 when they lost ~350 basis points. Note that the rate of decline (derivative) has slowed meaningfully in the two past quarters. If this continues, Encore could have its profit margins settle at a higher rate than pre-2020 (~15%).

The point here is that if financial performance was heading for a major drop this deal would be a situation in which management is striking while the iron is hot. But it no longer feels that way. Encore has smartly invested in vertical integration to capture profit and realize a higher profit margin than its historic average. Investors will get a chance to realize the full value because the merger agreement with Prysmian includes 35 days for Encore to shop themselves to other suitors with the hope of fetching a higher price (go-shop period). Shares did close at $291.23 on April 15 implying there’s some small probability a higher price does come in (stock has dipped below $290 today).

Regardless, I do expect Encore to get acquired. CEO Daniel Jones has been at the helm for 18 years and this is a logical approach to transitioning to new top management. I’m a little saddened that Encore Wire won’t be listed any longer because it was truly the only pure-play publicly traded cable copper wire manufacturer.

Disclaimer: The content of this report is for informational and research purposes only and should not be construed as financial advice. The views expressed are my own and do not reflect those of my employer. While care has been taken in preparing this report, I make no representations or warranties of any kind regarding its accuracy or completeness. I currently hold no position in any stock mentioned. However, like any financial analyst, my perspectives may carry inherent biases. Readers are encouraged to conduct their own due diligence.