Littelfuse $LFUS, founded in 1927, is a global leader in circuit protection, providing solutions that help secure the reliability and safety of complex electrical systems across a broad spectrum of industries. The company specializes in the design and manufacture of electronic components, modules, and subassemblies. Littelfuse's products are indispensable in the industrial, transportation, and electronics sectors, ensuring functionality and safety in applications that power our daily lives.

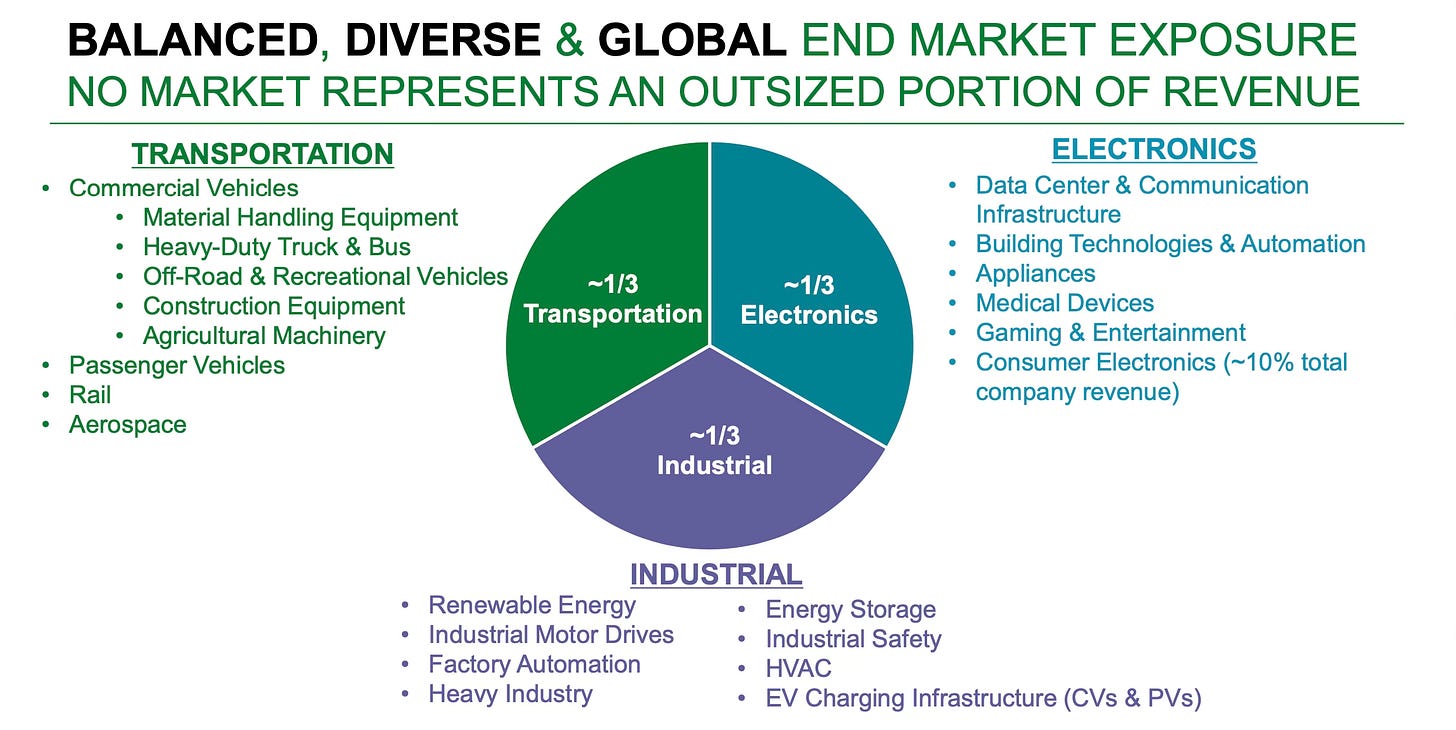

Littelfuse's business is structured around three primary segments: Electronics, Transportation, and Industrial. These segments collectively underscore the company's diversified approach, with the Electronics segment leading in both revenue and operating profit, accounting for 57% of 2023 revenue and 83% of the operating profit. This segment showcases Littelfuse's impact on empowering electrification, energy efficiency, and digital connectivity. Meanwhile, the Transportation and Industrial segments, though smaller in revenue contribution, are critical in advancing the company's strategic initiatives in eMobility, electrification, and sustainability, illustrating a balanced portfolio that addresses the evolving needs of a connected and safer world. Despite the business segment split up, Littelfuse collectively serves a balanced blend of end markets, seen in the graphic below.

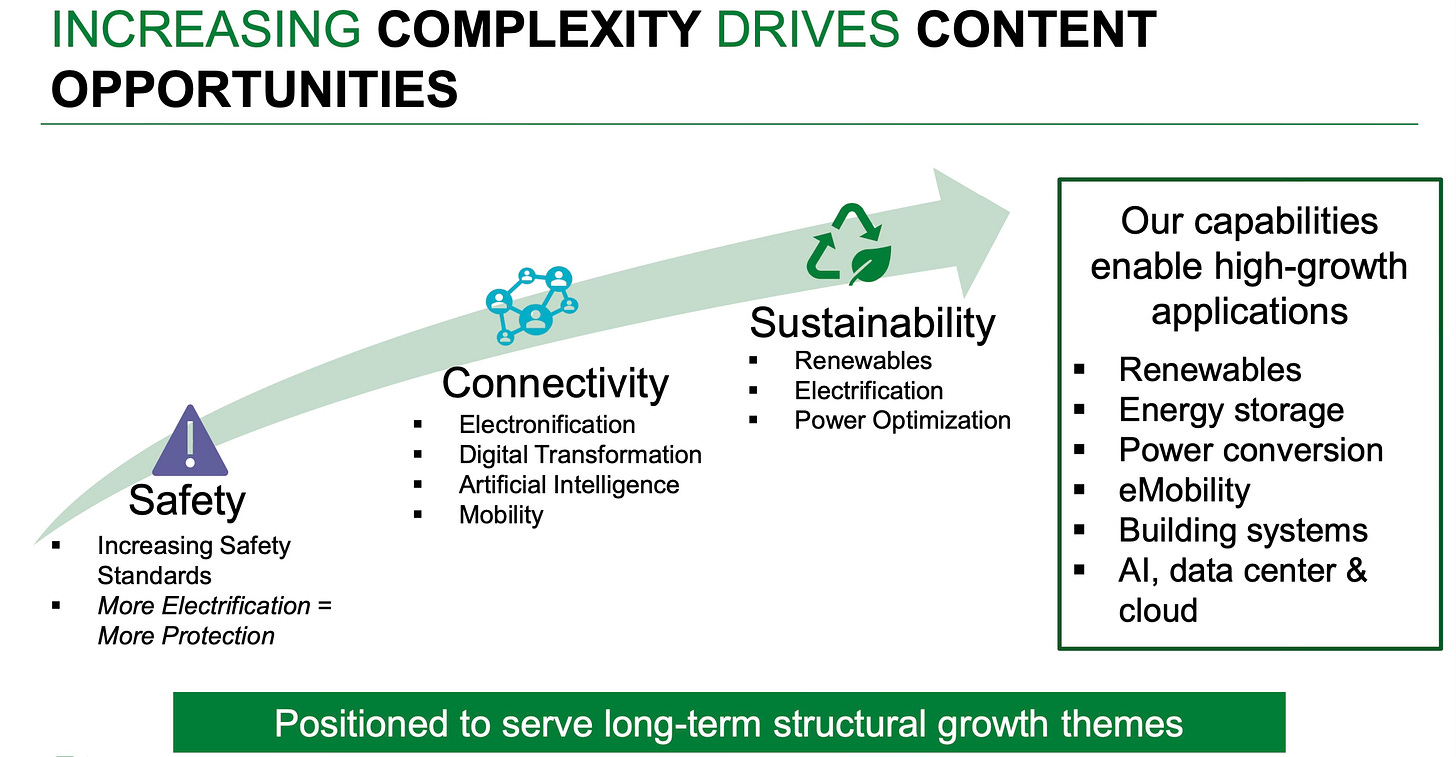

The company's strategic positioning within these segments leverages long-term secular growth themes of sustainability, connectivity, and safety. This approach has not only solidified Littelfuse's role as a critical partner in enabling its customers' applications towards a more sustainable and interconnected world but has also ensured a steady demand for its products. From electrification and automation in the Electronics markets to eMobility and electronification in Transportation, and advancements in renewable energy sources and safety automation within the Industrial segment, Littelfuse's product portfolio addresses the increasing complexity and growing demands of modern applications.

The investment rationale in Littelfuse is formed by a strong organic growth outlook due to notable secular trends of electrification and renewable energy. Higher energy needs for infrastructure will call for greater circuit protection. In addition, Littelfuse’s growing power semiconductor business offers another avenue of growth due to electrification. Management of Littelfuse has a good history of amplifying growth through acquisitions that have helped create shareholder value, another compelling facet of the investment rationale. My present valuation calculations implies upside of 26% to the current stock price.

The rest of this analysis will cover Littelfuse by providing an overview of the business, an examination of the capital allocation history, management and their incentives, capped with an outlook and valuation.

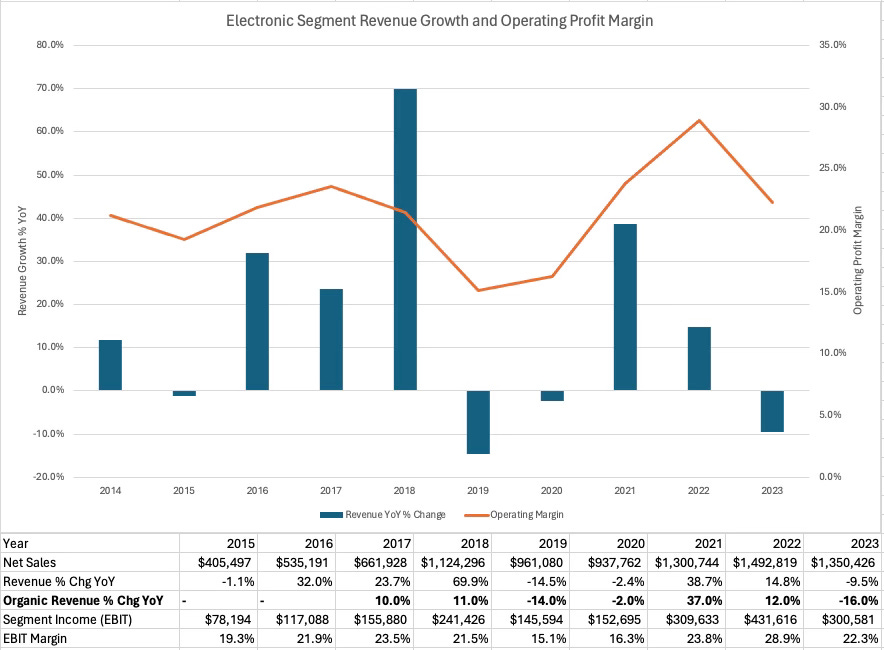

Business Overview: The first segment we'll explore is the Electronics segment, which is the largest of Littelfuse's three segments. With an extensive range of products, this segment caters to a wide array of end markets, from automotive electronics and electric vehicles to data centers, medical devices, and more, underscoring its pivotal position in powering and protecting today's increasingly digital and electrified world.

At the heart of the Electronics segment are legacy products and innovative technologies designed for circuit protection, power control, and sensing. These are vital for safeguarding electronic systems against common hazards such as voltage spikes, short circuits, and electrostatic discharge. Among the passive protection components, transient voltage suppressor (TVS) diodes and arrays protect against brief voltage spikes, while positive temperature coefficient (PTC) resettable fuses, a legacy product, can recover from overcurrent conditions without needing replacement, reducing maintenance. Additionally, electrostatic discharge (ESD) suppressors provide crucial protection for sensitive electronics against sudden electrical charges. These passive components, including traditional fuses and related accessories, represent the foundational technologies of Littelfuse, reflecting their long-standing expertise in circuit protection.

Littelfuse has been shifting the Electronics segment’s offering more toward power semiconductors, which help manage the efficiency and reliability of energy conversion and distribution. These are critical in high-power applications and are essential for demanding applications that require robust energy management, such as in renewable energy systems and industrial motor drives. This category includes advanced technologies like Silicon Carbide (SiC) and Metal-Oxide-Semiconductor Field-Effect Transistors (MOSFETs), and Insulated Gate Bipolar Transistors (IGBTs). The integration of these high-performance semiconductors ensures that the Electronics segment leads in developing solutions that enhance the reliability, safety and longevity of end-user applications. The simplest way to think about the Electronic segments offerings is that Littelfuse is providing solutions to safely stop electricity through circuit protection and fuses, and also starting/stopping electricity flow through the power semiconductors.

Littelfuse has historically provided quarterly GAAP (reported) sales growth, and also growth attributed to M&A, divestitures, Foreign exchange, and other line items to better gauge operating performance. I was able to use tables back to 2016 to analyze and separate organic growth from acquisition-driven growth.

For the Electronics segment, reported revenue grew at a compounded annual growth rate (“CAGR”) of 14.2% since 2016. That can be decomposed to 4.1% from organic growth and 10.9% M&A, so clearly the segment has been fueled by acquisitions. Littelfuse also disclosures operating income (EBIT) for each of its segments. The Electronic segment has almost always had the highest operating profit margin, despite the fluctuations. The operating profit margin for this segment stood at 21.2% in 2014 and over the last 10 years it moved as high as 28.9% in 2022 before regressing back to 22.3% in 2023. The recent drop was driven by a reduction in revenue “mainly due to lower volume from the Electronics products business driven by inventory rebalancing at certain distributors and reduced demand across certain electronics markets, including consumer facing and personal electronics, and telecom,” according to the 10-K.

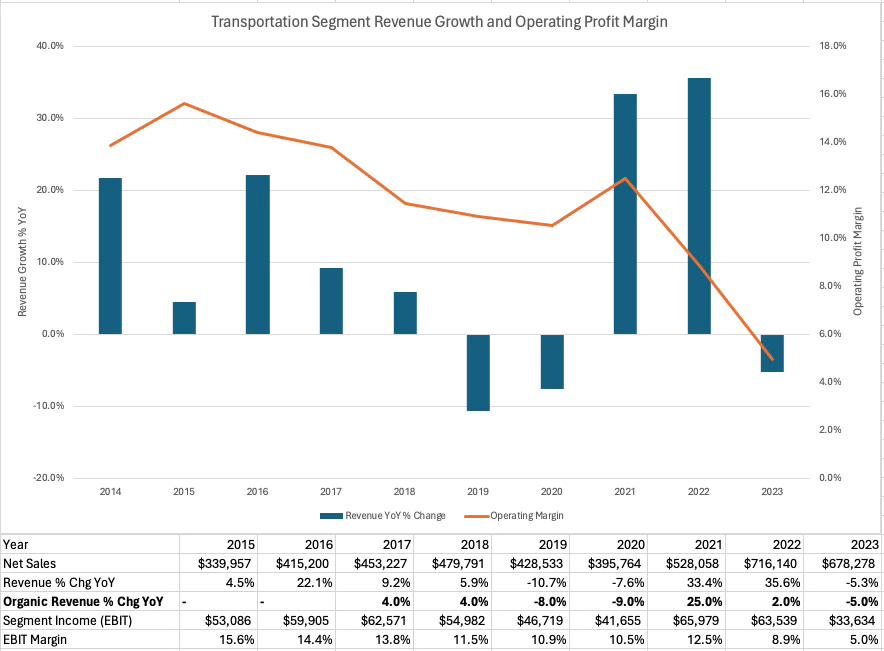

The next segment to explore is the Transportation segment at Littelfuse, which caters to a wide spectrum of vehicle types and applications, from passenger vehicles to heavy-duty trucks and construction equipment. This segment has historically focused the least on acquisitions and has shown modest growth, reflecting a more conservative expansion strategy within the company's portfolio.

Littelfuse's transportation products encompass a variety of circuit protection, power control, and sensing technologies essential for the safety and efficiency of vehicles. These technologies are particularly necessary in a world increasingly leaning towards hybrid and electric vehicles. For instance, blade fuses, which are thin metal strips enclosed in plastic, protect circuits by melting and breaking the circuit when too much current flows through. High-current and high-voltage fuses are designed to handle larger loads, crucial for safeguarding components in electric vehicles.

Resettable fuses, another innovative component, can restore themselves after an overcurrent event, providing ongoing protection without the need for replacement. This is particularly useful in applications where maintenance access is challenging or where frequent fuse replacement would be disruptive. Sensor products within this segment monitor various vehicle conditions—from occupant safety to environmental parameters—ensuring both functionality and compliance with safety standards.

The acquisition of Carling Technologies in 2021 enhanced Littelfuse's capabilities in the commercial vehicle markets by adding robust switching, circuit protection, and power distribution products to its offerings. The strategic move was aimed at bolstering the company's portfolio and strengthening its market presence, particularly in sectors that are increasingly relying on advanced technology solutions. It also makes the revenue bars in the chat below stand out by driving growth. Since 2016, though, the Transportation segment had revenue CAGR of 7.3%. That can be decomposed as 1.3% from organic growth and 6.3% from M&A. When you look at the past decade, a disappointing attribute is the gradual decline in EBIT margins which was 13.9% in 2014 and only 5.0% in 2023. 2023 revenue declined by 5% “largely driven by reduced demand largely due to inventory rebalancing at certain distributors and customers, and some demand reduction in commercial vehicle end markets.” This lower volume directly impacted profit margins for the segment.

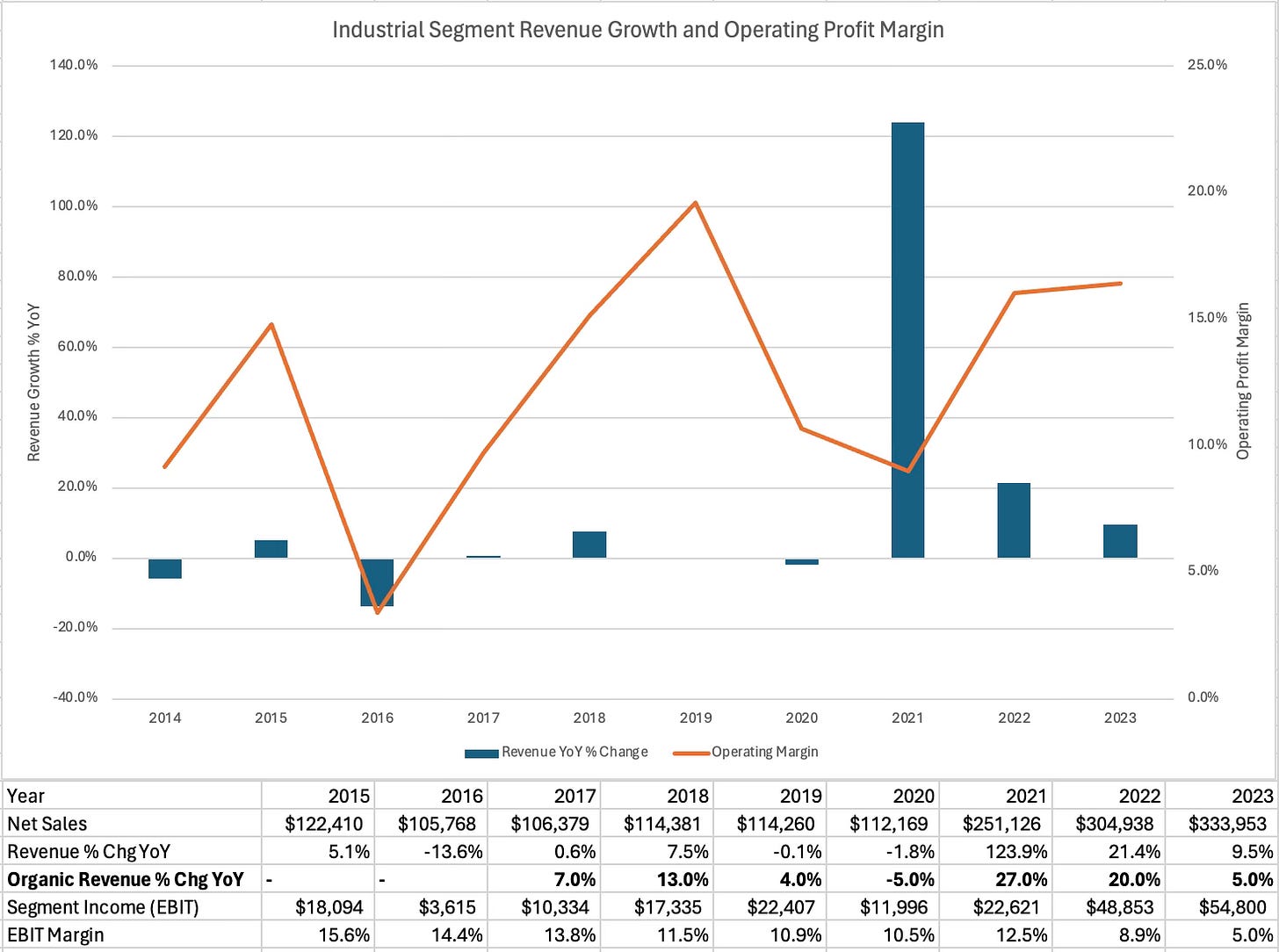

The third and last segment to discuss is the Industrial segment, which has shown the strongest performance over the last decade. This segment’s range of products is geared towards ensuring safety and efficiency in heavy-duty industrial applications. Industrial segment products include industrial circuit protection devices such as fuses, which serve to protect circuits by interrupting excess currents and preventing damage to equipment. The segment also features industrial controls like protection relays and contactors. Protection relays monitor for abnormal or fault conditions and activate mitigation actions, whereas contactors are specialized switches used to handle high power loads. Transformers, another critical component, are devices that transfer electrical energy between two or more circuits through electromagnetic induction, essential for voltage regulation across various industrial systems.

Ground fault circuit interrupters (GFCIs) and residual current devices are designed to protect against electrical shock by breaking the circuit when a fault current to ground is detected. Similarly, residual current monitors provide ongoing surveillance of electrical networks to ensure safety and compliance with regulatory standards. Arc fault detection devices enhance safety by identifying and interrupting arcing faults, which can be a fire risk in electrical systems.

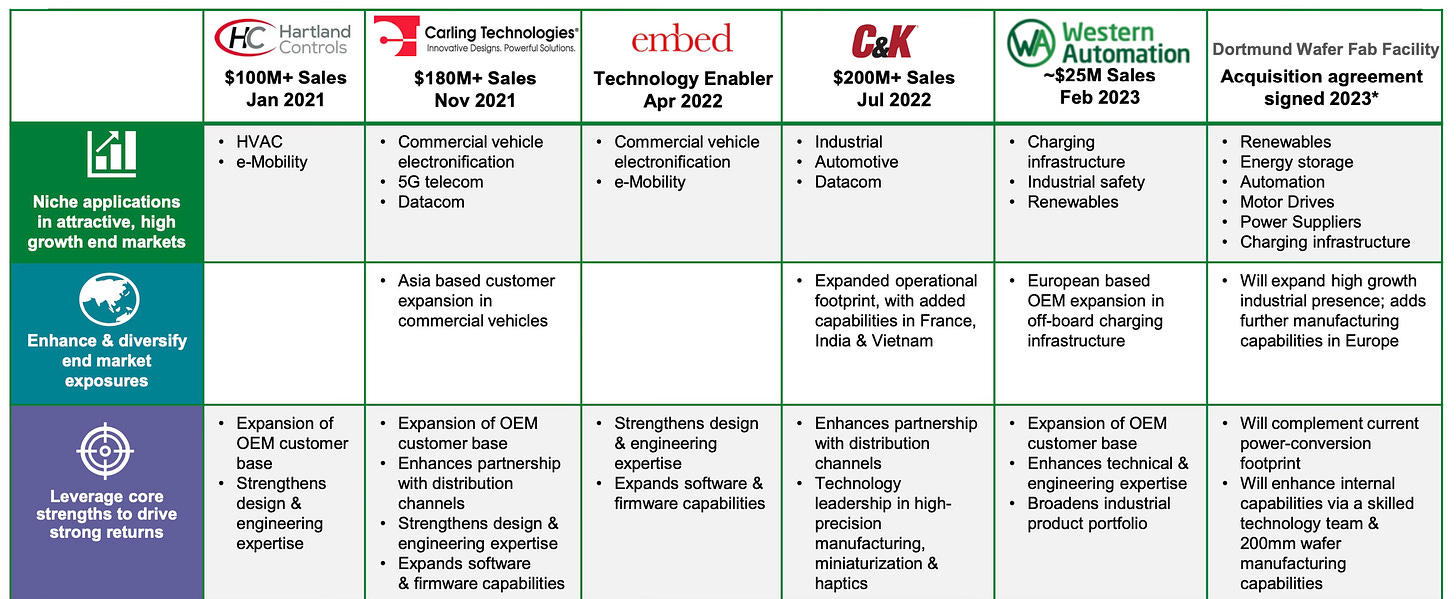

Recent acquisitions, such as Hartland and Western Automation, have bolstered Littelfuse’s offerings in contactors, transformers, and shock protection devices, particularly enhancing applications in HVAC systems and e-Mobility charging infrastructure. Through these strategic expansions and its robust distribution network, Littelfuse is well-positioned to continue its growth trajectory in the Industrial segment, leveraging advanced technologies in industrial safety, renewable energy, and EV infrastructure.

As for financial performance, the revenue CAGR since 2016 stands at 17.9%. Organic revenue growth was a solid 9.7% and growth from M&A was 10.8%. Profit margins have been volatile for the Industrial segment and haven’t evolved in a particular direction, with an average of 13.1% in the past decade.

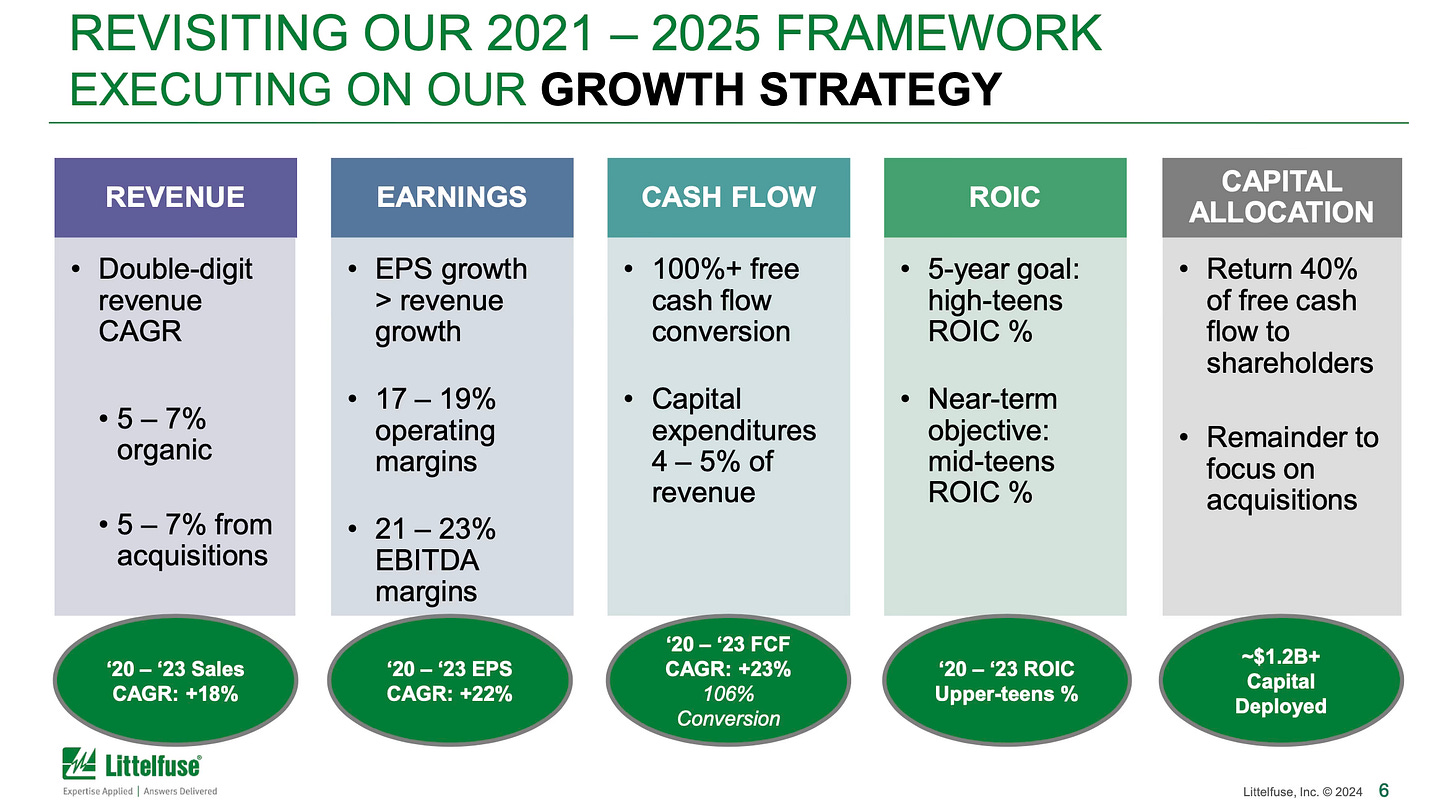

Before discussing company-wide financial performance, it will be helpful for me to first cover Littelfuse's business strategy. Littelfuse announced a five-year strategic plan in 2021 that aims to harness the global mega trends of sustainability, connectivity, and safety. These themes are central to driving increased demand for Littelfuse's products across its diverse markets.

The company targets average annual organic sales growth and growth from strategic acquisitions each in the range of 5-7%, which matches the growth objectives of the prior five-year plan announced in 2016. To achieve these goals, Littelfuse focuses on increasing product content with both existing and new customers, expanding its market presence into high-growth geographies and niche applications, and leveraging its comprehensive go-to-market strategies. The strategy also emphasizes enhancing commercial and operational excellence to improve profitability and margins.

Investments in innovation, customer-driven solutions, and digital infrastructure are key to adapting to the converging technologies across Littelfuse's segments. The company plans to sustain double-digit sales growth and superior profitability through a disciplined capital allocation strategy. This includes targeting a return of 40% of free cash flow to shareholders and reinvesting the remainder in strategic acquisitions that align with Littelfuse's long-term objectives. This approach is designed to deliver top-tier shareholder returns by combining robust growth with careful investment and resource management.

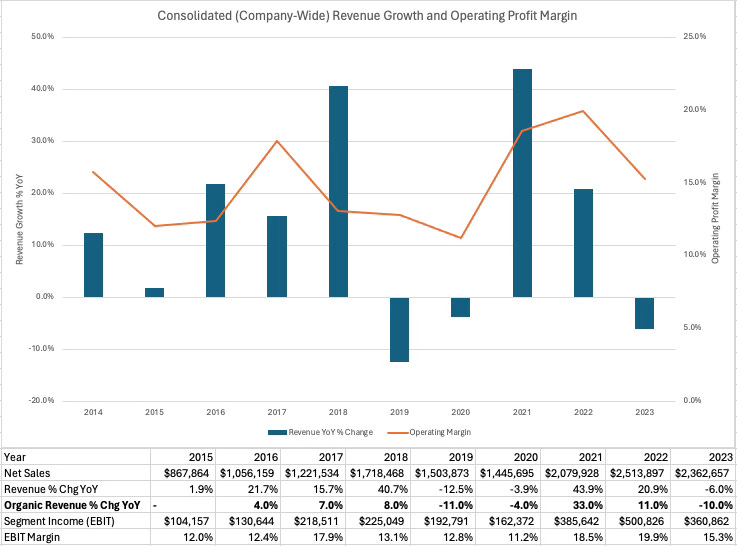

Those financial targets have generally worked for Littelfuse. Since 2016, the company-wide revenue CAGR 12.2% through 2023. That can be decomposed as 4% from organic growth and 9.3% from M&A. Just like the segment data I shared, those two numbers don’t add to 12.2% because the difference is from divestitures and Fx change. Had it not been for the poor financial results in 2023, organic growth and overall reported growth would’ve been higher. Through 2022 organic CAGR was 6.5% and 15.5% all-in including M&A. My sense is the long-term average for Littelfuse is about 5% organic and about 7% from M&A. I’ll note that the GAAP revenue CAGR since 2012 is 12.2%. Here’s an old comment from CFO Meenal Sethna in a December 2018 conference call:

"Our strategy is largely unchanged since 2012. It's been a continuation, little bit of an evolution, hasn't really changed dramatically since then. I would say the same thing about our financial commitments as it relates to the strategy. The first one I would start out with, you heard Dave talk about it double-digit sales growth, right? It's a combination of both an accelerated organic revenue growth. I say accelerated because historically, we have been in the 4% or 5% range on organic growth and when we updated our strategy in 2016, we felt the portfolio that we had built through acquisitions, through the diversity of the portfolio enabled us to grow faster than we've been growing previously in the 5% to 7% range organically. In addition to that, complementing it with 5% to 7% on average annualized growth on sales from acquisitions”.

Shifting to the margin profile of Littelfuse. The average operating profit (EBIT) over the last decade is 15.4%, with slight improvement over time. It was as low as 11.2% in 2020 and as high as 19.9% in 2022. Generally the margin has ebbed and flowed with volume, with a particular correlation to organic annual sales growth. When discussing the Electronics and Transportation segments I noted that sales were down in 2023 due to weak demand and bloated channel inventories that needed to be rebalanced. Those two segments, especially the Electronics segment, dragged down company-wide revenue and thus lowered the operating profit margin to 15.3% in 2023 from 19.9% in 2022.

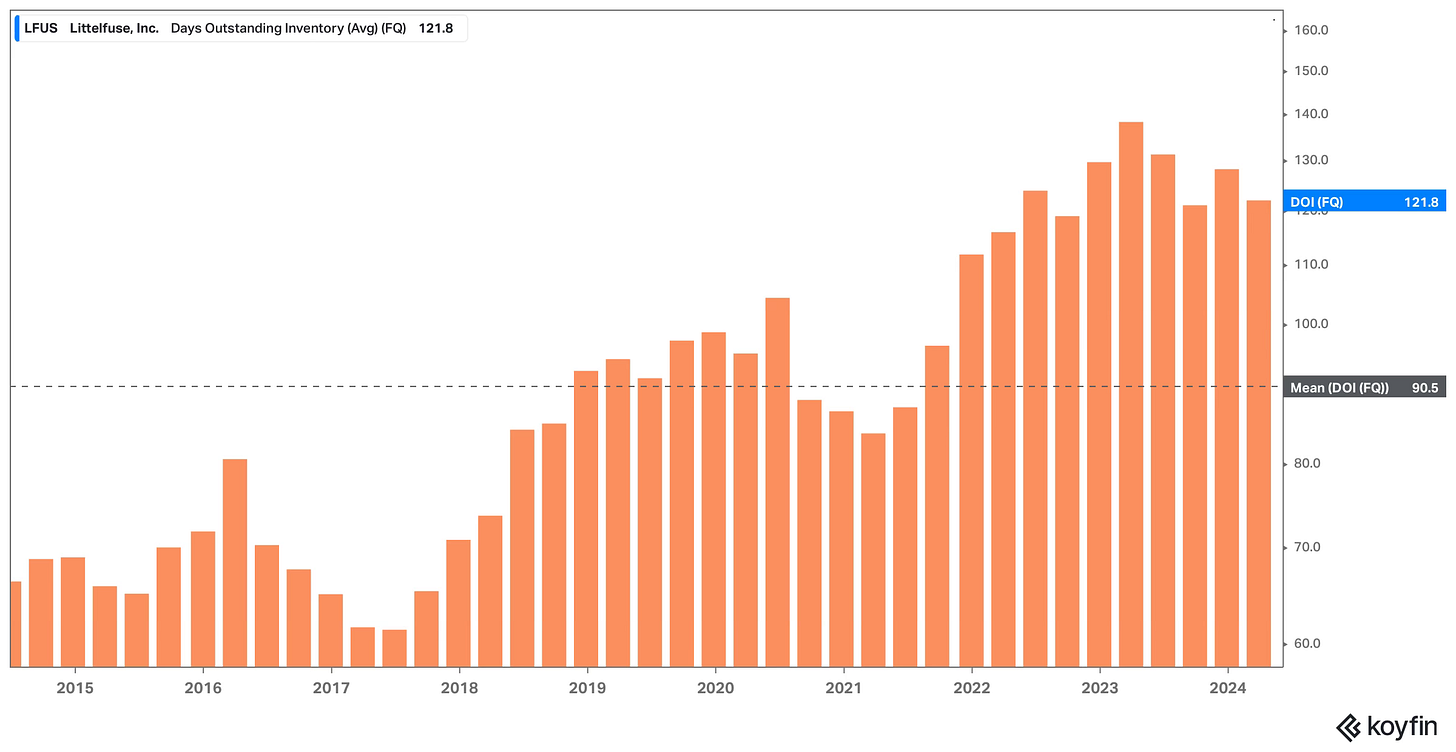

An effective way to gauge whether too much inventory is building up is by using the inventory turnover ratio or Days Inventory Outstanding (“DIO”). These metrics are inverses of one another, and DIO is expressed in days, which is more digestible, so we’ll look at that here. Last quarter, Littelfuse held its inventory for 121.8 days before selling it. That’s down from a year ago, but still well above the 10-year average of ~90. As you can see on the chart below, there’s been a general long-term trend of increasing its inventory and Littelfuse should work to re-adjust their inventory balance.

For context of Littelfuse managing their inventory level, here’s a quote from CFO Meenal Sethna from the November 2023 earnings call that points out Littelfuse is selling more directly to customers and therefore holding more inventory.

“We are running at about 115-ish days or so of inventory on hand, but they are targets somewhere 100, maybe a little bit more than 100 days of inventory on hand.

The biggest change for us… is our business has evolved versus pre-pandemic times, there's different mix, some of which have longer lead time. And as we continue to grow our OEM-related business, where we're holding a lot of our own inventory also that adds a little bit more. So I would say, our target may be a little higher than historical, but at the same time, we've got more progress that we can make that's going to help us from a cash generation, still going into the end of the year and going into 2024.

So I'm pretty pleased with where we are, the progress we've made and where we're heading.”

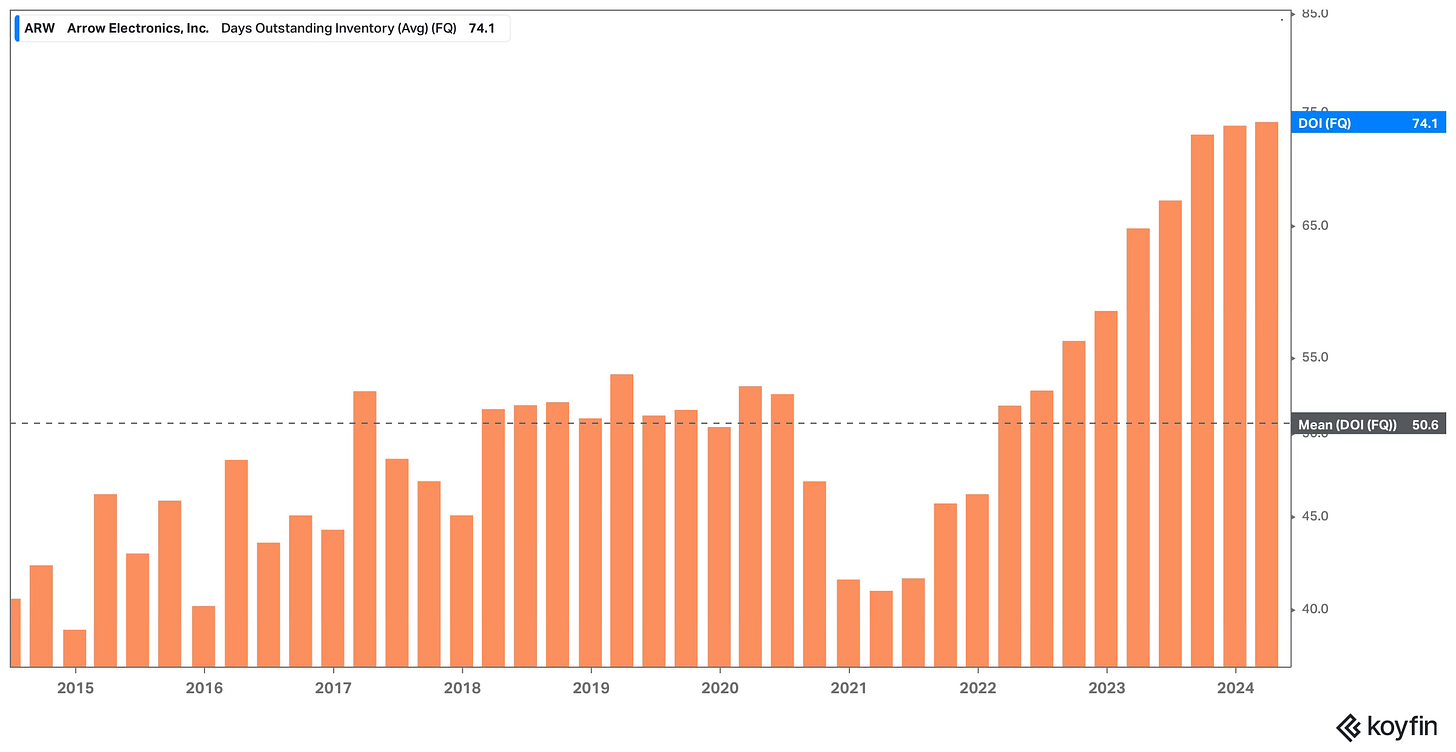

Unfortunately, the inventory issue isn’t just Littelfuse’s own inventory, but also their distribution partners and end customers. According to the 10-K, Arrow Electronics ARW 0.00%↑ is the largest distributor, accounting for 11.2% of sales in 2023, down from 11.5% in the prior year. (The customer section of the filing says no other customer accounted for more than 10% of sales.) For Arrow, their days of inventory outstanding was 74.1 last quarter, which is also quite elevated compared to the 10-year average of 50.6.

According to Littelfuse CEO David Heinzmann, excess channel inventory is nearly complete. Heinzmann said in the January 2024 earnings call Littelfuse made their way through 70% of the excess inventory and more recently in the May 1 earnings call he said they’re through 85% so the company is only another quarter or two away from fully digesting excess inventory.

It should be noted that this time last year, Heinzmann said in the February 2023 earnings call that the excess inventory would be worked through by Q2’23, so he was quite early in that prediction since it’s ongoing into 2024. Regardless, it should be noted that Littelfuse, their channel partners and customers have more work to do to bring down inventory levels.

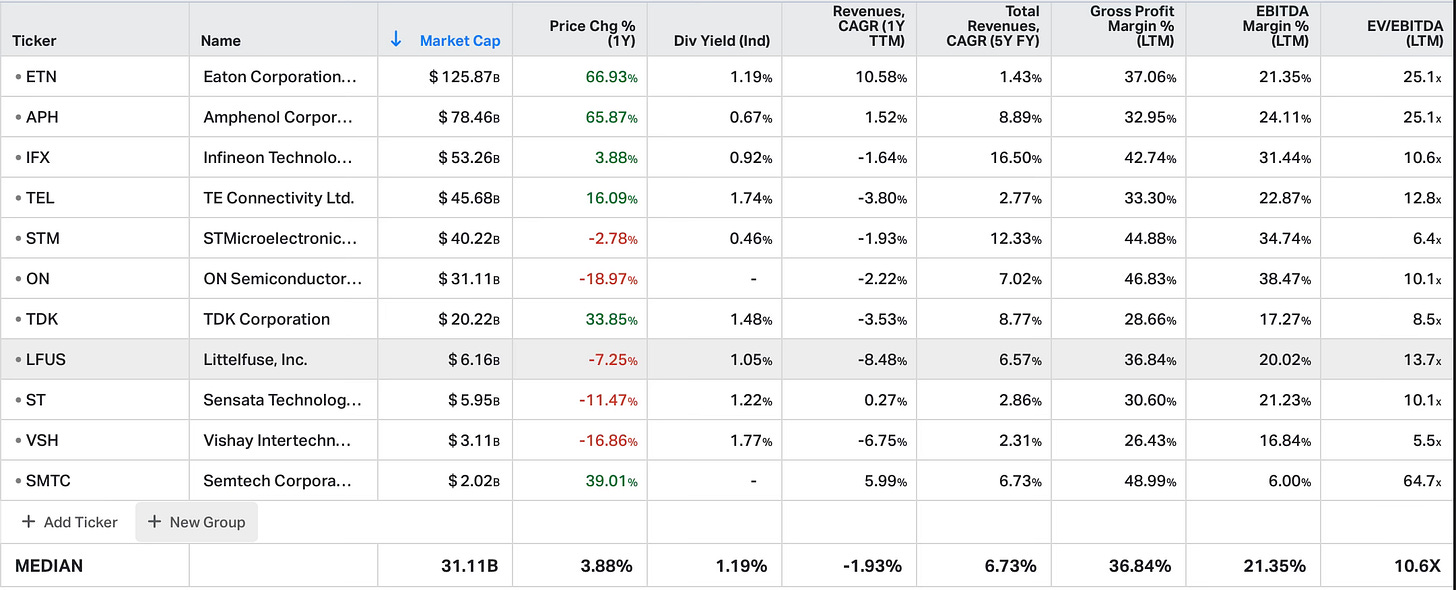

Competition: According to the 10-K, Littelfuse operates in a competitive space with several larger and well-established companies. In the Electronics segment, for example, Littelfuse competes with notable companies like Eaton Corporation (ETN), which offers a comprehensive range of electrical components. This segment also sees Littelfuse competing with specialized semiconductor firms such as ON Semiconductor Corporation (ON), STMicroelectronics NV (STM), and Infineon Technologies AG (IFNNY), which focus on components critical for power management and efficiency. Littelfuse’s offerings, particularly in innovative and high-efficiency silicon carbide (SiC) technologies, position it to leverage growth trends in areas like electric vehicles and renewable energy systems, which are central to the power semiconductor industry's expansion.

Littelfuse aligns strongly with the industry dynamics emphasized in reports by Sky Quest and Mordor Intelligence. According to Sky Quest, the increasing vehicle electrification and clean energy production, alongside the reduction of carbon emissions, are propelling the power semiconductor market forward, a space where Littelfuse leaned into through their expertise in SiC technologies and other power control components. Similarly, Mordor Intelligence underscores the market's acceleration due to the robust adoption of electric vehicles and advancements in power electronics, which dovetails with Littelfuse's strategic emphasis on eMobility and efficient energy management solutions. The company's focus on power-efficient electronic devices and its investment in innovative power semiconductor components should help it capitalize on the escalating demand within the automotive sector and beyond. As the global market gravitates toward a more energy-efficient and environmentally conscious landscape, Littelfuse's product offerings and technological competencies demonstrate a clear alignment with the top themes and drivers shaping the power semiconductor industry today.

In the Transportation segment, Littelfuse competes with Amphenol Corporation (APH) and TE Connectivity Ltd. (TEL), both of which provide a range of solutions for vehicle electrification and connectivity, emphasizing the industry's move towards more electric and hybrid vehicles. Sensata Technologies Holding NV (ST), another key competitor, offers sensors and controls that are integral to advanced vehicle systems.

The Industrial segment, although Littelfuse is smaller in scale compared to some of its competitors, competes effectively due to its focus on niche areas. Again, Eaton is a competitor for the Industrial segment and Littelfuse also competes against General Electric's GE Multilin division.

Littelfuse's strategy to counteract the resource advantage of larger competitors includes focusing on customer-centric innovation, technical support, and strategic acquisitions that strengthen its product portfolio. While the market cap of Littelfuse is around $6 billion, smaller than the median of about $30 billion among its named competitors, this allows for agility and specialized attention to market niches where it can lead and expand.

The company’s strategic position is not just about competing on scale but also on the differentiation of its products, the quality of its customer service, and its ability to deliver reliable and safe products across its market segments. This approach, paired with a strong customer loyalty indicated by a healthy Net Promoter Score, bolsters Littelfuse's position in its competitive market.

Overall, there isn’t a direct peer for Littelfuse. Eaton makes products that compete against Littelfuse essentially across the board. But Eaton sports a ~$130B market cap and therefore manages the business differently than Littelfuse. Elsewhere, electronic component makers focus on becoming dominant in market niches, just like Littelfuse. Here’s a quote from CEO David Heinzmann in the May 2023 Oppenheimer Industrial Growth Conference:

“Quite frankly, as our business is pretty diverse. And even by segment, if you look by segment, we don't have singular significant competitors in a segment because our segments have a pretty broad offering of technologies across those segments. And each one of those sets of technologies tends to have a unique set of competitors. So we've built out this portfolio of technologies and even in-market applications we're focused on. And in most cases, we would be one of the market leaders within that space.

So as an example, in our legacy fuse business, we would have even different competitors in each of the 3 segments between Electronics, Automotive and Transportation as well as Industrial, but we would be a leader in each one of those markets. So if we think about like our Electronics Passive business, we would be the market leader or at least top 2 in each category of technology that we have in that offering.

In our protection semiconductor business, also, we see that where we're #1 or #2 kind of neck and neck there as well. Passenger car, circuit protection business, we're clearly the leader. As you talked about in Industrial, we've identified some specific applications and technologies where we're building up leadership within them, maybe not the full breadth of the Industrial segment yet. So as a whole, we really identify niches, where we can create unique value and really become a market leader from a technology and an application understanding. So it's a very broad set of competitors that we deal with.”

Among those competitors, Eaton is the most interesting comparable due to the strong overlap. Eaton is more than 20X larger than Littelfuse and it has outperformed Littelfuse materially over the past decade.

This has been attributed to Eaton’s strategic focus on high-growth, high-margin markets, effective cost management, and divestitures of low-growth, low-margin businesses. The chart below shows annual EBITDA margins for the two companies, according to Koyfin. Littelfuse’s EBITDA margin started at 21.7% in 2014 and ended at 21.8% in 2023, with no gain during the decade. However, Eaton showed steady improvement in its EBITDA margin, increasing from 15.9% in 2014 to 21.0% in 2023.

While many electronic component companies, including Littelfuse, saw their revenue decline in 2023, Eaton was able to grow revenue and margins in 2023. Eaton’s 10-K said “Organic sales increased 12% in 2023 due to strength in commercial & institutional, utility, industrial, and data center end-markets in the Electrical Americas and Electrical Global business segments, strength in sales to commercial OEM and aftermarket in the Aerospace business segment, strength in the North American, European, and Asia Pacific regions in the Vehicle business segment, and the ramp up of key programs in the eMobility business segment due to robust demand for electric vehicles.”

For Littelfuse shares to catch up to Eaton’s shares, Littelfuse's management will need to lean more on high-growth markets that are working for Eaton, such as data center power management products. It’s reasonable to expect Littelfuse to capture a portion of the growing data center demand. In January, CEO Heinzmann pointed out that there were “multiple data center wins in the quarter across technology offerings, including switches and fuses. Long term, we believe the use of artificial intelligence and computing will drive strong demand for our products in data center applications.”

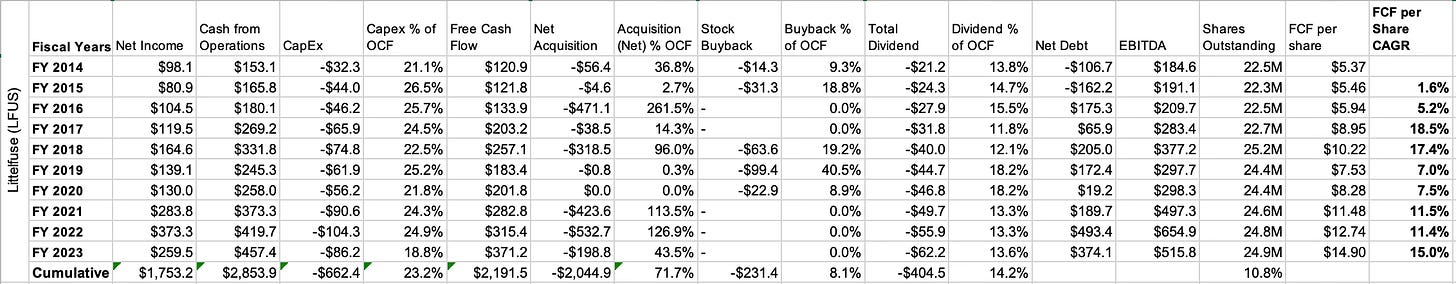

Capital Allocation: The four main buckets of capital allocation are 1) internal growth via capital expenditures (cash flow statement item) and research and development investments (income statement item); 2) external growth by buying other companies; 3) dividends; and 4) stock buybacks. Management has the discretion to change spending habits in each category and Littelfuse has dynamically included all categories at different times.

Over the last 10 years (2014 to 2023), Littelfuse generated $2.9B in cash from operations. About $660M was spent on CapEx (23.2% of cash from operations), $400M was spent on dividends (14.2%), $230M was spent on share buybacks (8.1%) and the largest category for Littelfuse was M&A for which they spent a little over $2.0B (71.7%), according to cash flow statements.

For context, the internal investment by spending 23.2% of its cash from operations is squarely in-line with peers in the space. In addition, Littelfuse’s internal investment in research & development is also squarely medium. About 4% of revenue was directed toward R&D over the last decade and the 2023 figure of 4.3% is the exact median compared to its competitors.

The return of capital via dividends and buybacks has been modest and opportunistic. Notably, Littelfuse returned to modest buybacks in Q1’24 for the first in four years with shares languishing this year. The last time Littelfuse was buying back shares was in Q1’20 during a pullback, and overall their track record is timely. I’ll add that during the May 1 conference call CFO Meenal Sethna pointed out in her prepared remarks that Littelfuse picked up the pace of buybacks slightly in Q2’24:

“During the second quarter, we've repurchased an additional $23 million in shares through last Friday. We also announced yesterday that our Board approved a new 3-year $300 million stock buyback authorization effective May 1. We will continue to assess periodic share buybacks. Especially when we believe our valuation doesn't reflect our continued confidence in our long-term growth strategy.”

The biggest component of the capital allocation framework is the consistent spending on acquisitions. For 2023, Littelfuse spent nearly $200M on a pair of acquisitions, with most of it on Western Automation, a maker of electrical shock protection devices. Western Automation’s end markets are EV off-board charging (fast charging) infrastructure and other renewables.

2022 was Littelfuse’s biggest year for M&A spend driven by the purchase of C&K Switches for $540M. C&K is a maker of switches and interconnect product, which connect and transmit signals to various electronic components. Their end markets are broad and at the time C&K had $200M in annualized sales (2.7X price-to-sales ratio). Littelfuse and C&K are similar companies so there was natural synergies. CEO Heinzmann talked about the merger in an August 2022 earnings call:

“The combination of our companies significantly expands our technologies and capabilities enabling us to deliver a comprehensive solutions offering to our broad customer base. C&K enhances our technical and application expertise, engineering and designing capabilities, and our technology leadership and high-precision manufacturing, miniaturization and haptics. Our businesses are highly complementary and enable us to leverage our selective partnerships with distribution channels, OEM relationships and global footprints, including expanded capabilities in India and Vietnam. The integration is underway, and we look forward to leveraging our respective strengths.”

In 2021, Littelfuse made two material purchases by acquiring Carling for $315.5M and Hartland for $111M. Carling’s focus is on switches and circuit protection technology in the transportation space. They had $170M in revenue at the time making (1.9X price-to-sales ratio). Hartland’s focus was electronic components within HVAC and had $70M in revenue (1.6X price-to-sales ratio).

Littelfuse’s largest acquisition was for IXYS (former ticker IXYS) in 2018 for total consideration of $856.6M. The merger was paid for in cash and stock with $380.6M paid in cash and the remaining $434.2M paid in the form of Littelfuse stock, which caused the only jump in the shares outstanding. In the 12 months before the acquisition, IXYS generated $325M in sales making for a 2.6X price-to-sales ratio. IXYS was a maker of medium to high voltage power semiconductors across various end markets. This bolstered Littelfuse’s presence in power semiconductors after two material acquisitions in 2016, one being assets from ON Semiconductor. CEO Heinzmann said at the time:

“The IXYS extensive power semiconductor portfolio and technology expertise aligns with the key objective to accelerate our growth across power control. It diversifies and expands our presence within industrial and electronics markets, with a tremendous OEM customer base. We also expect long term increased content per vehicle by expanding our combined power semiconductor portfolio with automotive customers. These were all areas we identified as significant elements of our 5-year strategy. The combination is highly complementary in many areas, including technology capabilities, product portfolio, end markets and sales channels. The combination will also bring many more opportunities for our collective employees and new differentiated solutions for our customers. We look forward to welcoming the IXYS team to Littelfuse.”

Overall, Littelfuse’s capital allocation practice has been efficient, evidenced by its growth in free cash flow (“FCF”) per share. In 2014, Littelfuse generated $5.37 per share in free cash flow. By 2023, that figure grew to $14.90, which represents a CAGR of 15.0% over the 10-year period. This has come with Littelfuse consistently keeping its net debt to EBITDA ratio, a popular debt evaluation metric, close to 0.6 over the last decade. Most shareholders would be happy to see their management deploy most of the FCF toward acquisitions if it means the FCF per share continues to grow at a solid clip. In fact, the FCF per share has outgrown the Littelfuse stock over the last 10-years too, which has a CAGR of about 12%. That FCF per share CAGR also outpaced Eaton which saw FCF per share grow at a CAGR rate of 11.8% in the past decade.

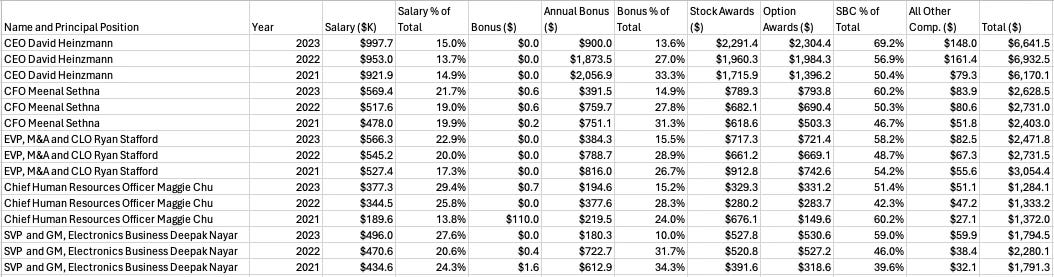

Management and Incentives: Littelfuse has been led by David Heinzmann as CEO since January 2017. Heinzmann joined the company as an engineer in 1985 and worked his way in increasing roles, including VP of the automotive segment from 2004 to 2007, VP of global operations from 2007 to 2014 and COO from 2014 until taking over as CEO in 2017. Heinzmann took over for Gordon Hunter who was CEO for 12 years and before that Howard Witt was CEO for 15 years so there’s been good stability for the past 30+ years.

Meenal Sethna joined Littelfuse as SVP, finance in May 2015 and was promoted to CFO in March 2016. Before Littelfuse, Sethna held corporate finance roles at Motorola and Baxter International.

The third highest ranking executive is Ryan Stafford, who wears a few hats with the title of EVP of M&A, chief legal officer and corporate secretary. Stafford joined Littelfuse as general counsel and VP of human resources in 2007. His background is both in operations and legal having previously served as VP of China operations at Tyco International.

Littelfuse’s executive compensation program consists of a base salary, annual bonus tied to financial metrics and stock-based compensation, called long-term incentive compensation. Management is also sporadically given discretionary “wellness” bonuses. CFO Sethna has been a frequent recipient of the wellness bonus, while Deepak Nayar, general manager of the Electronics Business, has been given bonuses related to the patent program.

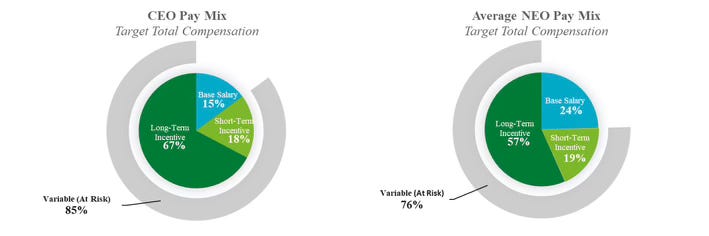

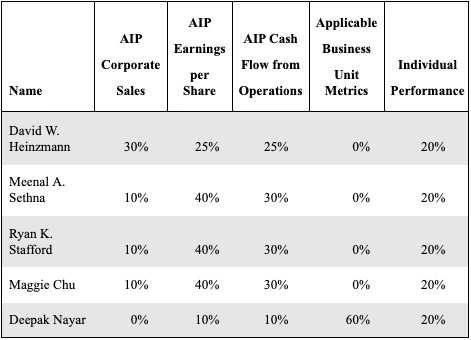

To understand how management is incentivized, let’s start with the annual bonus. Named executives are paid annual bonuses with the target amount ranging from 60% to 120% of their base salary. The incentive is a blend of corporate sales, EPS, cash from operations, individual performance and business segment performance for Nayar, who heads the Electronics segment. See the graphic below for the weighting for each executive’s annual bonus composition. The targets were sufficiently difficult so that only the cash flow metric generated a payout in 2023. However, management had bonus payouts near the max in the prior two years.

The largest component to executive compensation at Littelfuse is the long-term incentive, known broadly as stock-based compensation. CEO Heinzmann had 69% of his compensation paid out through stock and the rest of the executives were at 57% in 2023 (both higher than recent years). The accounting value of the stock-based compensation is split evenly between restricted stock units (“RSUs”) and stock options. RSUs vest in thirds over a three-year period regardless of performance while stock options also vest over a three-year period at Littelfuse. The RSUs and stock options are both structured in relatively simple methods and the latter directly incentivizes management to grow the stock price above the strike price (market price upon grant date). I have no issue with a company employing simple incentive metrics. Given the reliance on M&A, I can imagine some investors would prefer stock-based compensation to be more closely tied to M&A efficiency. However, applying M&A incentives tends to be messy and I think the pros don’t actually outweigh the cons. As it stands, Littelfuse management needs to win over the market in order for the stock options to truly grow in value and that’s the most important attribute.

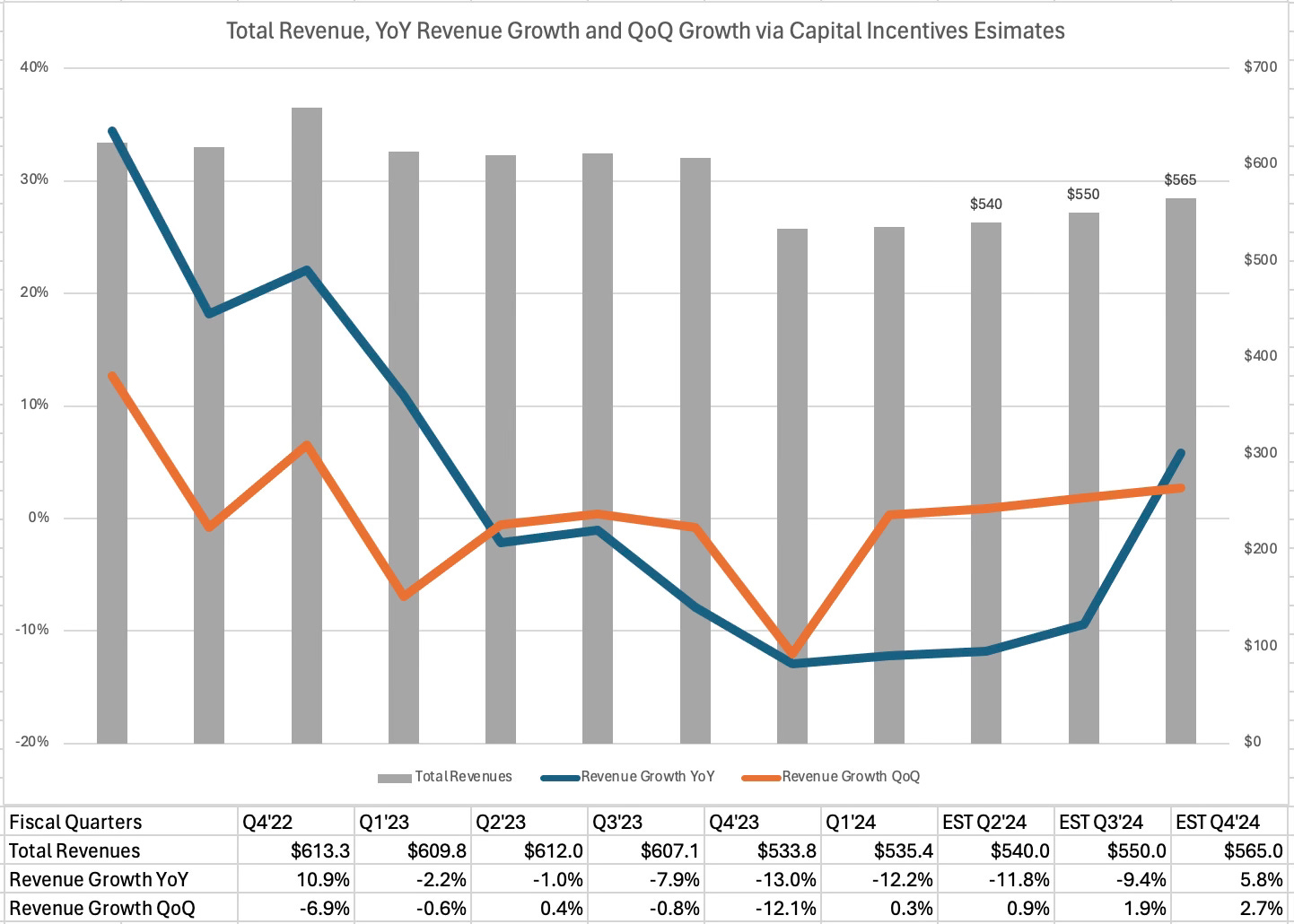

Outlook: Littelfuse last issued earnings on April 30, and at the time, management guided Q2’24 revenue growth to be down -11.8% YoY and up 0.9% compared to Q1’24. Management does not give full-year guidance, but they did disclose 2024 assumptions that included a return to sales growth. This implies a recovery from the trough for this cycle will be slow and modest.

Cycles for Littelfuse are normal, with business ebbing every three or four years, at least to a modest level. In the past, growth generally stalls out with a four to five quarter peak-to-trough length,, so the current 2023/2024 trend has been longer than usual. David Heinzmann pinned the reasoning on the unusual nature of the post-COVID supply chains during the May 1 earnings call:

“And we've talked about how in the electronics side of our business that, it's been a bit of a long-gated cycle. So it's the peak to trough has been a little longer than we have typically seen before, and we really think that based on our analysis and the work we do with customers is that is really driven out of the fact that end customers, EMS, OEMs, bulked up a little more on inventory in this past cycle than historically, they have because of all the disruptions that were taking place. So that's what's kind of elongated.”

I think the light at the end of the tunnel is near for this present cycle for Littelfuse. Given CEO Heinzmann recently said inventory de-stocking is nearly complete, with only another quarter or two of drag left, and revenue appearing to stabilize, it’s likely Littelfuse can return to modest organic growth in 2025.

Zooming out, Littelfuse’s longer-term growth themes of electrification and electronification are in tact. During my research of Encore Wire WIRE 0.00%↑ I discussed ‘electrification of everything’. Just as it sounds, we’re talking about electrifying everything. Infrastructure that was previously fossil fuels getting switched to electric, and other consumer products getting switched to electric. Think stoves and furnaces. In Washington State, where I live, we’re also electrifying ferry boats - WSJ article looking at electrifying public transportation. Littelfuse benefits from a grid that’s getting electrified because the increase in electricity means there’s an increase in moving it safely and therefore a need for fuses. Littelfuse’s adjacent product category of power semiconductor’s also benefits because they help start and stop the movement of electricity.

The other theme Littelfuse emphasizes is electronification, which refers to the growing number of electronic components in various products. Over the decades, the volume and complexity of electronic components have increased significantly. For instance, while every car now has electronic windows, it’s becoming more common to see advanced connectivity features in vehicles. This includes sensors that assist with parking and collision avoidance, as well as systems that allow drivers to adjust suspension settings between sport mode and eco mode. Littelfuse plays a crucial role in this trend with its wide range of sensors and power semiconductors. Their offerings include speed sensors, fluid level sensors, and position sensors, which are essential for powertrain, chassis, and comfort and convenience applications. Specifically, their sensors support active suspension systems by providing real-time data that helps in adjusting the suspension for optimal ride comfort and handling.

The industry tailwinds should support modest organic growth. However, the other notable growth driver for Littelfuse’s outlook is the M&A spend. The company hasn’t entered into a material acquisition since June 2023, and this follows a modest year of acquisition spend in 2023 overall. Littelfuse has ample capacity to take on additional debt to fund deals right now. Their own method of calculating net debt/EBITDA sits 1.4X, which is below their target of 2.0X meaning they could $300M in debt to fund an acquisition. I’ll note that their method of calculating is conservative by only including cash held in the U.S.

I’ll note a few risks to the near and medium-term outlook. The first is that a return to growth takes several more quarters, which is already past a normal cycle length for Littelfuse. Growth hasn’t shown signs of a turnaround yet and so investors will be cautious watching to see that growth does materialize in the coming months.

Another potential headwind to watch for is the recall that Littelfuse disclosed in the May 2024 10-Q. Littelfuse added a risk factor stating a customer notified them of “a product recall potentially due to certain fuses provided by the Company”. It’s unclear at this point if the recall will be material financially. However, it was a rare move for Littelfuse to add a risk factor in a 10-Q as it’s been four years since the last time a risk factor was added in a 10-Q, according to inFilings data. Littelfuse discloses and updates risk factors annually in 10-Ks instead of 10-Qs. Even if the recall doesn’t cause a financial headwind, there’s a potential harm to their reputation. Given Littelfuse's role in supplying mission-critical components, long product life cycles, and high switching costs, reputation is important. When a manufacturer builds with Littelfuse components they’re often doing so for a product’s life that could be five to 10 years. Reliability is paramount and maintaining an impeccable reputation is crucial. Swiftly and effectively managing this recall will be key to reassuring risk-averse OEM customers of Littelfuse's commitment to quality and reliability, preserving their trust and continued business. This response will help mitigate the risk of customer attrition and reinforce Littelfuse's long-standing industry position.

Lastly, another risk for Littelfuse lies in its strategy of relying on acquisitions to drive growth, aiming for about 6% annual growth through M&A as stated by management. There's a potential for overpaying for targets due to their commitment of growth via acquisitions. However, I trust the management team, which has a strong history of handling cash effectively for opportunistic buybacks and making acquisitions that have enhanced shareholder value and improved free cash flow.

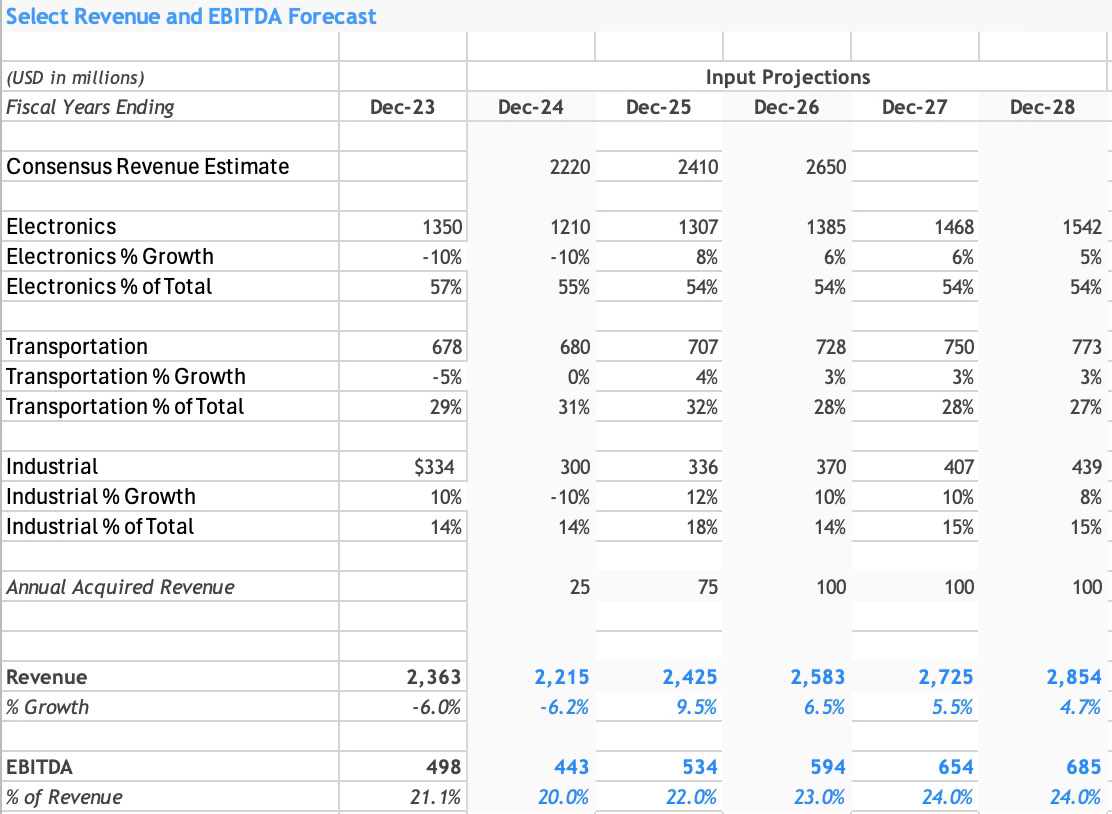

Valuation: To value Littelfuse, I built a discounted cash flow model for the next five years through 2028. My forecast indicates the Electronics segment continues to drag company-wide revenue in 2024 then rebounds in 2025 with growth moderating after the cyclical weakness in 2023/2024. Transportation will have modest growth throughout the period, in-line with the organic growth history. My expectation also indicates a poor year for the industrial segment, which is an extension of material negative growth in Q1’24. However, this segment has been the strongest in the last decade and next five years should also be strong backed by growth in renewable energy.

The approach to fold in the M&A impact is simple. The assumption is that Littelfuse continues to acquire businesses at 2.0X a price-to-sales ratio. In 2024, there’s M&A spending of $50M model, then $200M in 2025 and then increasing by $50M each year through 2028. Therefore, half of those amounts are added each year through additional acquired revenue. The 2.0X ratio was decided based on the valuation multiple paid over the last three years. Including the acquired revenue via M&A spend, the CAGR total revenue increase from 2023 to 2028 is a modest 7.2%.

Littelfuse has an average EBITDA margin of ~21% over the last decade. It was 24.7% in 2022, then regressed to 21.1% in 2023. My forecast includes a continued increase in the EBITDA margin before gradually reaching a mid-cycle level of 24.0% in 2028. The EBITDA is expected to increase at a CAGR of 10% during the model.

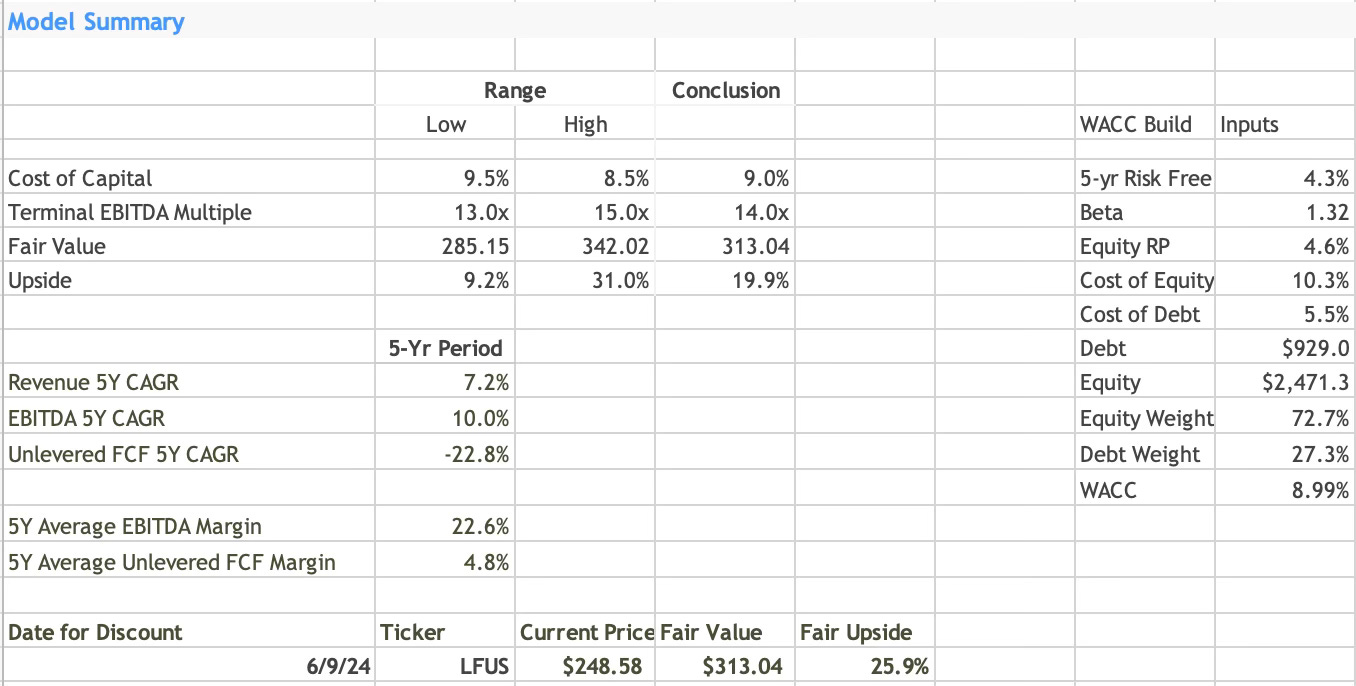

The cost of capital of 9.0% is calculated primarily through a beta of 1.32 and an equity risk premium of 4.6%. Littelfuse has traded with an average 14.0X EV/EBITDA ratio (trailing 12-months) over the last 10-years which is selected for the exit multiple of the DCF model. Altogether, the calculated fair value is $313.00, or about 26% higher than the current stock price.

The financial outlook in the model is fairly conservative for a company that grew revenue and operating profit ~12% annual over the past decade. Many investors approach M&A expectations and valuations differently, so that’s certainly a wild card in this model. If you subtract it out of free cash flow differently than I do, your intrinsic valuation calculation could look materially different than my valuation of $313. For a more simple valuation marker I’ll add that Littelfuse is currently trading ahead of their average forward EV/EBITDA ratio of 13.2X with a current multiple of 14.4X. This is also slightly higher than their competitors, who have a median of ~12X. Taken together, the relative valuation approach indicates Littelfuse is at fair value. My preference for valuation is to lean on the DCF model.

Conclusion: Littelfuse isn’t the most exciting company, but they are a quality company with a rich history and I believe good they have a good runway ahead of them. Their secular tailwinds of electrification and electronification provide plenty of organic growth in the coming years and the electronic parts industry could consolidate further, providing plenty of M&A opportunities.

After researching Littelfuse I was left thinking, can this company become the next Eaton? or at least a mini Eaton. I pointed out in the competition section that Littelfuse needs to lean into higher growth markets, such as data centers due to the elevated demand from AI. Management also needs sell the idea that they’ll benefit from high-growth end markets. If they can do that, ideally shares could grow based on the multiple expansion. Eaton trades at a rich 23X forward EV/EBITDA, which has steadily grown over the last decade alongside the rise in their profit margins. However, Littelfuse trails that mark quite a bit at 14.4X.

As a long-term investor, I’m less concerned about perfectly timing the cycle turning and growth returning for Littelfuse. I’d be an interested buyer of Littelfuse at about $230.00 per share, which would imply 35% upside at that point, and enough margin of safety. It’s also the valuation at which Littelfuse decided to buy back its own shares in Q1’24.

On a personal note, it’s been nearly three months since I last published a deep dive, which is a longer stretch than usual. My wife and I welcomed our second baby in April so my hands have been full during my usual blogging time. I hope to get back to my regular cadence in the coming months so look out for more research updates this summer.

Disclaimer: The content of this report is for informational and research purposes only and should not be construed as financial advice. The views expressed are my own and do not reflect those of my employer. While care has been taken in preparing this report, I make no representations or warranties of any kind regarding its accuracy or completeness. I currently hold no position in any stock mentioned. However, like any financial analyst, my perspectives may carry inherent biases. Readers are encouraged to conduct their own due diligence.